the market place

189 results back to index

The Trade Lifecycle: Behind the Scenes of the Trading Process (The Wiley Finance Series) by Robert P. Baker

asset-backed security, bank run, banking crisis, Basel III, Black-Scholes formula, book value, Brownian motion, business continuity plan, business logic, business process, collapse of Lehman Brothers, corporate governance, credit crunch, Credit Default Swap, diversification, financial engineering, fixed income, functional programming, global macro, hiring and firing, implied volatility, interest rate derivative, interest rate swap, locking in a profit, London Interbank Offered Rate, low interest rates, margin call, market clearing, millennium bug, place-making, prediction markets, proprietary trading, short selling, statistical model, stochastic process, the market place, the payments system, time value of money, too big to fail, transaction costs, value at risk, Wiener process, yield curve, zero-coupon bond

They are sometimes referred to as the ‘sell side’ of the industry because they are supplying products for the market place. Investment banks are active in trading activities in order to: 1. Service their clients The clients come to the bank with requirements that are satisfied by trading. The bank can either act as the middleman or broker to execute trades on behalf of the client who has no access to counterparties or it can trade directly with the client and either absorb the trade or deal an equal and opposite trade (known as back-to-back) in the market place, making a profit by enjoying lower trade costs. 2. Proprietary trading Most investment banks have proprietary (or ‘prop’) desks with the aim of using the bank’s resources to make profit.

…

Such options may trade regularly with a three and six-month maturity, but not the exact maturity of the trade. The basic product (call options on BT) is liquid, but the specific trade is not. No prices available For complicated or illiquid trades there may be no equivalent trade available in the market place and so mark-to-market is impossible. To take the 340 THE TRADE LIFECYCLE car example, if I owned a car which I customised in some way so that very few cars like it were available in the market place, I would not be able to get a direct valuation. I would have to estimate how much difference my modification had made to the price of the standard model and add that to the standard model price.

…

He does however take a keen interest in the apple market, understands the factors affecting it such as weather, blight and consumer demands and can therefore offer financial products to both buyers and sellers of apples and take profit in order to help them offset their risk. The facilitator brings all of the market participants together hence creating a market place for apples and financial products based on apples. 54 THE TRADE LIFECYCLE Typical activities in the market place might be: buying and selling apples now buying and selling apples at a later date for a fixed price options to buy and sell apples later insurance against apples not being grown (because of bad weather etc) or not being available (due to high demand). Let’s consider how one of the market participants, the grower, can take advantage of financial products in apples.

pages: 369 words: 94,588

The Enigma of Capital: And the Crises of Capitalism by David Harvey

accounting loophole / creative accounting, Alan Greenspan, anti-communist, Asian financial crisis, bank run, banking crisis, Bernie Madoff, Big bang: deregulation of the City of London, Bretton Woods, British Empire, business climate, call centre, capital controls, cotton gin, creative destruction, credit crunch, Credit Default Swap, David Ricardo: comparative advantage, deindustrialization, Deng Xiaoping, deskilling, equal pay for equal work, European colonialism, failed state, financial innovation, Frank Gehry, full employment, gentrification, Glass-Steagall Act, global reserve currency, Google Earth, Great Leap Forward, Guggenheim Bilbao, Gunnar Myrdal, guns versus butter model, Herbert Marcuse, illegal immigration, indoor plumbing, interest rate swap, invention of the steam engine, Jane Jacobs, joint-stock company, Joseph Schumpeter, Just-in-time delivery, land reform, liquidity trap, Long Term Capital Management, market bubble, means of production, megacity, microcredit, military-industrial complex, Money creation, moral hazard, mortgage debt, Myron Scholes, new economy, New Urbanism, Northern Rock, oil shale / tar sands, peak oil, Pearl River Delta, place-making, Ponzi scheme, precariat, reserve currency, Ronald Reagan, Savings and loan crisis, sharing economy, Shenzhen special economic zone , Silicon Valley, special drawing rights, special economic zone, statistical arbitrage, structural adjustment programs, subprime mortgage crisis, technological determinism, the built environment, the market place, The Theory of the Leisure Class by Thorstein Veblen, The Wealth of Nations by Adam Smith, Thomas L Friedman, Thomas Malthus, Thorstein Veblen, Timothy McVeigh, too big to fail, trickle-down economics, urban renewal, urban sprawl, vertical integration, white flight, women in the workforce

In this case the capitalist starts the day with a certain amount of money, and, having selected a technology and organisational form, goes into the market place and buys the requisite amounts of labour power and means of production (raw materials, physical plant, intermediate products, machinery, energy and the like). The labour power is combined with the means of production through an active labour process conducted under the supervision of the capitalist. The result is a commodity that is sold by its owner, the capitalist, in the market place for a profit. The next day, the capitalist, for reasons that will shortly become apparent, takes a portion of yesterday’s profit, converts it into fresh capital and begins the process anew on an expanded scale.

…

This reserve army needs to be accessible, socialised, disciplined and of the requisite qualities (i.e. flexible, docile, manipulable and skilled when necessary). If these conditions are not met, then capital faces a serious barrier to continuous accumulation. The dispossession of the mass of the population from direct access to the means of production (land in particular) releases labour power as a commodity into the market place. Marx’s account of so-called ‘primitive accumulation’ may be overdramatised and oversimplified but its essential truth is undeniable. Somehow or other the mass of a population has been put in a position of having to work for capital in order to live. Primitive accumulation did not end with the rise of industrial capitalism in Britain in the late eighteenth century.

…

They can also support investing in improvements to the qualities of labour supply through health care, education and housing and ultimately, as did Henry Ford when he moved to establish a $5 dollar 8-hour day in the 1920s, propose higher wages and rationalised worker consumption as a means to ensure a stronger effective demand in the market place. The role of state power in relation to such struggles is by no means fixed. To be sure, if labour is too well organised and too powerful in a particular location, then the capitalist class will seek to command the state apparatus to do its bidding, as happened, noted earlier, with Pinochet, Reagan, Thatcher, Kohl et al.

The Rough Guide to England by Rough Guides

active transport: walking or cycling, Airbnb, Albert Einstein, Apollo 11, bike sharing, Bletchley Park, Bob Geldof, Boris Johnson, Brexit referendum, British Empire, car-free, Columbine, company town, congestion charging, Corn Laws, country house hotel, Crossrail, deindustrialization, Downton Abbey, Edmond Halley, Etonian, food miles, gentrification, Great Leap Forward, haute cuisine, housing crisis, Isaac Newton, James Watt: steam engine, Jeremy Corbyn, John Harrison: Longitude, Kickstarter, low cost airline, Neil Kinnock, offshore financial centre, period drama, plutocrats, Suez canal 1869, Suez crisis 1956, the market place, trade route, transatlantic slave trade, University of East Anglia, upwardly mobile, urban sprawl

Corinium Museum Park St, GL7 2BX • Mon–Sat 10am–5pm, Sun 2–5pm; Nov–March closes 4pm • £5.40 • 01285 655611, coriniummuseum.org West of the Market Place, the sleek Corinium Museum is devoted to the history of the town from Roman to Victorian times. The collection of Romano-British antiquities is particularly fine, including wonderful mosaic pavements. Other highlights include a trove of Bronze Age gold and an excellent video on Cotswold life in the Iron Age. New Brewery Arts Centre Brewery Court, off Cricklade St, GL7 1JH • Mon–Sat 9am–5pm; April–Dec also Sun 10am–4pm • Free • 01285 657181, newbreweryarts.org.uk Just south of the Market Place, the New Brewery Arts Centre is occupied by more than a dozen resident artists whose studios you can visit and whose work you can buy in the shop.

…

Opposite, just across the street to the north, is former Ossington Coffee Palace, a flashy structure whose Tudor appearance is entirely fraudulent – it was built in the 1880s as a temperance hotel by a local bigwig, in an effort to save drinkers from themselves. From here, it’s just a couple of minutes’ walk east through a network of narrow lanes and alleys to the Market Place, an expansive square framed by attractive Georgian and Victorian facades. Church of St Mary Magdalene Church Walk, NG24 1JS • Mon–Sat 8.30am–4pm, but often closed for lunch; May–Sept also Sun noon–4pm • Free • 01636 706473 Standing just off the Market Place, the mostly thirteenth-century church of St Mary Magdalene is a handsome if badly weathered structure whose massive spire (236ft) soars high above the town centre.

…

Henley-on-Thames Three counties – Oxfordshire, Berkshire and Buckinghamshire – meet at HENLEY-ON-THAMES, long a favourite stopping place for travellers between London and Oxford. Nowadays, Henley is a good-looking, affluent commuter town at its prettiest among the old brick and stone buildings that flank the short main drag, Hart Street. At one end of Hart Street is the Market Place and its fetching Town Hall, while at the other stand the easy Georgian curves of Henley Bridge. Overlooking the bridge is the parish church of St Mary, whose square tower sports a set of little turrets worked in chequerboard flint and stone. River and Rowing Museum Mill Meadows, RG9 1BF • Daily 10am–5pm • £12.50 • 01491 415600, rrm.co.uk A five-minute walk south along the riverbank from the foot of Hart Street lies Henley’s imaginative River and Rowing Museum.

pages: 1,497 words: 492,782

The Complete Novels Of George Orwell by George Orwell

British Empire, fixed income, gentleman farmer, Machine translation of "The spirit is willing, but the flesh is weak." to Russian and back, pneumatic tube, the market place, traveling salesman, union organizing, white flight

This was Binfield House (‘The Hall’, everybody called it), and the top of the hill was known as Upper Binfield, though there was no village there and hadn’t been for a hundred years or more. I must have been nearly seven before I noticed the existence of Binfield House. When you’re very small you don’t look into the distance. But by that time I knew every inch of the town, which was shaped roughly like a cross with the market-place in the middle. Our shop was in the High Street a little before you got to the market-place, and on the corner there was Mrs Wheeler’s sweet-shop where you spent a halfpenny when you had one. Mother Wheeler was a dirty old witch and people suspected her of sucking the bull’s-eyes and putting them back in the bottle, though this was never proved.

…

Behind the houses you could see the chimneys of the brewery. In the middle of the market-place there was the stone horse-trough, and on top of the water there was always a fine film of dust and chaff. Before the war, and especially before the Boer War, it was summer all the year round. I’m quite aware that that’s a delusion. I’m merely trying to tell you how things come back to me. If I shut my eyes and think of Lower Binfield any time before I was, say, eight, it’s always in summer weather that I remember it. Either it’s the market-place at dinner-time, with a sort of sleepy dusty hush over everything and the carrier’s horse with his nose dug well into his nosebag, munching away, or it’s a hot afternoon in the great green juicy meadows round the town, or it’s about dusk in the lane behind the allotments, and there’s a smell of pipe-tobacco and night-stocks floating through the hedge.

…

Another couple of hundred yards and I’d be in the market-place. The old shop was down the other end of the High Street. I’d go there after lunch–I was going to put up at the George. And every inch a memory! I knew all the shops, though all the names had changed, and the stuff they dealt in had mostly changed as well. There’s Lovegrove’s! And there’s Todd’s! And a big dark shop with beams and dormer windows. Used to be Lilywhite’s the draper’s, where Elsie used to work. And Grimmett’s! Still a grocer’s apparently. Now for the horse-trough in the market-place. There was another car ahead of me and I couldn’t see.

The Hour of Fate by Susan Berfield

bank run, buy and hold, capital controls, collective bargaining, company town, Cornelius Vanderbilt, death from overwork, friendly fire, Howard Zinn, Ida Tarbell, income inequality, new economy, plutocrats, Ralph Waldo Emerson, Simon Kuznets, strikebreaker, the market place, transcontinental railway, wage slave, working poor

Honorable Justice: The Life of Oliver Wendell Holmes. Lexington, MA: Plunkett Lake Press, 1989. Noyes, Alexander Dana. Forty Years of American Finance: A Short Financial History of the Government and People of the U.S. since the Civil War, 1865–1907. New York, NY: G. P. Putnam’s Sons, 1909. ________. The Market Place: Reminiscences of a Financial Editor. Boston, MA: Little, Brown and Company, 1938. Oberholtzer, Ellis Paxon. Jay Cooke: Financier of the Civil War. Vol. 2. Philadelphia, PA: George W. Jacobs & Co., 1907. Painter, Nell Irvin. Standing at Armageddon: A Grassroots History of the Progressive Era.

…

Be worth double: Historical Statistics of the United States, 1789–1945, 296. 15. A courier had earlier: Albro Martin, James J. Hill and the Opening of the Northwest, 427. 16. Morgan put on: Morgan’s reaction described in “Leaders of Finance Amazed,” New York Times, September 7, 1901, 3; “Financiers Shocked,” New York Tribune, September 7, 1901, 5; Alexander Dana Noyes, The Market Place: Reminiscences of a Financial Editor, 215. 17. McKinley was put under: Details of the operation drawn from “The Case of President McKinley,” Boston Medical and Surgical Journal (now New England Journal of Medicine) CXLV, no. 17 (October 12 1901): 451–57; “Report of the Medical Department of the Pan-American Expo, Buffalo 1901,” Buffalo Medical Journal, December 1901. 18.

…

It was responsible: Strouse, Morgan: American Financier, 404; employment number, Craig Phelan, Divided Loyalties: The Public and Private Life of Labor Leader John Mitchell, 135; Philip S. Forner, History of the Labor Movement in the United States, 78. 17. Orders came from: Alexander Dana Noyes, The Market Place: Reminiscences of a Financial Editor, 191. 18. So many checks: John Winkler, Morgan the Magnificent, 197–98. 19. “Mr. Morgan’s power”: “J. Pierpont Morgan Dazzles Mr. McKinley,” The World, March 9, 1901. 20. “Pierpont Morgan is”: Henry Adams to Elizabeth Cameron, February 11, 1901, Letters of Henry Adams, vol. 5: 199. 21.

pages: 312 words: 93,836

Barometer of Fear: An Insider's Account of Rogue Trading and the Greatest Banking Scandal in History by Alexis Stenfors

Alan Greenspan, Asian financial crisis, asset-backed security, bank run, banking crisis, Bear Stearns, Big bang: deregulation of the City of London, bonus culture, capital controls, collapse of Lehman Brothers, credit crunch, Credit Default Swap, Eugene Fama: efficient market hypothesis, eurozone crisis, financial deregulation, financial innovation, fixed income, foreign exchange controls, game design, Gordon Gekko, inflation targeting, information asymmetry, interest rate derivative, interest rate swap, London Interbank Offered Rate, loss aversion, mental accounting, millennium bug, Nick Leeson, Northern Rock, oil shock, Post-Keynesian economics, price stability, profit maximization, proprietary trading, regulatory arbitrage, reserve currency, Rubik’s Cube, Snapchat, Suez crisis 1956, the market place, The Wealth of Nations by Adam Smith, too big to fail, transaction costs, work culture , Y2K

One by one, these prices would be shouted across the dealing room to the chief dealer, who would then decide what to do and would shout back ‘Mine!’, ‘Yours!’ or ‘Thanks, but nothing there!’ We would then immediately repeat ‘Mine!’, ‘Yours!’ or ‘Thanks, but nothing there!’ to the person on the other line. Clients were referred to as market or price ‘takers’, referring to how they approached the market place. We and our competitors, on the other hand, were market or price ‘makers’, as we quoted the prices they could trade at. One of the key requirements to becoming a member of the market-making club was that you always had to quote two-way prices to the other club members: a bid and an offer at the same time.

…

The bank can lower the interest rate it charges on its loans, which is linked to LIBOR. Households with mortgages gain. Companies can borrow at lower interest rates, invest more and create more jobs. And so on. Despite the success story of the exchange-traded LIBOR-based derivatives, such as Eurodollar futures, it was the OTC derivatives market that truly changed the market place. This was the largely unregulated market for interest rate and foreign exchange derivatives that always involved two counterparties: a bank and a client, or, more frequently, a bank and another bank. OTC derivatives, such as IRSs, CRSs, FRAs, caps and floors differed from exchange-traded derivatives in the sense that they were much less standardised and could be tailor-made to suit the needs and wants of those involved in the transaction.

…

The ability to participate in auctions or to be a vehicle through which interventions take place is often profitable, but sometimes also loss making. The information, however, is useful. If you cannot profit from it directly, it is still perceived to be valuable, as others not belonging to the club might think you know something they don’t. This enhances your reputation tremendously in the market place. When I was working for HSBC in Stockholm, we were desperate to become primary dealers in government bonds. Being part of the T-bill club was not enough. Some of our sales people even complained that their customers refused to trade with us unless we also joined the bond club. The information they got from the primary dealers was superior to what we had to offer.

pages: 273 words: 34,920

Free Market Missionaries: The Corporate Manipulation of Community Values by Sharon Beder

"Friedman doctrine" OR "shareholder theory", "World Economic Forum" Davos, Alan Greenspan, anti-communist, battle of ideas, business climate, Cornelius Vanderbilt, corporate governance, electricity market, en.wikipedia.org, full employment, Herbert Marcuse, Ida Tarbell, income inequality, invisible hand, junk bonds, liquidationism / Banker’s doctrine / the Treasury view, minimum wage unemployment, Mont Pelerin Society, new economy, old-boy network, popular capitalism, Powell Memorandum, price mechanism, profit motive, Ralph Nader, rent control, risk/return, road to serfdom, Ronald Reagan, school vouchers, shareholder value, spread of share-ownership, structural adjustment programs, The Chicago School, the market place, The Wealth of Nations by Adam Smith, Thomas L Friedman, Torches of Freedom, trade liberalization, traveling salesman, trickle-down economics, two and twenty, Upton Sinclair, Washington Consensus, wealth creators, young professional

The supply-siders will always have a safe haven in the world of Free Enterprise Institutes and Centers for the Study of Capitalism, outlets in the pages of Forbes and the Wall Street Journal, and new recruits who never tire of saying the same things again and again.33 Similarly, Sidney Blumenthal, in his book The Rise of the Counter-Establishment, argued that supply-side economics ‘travelled from lunatic panacea to official catechism in a few short years’.34 It also had popular appeal because of its ‘have your cake and eat it too’ message: Supply-side economics provided the theoretical underpinnings for oldfashioned optimism. The doctrine restated the free-market myth with verve and originality. In an era when the ‘limits to growth’ were proclaimed, the gnostic supply-siders made claims to knowing the secret of endless wealth: the magic of the market place . . . a theory for the multitude of go-getters, promising that the cornucopia was bottomless.35 This optimism helped Ronald Reagan to get elected, despite George Bush labelling supply-side theories as ‘voodoo economics’ when he was a rival candidate for presidential nomination in the 1980 primaries.

…

Without market pressures, government managers have no incentive to reduce waste or become economically efficient. In this way, governments tend to oversupply public goods, or supply them in a wasteful way. However, critics do not accept the assumption that motivations in the political sphere are the same as those in the market place. Surveys seem to back this up: In almost every case there is a relationship between the way the individual views the state of the economy or the competence of the government and how she votes; but little relationship between her vote and her personal financial status . . . Of course the voter will hope that what is best for the PRO-BUSINESS POLICIES AS IDEOLOGY 105 national prosperity will also in due course benefit him or herself but this is a different kind of judgement from ‘pocketbook voting’.52 Ideology, which also plays a key role in politics, cannot easily be explained in terms of self-interest.

…

Politicians and government officials therefore look to experts in the think tanks to interpret and make sense of all that information. This gives rise to a set of policy entrepreneurs based in think tanks who usually have the coherent vision that politicians lack, particularly the conservative think tanks that promote the market place as an alternative to big government.36 Corporate-funded neoconservative think tanks proliferated and expanded in the US in the 1970s, promoting the free market and campaigning against big government and government regulation. Their explicit political goals caused them to be referred to as advocacy think tanks.

pages: 273 words: 21,102

Branding Your Business: Promoting Your Business, Attracting Customers and Standing Out in the Market Place by James Hammond

Abraham Maslow, Albert Einstein, call centre, Donald Trump, intangible asset, James Dyson, Jeff Bezos, low interest rates, market design, Nelson Mandela, Pepsi Challenge, Ralph Waldo Emerson, Steve Jobs, the market place

Well-written, clearly structured, and packed full of sound advice, James has produced an outstanding and intelligent guide to branding in the 21st century.” Roderick Wilkes, CEO, The Chartered Institute of Marketing E N T E R P R I S E S E R I E S Branding Your Business Promoting your business, attracting customers and standing out in the market place James Hammond Branding Your Business THIS PAGE INTENTIONALLY LEFT BLANK ii Branding Your Business Promoting your business, attracting customers and standing out in the market place James Hammond London and Philadelphia Publisher’s note Every possible effort has been made to ensure that the information contained in this book is accurate at the time of going to press, and the publishers and author cannot accept responsibility for any errors or omissions, however caused.

…

ISBN 978 0 7494 5073 1 British Library Cataloguing-in-Publication Data A CIP record for this book is available from the British Library. Library of Congress Cataloging-in-Publication Data Hammond, James, 1952– Branding your business : promoting your business, attracting customers, and standing out in the market place / James Hammond. p. cm. Includes bibliographical references and index. ISBN 978-0-7494-5073-1 1. Branding (Marketing)– –Management. 2. Consumer behavior. 3. Brand name products– –Psychological aspects. 4. Senses and sensation. 5. Communication in marketing. I. Title. HF5415.1255.H36 2008 658.8'27– –dc22 2007047429 Typeset by JS Typesetting Ltd, Porthcawl, Mid Glamorgan Printed and bound in India by Replika Press Pvt Ltd Contents Acknowledgements About the author ix xi Introduction 1 Part 1 Nothing but the brand 5 1.

Common Stocks and Uncommon Profits and Other Writings by Philip A. Fisher

book value, business climate, business cycle, buy and hold, data science, El Camino Real, estate planning, fixed income, index fund, low interest rates, market bubble, market fundamentalism, profit motive, RAND corporation, Salesforce, the market place, transaction costs, vertical integration

Informed chemical businessmen would not give this kind of award in the industry to a company that did not have the research departments to keep developing worthwhile new products and the chemical engineers to produce them profitably. Secondly, this type of award will leave its impression on the investment community. Nothing is more desirable for stockholders than the influence on share prices of an upward trend of earnings multiplied by a comparable upward trend in the way each dollar of such earnings is valued in the market place, as I mentioned in my concluding remarks about this company in the original edition. Other matters besides the introduction of new products and the problems of starting complex plants can also open up buying opportunities in the unusual company. For example, a Middle Western electronic company was, among other things, well known for its unusual and excellent labor relations.

…

Furthermore, since by definition he is only buying into a situation which for one reason or another is about to have a worthwhile increase in its earning power in the near- or medium-term future, he has a second element of support. Just as his stock would have risen more than the average stock when this new source of earning power became recognized in the market place if business had remained good, so if by bad fortune he has made his new purchase just prior to a general market break this same new source of earnings should prevent these shares from declining quite as much as other stocks of the same general type. However, many investors are not in the happy position of having a backlog of well-chosen investments bought comfortably below present prices.

…

But most important of all, as already discussed in an earlier chapter, the corporation of today is a very different thing from what it used to be. For the reasons already explained, today's corporation is designed to be far more suitable as an investment medium for those desiring long-range growth than as a vehicle for in-and-out trading. All this has profoundly changed the market place. It undoubtedly represents tremendous improvement—improvement, however, at the expense of marketability. The liquidity of the average stock has decreased rather than increased. In spite of breathtaking economic growth and a seemingly endless procession of stock splits, the volume of trading on the New York Stock Exchange has declined.

pages: 494 words: 128,801

Battle: The Story of the Bulge by John Toland

always be closing, Mason jar, the market place

But as his tanks approached the center of Stavelot heavy bazooka fire broke out. The first tank spun out of control into a house. Then the roar of antitank guns came from the market place. Two more German tanks burst into flames. Peiper angrily ordered a task force to detach itself from the main column, blast through the nest of resistance in the market place and secure the right flank. Then he ordered the main group to head west toward Trois Ponts and the Meuse. Over an hour had been senselessly lost already. The market place was defended by a company of infantrymen and a platoon of tank destroyers, commanded by Major Paul J. Sollis. They had entered Stavelot at 4 a.m.

…

But by dawn none of the reinforcing American units was as yet a threat to Kampfgruppe Peiper as it stood poised at the southern outskirts of Stavelot, only 25 air miles from its goal, the Meuse River. Peiper's men had bivouacked on the heights just south of the Ambleve River. First they would cross to the north bank over an ancient stone bridge, into the center of Stavelot, an industrial town of 3,000. After a hundred yards they would reach the market place and the main highway to the west. They would turn sharp left onto this road and continue to the next town on their route, Trois Ponts. Peiper's primary concern was the stone bridge. The night before an attempt to cross had brought a volley of rifle fire. But no matter how strongly defended, the bridge had to be seized before the Amis blew it up.

pages: 1,164 words: 309,327

Trading and Exchanges: Market Microstructure for Practitioners by Larry Harris

active measures, Andrei Shleifer, AOL-Time Warner, asset allocation, automated trading system, barriers to entry, Bernie Madoff, Bob Litterman, book value, business cycle, buttonwood tree, buy and hold, compound rate of return, computerized trading, corporate governance, correlation coefficient, data acquisition, diversified portfolio, equity risk premium, fault tolerance, financial engineering, financial innovation, financial intermediation, fixed income, floating exchange rates, High speed trading, index arbitrage, index fund, information asymmetry, information retrieval, information security, interest rate swap, invention of the telegraph, job automation, junk bonds, law of one price, London Interbank Offered Rate, Long Term Capital Management, margin call, market bubble, market clearing, market design, market fragmentation, market friction, market microstructure, money market fund, Myron Scholes, National best bid and offer, Nick Leeson, open economy, passive investing, pattern recognition, payment for order flow, Ponzi scheme, post-materialism, price discovery process, price discrimination, principal–agent problem, profit motive, proprietary trading, race to the bottom, random walk, Reminiscences of a Stock Operator, rent-seeking, risk free rate, risk tolerance, risk-adjusted returns, search costs, selection bias, shareholder value, short selling, short squeeze, Small Order Execution System, speech recognition, statistical arbitrage, statistical model, survivorship bias, the market place, transaction costs, two-sided market, vertical integration, winner-take-all economy, yield curve, zero-coupon bond, zero-sum game

We assume that the limit order book was empty at the start of trading. 1. At 10:01, Bea submits the first order. The market cannot match it with any other order because no standing orders are in the book. The market places Bea’s order to buy 3 limit 20.0 in the book. The market quote is now 20.0 bid for 3, no offer. 2. At 10:05, Sam submits the second order, to sell 2 limit 20.1. Sam cannot trade with Bea because Bea will not pay what Sam demands. The market places Sam’s order in the book. The market quote is now 20.0 bid for 3, 2 offered at 20.1. In some electronic screens, the quote would appear as “20.0-20.1 3 × 2.” Traders read this as “20 to a dime, 3 by 2,” or “20 bid for 3, 2 offered at a dime.” 3.

…

If the new order is a buy order, the order must indicate that the trader will pay at least the best offer price. If it is a sell order, the order must indicate that the trader will sell at or below the best bid. If a trade is possible, the new order is marketable. Market orders and aggressively priced limit orders are marketable orders. If the new order is not marketable, the market places it in the order book—according to its precedence—to wait for orders to arrive on the opposite side. Traders who do not want their unfilled orders to stand in the book must attach a fill-or-kill or an immediate-or-cancel instruction to their orders. If the new order is marketable, the matching system arranges a trade by matching the new order with the highest-ranking order on the other side of the market.

…

If the new order is marketable, the matching system arranges a trade by matching the new order with the highest-ranking order on the other side of the market. If this trade does not completely fill the new order, the market then matches the remainder of the new order with the next highest-ranking order on the other side. This process continues until the new order fills completely or until no further trades are feasible. The market places any remaining size in the order book unless the trader instructs otherwise. Under the discriminatory pricing rule, the limit price of the standing order determines the price for each trade. If the market matches a large incoming order with several standing limit orders placed at different prices, trades will take place at the various limit order prices. 6.4.1 Continuous Trading Example Suppose that traders submit the same set of orders used in the single price auction example to a continuous two-sided auction market.

pages: 403 words: 138,026

Arabian Sands by Wilfred Thesiger

back-to-the-land, clean water, Etonian, Fellow of the Royal Society, MITM: man-in-the-middle, the market place

Khartoum seemed like the suburbs of North Oxford dumped down in the middle of the Sudan. I hated the calling and the cards, I resented the trim villas, the tarmac roads, the meticulously aligned streets in Omdurman, the signposts, and the public conveniences. I longed for the chaos, the smells, the untidiness, and the haphazard life of the market-place in Addis Ababa; I wanted colour and savagery, hardship and adventure. Had I been posted to one of the towns I have no doubt that, disgruntled, I should have left the Sudan within a few months, but Charles Dupuis, Governor of Darfur, had anticipated my reaction and had asked that I should be sent to his Province.

…

They were small and wiry, about five feet four inches in height, and were dressed in a length of dark-blue cloth wound round their waists, with an end thrown over one shoulder; the indigo had run out from the cloth and smeared their chests and arms. They were bare-headed, and their hair was long and untidy. Both of them wore daggers and carried rifles. My guard said that they were Bedu from beyond the mountains and that they belonged to the Bait Kathir. In the market-place were more of them, while others waited outside the palace gates. They reminded me of the tribesmen whom I had seen recently at Dhala on the Yemen border, and seemed very different to the Arabs from the great Bedu tribes I had met in Syria and the Najd. The palace gates were guarded by armed men dressed in long Arab shirts and head-cloths.

…

The Dahm had a blood-feud with his own tribe and was living among the Yam. He told me that he had been in Najran in the summer when a Christian had come there from Abha and stayed for two days with bin Madhi, the Amir. He was amused when I told him that I was this Christian. He said he had seen me in the distance in the market-place, but that I was then wearing different clothes. This was true, as at that time I was dressed as a Saudi. When we left them they explained how to find the next well. There was a clearly-marked track to Laila, and this route, surveyed by Philby, was shown on the map I had with me. The following afternoon, seeing dark clouds banking up in the west, I asked Muhammad, without thinking, if it would rain, and he answered immediately, ‘Only God knows.’

pages: 495 words: 138,188

The Great Transformation: The Political and Economic Origins of Our Time by Karl Polanyi

agricultural Revolution, Berlin Wall, borderless world, business cycle, central bank independence, Corn Laws, currency manipulation / currency intervention, David Ricardo: comparative advantage, Fall of the Berlin Wall, full employment, inflation targeting, joint-stock company, Kula ring, land reform, land tenure, liberal capitalism, manufacturing employment, new economy, Panopticon Jeremy Bentham, price mechanism, profit motive, Republic of Letters, road to serfdom, Ronald Reagan, scientific management, the market place, The Wealth of Nations by Adam Smith, trade liberalization, trade route, trickle-down economics, Washington Consensus, Wolfgang Streeck, working poor, Works Progress Administration

If any occurrence should prevent the holding of the market on one or more days, business cannot be resumed until the market-place has been purified.… Every injury occurring on the market-place and involving the shedding of blood necessitated immediate expiation. From that moment no woman was allowed to leave the market-place and no goods might be touched; they had to be cleansed before they could be carried away and used for food. At the very least a goat had to be sacrificed at once. A more expensive and more serious expiation was necessary if a woman bore a child or had a miscarriage on the market-place. In that case a milch animal was necessary. In addition to this, the homestead of the chief had to be purified by means of sacrificial blood of a milch-cow.

pages: 343 words: 41,228

Memoirs of Extraordinary Popular Delusions and the Madness of Crowds - the Original Classic Edition by Charles MacKay

clean water, invention of gunpowder, invisible hand, joint-stock company, land bank, railway mania, South Sea Bubble, the market place

He saw immediately how the mischief had been done; and, dismissing all the inferior imps, asked the principal demon how he could have been so rash as to kill the young man. The demon replied, that he had been needlessly invoked by an insulting youth, and could do no less than kill him for his presumption. Agrippa reprimanded him severely, and ordered him immediately to reanimate the dead body, and walk about with it in the market-place for the whole of the afternoon. The demon did so: the student revived; and, putting his arm through that of his unearthly murderer, walked very lovingly with him in sight of all the people. At sunset, the body fell down again, cold and lifeless as before, and was carried by the crowd to the hospital, it being the general opinion that he had expired in a fit of apoplexy.

…

One man had brooded over such tales till he became firmly convinced that the wild flights of his own fancy were realities. He stationed himself 13/10/2008 17:39 Printable format for Mackay, Charles, Memoirs of Extraordinary Popular ... 4 of 14 http://www.econlib.org/cgi-bin/printarticle.pl in the market-place of Milan, and related the following story to the crowds that gathered round him. He was standing, he said, at the door of the cathedral, late in the evening; and when there was nobody nigh, he saw a dark-coloured chariot, drawn by six milk-white horses, stop close beside him. The chariot was followed by a numerous train of domestics in dark liveries, mounted on dark-coloured steeds.

…

Several who had been thus informed against, were thrown into prison, and so horribly tortured, that reason fled, and, in their ravings of pain, they also confessed their midnight meetings with the devil, and the oaths they had taken to serve him. Upon these confessions judgment was pronounced: the poor old women, as usual in such cases, were hanged and burned in the market-place; the more wealthy delinquents were allowed to escape, upon payment of large sums. It was soon after universally recognized that these trials had been conducted in the most odious manner, and that the judges had motives of private vengeance against many of the more influential persons who had been implicated.

Free Money for All: A Basic Income Guarantee Solution for the Twenty-First Century by Mark Walker

3D printing, 8-hour work day, additive manufacturing, Affordable Care Act / Obamacare, basic income, Baxter: Rethink Robotics, behavioural economics, Capital in the Twenty-First Century by Thomas Piketty, commoditize, confounding variable, driverless car, financial independence, full employment, guns versus butter model, happiness index / gross national happiness, industrial robot, intangible asset, invisible hand, Jeff Bezos, job automation, job satisfaction, John Markoff, Kevin Kelly, laissez-faire capitalism, late capitalism, longitudinal study, market clearing, means of production, military-industrial complex, new economy, obamacare, off grid, off-the-grid, plutocrats, precariat, printed gun, profit motive, Ray Kurzweil, rent control, RFID, Rodney Brooks, Rosa Parks, science of happiness, Silicon Valley, surplus humans, The Future of Employment, the market place, The Wealth of Nations by Adam Smith, too big to fail, transaction costs, universal basic income, warehouse robotics, working poor

Coercion and Capitalism An important objection to U.$. Inc. is that there is a major dis-analogy between the profit-seeking activity of U.$. Inc. and its other business activities, namely, that U.$. Inc. is able to extract wealth only because it is a monopoly backed by illegitimate use of force. The thought is that there is choice in the market place: we can choose between different car brands, restaurants, and so on. Indeed, the eBay analogy supports this claim: there are alternative online auction companies to eBay if one does not like the price or services offered by eBay. The state offers no such alternatives and so it is a monopoly.

…

Some libertarians, for example, have considered buying an island or setting up a nation at sea, perhaps refurbishing an ocean liner. An appropriate name might be, “Our Lady Of Taxes Are Theft.” I predict that should she ever set sail, Our Lady Of Taxes Are Theft will sink—qua business model. For if it is launched as a business venture where it seeks to give a return to investors, it will have trouble competing in the market place for the usual reasons: would-be entrepreneurs who think they can undercut the price of existing business typically underestimate the costs of doing business and overestimate 62 FREE MONEY FOR ALL revenues. If Our Lady Of Taxes Are Theft is run on a socialistic co-op model, then I predict it will not work for the reason that many co-ops fail: it is hard to apportion the costs and benefits of such ventures.

…

Notice, however, the structure of this line of thought: negative liberty is used as an instrument to promote or preserve substantive autonomy. If it is correct that negative freedoms are tools for promoting substantive autonomy, then these tools can be evaluated in terms of how effective they are in achieving their ends. Laws permitting freedom of expression have, by and large, been successful in promoting substantive autonomy. The market place of ideas, as Mill termed it, has helped individuals explore a variety of viewpoints. It need not have turned out this way. It is possible to imagine Dr. Mesmer with the power of hypnotic speech such that he can hypnotize anyone into doing anything. As millions under the hypnotic influence line up to give away all their possessions to the doctor, we might insist that he refrain from using his hypnotic speech.

pages: 32 words: 7,759

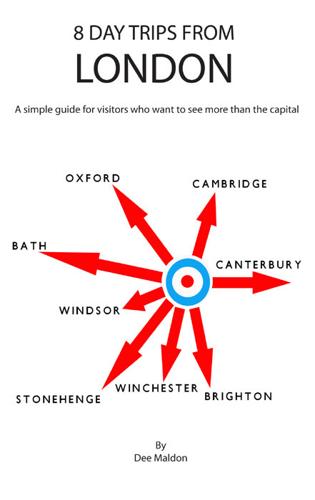

8 Day Trips From London by Dee Maldon

Doomsday Book, information retrieval, Isaac Newton, Stephen Hawking, the market place

The Whipple Museum of Science (Free School Lane off Pembroke Street) hosts scientific instruments that date from the Middle Ages. The Botanic Gardens (Bateman Street) offers a quiet stroll through a vast array of botanic specimens. Non-University sites worth seeing Most of the roads in the centre lead to Market Square, a comfortable place for walking. The market place offers a large plaza of independent traders. On its far side, you will see a tall church, St Mary the Great. This Gothic building is the main university and city church. Visitors are usually welcome and, for a fee, you can climb to the top of its church tower and survey the city and the surrounding countryside.

pages: 225 words: 61,814

The Consolations of Philosophy by Alain de Botton

classic study, Johann Wolfgang von Goethe, Socratic dialogue, the market place, urban planning

Intuitively, he places the blame on his choice of occupation and begins searching for an alternative, despite the high costs of doing so. It was the last time I would turn to See Inside an Ancient Greek Town. a blacksmith; a shoemaker; a fishmonger (Ill. 8.2) Deciding rapidly that he would be happy in the fish business, the man acquires a net and an expensive stall in the market-place. And yet his melancholy does not abate. We are often, in the words of the Epicurean poet Lucretius, like ‘a sick man ignorant of the cause of his malady’. It is because they understand bodily maladies better than we can that we seek doctors. We should turn to philosophers for the same reason when our soul is unwell – and judge them according to a similar criterion: Just as medicine confers no benefit if it does not drive away physical illness, so philosophy is useless if it does not drive away the suffering of the mind.

…

It was just that after rational analysis, he had come to some striking conclusions about what actually made life pleasurable – and fortunately for those lacking a large income, it seemed that the essential ingredients of pleasure, however elusive, were not very expensive. Happiness, an Epicurean acquisition list 1. Friendship On returning to Athens in 306 BC at the age of thirty-five, Epicurus settled on an unusual domestic arrangement. He located a large house a few miles from the centre of Athens, in the Melite district between the market-place and the harbour at Piraeus, and moved in with a group of friends. He was joined by Metrodorus and his sister, the mathematician Polyaenus, Hermarchus, Leonteus and his wife Themista, and a merchant called Idomeneus (who soon married Metrodorus’s sister). There was enough space in the house for the friends to have their own quarters, and there were common rooms for meals and conversations.

The City on the Thames by Simon Jenkins

Ascot racecourse, Big bang: deregulation of the City of London, Black Monday: stock market crash in 1987, Boris Johnson, bread and circuses, Brexit referendum, British Empire, clean water, computerized trading, congestion charging, Corn Laws, cross-subsidies, Crossrail, deindustrialization, estate planning, Frank Gehry, gentrification, housing crisis, informal economy, Isaac Newton, Jane Jacobs, John Snow's cholera map, light touch regulation, Louis Blériot, negative equity, new economy, New Urbanism, Northern Rock, Peace of Westphalia, place-making, railway mania, Richard Florida, Right to Buy, South Sea Bubble, sovereign wealth fund, strikebreaker, the built environment, The Death and Life of Great American Cities, the market place, Traffic in Towns by Colin Buchanan, upwardly mobile, urban renewal, Winter of Discontent, women in the workforce

Wherever people congregate there is potential for unrest but, over the two millennia of its existence, London’s conflicts have been remarkably peaceful. Fewer people have died from political violence in its streets than in any of the world’s other great cities. Its struggles have been organic, deriving from the nature of its growth, the forces of the market place and attempts to plan or regulate that market. That those attempts have largely failed is the outstanding fact of this story. London has long been its own master. When it has been traumatized – by Boudicca’s revolt, Norman conquest, Henrician Reformation, plague, fire or bombs – it has put its head down and minded its own business, with extraordinary success.

…

No one demurred from the ideal. Acts were even passed, one of 1935 ambitiously called the Restriction of Ribbon Development Act. But the disconnect between government in Whitehall and reality on the ground was total. Authority could say what it liked. Nothing linked steering wheel to engine, and the engine was the market place. Where there are people and space without regulation, the one will occupy the other. Britain’s parliament was unsettled by the labour unrest of the 1920s, and by the furious revival of autocracy across Europe. It seemed to regard sprawl as a pacifying force, almost a narcotic. The truth was that Londoners craved what sprawl offered: a house, a garden and a train station.

…

Bond Street’s ‘suburb’ Avery Row, is the Crown Estate’s model restoration of what was a scruffy ‘borderland’ of studios and warehouses, running through to the deserted streets of west Mayfair. These are streets that have prospered where the city has kept its nerve and not run screaming into the market place. They are where fabric was the essence, offering a welcome to whatever the transient market ordains. London has its clusters and some of them are splendid. But it is clear that the creative juices that keep the city constantly on the alert crave the patina of time passing. The neighbourhoods through which I walk can be replicated in Paddington, King’s Cross, Clerkenwell, Shoreditch, Bermondsey and Lambeth.

pages: 193 words: 11,060

Ethics in Investment Banking by John N. Reynolds, Edmund Newell

accounting loophole / creative accounting, activist fund / activist shareholder / activist investor, banking crisis, Bear Stearns, collapse of Lehman Brothers, corporate governance, corporate social responsibility, credit crunch, Credit Default Swap, discounted cash flows, financial independence, Glass-Steagall Act, index fund, invisible hand, junk bonds, light touch regulation, margin call, Michael Milken, moral hazard, Nick Leeson, Northern Rock, proprietary trading, quantitative easing, shareholder value, short selling, South Sea Bubble, stem cell, the market place, The Wealth of Nations by Adam Smith, too big to fail, two and twenty, zero-sum game

Goodhart, C.A.E. (2009) The Regulatory Response to the Financial Crisis (Cheltenham and Northampton, MA: Edward Elgar). Green, R.M. (1994) The Ethical Manager: A New Method for Business Ethics (Eaglewood, NJ: Macmillan). Green, S. (2009) Good Value: Reflections on Money, Morality and an Uncertain World (London: Allen Lane). Griffiths, B. (1982) Morality and the Market Place (London: Hodder and Stoughton). Bibliography 167 Griffiths, B. (2001) Capitalism, Morality and Markets (London: Institute of Economic Affairs). Griseri, T. (2010) Business Ethics (London: Cengage Learning). Harries, R. (1995) Questioning Belief (London: SPCK). Harvard Business School (2003) Harvard Business Review on Corporate Ethics (Cambridge, MA: Harvard Business School Press).

…

Clough (2010) The Ethics of Executive Remuneration: A Guide for Christian Investors (Church Investors Group). Higgs-Kleyn, N. and D. Kapeliansis (1999) “The Role of Professional Codes in Regulating Ethical Conduct”, Journal of Business Ethics, 19, 363–74. Hill, A. (1998) Just Business: Christian Ethics for the Market Place (Carlisle: Paternoster Press). Hotten, R. (2008) “Shell Plots $1.2 bn Regal Takeover Bid”, Daily Telegraph, 2 October. http://www.telegraph.co.uk/finance/newsbysector/energy/oilandgas/ 3124785/Shell-plots-1.2bn-Regal-takeover-bid.html, accessed 12 May 2011. Howes, S., and P. Robins (1994) A Theory of Moral Organization: A Buddhist View of Business Ethics (Birmingham: Aston Business School Research Institute).

pages: 253 words: 69,529

Britain's 100 Best Railway Stations by Simon Jenkins

Beeching cuts, British Empire, Crossrail, gentrification, joint-stock company, Khartoum Gordon, market bubble, railway mania, South Sea Bubble, starchitect, the market place, urban renewal, wikimedia commons

Railway mania: John Bull drunkenly accepts proposals for investing in railways, cartoon, 1836 In November 1845, The Times calculated that parliament had that year projected 1,200 new railways in Britain, notionally requiring £500m in public subscription (or £50bn today). Some were for lines along parallel routes, some for trains running the length and breadth of the land. The freedom of the market place was given the job of regulating the industry, with no attempt to impose network coherence or national plan. Massive duplication occurred. When the Great Eastern company came to be formed in 1862, it needed the amalgamation of thirty-two approved railways in East Anglia alone. Like all such bubbles, the Mania over-reached itself, bursting in 1847.

…

It redefined geographical identity and rewrote the conversation between London and the nation, town and country, rich and poor. It also introduced a new realm of classlessness. The Liverpool & Manchester’s segregation of passengers in different buildings did not last. Two (initially three) classes of waiting-rooms and carriages survived, but the concourse, ticket office and platform became, like the church nave and the market place, a common space. Travel beyond the bounds of one village or town had been confined to a few, mostly prosperous, people. Most humans lived, worked, played and died within single communities. Travel now became an obsession, abetted by Thomas Cook’s innovation of rail excursions in the 1850s (see here).

pages: 295 words: 66,912

Walled Culture: How Big Content Uses Technology and the Law to Lock Down Culture and Keep Creators Poor by Glyn Moody

Aaron Swartz, Big Tech, bioinformatics, Brewster Kahle, connected car, COVID-19, disinformation, Donald Knuth, en.wikipedia.org, full text search, intangible asset, Internet Archive, Internet of things, jimmy wales, Kevin Kelly, Kickstarter, non-fungible token, Open Library, optical character recognition, p-value, peer-to-peer, place-making, quantitative trading / quantitative finance, rent-seeking, text mining, the market place, TikTok, transaction costs, WikiLeaks

The RDI [Rights Data Integration] Project has demonstrated unequivocally how such a Rights Data Network could implement the LCC framework; and the Copyright Hub has provided a first implementation of how this works in practice. The time to go live with actual services in the market place is now.”571 Nevertheless, no ‘actual services in the market place’ appeared. The Final Report of the RDI Project was released in 2016 and said: ‘The RDI project has produced a set of tools and prototypes which the project partners, including the LCC and the Copyright Hub, now expect to take forward into production systems’.572 Far from doing so, the LCC has not issued any kind of update on its work since April 2013,573 while the Copyright Hub Web site has disappeared from the Internet.

pages: 275 words: 77,955

Capitalism and Freedom by Milton Friedman

"Friedman doctrine" OR "shareholder theory", affirmative action, Berlin Wall, central bank independence, Corn Laws, Deng Xiaoping, floating exchange rates, Fractional reserve banking, full employment, invisible hand, Joseph Schumpeter, liquidity trap, market friction, minimum wage unemployment, price discrimination, rent control, road to serfdom, Ronald Reagan, secular stagnation, Simon Kuznets, the market place, The Wealth of Nations by Adam Smith, union organizing

The challenge to the believer in liberty is to reconcile this widespread interdependence with individual freedom. Fundamentally, there are only two ways of co-ordinating the economic activities of millions. One is central direction involving the use of coercion—the technique of the army and of the modern totalitarian state. The other is voluntary co-operation of individuals—the technique of the market place. The possibility of co-ordination through voluntary co-operation rests on the elementary—yet frequently denied—proposition that both parties to an economic transaction benefit from it, provided the transaction is bi-laterally voluntary and informed. Exchange can therefore bring about co-ordination without coercion.

…

The logical conclusion is presumably “Past labor is exploited,” and the inference for action is that past labor should get more of the product, though it is by no means clear how, unless it be in elegant tombstones. The achievement of allocation of resources without compulsion is the major instrumental role in the market place of distribution in accordance with product. But it is not the only instrumental role of the resulting inequality. We have noted in chapter i the role that inequality plays in providing independent foci of power to offset the centralization of political power, as well as the role that it plays in promoting civil freedom by providing “patrons” to finance the dissemination of unpopular or simply novel ideas.

pages: 105 words: 18,832

The Collapse of Western Civilization: A View From the Future by Naomi Oreskes, Erik M. Conway

Anthropocene, anti-communist, correlation does not imply causation, creative destruction, en.wikipedia.org, energy transition, Great Leap Forward, Intergovernmental Panel on Climate Change (IPCC), invisible hand, Kim Stanley Robinson, laissez-faire capitalism, Lewis Mumford, market fundamentalism, mass immigration, means of production, military-industrial complex, oil shale / tar sands, Pierre-Simon Laplace, precautionary principle, road to serfdom, Ronald Reagan, stochastic process, the built environment, the market place

Their views came out of the Cold War—particularly the writings of Milton Friedman and Friedrich von Hayek—but the essential idea remains a tenet for many people on the right wing of the American political spectrum today. While rarely stated quite this bald-ly, the reasoning goes like this: Government intervention in the market place is bad. Accepting the reality of climate change requires us to acknowledge the need for government intervention either to regulate the use of fossil fuels or to increase the cost of doing so. So we won’t accept the reality of climate change. Erik and I have pointed out that besides being illogical, this sort of thinking—by delaying action— increases the risk that disruptive climate change will lead to the very sort of heavy-handed interventions that conservatives wish to avoid.

Basic Income And The Left by henningmeyer

basic income, Bernie Sanders, carbon tax, centre right, eurozone crisis, income inequality, Jeremy Corbyn, John Maynard Keynes: technological unemployment, labour market flexibility, land value tax, means of production, mini-job, moral hazard, precariat, quantitative easing, Silicon Valley, technological determinism, the market place, Tobin tax, universal basic income

who are not, or are only partially, employed. Comprehensive social services that go beyond pure poverty control, however, are legitimised by existing concepts of social justice. How else? Norms of social justice include the idea of equal opportunity, giving everyone a shot at making it on the labour market and in the market place. This justifies, for instance, public spending on education or inheritance tax. Or the idea of social insurance which links contribution for unemployment and old age insurance to social transfers. Social Values Thirdly, an unconditional basic income runs counter to the needs of a society with rapidly growing immi‐ gration.

pages: 93 words: 24,584

Walk Away by Douglas E. French

Alan Greenspan, Bear Stearns, behavioural economics, business cycle, Elliott wave, forensic accounting, full employment, Home mortgage interest deduction, loss aversion, low interest rates, McMansion, mental accounting, mortgage debt, mortgage tax deduction, negative equity, New Journalism, Own Your Own Home, Richard Thaler, risk free rate, Robert Shiller, Savings and loan crisis, Tax Reform Act of 1986, the market place, transaction costs, unbiased observer, wealth creators

Housing didn’t have to compete with business for credit in post-war America, a “federally insured ‘loop’ directed the savings of small investors into savings and loan institutions, where they were channeled directly into short term loans for builders or mortgages for buyers.” Another government loan guaranty program was born in 1944 after WWII. The U.S. Department of Veterans Administration (VA) loan program was to make it possible for military veterans “to compete in the market place for credit with persons who were not obliged to forego the pursuit of gainful occupations by reason of service in the Armed Forces of the nation. The VA programs are intended to benefit men and women because of their service to the country, and they are not designed to serve as instruments of attaining general economic or social objectives.”

pages: 287 words: 44,739

Guide to business modelling by John Tennent, Graham Friend, Economist Group

book value, business cycle, correlation coefficient, discounted cash flows, double entry bookkeeping, G4S, Herman Kahn, intangible asset, iterative process, low interest rates, price elasticity of demand, purchasing power parity, RAND corporation, risk free rate, shareholder value, the market place, time value of money

Macroeconomic variables such as gross domestic product (gdp), interest rates, inflation, exchange rates, income levels and income distribution are likely to be important factors. Population growth, urbanisation and trends in transport may also be relevant. At a microeconomic level, customer needs, market size and market growth will be essential. Current and future competitors, the nature of their product offerings and their positioning in the market place should be identified. Once all the critical factors have been identified they should be divided into those that will be explicitly modelled and those that simply provide the context for the forecast and are likely to be described in a business planning document. Critical factors for wind-farm operators Chart 3.2 on the next page shows some of the critical factors for a wind-farm operator.

…

The macroeconomic variables discussed in detail here will provide a solid basis for most business planning exercises. 85 10 Forecasting revenue Forecasting revenue is one of the greatest challenges for the business modeller. The first problem is producing a meaningful and useful definition of the market place. In the telecommunications, information technology and media sectors, for example, there is such a high degree of convergence that it is becoming increasingly difficult to differentiate between the separate markets. Modellers may also have incomplete or inaccurate data as a basis for their forecasts.

Manias, Panics and Crashes: A History of Financial Crises, Sixth Edition by Kindleberger, Charles P., Robert Z., Aliber

active measures, Alan Greenspan, Asian financial crisis, asset-backed security, bank run, banking crisis, Basel III, Bear Stearns, Bernie Madoff, Black Monday: stock market crash in 1987, Black Swan, Boeing 747, Bonfire of the Vanities, break the buck, Bretton Woods, British Empire, business cycle, buy and hold, Carmen Reinhart, central bank independence, cognitive dissonance, collapse of Lehman Brothers, collateralized debt obligation, Corn Laws, corporate governance, corporate raider, credit crunch, Credit Default Swap, credit default swaps / collateralized debt obligations, crony capitalism, cross-border payments, currency peg, currency risk, death of newspapers, debt deflation, Deng Xiaoping, disintermediation, diversification, diversified portfolio, edge city, financial deregulation, financial innovation, Financial Instability Hypothesis, financial repression, fixed income, floating exchange rates, George Akerlof, German hyperinflation, Glass-Steagall Act, Herman Kahn, Honoré de Balzac, Hyman Minsky, index fund, inflation targeting, information asymmetry, invisible hand, Isaac Newton, Japanese asset price bubble, joint-stock company, junk bonds, large denomination, law of one price, liquidity trap, London Interbank Offered Rate, Long Term Capital Management, low interest rates, margin call, market bubble, Mary Meeker, Michael Milken, money market fund, money: store of value / unit of account / medium of exchange, moral hazard, new economy, Nick Leeson, Northern Rock, offshore financial centre, Ponzi scheme, price stability, railway mania, Richard Thaler, riskless arbitrage, Robert Shiller, short selling, Silicon Valley, South Sea Bubble, special drawing rights, Suez canal 1869, telemarketer, The Chicago School, the market place, The Myth of the Rational Market, The Wealth of Nations by Adam Smith, too big to fail, transaction costs, tulip mania, very high income, Washington Consensus, Y2K, Yogi Berra, Yom Kippur War

Some of the senior executives of Lehman would be given positions in the acquiring firm, most would not. The owners of Lehman’s short-term IOUs would be made whole, and perhaps the owners of its bonds would be made whole like those of Fannie and Freddie; alternatively these bondholders might have been given haircuts. The Lehman name would disappear from the market place. The financial cost to the Federal Reserve might have been $50 billion or $60 billion or $70 billion that it would have used to buy the toxic securities – but these securities would have had some value after the economy stabilized. A second model is provided by the US Treasury’s investment of Troubled Assets Relief Program (TARP) money in Citibank and Bank of America; the US government would buy 60 or 80 million new shares in Lehman at $1 a share – the amount needed to re-capitalize the firm.

…

., tables 7 and, pp. 136, 144, 145. 42. John Carswell, The South Sea Bubble (London: Cresset Press, 1960), p.171. 43. Bouvier, Le krach, pp. 112, 113. 44. Federal Reserve System, Banking and Monetary Statistics (Washington, DC: Board of Governors of the Federal Reserve System, 1943), p. 494. 45. Alexander Dana Noyes, The Market Place: Reminiscences of a Financial Editor (Boston: Little, Brown, 1937), p. 353. 46. Peter H. Lindert, Key Currencies and Gold, 1900–1913, Princeton Studies in International Finance, no. 24 (August 1969). 47. Jeffrey G. Williamson, American Growth and the Balance of Payments, 1830– 1913: a Study of the Long Swing (Chapel Hill: University of North Carolina Press, 1964). 48.

…

Andréadès, Bank of England, p. 137, citing Henry D. McLeod, Theory and Practice of Banking, 3rd edn (London: Longman Green, Reader & Dyer, 1879), p. 428. 31. John Carswell, The South Sea Bubble (London: Cresset Press, 1960), p. 184. 32. Andréadès, Bank of England, p. 151. 33. Alexander Dana Noyes, The Market Place: Reminiscences of a Financial Editor (Boston: Little, Brown, 1938), p. 333. 34. Sprague, History of Crises, p. 259. 35. Ibid. 36. Ibid., p. 181. 37. Max Wirth, Geschichte der Handelskrisen, 4th edn (1890; reprint edn, New York: Burt Franklin, 1968), p. 521. 38. Maurice Lévy-Leboyer, Les banques européennes et l’industrialisation internationale dans la première moitié du XIXe siècle (Paris: Presses universitaires de France, 1964), p. 480, text and note 5. 39.

pages: 358 words: 104,664

Capital Without Borders by Brooke Harrington

Alan Greenspan, banking crisis, Big bang: deregulation of the City of London, British Empire, capital controls, Capital in the Twenty-First Century by Thomas Piketty, classic study, complexity theory, corporate governance, corporate social responsibility, diversified portfolio, emotional labour, equity risk premium, estate planning, eurozone crisis, family office, financial innovation, ghettoisation, Great Leap Forward, haute couture, high net worth, income inequality, information asymmetry, Joan Didion, job satisfaction, joint-stock company, Joseph Schumpeter, Kevin Roose, liberal capitalism, mega-rich, mobile money, offshore financial centre, prudent man rule, race to the bottom, regulatory arbitrage, Robert Shiller, South Sea Bubble, subprime mortgage crisis, the market place, The Theory of the Leisure Class by Thorstein Veblen, Thorstein Veblen, transaction costs, upwardly mobile, wealth creators, web of trust, Westphalian system, Wolfgang Streeck, zero-sum game

Salmon: “A trustee is held to something stricter than the morals of the market place. Not honesty alone, but the punctilio of an honor the most sensitive, is then the standard of behavior.… [T]he level of conduct for fiduciaries [has] been kept at a level higher than that trodden by the crowd.”40 These are precisely the characteristics attributed to medieval knights: punctilio (a regard for formalities and etiquette), honor, honesty, and a sense of being above the crowd, bound to a duty “stricter than the morals of the market place.” In fact, it reads like an updated portrait of the pilgrim knight in Chaucer’s Canterbury Tales, who “loved chivalry, truth, honor … and all courtesy.”41 The medieval becomes modern But these historical continuities also raise the question: Why did an adaptation to feudal conditions survive the Middle Ages?

The Darkening Age: The Christian Destruction of the Classical World by Catherine Nixey

classic study, Eratosthenes, Index librorum prohibitorum, Socratic dialogue, the market place, trade route, wikimedia commons

Celsus, however, implied that if people were better educated they would be more resistant to such hucksters as Peregrinus – or indeed to Jesus, who Celsus considered little more than a ‘sorcerer’.62 The ‘miracles’ that Jesus performed were, he felt, no better than the sort of thing that was constantly being peddled by tricksters to the gullible across the Roman Empire. In a world in which medical provision was rare, many laid claim to magical powers. Travel in the East and you would come across any number of men who, ‘for a few obols make known their sacred lore in the middle of the market-place and drive daemons out of men and blow away diseases’, and display ‘dining-tables and cakes and dishes which are non-existent’.63 Even Jesus himself, observes Celsus, admits the presence of such people when he talks about men who can perform similar wonders to his own. Modern scholarship supports Celsus’s accusations: ancient papyri tell of sorcerers who had the power to achieve such biblical-sounding feats as stilling storms and miraculously providing food.64 Celsus touches on a sore point here.

…

By constantly accusing yourself, said another monk, by ‘constantly reproaching myself to myself.’24 Sit in your cell all day, advised another, weeping for your sins.25 A hint of desert isolationism started to find its way into pious city life, too. In John Chrysostom’s writings, contact with women of all kinds was something to be feared and, if possible, avoided altogether. ‘If we meet a woman in the market-place,’ Chrysostom told his congregation, herding his listeners into complicity with that first-person plural, then we are ‘disturbed’.26 Desire was dangerously easy to inflame. Women who inflamed it were not to be relished as Ovid had relished them, but eschewed, scorned and denigrated in writings that made it abundantly clear that the fault of the man’s desire lay with them.

pages: 95 words: 32,910

The Prince by Niccolò Machiavelli, Peter Bondanella

the market place, The Wealth of Nations by Adam Smith

And knowing that past severities had generated ill-feeling against himself, in order to purge the minds of the people and gain their good-will, he sought to show them that any cruelty which had been done had not originated, with him, but in the harsh disposition of his minister. Availing himself of the pretext which this afforded, he one morning caused Remiro to be beheaded, and exposed in the market place of Cesena with a block and bloody axe by his side. The barbarity of which spectacle at once astounded and satisfied the populace. But, returning to the point whence we diverged, I say that the Duke, finding himself fairly strong and in a measure secured against present dangers, being furnished with arms of his own choosing and having to a great extent got rid of those which, if left near him, might have caused him trouble, had to consider, if he desired to follow up his conquests, how he was to deal with France, since he saw he could expect no further support from King Louis, whose eyes were at last opened to his mistake.

pages: 349 words: 109,304

American Kingpin: The Epic Hunt for the Criminal Mastermind Behind the Silk Road by Nick Bilton

bitcoin, blockchain, Boeing 747, crack epidemic, Edward Snowden, fake news, gentrification, mandatory minimum, Marc Andreessen, Mark Zuckerberg, no-fly zone, off-the-grid, Ross Ulbricht, Rubik’s Cube, Satoshi Nakamoto, side project, Silicon Valley, Skype, South of Market, San Francisco, Steve Jobs, Ted Kaczynski, the market place, trade route, Travis Kalanick, white picket fence, WikiLeaks

In a message to DPR, while pretending to be French Maid, he accidentally signed the message with his own name, Carl. A short while later, when Carl realized what he had done, he quickly followed up with another message to Dread. “Whoops! I am sorry about that. My name is Carla Sophia and I have many boyfriends and girlfriends on the market place. DPR will want to hear what I have to say ;) xoxoxo.” Luckily for Carl, the Dread Pirate Roberts could care less who Carl or Carla was; Dread just wanted the information that was for sale and gladly handed more than $100,000 to French Maid for more information that could help him keep the Feds at bay.

…

But as the FBI started to look further, they noticed that one of the messages sent from French Maid to DPR was bizarrely signed “Carl.” And then another message sent shortly afterward provided a clarification: “I am sorry about that. My name is Carla Sophia and I have many boyfriends and girlfriends on the market place.” It was evident that Carl had fucked up and accidentally written his own name when selling information to DPR as someone else. The Feds later learned that Carl had created several other fake accounts that were used to threaten, coerce, or bribe the Dread Pirate Roberts. As all the loose ends were tied back together, they found dozens of clues that linked Carl to $757,000 in stolen Bitcoins.

pages: 459 words: 103,153

Adapt: Why Success Always Starts With Failure by Tim Harford

An Inconvenient Truth, Andrew Wiles, banking crisis, Basel III, behavioural economics, Berlin Wall, Bernie Madoff, Black Swan, Boeing 747, business logic, car-free, carbon footprint, carbon tax, Cass Sunstein, charter city, Clayton Christensen, clean water, cloud computing, cognitive dissonance, complexity theory, corporate governance, correlation does not imply causation, creative destruction, credit crunch, Credit Default Swap, crowdsourcing, cuban missile crisis, Daniel Kahneman / Amos Tversky, Dava Sobel, Deep Water Horizon, Deng Xiaoping, disruptive innovation, double entry bookkeeping, Edmond Halley, en.wikipedia.org, Erik Brynjolfsson, experimental subject, Fall of the Berlin Wall, Fermat's Last Theorem, financial engineering, Firefox, food miles, Gerolamo Cardano, global supply chain, Great Leap Forward, Herman Kahn, Intergovernmental Panel on Climate Change (IPCC), Isaac Newton, Jane Jacobs, Jarndyce and Jarndyce, Jarndyce and Jarndyce, John Harrison: Longitude, knowledge worker, loose coupling, Martin Wolf, mass immigration, Menlo Park, Mikhail Gorbachev, mutually assured destruction, Netflix Prize, New Urbanism, Nick Leeson, PageRank, Piper Alpha, profit motive, Richard Florida, Richard Thaler, rolodex, Shenzhen was a fishing village, Silicon Valley, Silicon Valley startup, South China Sea, SpaceShipOne, special economic zone, spectrum auction, Steve Jobs, supply-chain management, tacit knowledge, the market place, The Wisdom of Crowds, too big to fail, trade route, Tyler Cowen, Tyler Cowen: Great Stagnation, Virgin Galactic, web application, X Prize, zero-sum game

We’ve been imagining a flat plane stretching in every direction, but now let’s change the picture and say that on our fitness landscape: the better the solution, the higher the altitude of the square that contains it. Now the fitness landscape is a jumble of cliffs and chasms, plateaus and jagged summits. Valleys represent bad solutions; mountain tops are good. In an ecosystem, the latter are creatures more likely to survive and reproduce; in the market place, they are the profitable business ideas; and at the dinner party, they are the tastiest dishes. In our dinnerparty landscape, a deep, dark pit might contain a recipe for spaghetti with fish fingers and a jar of curry sauce. From there, the only way is up. Trek in one direction and you might eventually ascend to the soaring peak of Bolognese ragù.

…

Selection happens through heredity: successful creatures reproduce before they die and have offspring that share some or all of their genes. In a market economy, variation and selection are also at work. New ideas are created by scientists and engineers, meticulous middle managers in large corporations or daring entrepreneurs. Failures are culled because bad ideas do not survive long in the market place: to succeed, you have to make a product that customers wish to buy at a price that covers costs and beats obvious competitors. Many ideas fail these tests, and if they are not shut down by management they will eventually be shut down by a bankruptcy court. Good ideas spread because they are copied by competitors, because staff leave to set up their own businesses, or because the company with the good ideas grows.

pages: 1,042 words: 266,547

Security Analysis by Benjamin Graham, David Dodd

activist fund / activist shareholder / activist investor, asset-backed security, backtesting, barriers to entry, Bear Stearns, behavioural economics, book value, business cycle, buy and hold, capital asset pricing model, Carl Icahn, carried interest, collateralized debt obligation, collective bargaining, corporate governance, corporate raider, credit crunch, Credit Default Swap, credit default swaps / collateralized debt obligations, currency risk, diversification, diversified portfolio, fear of failure, financial engineering, financial innovation, fixed income, flag carrier, full employment, Greenspan put, index fund, intangible asset, invisible hand, Joseph Schumpeter, junk bonds, land bank, locking in a profit, Long Term Capital Management, low cost airline, low interest rates, Michael Milken, moral hazard, mortgage debt, Myron Scholes, prudent man rule, Right to Buy, risk free rate, risk-adjusted returns, risk/return, secular stagnation, shareholder value, stock buybacks, The Chicago School, the market place, the scientific method, The Wealth of Nations by Adam Smith, transaction costs, two and twenty, zero-coupon bond