index fund

217 results back to index

pages: 356 words: 51,419

The Little Book of Common Sense Investing: The Only Way to Guarantee Your Fair Share of Stock Market Returns by John C. Bogle

asset allocation, backtesting, buy and hold, creative destruction, currency risk, diversification, diversified portfolio, financial intermediation, fixed income, index fund, invention of the wheel, Isaac Newton, John Bogle, junk bonds, low interest rates, new economy, passive investing, Paul Samuelson, random walk, risk tolerance, risk-adjusted returns, Sharpe ratio, stocks for the long run, survivorship bias, transaction costs, Upton Sinclair, Vanguard fund, William of Occam, yield management, zero-sum game

In order to achieve such a 50/50 government/corporate bond portfolio, investors who require a higher yield than the total bond market index fund (yet still seek a high-quality portfolio) might consider a portfolio consisting of 75 percent in the total bond market index fund and 25 percent in an investment-grade corporate bond index fund. The value of bond index funds is created by the same forces that create value for stock index funds. The reality is that the value of bond index funds is derived from the same forces that create value in stock index funds: broad diversification, rock-bottom costs, disciplined portfolio activity, tax efficiency, and focus on shareholders who place their trust in long-term strategies.

…

In fact, after all of the selection challenges, timing risks, extra costs, and added taxes, ETF traders can have absolutely no idea what relationship their investment returns will bear to the returns earned in the stock market. These differences between the traditional index fund—the TIF—and the index fund nouveau represented by the ETF are stark (Exhibit 15.1). Exchange-traded funds march to a different drummer than the original index fund. In the words of the old song, I’m left to wonder, “What have they done to my song, ma?” The creation of the “Spider.” EXHIBIT 15.1 Traditional Index Funds versus Exchange-Traded Index Funds ETFs Broad Index Funds Specialized Index Funds TIFs Investing Trading Broadest possible diversification Yes Yes Yes No Longest time horizon Yes Yes No Rarely Lowest possible cost Yes Yes Yes* Yes* Greatest possible tax efficiency Yes Yes No No Highest possible share of market return Yes Yes Unknown Unknown *But only if trading costs are ignored.

…

Over the past decade, both the original “fundamental” index fund and the first “dividend-weighted” index fund have had the opportunity to prove the value of their theories. What have they proven? Essentially nothing. Exhibit 16.1 presents the comparisons. EXHIBIT 16.1 “Smart Beta” Returns: 10-Year Period Ended December 31, 2016 Fundamental Index Fund Dividend Index Fund S&P 500 Index Fund Annual return 7.6% 6.6% 6.9% Risk (standard veviation) 17.7 15.1 15.3 Sharpe ratio* 0.39 0.38 0.40 Correlation with S&P 500 Index 0.97 0.97 1.00 *A measure of risk-adjusted return. You’ll note that the fundamental index fund earned higher returns while assuming higher risk than the S&P 500 fund.

pages: 345 words: 87,745

The Power of Passive Investing: More Wealth With Less Work by Richard A. Ferri

Alan Greenspan, asset allocation, backtesting, Benchmark Capital, Bernie Madoff, book value, buy and hold, capital asset pricing model, cognitive dissonance, correlation coefficient, currency risk, Daniel Kahneman / Amos Tversky, diversification, diversified portfolio, endowment effect, estate planning, Eugene Fama: efficient market hypothesis, fixed income, implied volatility, index fund, intangible asset, John Bogle, junk bonds, Long Term Capital Management, money market fund, passive investing, Paul Samuelson, Performance of Mutual Funds in the Period, Ponzi scheme, prediction markets, proprietary trading, prudent man rule, random walk, Richard Thaler, risk free rate, risk tolerance, risk-adjusted returns, risk/return, Sharpe ratio, survivorship bias, Tax Reform Act of 1986, too big to fail, transaction costs, Vanguard fund, yield curve, zero-sum game

My test compared this index fund portfolio to thousands of randomly selected active funds from the Morningstar list, in the correct weightings. Table 6.7 Model Index Fund Portfolio Used in the Live Study Index Fund Name Percent Allocation Vanguard Total Stock Market Index Fund 45% Vanguard Total International Stock Index Fund* 15% Vanguard Total Bond Market Index Fund 40% * The Vanguard Total International Fund had its first full year under management in 1998. The FTSE All-World ex-US Index Fund (less 0.4 percent fee) is substituted for the years 1995 through 1997. The allocation of the FTSE ex-US could have been replicated using three other Vanguard international index funds that were in existence over the entire time period.

…

If there was no excess return, then the fund didn’t produce alpha, because the same returns could be engineered in a portfolio through a combination of a total market index fund (beta exposure), small cap index fund (size factor exposure), and value index fund (value factor exposure). If approximately 95 percent of diversified fund performance can be explained using the three-factor model, and active management contributes very little, if any, to return then why pay high fees for active management when you can engineer the same risk exposures using low-cost index funds? How to create a three-factor portfolio using index funds is beyond the scope of this book. There are several books available on this investment strategy including one that I wrote, All About Asset Allocation, 2nd Edition, 2010, from McGraw-Hill.

…

This was a huge boon for the Vanguard S&P 500 index fund. Not only did interest in index investing start to catch on, the index fund itself outperformed three-quarters of all active funds from 1983 to 1986. This run brought increased publicity to Vanguard. The unexpected asset growth at Vanguard made competitors rethink their opposition to index funds. Wells Fargo was the first to launch a competing fund in 1984. The fund had expenses of almost 1 percent per year and attracted few assets. Two other index funds were formed in 1985, although they were only offered to institutional investors. Eight new index funds were launched by competitors in 1986, which marked the beginning of true competition.

pages: 432 words: 106,612

Trillions: How a Band of Wall Street Renegades Invented the Index Fund and Changed Finance Forever by Robin Wigglesworth

Albert Einstein, algorithmic trading, asset allocation, Bear Stearns, behavioural economics, Benoit Mandelbrot, Big Tech, Black Monday: stock market crash in 1987, Blitzscaling, Brownian motion, buy and hold, California gold rush, capital asset pricing model, Carl Icahn, cloud computing, commoditize, coronavirus, corporate governance, corporate raider, COVID-19, data science, diversification, diversified portfolio, Donald Trump, Elon Musk, Eugene Fama: efficient market hypothesis, fear index, financial engineering, fixed income, Glass-Steagall Act, Henri Poincaré, index fund, industrial robot, invention of the wheel, Japanese asset price bubble, Jeff Bezos, Johannes Kepler, John Bogle, John von Neumann, Kenneth Arrow, lockdown, Louis Bachelier, machine readable, money market fund, Myron Scholes, New Journalism, passive investing, Paul Samuelson, Paul Volcker talking about ATMs, Performance of Mutual Funds in the Period, Peter Thiel, pre–internet, RAND corporation, random walk, risk-adjusted returns, road to serfdom, Robert Shiller, rolodex, seminal paper, Sharpe ratio, short selling, Silicon Valley, sovereign wealth fund, subprime mortgage crisis, the scientific method, transaction costs, uptick rule, Upton Sinclair, Vanguard fund

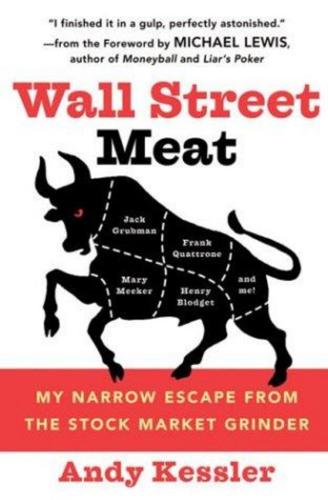

This tongue-in-cheek poster produced by The Leuthold Group, an investment manager specializing in active management, adorned the offices of some of the early pioneers. Index funds may have been first invented in the early 1970s but only really started gaining in prominence in the 1990s. The last decade has seen rampant growth, with index funds—whether passive mutual funds or exchange-traded funds—gobbling up more and more of the investment industry’s market share. Index funds come in many flavors, from exchange-traded notes that track the price of oil to passive money market funds. Equity index funds are by far the biggest, but bond index funds have been growing quickly in recent years and are expected to take off further in the coming decade.

…

The investment manager turned historian Peter Bernstein recounts that at the time one former colleague sputtered that he wouldn’t buy the S&P 500 even for his mother-in-law.30 The Leuthold Group, a Minneapolis-based financial research group, famously distributed a poster where Uncle Sam declared, “Help stamp out index funds. Index funds are un-American!” Copies continue to float around the offices of index fund managers as mementos of the hostility they initially faced. Of course, as the writer Upton Sinclair once observed, it is difficult to get someone to understand something when their salary depends on them not understanding it. “If people start believing this random-walk garbage and switch to index funds, a lot of $80,000-a-year portfolio managers and analysts will be replaced by $16,000-a-year computer clerks.

…

Rowe Price, 127, 234, 244 Trump, Donald, 246 Tsai, Gerald, 34 Tufts University, 47, 48 Tull, Robert, 195–96, 247 Turner, Grant, 260 Turner, Judith, 58 Twardowski, Jan, xi, 97, 101, 104, 127 at Russell Investments, 142 setting up Vanguard FIIT (“Bogle’s Folly”), 108–9, 110–14 Unilever, 255–56 Union League Club, 97, 99, 100–101 Union Warren Savings Bank, 128 United Airlines, 230 United States Oil Fund (USO), 248 Universities Superannuation Scheme (USS), 274–76 University of Besançon, 23 University of British Columbia, 186 University of California, Berkeley, 42, 58, 137, 138, 161, 187 University of California, Los Angeles (UCLA), 42, 43, 169, 206–7, 234–35 University of Chicago, 52–53, 75 Booth at, 50, 140–41 Booth gift to, 157–58 Fama at, 47–50, 63, 140 Grauer at, 186–87 Lorie and CRSP, 30–33, 35–36, 52–53 Markowitz at, 38–41 Miller at, 48–49, 63, 138, 140, 147 Sauter at, 123 Sinquefield at, 35, 63, 64, 140 University of Dijon, 23 University of Kansas, 139 University of Kentucky, 72 University of Leuven, 47 University of Pennsylvania, 153 value investing, 7, 152, 154 value stocks, 154–56 VanEck Vectors Gold Miners ETF, 242, 242n VanEck Vectors Junior Gold Miners ETF, 262–63 Vanguard billion-dollar milestones of, 119–20, 121 Bogle-Brennan schism, 130–34 DFA and, 146 ETFs, 166–68, 200–201, 256 fee structure, 116–17, 120–21, 123 founding of, 11–12, 104–10, 104n “Giant Three” scenario, 297–99 growth of, 119–20, 121–22 gun stock boycott, 285–87 Malvern headquarters of, 125–26 rise of, 119–35 Vanguard, HMS, 104, 126 Vanguard Adviser, 121 Vanguard Extended Market Index Fund, 124 Vanguard First Index Investment Trust (FIIT), 107–17, 121–22 loads, 115–17 name change of, 121–22 selling, 114–15 setting up, 107–14 Vanguard 500 Index Fund, 15, 122–25, 133–34, 181 Vanguard Index Trust, 122 Vanguard Total Bond Market Index Fund, 261 Vanguard Total Stock Market Index Fund, 123–25 Varley, John, 205 Vasi, Alonso Segura, 257 Velocity Shares Daily Inverse VIX Short Term ETN, 247–48 Vertin, James “Jim,” xi at Wells Fargo, 62, 69–72, 73–74, 81, 187 retirement, 184 Vestager, Margrethe, 296 Vietnam War, 63, 139–40, 161 Visa, 256 volatility, 40, 74, 151, 152–53 volatility index, 247–48 Volcker, Paul, 17–18, 119, 185 Volkswagen, 236 von Neumann, John, 43 Wachter, Paul, 160 Wagner, Susan, 204, 210, 212, 224 Wagner, Wayne, 71, 76 Wallace, David Foster, 265–66 Wall Street Crash of 1929, 27, 88, 89, 92, 225–26 Wall Street Journal, 27, 29, 33, 82, 83, 84, 122, 137, 152, 160, 180, 252 Walmart, 198 Wang, Zexi, 254 Warwick Municipal Bond Fund, 117–18 Washington Post, 4, 7, 8, 17 Wasserstein, Bruce, 210 Weber, Clifford, 176–77, 182 Wellington, Arthur Wellesley, Duke of, 92, 103 Wellington Management Company, 53, 88, 92–104, 115, 127, 130 Wells Fargo, 106, 152–53, 188 Amex and Most, 175 McQuown’s hiring, 57–59 Netzly at, 236–37 origin story of index investing, 69–77, 164–65 WFIA’s relationship with, 185–88 Wells Fargo Investment Advisors (WFIA), 76–77, 79–81, 122, 184–86 Dunn at, 185–86, 193–95 Grauer at, 188–93 “Tactical Asset Allocation” fund, 189n Wells Fargo’s relationship with, 185–88 Wells Fargo Management Sciences, 69–77 McQuown’s departure, 81–82, 184 McQuown’s hiring, 58–59, 61–62 McQuown-Vertin battles, 69–70 Wells Fargo Nikko Investment Advisors (WFNIA), 190–92 Wells Fargo Stagecoach Fund, 74–75, 81, 141, 143 Wheeler, Dan, xii, 138, 161–64 background of, 161 at DFA, 138, 161, 162–64 Where Are the Customers’ Yachts?

pages: 339 words: 109,331

The Clash of the Cultures by John C. Bogle

Alan Greenspan, asset allocation, buy and hold, collateralized debt obligation, commoditize, compensation consultant, corporate governance, corporate social responsibility, Credit Default Swap, credit default swaps / collateralized debt obligations, diversification, diversified portfolio, estate planning, Eugene Fama: efficient market hypothesis, financial engineering, financial innovation, financial intermediation, fixed income, Flash crash, Glass-Steagall Act, Hyman Minsky, income inequality, index fund, interest rate swap, invention of the wheel, John Bogle, junk bonds, low interest rates, market bubble, market clearing, military-industrial complex, money market fund, mortgage debt, new economy, Occupy movement, passive investing, Paul Samuelson, Paul Volcker talking about ATMs, Ponzi scheme, post-work, principal–agent problem, profit motive, proprietary trading, prudent man rule, random walk, rent-seeking, risk tolerance, risk-adjusted returns, Robert Shiller, seminal paper, shareholder value, short selling, South Sea Bubble, statistical arbitrage, stock buybacks, survivorship bias, The Wealth of Nations by Adam Smith, transaction costs, two and twenty, Vanguard fund, William of Occam, zero-sum game

See also Index funds assets exchange traded funds versus future of growth in number of as portfolio core profile of trading volumes “Trafficking” in management contracts Transactions: cost of taxes on Trends Turner, Adair Turner, Lynn Turnover: actively managed equity funds exchange traded funds index funds mutual funds Stewardship Quotient and stock market Twardowski, Jan M. 12b-1 fees Value, corporate Vanguard: Admiral shares balanced index fund bond funds, defined-maturity cash flow emerging markets stock fund exchange traded funds “Extended Market” portfolio growth and value index funds history index fund family milestones international funds LifeStrategy Portfolios proxy votes REIT index fund small capitalization stock fund Stewardship Quotient structure and strategy tax-managed index funds Vanguard 500 Index Fund Vanguard Institutional Index Fund Vanguard PRIMECAP Fund Vanguard Total Bond Market Index Fund Vanguard Total Stock Market Index funds Vanguard U.S. Growth Fund Vanguard Wellington Fund.

…

The process moved forward quickly and easily. In the years that followed the creation of our stock index fund, we moved first into the bond index area. Thereafter, we would build an index fund “family” that would greatly expand our mandate. Here are the highlights.10 Vanguard Index Fund Family Milestones (1976 to 1996) 1986: The Bond Index Fund. We took this obvious step to build on our reputation as an index manager. Its story is told in greater depth in Box 6.2. Box 6.2: The Bond Index Fund In 1986, the first decade of Vanguard’s stock index fund came to a close. Its assets would soon top the $1 billion milestone. Its performance success and its growing, if modest, acceptance—led to an obvious idea: If indexing worked so well in the stock market, why wouldn’t it also work in the bond market?

…

When I stepped down as Vanguard’s chief executive in 1996, the most fertile ground for index funds had already been plowed. During the next few years, we rounded out our index offerings, forming index funds to complete our participation in all nine Morningstar “style box” categories, namely: growth, value, and blended index funds for small-, mid-, and large-cap stocks. We formed more tax-managed index funds, along with a “social index” fund based on an external index of corporations said to honor the principles of “corporate social responsibility.” In 2004, we created index funds for the 10 industry segments of the S&P 500, including financial, health care, energy, and information technology.

pages: 274 words: 60,596

Millionaire Teacher: The Nine Rules of Wealth You Should Have Learned in School by Andrew Hallam

Albert Einstein, asset allocation, Bernie Madoff, buy and hold, diversified portfolio, financial independence, George Gilder, index fund, John Bogle, junk bonds, Long Term Capital Management, low interest rates, Mary Meeker, new economy, passive investing, Paul Samuelson, Ponzi scheme, pre–internet, price stability, random walk, risk tolerance, Silicon Valley, South China Sea, stocks for the long run, survivorship bias, transaction costs, Vanguard fund, yield curve

My hope, though, is that this book will give you every tool required to build portfolios of index funds yourself. Then you can hire a trustworthy accountant to provide advice on tax-sheltered accounts. Seeking an accountant’s advice, you’ll confidently avoid every conflict of interest corrupting the financial service industry—as long as your accountant doesn’t sell financial products on the side. For a review, however, let’s take another look at total stock market index funds and actively managed mutual funds with a side-by-side comparison. Table 3.1 Differences between Actively Managed Funds and Index Funds Actively Managed Mutual Funds Total Stock Market Index Fund 1. A fund manager buys and sells (trades) dozens or hundreds of stocks.

…

Actively managed fund companies pay annual “trailer fees” to advisers, rewarding them for selling their funds to investors—who end up paying for these. 8. Index funds rarely pay trailer fees to advisers. 9. Most U.S. fund companies charge sales or redemption fees—which go directly to the broker/adviser who sold you the fund. The investor pays for these. 9. Most index funds do not charge sales or redemption fees. 10. Actively managed mutual fund companies are extremely well liked by advisers and brokers. 10. Index funds are not well liked by most advisers and brokers. Global citizens and index funds If you’re British or Australian, you can follow the lead with Vanguard, which has already set up shop in your country.

…

If you want to invest like Keith, you have two low-cost options: 1. You can buy the low-cost Toronto Dominion Bank Index Funds <www.tdcanadatrust.com/mutualfunds/tdeseriesfunds/index.jsp> (called e-Series Funds), which are—as of 2010—Canada’s cheapest regular index funds. Or, 2. You can open a discount brokerage account and buy Exchange Traded Index Funds. Let’s focus on the bank indexes first: Toronto Dominion Bank currently has the most competitively priced index funds in Canada. But if you try walking into a bank and buying them, one of two things might happen to you: 1. The bank representative might try convincing you to buy actively managed funds instead.

The Smartest Investment Book You'll Ever Read: The Simple, Stress-Free Way to Reach Your Investment Goals by Daniel R. Solin

Alan Greenspan, asset allocation, buy and hold, corporate governance, diversification, diversified portfolio, index fund, John Bogle, market fundamentalism, money market fund, Myron Scholes, PalmPilot, passive investing, prediction markets, prudent man rule, random walk, risk tolerance, risk-adjusted returns, risk/return, transaction costs, Vanguard fund, zero-sum game

Low Risk Medium-Low Risk Medium-High Risk High Risk 20/80 40/60 60/40 80120 Average annual return (Geometric) 10.14% 10.89% 11.56% 12.15% Annualized standard deviation 7.51% 8.47% 10.25% 12.51% Worst single calendar year -2.07% -2.02% -7.99% -13.95% Worst two-calendaryear period 7.59% -2.71% -12.51% -21.80% Worst three-calendaryear period 13.32% 0.37% -12.74% -24.69% 180 Appendix B Composition of model portfulillS: 20/ 80 40/60 60/40 2% 10% 8% 80% iShares iShares iShares iShares CON CON CON CON Composite Index Fund (XIC) S&P 500 Index Fund (XSP) MSCI EAFE Index Fund (XIN) Bond Index Fund (XBB) 4% 20% 16% 60% iShares iShares iShares iShares CON CON CON CON Composite Index Fund (X1C) S&P 500 Index Fund (XSP) MSCI EAFE Index Fund (XIN) Bond Index Fund (XBB) 6% iShares iShares iShares iShares CON CON CON CON Composite Index Fund (XIC) S&P 500 Index Fund (XSP) MSCI EAFE Index Fund (XIN) Bond Index Fund (XBB) iShares iShares iShares iShares CON CON CON CON Composite Index Fund (XIC) S&P 500 Index Fund (XSP) MSCI EAFE Index Fund (XIN) Bond Index Fund (XBB) 30% 24% 40% 80/20 8% 40% 32% 20% Raw data used 10 produce performance numbers: iShares CON Composite Index Fund (XIC) =- actual fund retu rns 2002-2005, (TSX 300 Index-o.25% per year) 1977-2001 iShares CON S&P 500 Index Fund (XSP) '" actual fund returns 2002-2005.

…

Randolph, 162 house funds, 77- 78, 163 Hyperactive Investors about Hyperactive Investors, 19- 20,25,30-33,75 as percentage of all investors, 29 reliance on financial media, 96 See also financial media; psychology of investing Hyperactive Managers about managers, 5 disadvantages of, 9 how to manage, 136-38 myths of, 9 research on, 150 use of fund rating systems, 55-56, 158-59 See also actively managed funds; securities industry Ibbotson, Roger G., 108 Ilkiw, John, 139 income trusts, 134--35, 169 index funds about index funds, 8 benchmark indexes and, 23-24 benefits of, 6, 150 costs and fees, 129, 147 DFA index funds, 112-14, 168 famous investors in, 107-9 four types of, 19 institutional investors in, 89, 105-7, 114, 168 list of Canadian index funds, 112, 167 market returns and, 12, 18 market segment funds, 113-14 regulations on buying U.S. funds, 89 research on, 147, 151, 168 See also ETFs (exchange traded funds) Index Funds, Advisors, 147, 182 Index Funds: The 12-Step Program for Active Investors (Hebner), 148, 150, 151, 182 Index Mutual Funds (Simon), 148 indexes, benchmark, 23-24 See also S&P Composite Index (U.S.); S&P/TSX Composite Index initial public offering (IPOs), prospectus for, 60 insurance companies.

…

Smart Investing Simply Makes Sense 19 You will hold investments in funds that represent four broad indexes. The four types of index funds you will hold are 1. an index fund representative of the u.s. stock market in its broadest terms; 2. an index fund representative of the Canadian stock market in its broadest terms; 3. an index fund representative of the international stock market (exclusive of the U.S. and Canadian markets) in its broadest terms; and 4. an index fund representative of the Canadian bond market in its broadest terms. I will show you how to determine the exact percentage of your portfolio that you will hold in each of these ETFs in greater detail later.

All About Asset Allocation, Second Edition by Richard Ferri

activist fund / activist shareholder / activist investor, Alan Greenspan, asset allocation, asset-backed security, barriers to entry, Bear Stearns, Bernie Madoff, Black Monday: stock market crash in 1987, book value, buy and hold, capital controls, commoditize, commodity trading advisor, correlation coefficient, currency risk, Daniel Kahneman / Amos Tversky, diversification, diversified portfolio, equity premium, equity risk premium, estate planning, financial independence, fixed income, full employment, high net worth, Home mortgage interest deduction, implied volatility, index fund, intangible asset, inverted yield curve, John Bogle, junk bonds, Long Term Capital Management, low interest rates, managed futures, Mason jar, money market fund, mortgage tax deduction, passive income, pattern recognition, random walk, Richard Thaler, risk free rate, risk tolerance, risk-adjusted returns, risk/return, Robert Shiller, selection bias, Sharpe ratio, stock buybacks, stocks for the long run, survivorship bias, too big to fail, transaction costs, Vanguard fund, yield curve

Figure 15-1 compares the fee savings and five-year annualized return advantage of several Vanguard index funds compared to their representative Morningstar category averages. The average fee for the Vanguard index funds was 0.2 percent, and the average fee for the categories ranged between 1.0 and 1.4 percent. In every category, the no-load index funds saved a considerable amount in fees over the category average, and this led to higher returns for index funds in every category. Index funds have no sales commissions. However, many funds in the categories listed do charge a sales commission. In Figure 15-1 commissions have not been deducted, from the five-year average. Index fund returns would have faired even better had the commissions been included in the analysis.

…

Accordingly, market-matching index funds and ETFs are a logical investment choice for people who want to make the most of asset allocation analysis. Any deviation from index funds adds an element of risk that was not captured in the asset allocation analysis. Fees Matter in Asset Allocation Planning 313 2. Low expense ratios. In general, stock and bond index funds and ETFs have the lowest investment fees in the industry. The lowest-cost index funds and ETFs charge about 0.1 percent per year, which is well below the industry average of 1.4 percent. One word of caution: Not all index funds have low fees. Some investment companies charge over 1.0 percent to invest in exactly the same indexes as very low-cost funds.

…

For example, the S&P 500 is composed of predominantly large-company stocks, although there are also several midcap stocks and a few small stocks in the index. There would be some overlap of stocks if a person were to invest in both an S&P 500 Index fund and a small-cap index fund. For all practical considerations, the effect of a small-cap stocks on the return of the S&P 500 Index is negligible. As a result, you can add a small-cap index fund to an S&P 500 Index fund and obtain broader diversification without adding measurable securities overlap to the portfolio. FIGURE 5-2 Number of New Growth and Value Funds, 1997–2000 250 227 200 150 134 133 108 100 50 37 48 36 26 0 1997 1998 New value funds 1999 2000 New growth funds CHAPTER 5 94 The Asset Class Has a Real Expected Return Each asset class to be held in a portfolio for the long term should be expected to earn a return greater than the inflation rate.

pages: 490 words: 117,629

Unconventional Success: A Fundamental Approach to Personal Investment by David F. Swensen

asset allocation, asset-backed security, Benchmark Capital, book value, buy and hold, capital controls, classic study, cognitive dissonance, corporate governance, deal flow, diversification, diversified portfolio, equity risk premium, financial engineering, fixed income, index fund, junk bonds, law of one price, Long Term Capital Management, low interest rates, market bubble, market clearing, market fundamentalism, money market fund, passive investing, Paul Samuelson, pez dispenser, price mechanism, profit maximization, profit motive, risk tolerance, risk-adjusted returns, Robert Shiller, Savings and loan crisis, shareholder value, Silicon Valley, Steve Ballmer, stocks for the long run, survivorship bias, technology bubble, the market place, transaction costs, Vanguard fund, yield curve, zero-sum game

Trading small-capitalization portfolios involves a significant level of costs. Index funds provide the exception to the mutual-fund rule of ridiculously high portfolio turnover and incredibly burdensome transactions costs. In 2002, index fund portfolio turnover amounted to a modest 7.7 percent, causing commissions to consume a mere 0.007 percent of assets. Ironically, index fund portfolio managers operate in an extremely tough trading environment. The transparency of index fund trades required for full replication and the promptness of execution demanded to match index characteristics combine to increase costs of market impact for index funds. Because market makers see the index portfolio transactions coming, Wall Street stands ready to take more than a fair share of the trade.

…

Because market makers see the index portfolio transactions coming, Wall Street stands ready to take more than a fair share of the trade. In spite of the adverse market environment for index fund trading, low turnover causes overall index fund trading costs to remain small. The transactions cost advantage enjoyed by index funds joins a long list of reasons to prefer the rock-solid certainty of market-mimicking returns over the will-o’-the-wisp possibility of market-beating results. Trading Costs for Index Funds Turnover matters even in the world of index funds. Well-constructed indices, such as the S&P 500 and the Wilshire 5000, exhibit low turnover, leading to attractive trading cost characteristics and reasonable tax consequences.

…

Knowing that index managers mechanistically buy new joiners and mindlessly sell old exiters, the arbitrageurs buy the stocks likely to enter and sell the stocks likely to leave. When the July reconstitution occurs, the arbitrage activity causes the index fund manager to pay more for purchases and receive less for sales. Russell 2000 index-fund investors suffer. A more complicated version of the arbitrage occurs at the top end of the Russell 2000 capitalization range. There, reconstitution-induced price movement depends on the relative demand for Russell 1000 and Russell 2000 Index-related portfolios. If demand for Russell 2000 Index funds exceeds demand for Russell 1000 Index funds, stocks graduating from the Russell 2000 to the Russell 1000 face downward price pressure, while stocks falling from the Russell 1000 to the Russell 2000 enjoy upward price pressure.

pages: 194 words: 59,336

The Simple Path to Wealth: Your Road Map to Financial Independence and a Rich, Free Life by J L Collins

asset allocation, Bernie Madoff, Black Monday: stock market crash in 1987, buy and hold, compound rate of return, currency risk, diversification, financial independence, full employment, German hyperinflation, index fund, inverted yield curve, John Bogle, lifestyle creep, low interest rates, money market fund, Mr. Money Mustache, nuclear winter, passive income, payday loans, risk tolerance, side hustle, The 4% rule, Vanguard fund, yield curve

This just means that the fund holds several other funds, each with different investment objectives. In the case of Vanguard, the funds held are all low-cost index funds. As you know by now, that’s a very good thing. The TRFs ranging from 2020 to 2060 each hold only four funds: Total Stock Market Index Fund Total Bond Market Index Fund Total International Stock Market Index Fund Total International Bond Market Index Fund To those four funds the TR 2010, 2015 and 2020 funds add: Short-Term Inflation-Protected Securities Index Fund As the years roll by and the retirement date chosen approaches, the funds will automatically adjust the balance held, becoming steadily more conservative and less volatile over time.

…

So without Vanguard in your plan, the question becomes how to select the best option, which by now you know is a low-cost total stock and/or bond index fund. The good news is that—due to the competitive pressure from Vanguard—nearly every other major mutual fund company now offers low-cost index funds. Just like the variations you can find in Vanguard of VTSAX, you can in all probability find a reasonable alternative in your 401(k). Here’s what you are looking for: A low-cost index fund. For tax-advantaged funds you’ll be holding for decades, I slightly prefer a total stock market index fund but an S&P 500 index fund is just fine. You can also look for a total bond market index fund if your needs or preferences call for it.

…

To ignore inflation (too unpredictable), taxes (too variable between individuals) and fees (also variable and if you choose the index funds I recommend, minimal). If you want to see what the numbers look like including any of these variables, I encourage you to visit the calculators and run the numbers with your own specifications. Most often in running these scenarios, the period of time I’ve chosen has been January 1975 - January 2015, for these reasons: It is a nice, solid 40-year period and this book advocates investing for the long term. 1975 is the year Jack Bogle launched the world’s first index fund and this book advocates investing in index funds. 1975 happens to be the year I started investing, not that this matters to you.

pages: 482 words: 121,672

A Random Walk Down Wall Street: The Time-Tested Strategy for Successful Investing (Eleventh Edition) by Burton G. Malkiel

accounting loophole / creative accounting, Alan Greenspan, Albert Einstein, asset allocation, asset-backed security, beat the dealer, Bernie Madoff, bitcoin, book value, butter production in bangladesh, buttonwood tree, buy and hold, capital asset pricing model, compound rate of return, correlation coefficient, Credit Default Swap, Daniel Kahneman / Amos Tversky, Detroit bankruptcy, diversification, diversified portfolio, dogs of the Dow, Edward Thorp, Elliott wave, equity risk premium, Eugene Fama: efficient market hypothesis, experimental subject, feminist movement, financial engineering, financial innovation, financial repression, fixed income, framing effect, George Santayana, hindsight bias, Home mortgage interest deduction, index fund, invisible hand, Isaac Newton, Japanese asset price bubble, John Bogle, junk bonds, Long Term Capital Management, loss aversion, low interest rates, margin call, market bubble, Mary Meeker, money market fund, mortgage tax deduction, new economy, Own Your Own Home, PalmPilot, passive investing, Paul Samuelson, pets.com, Ponzi scheme, price stability, profit maximization, publish or perish, purchasing power parity, RAND corporation, random walk, Richard Thaler, risk free rate, risk tolerance, risk-adjusted returns, risk/return, Robert Shiller, Salesforce, short selling, Silicon Valley, South Sea Bubble, stock buybacks, stocks for the long run, sugar pill, survivorship bias, Teledyne, the rule of 72, The Wisdom of Crowds, transaction costs, Vanguard fund, zero-coupon bond, zero-sum game

But you can count on the fingers of your hands the number of mutual funds that have beaten index funds by any significant margin. The Index-Fund Solution: A Summary Let’s now summarize the advantages of using index funds as your primary investment vehicle. Index funds have regularly produced rates of return exceeding those of active managers. There are two fundamental reasons for this excess performance: management fees and trading costs. Public index funds and exchange-traded funds are run at fees of of 1 percent or even less. Actively managed public mutual funds charge annual management expenses that average 1 percentage point per year. Moreover, index funds trade only when necessary, whereas active funds typically have a turnover rate close to 100 percent.

…

Stocks Schwab Total Stock Market Index Fund (SWTSX) or Vanguard Total Stock Market Index Fund (VTSMX) 14% Developed International Markets Schwab International Index Fund (SWISX) or Vanguard International Index Fund (VTMGX) 14% Emerging International Markets Vanguard Emerging Markets Index Fund (VEIEX) or Fidelity Spartan Emerging Markets Index Fund (FFMAX) *A short-term bond fund may be substituted for one of the money-market funds listed. †Although it doesn’t fit under the rubric of an index-fund portfolio, investors might consider putting part of the U.S. bond portfolio in Treasury inflation-protection securities. The dividend growth and corporate bond funds are also an exception since they are not standard index funds.

…

Thus, investors should not buy a U.S. stock-market index fund and hold no other securities. But this is not an argument against indexing because index funds currently exist that mimic the performance of various international indexes such as the Morgan Stanley Capital International (MSCI) index of European, Australasian, and Far Eastern (EAFE) securities, and the MSCI emerging-markets index. In addition, there are index funds holding real estate investment trusts (REITs). Finally, Total Bond Market index funds are available that track the Barclays Aggregate Bond Market Index. Moreover, all these index funds have also tended to outperform actively managed funds investing in similar securities.

pages: 542 words: 145,022

In Pursuit of the Perfect Portfolio: The Stories, Voices, and Key Insights of the Pioneers Who Shaped the Way We Invest by Andrew W. Lo, Stephen R. Foerster

Alan Greenspan, Albert Einstein, AOL-Time Warner, asset allocation, backtesting, behavioural economics, Benoit Mandelbrot, Black Monday: stock market crash in 1987, Black-Scholes formula, Bretton Woods, Brownian motion, business cycle, buy and hold, capital asset pricing model, Charles Babbage, Charles Lindbergh, compound rate of return, corporate governance, COVID-19, credit crunch, currency risk, Daniel Kahneman / Amos Tversky, diversification, diversified portfolio, Donald Trump, Edward Glaeser, equity premium, equity risk premium, estate planning, Eugene Fama: efficient market hypothesis, fake news, family office, fear index, fiat currency, financial engineering, financial innovation, financial intermediation, fixed income, hiring and firing, Hyman Minsky, implied volatility, index fund, interest rate swap, Internet Archive, invention of the wheel, Isaac Newton, Jim Simons, John Bogle, John Meriwether, John von Neumann, joint-stock company, junk bonds, Kenneth Arrow, linear programming, Long Term Capital Management, loss aversion, Louis Bachelier, low interest rates, managed futures, mandelbrot fractal, margin call, market bubble, market clearing, mental accounting, money market fund, money: store of value / unit of account / medium of exchange, Myron Scholes, new economy, New Journalism, Own Your Own Home, passive investing, Paul Samuelson, Performance of Mutual Funds in the Period, prediction markets, price stability, profit maximization, quantitative trading / quantitative finance, RAND corporation, random walk, Richard Thaler, risk free rate, risk tolerance, risk-adjusted returns, risk/return, Robert Shiller, Robert Solow, Ronald Reagan, Savings and loan crisis, selection bias, seminal paper, shareholder value, Sharpe ratio, short selling, South Sea Bubble, stochastic process, stocks for the long run, survivorship bias, tail risk, Thales and the olive presses, Thales of Miletus, The Myth of the Rational Market, The Wisdom of Crowds, Thomas Bayes, time value of money, transaction costs, transfer pricing, tulip mania, Vanguard fund, yield curve, zero-coupon bond, zero-sum game

”48 The reaction by competing firms to the introduction of an index fund was harsh. Bogle still remembers one particular excessive reaction. “A Midwestern brokerage firm [Leuthold Group] flooded Wall Street with posters screaming ‘INDEX FUNDS ARE UN-AMERICAN. Help Stamp Out Index Funds!’49 Very little new money was attracted to the fund in the years after inception. It wasn’t until 1982 that the fund was able to break the $100 million in assets mark. No competing fund existed until 1984. Burton Malkiel later praised Bogle’s foresight. “Index funds are so popular now that it’s easy to forget how courageous and tenacious Jack Bogle was in starting them.

…

Its profits, running about $12 billion a year (in 2007), are largely rebated—98 percent or something—to our fund shareholders in the form of lower expenses. Without that kind of structure, it would be very difficult to bring out an index fund. We went no-load around the time the index fund was introduced. We then focused on being a low-cost provider in the mutual fund industry. When we began operations in May 1975, the first thing on my agenda was to start an index fund, which depended on low cost to work. The chicken-and-the-egg is that Vanguard was the chicken, and the index fund, the egg. But which was the most important?”67 Bogle reflected on the keys to Vanguard’s growth. “You start with the mutual structure.

…

Thus, his recommended investment horizon: “Holding it forever.”90 His advice to more sophisticated investors: “Ignore the short-term noise of emotions reflected in our financial markets and focus on the productive long-term economics of our corporate businesses.”91 And lower costs increase wealth, as articulated in his CMH. How should one’s asset allocation change over time? Bogle’s rule of thumb was this: “You should start out heavily invested in equities. Hold some bond index funds as well as stock index funds. By the time you get closer to retirement or into your retirement, you should have a significant position in bond index funds as well as stock index funds.”92 According to Bogle, taxes are an important consideration. “Watch out for taxes. If the funds are in your retirement plan, you can ignore taxes, but if they’re in your own account, you want to take into account the tax cost involved.”93 By his estimation, “In terms of tax efficiency alone, active managers lost to the index by about 120 basis points a year.”94 What did Bogle’s own portfolio look like before his passing?

pages: 335 words: 94,657

The Bogleheads' Guide to Investing by Taylor Larimore, Michael Leboeuf, Mel Lindauer

asset allocation, behavioural economics, book value, buy and hold, buy low sell high, corporate governance, correlation coefficient, Daniel Kahneman / Amos Tversky, diversification, diversified portfolio, Donald Trump, endowment effect, estate planning, financial engineering, financial independence, financial innovation, high net worth, index fund, John Bogle, junk bonds, late fees, Long Term Capital Management, loss aversion, Louis Bachelier, low interest rates, margin call, market bubble, mental accounting, money market fund, passive investing, Paul Samuelson, random walk, risk tolerance, risk/return, Sharpe ratio, statistical model, stocks for the long run, survivorship bias, the rule of 72, transaction costs, Vanguard fund, yield curve, zero-sum game

The Vanguard LifeStrategy Growth Fund has a fairly aggressive target asset allocation of 80 percent stocks and 20 percent bonds. This fund of funds invests in four Vanguard funds: 1. Total Stock Market Index Fund 2. Total International Stock Index Fund 3. Asset Allocation Fund 4. Total Bond Market Fund The Vanguard LifeStrategy Conservative Growth Fund has a more conservative target asset allocation of 40 percent stocks and 60 percent bonds. This fund of funds invests in five Vanguard funds: 1. Total Stock Market Index Fund 2. Total International Stock Index Fund 3. Asset Allocation Fund 4. Total Bond Market Fund 5. Short-Term Investment-Grade Bond Fund There are two other funds in the Vanguard LifeStrategy series that offer differing asset allocations.

…

Here is the crux of the strategy: Instead of hiring an expert, or spending a lot of time trying to decide which stocks or actively managed funds are likely to be top performers, just invest in index funds and forget about it! As we discussed in Chapter 4, an index fund attempts to match the return of the segment of the market it seeks to replicate, minus a very small management fee. For example, Vanguard's Index 500 seeks to replicate the return of the S&P 500; the Total Stock Market Index seeks to replicate the return of a broad U.S. stock market index; and Total International Index seeks to replicate the return of a broad cross-section of international stocks. In addition to stock index funds, there are bond index funds that seek to replicate the performance of various bond indexes.

…

Paul Farrell, columnist for CBS Marketwatch and author of The Lazy Person's Guide to Investing: "So much attention is paid to which funds are at the head of the pack today that most people lose sight of the fact that, over longer time periods, index funds beat the vast majority of their actively managed peers." Richard Ferri, author of Protecting Your Wealth in Good Times and Bad: "When you are finished choosing a bond index fund, a total U.S. stock market index fund, and a broad international index fund, you will have a very simple, yet complete portfolio." Walter R. Good and Roy W. Hermansen, authors of Index Your Way to Investment Success: "Index funds save on management and marketing expenses, reduce transaction costs, defer capital gain, and control risk-and in the process, beat the vast majority of actively managed mutual funds!" Arthur Levitt, former chairman of the Securities Exchange Commission and author of Take on the Street: "The fund industry's dirty little secret: Most actively managed funds never do as well as their benchmark."

The Intelligent Asset Allocator: How to Build Your Portfolio to Maximize Returns and Minimize Risk by William J. Bernstein

asset allocation, backtesting, book value, buy and hold, capital asset pricing model, commoditize, computer age, correlation coefficient, currency risk, diversification, diversified portfolio, Eugene Fama: efficient market hypothesis, financial engineering, fixed income, index arbitrage, index fund, intangible asset, John Bogle, junk bonds, Long Term Capital Management, p-value, passive investing, prediction markets, random walk, Richard Thaler, risk free rate, risk tolerance, risk-adjusted returns, risk/return, South Sea Bubble, stocks for the long run, survivorship bias, the rule of 72, the scientific method, time value of money, transaction costs, Vanguard fund, Wayback Machine, Yogi Berra, zero-coupon bond

Using the above principles, the investor has decided on the following policy allocation: 15% U.S. large market 10% U.S. large value 5% U.S. small market 10% U.S. small value 5% European 5% Pacific 5% Emerging markets 5% REITs 20% Municipal bonds 20% Short-term corporate bonds 154 The Intelligent Asset Allocator Using Table 8-2 for the stock funds, he decides to use the following Vanguard funds and place them in the appropriate taxable or taxsheltered account: Taxable Account 15% Total Stock Market Index Fund 5% Tax-Managed Small-Cap Index Fund 5% European Stock Index Fund 5% Pacific Stock Index Fund 20% Limited-Term Tax-Exempt Fund IRA Account 10% Value Index Fund 10% Small-Cap Value Index Fund 5% Emerging Markets Stock Index Fund 5% REIT Index Fund 20% Short-Term Corporate Fund Notice how the investor has segregated the most tax-efficient assets into the taxable account, and the least tax-efficient assets into the IRA.

…

But over many years, it takes a toll, as the SD of 25-year returns is only 1.6% (see Math Details). For large-cap funds, this means that the index-fund advantage, which has about the same 1.6% value, will result in a ⫹1 SD performance. Meaning that the index fund should beat 84% of actively managed funds. A small or foreign index fund with a 3.2% advantage should perform 2 SDs above the norm, meaning that it should beat 97% of active funds over a 25-year period. And an emerging-markets index fund with a several-percentage-point advantage should best all of its actively managed peers. Market Efficiency 97 Unfortunately, the real world is not nearly this neat, and it is worth looking at the actual data.

…

Vanguard also runs two other large-cap index funds, one for growth and one for value. Over the five-year period ending December 1998, the Growth Index Fund ranked in the 2nd percentile of the Morningstar large-cap growth category. The Value Index Fund ranked in the 21st percentile of its large-cap value category. Again, both of these are better than we’d calculate from the above formulation, which would predict only about 34th percentile fiveyear performance. Finally, to complete the picture, let’s look at small-cap indexing. The oldest small-cap index fund is the Dimensional Fund Advisors Market Efficiency 99 (DFA) 9-10 Small Company Fund.

The Permanent Portfolio by Craig Rowland, J. M. Lawson

Alan Greenspan, Andrei Shleifer, asset allocation, automated trading system, backtesting, bank run, banking crisis, Bear Stearns, Bernie Madoff, buy and hold, capital controls, correlation does not imply causation, Credit Default Swap, currency risk, diversification, diversified portfolio, en.wikipedia.org, fixed income, Flash crash, high net worth, High speed trading, index fund, inflation targeting, junk bonds, low interest rates, margin call, market bubble, money market fund, new economy, passive investing, Ponzi scheme, prediction markets, risk tolerance, stocks for the long run, survivorship bias, technology bubble, transaction costs, Vanguard fund

If, however, you only have access to an S&P 500 index fund, this will still work great for purposes of the Permanent Portfolio. Why Use an Index Fund? An index fund is a way of passively tracking a predefined basket of stocks. Index funds usually own stocks in proportion to the size of the company in the overall index. For example, an index fund tracking the U.S. stock market will typically own a larger number of shares of General Electric than a regional publicly traded utility company. The advantage of stock indexing is that an index fund doesn't need to engage in expensive activities associated with actively traded investment funds, such as research, analysts, advisors, and so on.

…

Owning Stocks To profit during times of prosperity you should own a broad-based stock index fund that captures the returns offered by the stock market without trying to beat the market. A broad-based stock index fund is able to capture the maximum gains available to all investors. There are many stock index funds available today. Some are great, some are mediocre, and some are downright bad. Unfortunately, the term “index fund” has also been used in recent years to describe all kinds of investment products, some of which bear little resemblance to a true index fund. These products are easily avoided if you follow the advice laid out in this chapter.

…

S&P 500 Index Vanguard S&P 500 Index Mutual Fund (Ticker: VFINX) State Street S&P 500 SPDR Exchange Traded Fund (Ticker: SPY) iShares S&P 500 Exchange Traded Fund (Ticker: IVV) Fidelity Spartan 500 Index Mutual Fund (Ticker: FSMKX) Schwab S&P 500 Index Mutual Fund (Ticker: SWPPX) Total Stock Market Index (TSM) Vanguard Total Stock Market Mutual Fund (Ticker: VTSMX) Vanguard Total Stock Market Exchange Traded Fund (Ticker: VTI) iShares Russell 3000 Index Exchange Traded Fund (Ticker: IWV) Fidelity Spartan Total Stock Market (Ticker: FSTMX) Schwab Total Stock Market (Ticker: SWTSX) This list is far from exhaustive, as many fund companies offer some type of index fund in their investment lineup. If you are at a brokerage or mutual fund company that offers its own index fund then you can use that as long as it meets the criteria outlined in this chapter. Which Type of Index Fund to Use? Given the choice between the two types of index funds described above, a total stock market fund offers wider diversification and tax efficiency when compared to S&P 500 index funds. A typical total stock market fund will hold thousands of stocks compared to the 500 stocks in the S&P 500 index.

pages: 239 words: 60,065

Retire Before Mom and Dad by Rob Berger

Airbnb, Albert Einstein, Apollo 13, asset allocation, Black Monday: stock market crash in 1987, buy and hold, car-free, cuban missile crisis, discovery of DNA, diversification, diversified portfolio, en.wikipedia.org, fixed income, hedonic treadmill, index fund, John Bogle, junk bonds, mortgage debt, Mr. Money Mustache, passive investing, Ralph Waldo Emerson, robo advisor, The 4% rule, the rule of 72, transaction costs, Vanguard fund, William Bengen, Yogi Berra, Zipcar

Furthermore, it’s impossible for us as investors to know ahead of time the one or two fund managers out of thousands who, 30 or 40 years from now, might beat the markets. Index funds are like having your cake and eating it too. They are cheap, simple, and most outperform actively managed funds over the long run. Index mutual funds come in different shapes and sizes, and that’s true for both stock index funds and bond index funds. Let’s look at both. Stock Index Funds We categorize stock index funds in four ways (actively managed funds are also categorized in four way): Size: Some index funds focus on small companies, some on big companies, and some on everything in between.

…

Bonds (20%) Foreign Developed Country Stocks (20%) Emerging Market Stocks (10%) REITs (10%) Here are the specific funds I used to create my 6-Fund Portfolio: Vanguard 500 Index Fund Admiral Shares (FVIAX) Vanguard Emerging Markets Stock Index Fund Admiral Shares (VEMAX) Vanguard Developed Markets Index Fund Admiral Shares (VTMGX) Vanguard Intermediate-Term Bond Index Fund Admiral Shares (VBILX) Vanguard Real Estate Index Fund Admiral Shares (VGSLX) Vanguard Small Cap Value Index Fund Admiral Shares (VSIAX) This approach does take more work. Remember, as market values change, you need to rebalance your portfolio from time to time.

…

So which is better, you ask—actively managed mutual funds or index funds? Oh, you’ve done it now. You’ve just stepped into one of the most contentious debates in all of investing. As contentious as the debate may be, I can settle it with two words: index funds. If you gave me a few more words, I’d say the following: Over long periods of time, index funds outperform most actively managed funds on an after-fee and after-tax basis. But that’s just the lawyer in me. My first answer was better: index funds. A review of the performance of mutual funds over decades strongly favors index funds. In a recent Op-ed piece in The Wall Street Journal,30 Burton Malkiel described the respective performance of actively managed funds compared to index funds: In 2016, two-thirds of actively managed mutual funds investing in large U.S. companies underperformed the S&P 500 Index.

pages: 407 words: 114,478

The Four Pillars of Investing: Lessons for Building a Winning Portfolio by William J. Bernstein

Alan Greenspan, asset allocation, behavioural economics, book value, Bretton Woods, British Empire, business cycle, butter production in bangladesh, buy and hold, buy low sell high, carried interest, corporate governance, cuban missile crisis, Daniel Kahneman / Amos Tversky, Dava Sobel, diversification, diversified portfolio, Edmond Halley, equity premium, estate planning, Eugene Fama: efficient market hypothesis, financial engineering, financial independence, financial innovation, fixed income, George Santayana, German hyperinflation, Glass-Steagall Act, high net worth, hindsight bias, Hyman Minsky, index fund, invention of the telegraph, Isaac Newton, John Bogle, John Harrison: Longitude, junk bonds, Long Term Capital Management, loss aversion, low interest rates, market bubble, mental accounting, money market fund, mortgage debt, new economy, pattern recognition, Paul Samuelson, Performance of Mutual Funds in the Period, quantitative easing, railway mania, random walk, Richard Thaler, risk tolerance, risk/return, Robert Shiller, Savings and loan crisis, South Sea Bubble, stock buybacks, stocks for the long run, stocks for the long term, survivorship bias, Teledyne, The inhabitant of London could order by telephone, sipping his morning tea in bed, the various products of the whole earth, the rule of 72, transaction costs, Vanguard fund, yield curve, zero-sum game

Steel, 147, 160 USA Today, 219, 220 Value averaging, 283–285 Value Line, 90 Value Line Fund, 90 Value stocks (“bad” companies) asset allocation, 120-122, 172, 248–255, 251–253 Graham on, 158 in portfolio building, 109, 120–122, 172 In Search of Excellence (Peters) on, 64 real returns on, 68, 69, 72 rebalancing, 289–290 returns on, 34-38 tax efficiency of, 263–264 Vanguard 500 Index Fund, 97, 98, 102–104, 215, 216 Vanguard GNMA Fund, 215-216 Vanguard Growth Index Fund, 249 Vanguard Limited Term Tax Exempt Fund, 261 Vanguard mutual funds fee structure, 210, 250, foreign indexed funds, 119 founding by Bogle, 213-214 as no-load company, 205 Vanguard Short-Term Corporate Fund, 261 Vanguard Small-Cap Index Fund, 99 Vanguard Tax-Managed Small-Cap Index Fund, 99 Vanguard Total International Fund, 255, 256 Vanguard Total Stock Market Fund, 104, 246 Vanguard Value Index Fund, 249-250 Variable annuity fund, 204 Variety, 145 Venetian prestiti, 10–13 Vertin, James, 96–97 Victoria, Queen of England, 143 Von Böhm-Bawerk, Eugen, 8 Wal-Mart, 34–35, 185 The Wall Street Journal, 85, 96, 98, 167, 211, 219, 222, 225 Wall Street Week (television program), 224 Walz, Daniel T., 231 Wellington Management Company, 213–214 Wells Fargo, first index fund, 96–97, 215, 245 Westinghouse, 133 Wheeler, Dan, 123 Where are the Customers’ Yachts?

…

But as Vanguard’s reputation, shareholder satisfaction ratings, and, most importantly, assets under management grew, it could no longer be ignored. By 1991, Fidelity threw in the towel and started its own low-cost index funds, as did Charles Schwab. As of this writing, there are now more than 300 index funds to choose from, not counting the newer “exchange-traded” index funds, which we’ll discuss shortly. Of course, not all of the companies offering the new index funds are suffused with Bogle’s sense of mission—fully 20% of index funds carry a sales load of up to 6%, and another 30% carry a 12b-1 annual fee of up to 1% per year for marketing. The most notorious of these is the American Skandia ASAF Bernstein (no relation!)

…

The smallest, American Greetings, has a market cap of $700 million, or 0.007% of the index—six hundred times smaller than GE. So an index fund which tracks the S&P 500 would have to own 600 times as much GE as American Greetings. What happens if GE plunges in value and American Greetings zooms? Nothing. Since an index fund simply holds each company in proportion to its market cap, the amount of each owned by an S&P 500 index fund adjusts automatically with its market cap. In other words, an index fund does not have to buy or sell stock with changes in value (unlike Wells Fargo’s ill-fated first index fund, which had to hold equal-dollar amounts of all 1,500 stocks on the New York Stock Exchange).

pages: 250 words: 77,544

Personal Investing: The Missing Manual by Bonnie Biafore, Amy E. Buttell, Carol Fabbri

asset allocation, asset-backed security, book value, business cycle, buy and hold, currency risk, diversification, diversified portfolio, Donald Trump, employer provided health coverage, estate planning, fixed income, Home mortgage interest deduction, index fund, John Bogle, Kickstarter, low interest rates, money market fund, mortgage tax deduction, risk tolerance, risk-adjusted returns, Rubik’s Cube, Sharpe ratio, stocks for the long run, Vanguard fund, Yogi Berra, zero-coupon bond

An index can represent just about any part of the financial market: U.S. stocks, foreign stocks, global stocks, bonds, the Asian market, and so on. An index fund buys the investments that its corresponding index owns (or, at the very least, a representative sampling) to replicate the performance of the index. An index fund of the S&P 500, for example, is made up of stocks from the 500 largest U.S. corporations. However, an index fund’s return is usually slightly lower than that of its index doppelganger, because the index fund has to pay fund-management expenses. Index funds are an easy and effective way to build a diversified investment portfolio. (Page 166 shows you just how easy it is.)

…

Instead, choose funds with above-average long-term performance—ones that beat the competition and, more importantly, the market indexes, over 3, 5, or 10 years or more. Troubleshooting Moment Watch for Closet Index Funds When you invest in stock funds, avoid closet index funds. They charge the high fees of actively managed mutual funds, but invest much like a market index. All they do is charge you fees for performance you could get cheaper from a genuine index fund, whether a mutual fund or ETF. Spotting a closet index fund is simple. You compare the fund’s average P/E ratio, sector weightings, and average earnings per share to the values for the fund’s comparable index.

…

How to Pick Funds Now that you know the basics about funds and how they work, you’re ready to hunt for the funds that meet your needs. Because index funds (mutual fund or ETF) and actively managed mutual funds don’t have the same characteristics, you evaluate them a little differently. Here’s a summary of how to choose different types of funds. Choosing an Index Fund or ETF The big challenge in picking an index fund or ETF is the number of choices. Depending on the index you’re looking at, you may have hundreds of index funds or ETFs to choose from. As with actively managed mutual funds, take a look at the fund’s prospectus, which you can find on the fund sponsor’s website. 92 Chapter 5 However, picking a fund is as easy as 1-2-3: 1.

pages: 357 words: 91,331

I Will Teach You To Be Rich by Sethi, Ramit

Albert Einstein, asset allocation, buy and hold, buy low sell high, diversification, diversified portfolio, do what you love, geopolitical risk, index fund, John Bogle, late fees, low interest rates, money market fund, mortgage debt, mortgage tax deduction, Paradox of Choice, prediction markets, random walk, risk tolerance, Robert Shiller, shareholder value, Silicon Valley, survivorship bias, the rule of 72, Vanguard fund

Just as the stock market may fall 10 percent one year and gain 18 percent the next year, index funds will rise and fall with the indexes they track. The big difference is in fees: Index funds have lower fees than mutual funds because there’s no expensive staff to pay. Vanguard’s S&P 500 index fund, for example, has an expense ratio of 0.18 percent. Remember, there are all kinds of index funds. International index funds are relatively volatile since they follow indexes that were just recently established. General U.S.-based index funds, on the other hand, are more reliable. Since they match the U.S. stock market, if the market goes down, index funds will also go down.

…

Ironically, this results in lots of taxes and trading fees, which, when combined with the expense ratio, makes it virtually impossible for the average fund investor to beat—or even match—the market over time. Bogle opted to discard the old model of mutual funds and introduce index funds. Today, index funds are an easy, efficient way to make a significant amount of money. Note, however, that index funds simply match the market. If you own all equities in your twenties (like me) and the stock market drops (like it has), your investments will drop (like mine, and everyone else’s, did). Index funds reflect the market, which is going through tough times but, as history has shown, will climb back up. As a bonus for using index funds, you’ll anger your friends in finance because you’ll be throwing up your middle finger to their entire industry—and you’ll keep their fees for yourself.

…

In short, mutual funds are prevalent because of their convenience, but because actively managed mutual funds are, by definition, expensive, they’re not the best investment any more. Active management can’t compete with passive management, which takes us to index funds, the more attractive cousin of mutual funds. Index Funds: The Attractive Cousin in an Otherwise Unattractive Family In 1975, John Bogle, the founder of Vanguard, introduced the world’s first index fund. These simple funds use computers to buy stocks and match the market (such as the S&P 500 or NASDAQ). Instead of having a mutual fund’s expensive staff of “experts” who try to beat the market, index funds set a lower bar: A computer matches the indexes by automatically matching the makeup of the market.

pages: 244 words: 58,247

The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your Life by Alexander Green

Alan Greenspan, Albert Einstein, asset allocation, asset-backed security, backtesting, behavioural economics, borderless world, buy and hold, buy low sell high, cognitive dissonance, diversification, diversified portfolio, Elliott wave, endowment effect, Everybody Ought to Be Rich, financial independence, fixed income, framing effect, hedonic treadmill, high net worth, hindsight bias, impulse control, index fund, interest rate swap, Johann Wolfgang von Goethe, John Bogle, junk bonds, Long Term Capital Management, means of production, mental accounting, Michael Milken, money market fund, Paul Samuelson, Ponzi scheme, risk tolerance, risk-adjusted returns, short selling, statistical model, stocks for the long run, sunk-cost fallacy, transaction costs, Vanguard fund, yield curve

So plunk the Vanguard High-Yield Corporate Fund (VWEHX), Vanguard REIT Index Fund (VGSIX), and Vanguard Inflation-Protected Securities Fund (VIPSX) in your retirement accounts. Our remaining funds—Vanguard Total Stock Market Index Fund (VTSMX), Vanguard Precious Metals and Mining Fund (VGPMX), Vanguard Emerging Markets Index Fund (VEIEX), Vanguard European Index Fund (VEURX), and Vanguard Pacific Index Fund (VPACX)—are pretty darn tax efficient. These are fine for your taxable accounts. However, the Vanguard Precious Metals Fund (VGPMX) is not an index fund and may make occasional capital gains distributions. So if there is still cash available in your retirement account, you might own this there, too.

…

Owning shares of a mutual fund saves you the trouble of researching, constructing, and monitoring a portfolio of individual stocks. THE WISER BET There are essentially two types of mutual funds: index funds and actively managed funds:1. Index funds. With indexing, the fund manager attempts to replicate the return of a particular benchmark, such as the S&P 500 or the Lehman Brothers Aggregate Bond Index. Index fund managers generally do not buy stocks or bonds that are not included in the benchmark. 2. Actively managed funds. Active managers try to outperform the benchmark by selecting the best-performing securities or trying to time the market.

…

That means you started with the following:• 15% in U.S. large-cap stocks ($15,000 in the Vanguard Total Stock Market Index) • 15% in U.S. small-cap stocks ($15,000 in the Vanguard Small-Cap Index) • 10% in European stocks ($10,000 in the Vanguard European Stock Index Fund) • 10% in Pacific Rim stocks ($10,000 in the Vanguard Pacific Stock Index Fund) • 10% in emerging markets ($10,000 in the Vanguard Emerging Markets Index Fund) • 10% in high-grade bonds ($10,000 in the Vanguard Short-Term Corporate Bond Fund) • 10% in high-yield bonds ($10,000 in the Vanguard High-Yield Corporate Bond Fund) • 10% in inflation-adjusted Treasuries ($10,000 in the Vanguard Inflation-Protected Securities Fund) • 5% in gold shares ($5,000 in the Vanguard Precious Metals and Mining Fund) • 5% in REITs ($5,000 in the Vanguard Real Estate Investment Trust Index Fund) At the end of the year, the total value of your portfolio will have changed, and so will the percentage you hold in each fund.

pages: 416 words: 118,592

A Random Walk Down Wall Street: The Time-Tested Strategy for Successful Investing by Burton G. Malkiel

accounting loophole / creative accounting, Alan Greenspan, Albert Einstein, asset allocation, asset-backed security, backtesting, Bear Stearns, beat the dealer, Bernie Madoff, book value, BRICs, butter production in bangladesh, buy and hold, capital asset pricing model, compound rate of return, correlation coefficient, Credit Default Swap, Daniel Kahneman / Amos Tversky, diversification, diversified portfolio, dogs of the Dow, Edward Thorp, Elliott wave, Eugene Fama: efficient market hypothesis, experimental subject, feminist movement, financial engineering, financial innovation, fixed income, framing effect, hindsight bias, Home mortgage interest deduction, index fund, invisible hand, Isaac Newton, Japanese asset price bubble, John Bogle, junk bonds, Long Term Capital Management, loss aversion, low interest rates, margin call, market bubble, Mary Meeker, money market fund, mortgage tax deduction, new economy, Own Your Own Home, PalmPilot, passive investing, Paul Samuelson, pets.com, Ponzi scheme, price stability, profit maximization, publish or perish, purchasing power parity, RAND corporation, random walk, Richard Thaler, risk free rate, risk tolerance, risk-adjusted returns, risk/return, Robert Shiller, short selling, Silicon Valley, South Sea Bubble, stock buybacks, stocks for the long run, sugar pill, survivorship bias, The Myth of the Rational Market, the rule of 72, The Wisdom of Crowds, transaction costs, Vanguard fund, zero-coupon bond

But you can count on the fingers of your hands the number of mutual funds that have beaten index funds by any significant margin. The Index-Fund Solution: A Summary Let’s now summarize the advantages of using index funds as your primary investment vehicle. Index funds have regularly produced rates of return exceeding those of active managers. There are two fundamental reasons for this excess performance: management fees and trading costs. Public index funds are run at a fee of less than 1/10 of 1 percent. Actively managed public mutual funds charge annual management expenses that average one percentage point per year. Moreover, index funds trade only when necessary, whereas active funds typically have a turnover rate close to 100 percent.

…

Thus, investors should not buy a U.S. stock-market index fund and hold no other securities. But this is not an argument against indexing, because index funds currently exist that mimic the performance of various international indexes such as the Morgan Stanley Capital International (MSCI) index of European, Australasian, and Far Eastern (EAFE) securities, and the MSCI emerging-markets index. In addition, there are index funds holding real estate investment trusts (REITs). Finally, Total Bond Market index funds are available that track the Barclays Aggregate Bond Market Index. Moreover, all these index funds have also tended to outperform actively managed funds investing in similar securities.

…

Those who need a steady income for living expenses could increase their holdings of real estate equities, because they provide somewhat larger current income. A SPECIFIC INDEX-FUND PORTFOLIO FOR AGING BABY BOOMERS Cash (5%)* Fidelity Money Market Fund (FORXX), or Vanguard Prime Money Market Fund (VMMXX) Bonds (27½%)† Vanguard Total Bond Market Index Fund (VBMFX) Real Estate Equities (12½%) Vanguard REIT Index Fund (VGSIX) Stocks (55%) U.S. Stocks (27%) Fidelity Spartan (FSTMX), T. Rowe Price (POMIX), or Vanguard (VTSMX) Total Stock Market Index Fund Developed International Markets (14%) Fidelity Spartan (VSIIX), or Vanguard (VDMIX) International Index Fund Emerging International Markets (14%) Vanguard Emerging Markets Index Fund (VEIEX) Remember also that I am assuming here that you hold most, if not all, of your securities in tax-advantaged retirement plans.

pages: 268 words: 64,786

Cashing Out: Win the Wealth Game by Walking Away by Julien Saunders, Kiersten Saunders

barriers to entry, basic income, Big Tech, Black Monday: stock market crash in 1987, blockchain, COVID-19, cryptocurrency, death from overwork, digital divide, diversification, do what you love, Donald Trump, estate planning, financial independence, follow your passion, future of work, gig economy, glass ceiling, global pandemic, index fund, job automation, job-hopping, karōshi / gwarosa / guolaosi, lifestyle creep, Lyft, microaggression, multilevel marketing, non-fungible token, off-the-grid, passive income, passive investing, performance metric, ride hailing / ride sharing, risk tolerance, Salesforce, side hustle, TaskRabbit, TED Talk, Uber and Lyft, uber lyft, universal basic income, upwardly mobile, Vanguard fund, work culture , young professional

And that’s what makes index funds so much more attractive. Index Funds Index funds are a type of mutual fund except for one key difference: they are passively managed. In other words, there aren’t nearly as many geeks in some back room looking at screens making guesses about which stocks will outperform others. Instead, when you buy an index fund, you’re buying a whole market, category, or sector of funds. For instance, if you purchase an S&P 500 index fund, you are essentially buying a piece of every stock listed on the S&P 500. Similarly, when you purchase a Nasdaq index fund, you’re buying a piece of the entire Nasdaq as a whole.

…

And the time and money you could be investing in yourself will be spent searching for all the answers to questions you may never actually encounter. Let’s say you’re ready to invest and want more information about index funds. Like most people, you’d probably google “Are index funds a good investment?” On the first page of the search results, you’d see several recent articles. One might be called “Four Reasons Why Index Funds Are the Best Investment for Everyday Investors.” Another, “Why the Index Fund Bubble Will Pop, Leaving Investors Out to Dry.” You might even see conflicting articles on the same website, published days or even hours apart. Now you’re doubting something you were pretty sure about a few minutes ago because there’s clearly more to learn.

…

Second, these new insights all led me to the same solution—index funds. Investing in index funds had been around for decades but had been cast as a boring, predictable, and lazy approach to investing. Nevertheless, I was intrigued and ready to give it a try. There was only one problem. When I told Martin what I’d learned and that I was interested in investing in index funds, he seemed a little hesitant. This was because, in order for him to do what I was asking him to do, he’d have to sell the stocks and mutual funds I’d already invested in and reallocate the funds into index funds. Well, the company he worked for didn’t offer those funds or anything remotely like them.

pages: 232 words: 70,835

A Wealth of Common Sense: Why Simplicity Trumps Complexity in Any Investment Plan by Ben Carlson

Albert Einstein, asset allocation, backtesting, Bernie Madoff, Black Monday: stock market crash in 1987, Black Swan, book value, business cycle, buy and hold, buy low sell high, commodity super cycle, corporate governance, delayed gratification, discounted cash flows, diversification, diversified portfolio, do what you love, endowment effect, family office, financial independence, fixed income, Gordon Gekko, high net worth, index fund, John Bogle, junk bonds, loss aversion, market bubble, medical residency, Occam's razor, paper trading, passive investing, Ponzi scheme, price anchoring, Reminiscences of a Stock Operator, Richard Thaler, risk tolerance, Robert Shiller, robo advisor, South Sea Bubble, sovereign wealth fund, stocks for the long run, technology bubble, Ted Nelson, transaction costs, Vanguard fund, Vilfredo Pareto

The lines are becoming increasingly blurred between the two approaches and it's going to matter less and less in the future as the industry evolves and ETFs continue to take market share from the current crop of overpriced and overhyped active mutual funds. To help sort out all of the clutter, here are the five degrees of active and passive investing: Total market index funds. The classic three-fund portfolio from Vanguard (or any low-cost index fund provider) consists of some combination of the Total U.S. Stock Market Index Fund, the Total International Stock Market Index Fund, and the Total U.S. Bond Market Index Fund. These three funds are very broadly diversified and include nearly 18,000 securities across a wide range of sectors, geographies, and companies. If you really want to cover all of your bases, these funds will get you there for the most part.

…

Next Ferri and Benke simulated 5,000 trials of randomly selected active mutual funds taken from the same categories at the same portfolio weights as their 40/20/40 index fund portfolio. Their results were impressive and somewhat surprising to even the study's authors. When they ran a simulation, the index fund portfolio beat the active fund portfolio almost 83 percent of the time or 4,144 times. That means 856 times or just 17 percent of active portfolios outperformed.12 Picking a single active mutual fund that can beat an index fund is not easy. Picking an entire portfolio of active funds that can beat a portfolio of index funds is even harder. Exhibit 5: Smaller Upside, But Bigger Downside Risk Ferri and Benke also ran studies that included portfolios that were more broadly diversified by including more asset class breakdowns (combinations of REITs, small-cap stocks, mid-cap stocks, emerging markets, TIPs, municipal bonds, and different bond durations).

…

Only 18 percent, or about 275 funds, of the initial 1,540 funds in the study both survived the full period and outperformed their benchmarks.10 In a separate study, Vanguard founder John Bogle discovered that almost half of all mutual funds created in the 1990s stock market boom ended up failing and following the technology bust there were 1,000 fund failures from 2000 to 2004.11 Exhibit 4: If Picking One Active Fund Is Hard . . . Rick Ferri and Alex Benke performed a study that spanned 16 years by looking at Vanguard's three-fund portfolio of total market index funds in U.S. stocks, foreign stocks, and U.S. bonds. You can see in Table 6.3 that these broadly diversified total market index funds beat the majority of active funds in their respective categories. Table 6.3 Index Fund Outperformance 1997 to 2012 Fund Category Index Win % Median Loss Median Win U.S. Stocks (VTSMX) 77.10% –2.01% 0.97% International Stocks (VGTSX) 62.50% –1.75% 1.34% U.S.

Playing With FIRE (Financial Independence Retire Early): How Far Would You Go for Financial Freedom? by Scott Rieckens, Mr. Money Mustache

Airbnb, An Inconvenient Truth, cryptocurrency, do what you love, effective altruism, financial independence, index fund, job satisfaction, lifestyle creep, low interest rates, McMansion, Mr. Money Mustache, passive income, remote working, sunk-cost fallacy, The 4% rule, Vanguard fund