financial thriller

12 results back to index

pages: 274 words: 93,758

Phishing for Phools: The Economics of Manipulation and Deception by George A. Akerlof, Robert J. Shiller, Stanley B Resor Professor Of Economics Robert J Shiller

Andrei Shleifer, asset-backed security, Bear Stearns, behavioural economics, Bernie Madoff, business cycle, Capital in the Twenty-First Century by Thomas Piketty, Carl Icahn, collapse of Lehman Brothers, compensation consultant, corporate raider, Credit Default Swap, Daniel Kahneman / Amos Tversky, dark matter, David Brooks, desegregation, en.wikipedia.org, endowment effect, equity premium, financial intermediation, financial thriller, fixed income, full employment, George Akerlof, greed is good, income per capita, invisible hand, John Maynard Keynes: Economic Possibilities for our Grandchildren, junk bonds, Kenneth Arrow, Kenneth Rogoff, late fees, loss aversion, market bubble, Menlo Park, mental accounting, Michael Milken, Milgram experiment, money market fund, moral hazard, new economy, Pareto efficiency, Paul Samuelson, payday loans, Ponzi scheme, profit motive, publication bias, Ralph Nader, randomized controlled trial, Richard Thaler, Robert Shiller, Robert Solow, Ronald Reagan, Savings and loan crisis, short selling, Silicon Valley, stock buybacks, the new new thing, The Predators' Ball, the scientific method, The Theory of the Leisure Class by Thorstein Veblen, The Wealth of Nations by Adam Smith, theory of mind, Thorstein Veblen, too big to fail, transaction costs, Unsafe at Any Speed, Upton Sinclair, Vanguard fund, Vilfredo Pareto, wage slave

.,” New York Times, November 28, 2011, accessed June 10, 2015, http://www.nytimes.com/2011/11/29/business/judge-rejects-sec-accord-with-citi.html?pagewanted=all. 21. Jed S. Rakoff, “The Financial Crisis: Why Have No High-Level Executives Been Prosecuted?” New York Review of Books, January 9, 2014. 22. Harry Markopolos, No One Would Listen: A True Financial Thriller (Hoboken, NJ: Wiley, 2010), Kindle location 587. 23. That involved cutting off losses by the purchase of (put) options (which allowed him to sell stocks when their price fell below the “strike price”); paying for those puts with the sale of (call) options (which allowed their purchasers to buy stocks from him when the price went above the “strike price”). 24.

…

“Nevada Gaming Tax: Estimating Resident Burden and Incidence.” University of Nevada, Las Vegas, April 2006. Last accessed May 5, 2015. https://faculty.unlv.edu/bmalamud/estimating.gaming.burden.incidence.doc. Mankiw, N. Gregory. Principles of Economics. New York: Harcourt, Brace, 1998. Markopolos, Harry. No One Would Listen: A True Financial Thriller. Hoboken, NJ: Wiley, 2010. Kindle. Mateyka, Peter, and Matthew Marlay. “Residential Duration by Race and Ethnicity: 2009.” Paper presented at the Annual Meeting of the American Sociological Association, Las Vegas, 2011. Maynard, Micheline. “United Air Wins Right to Default on Its Employee Pension Plans.”

pages: 478 words: 126,416

Other People's Money: Masters of the Universe or Servants of the People? by John Kay

Affordable Care Act / Obamacare, Alan Greenspan, asset-backed security, bank run, banking crisis, Basel III, Bear Stearns, behavioural economics, Bernie Madoff, Big bang: deregulation of the City of London, bitcoin, Black Monday: stock market crash in 1987, Black Swan, Bonfire of the Vanities, bonus culture, book value, Bretton Woods, buy and hold, call centre, capital asset pricing model, Capital in the Twenty-First Century by Thomas Piketty, cognitive dissonance, Cornelius Vanderbilt, corporate governance, Credit Default Swap, cross-subsidies, currency risk, dematerialisation, disinformation, disruptive innovation, diversification, diversified portfolio, Edward Lloyd's coffeehouse, Elon Musk, Eugene Fama: efficient market hypothesis, eurozone crisis, financial engineering, financial innovation, financial intermediation, financial thriller, fixed income, Flash crash, forward guidance, Fractional reserve banking, full employment, George Akerlof, German hyperinflation, Glass-Steagall Act, Goldman Sachs: Vampire Squid, Greenspan put, Growth in a Time of Debt, Ida Tarbell, income inequality, index fund, inflation targeting, information asymmetry, intangible asset, interest rate derivative, interest rate swap, invention of the wheel, Irish property bubble, Isaac Newton, it is difficult to get a man to understand something, when his salary depends on his not understanding it, James Carville said: "I would like to be reincarnated as the bond market. You can intimidate everybody.", Jim Simons, John Meriwether, junk bonds, light touch regulation, London Whale, Long Term Capital Management, loose coupling, low cost airline, M-Pesa, market design, Mary Meeker, megaproject, Michael Milken, millennium bug, mittelstand, Money creation, money market fund, moral hazard, mortgage debt, Myron Scholes, NetJets, new economy, Nick Leeson, Northern Rock, obamacare, Occupy movement, offshore financial centre, oil shock, passive investing, Paul Samuelson, Paul Volcker talking about ATMs, peer-to-peer lending, performance metric, Peter Thiel, Piper Alpha, Ponzi scheme, price mechanism, proprietary trading, purchasing power parity, quantitative easing, quantitative trading / quantitative finance, railway mania, Ralph Waldo Emerson, random walk, reality distortion field, regulatory arbitrage, Renaissance Technologies, rent control, risk free rate, risk tolerance, road to serfdom, Robert Shiller, Ronald Reagan, Schrödinger's Cat, seminal paper, shareholder value, Silicon Valley, Simon Kuznets, South Sea Bubble, sovereign wealth fund, Spread Networks laid a new fibre optics cable between New York and Chicago, Steve Jobs, Steve Wozniak, The Great Moderation, The Market for Lemons, the market place, The Myth of the Rational Market, the payments system, The Wealth of Nations by Adam Smith, The Wisdom of Crowds, Tobin tax, too big to fail, transaction costs, tulip mania, Upton Sinclair, Vanguard fund, vertical integration, Washington Consensus, We are the 99%, Yom Kippur War

Corporate Europe Observatory, April 2014. 15. Bureau of Investigative Journalism, 2012, 9 July, http://www.thebureauinvestigates.com/. 16. ProPublica, 2013, 10 October, http://www.propublica.org/article/ny-fed-fired-examiner-who-took-on-goldman. 17. Markopolos, H., 2010, No One Would Listen: A True Financial Thriller, Hoboken, NJ, Wiley. 18. Ferguson, C. (prod. and dir.), and Marrs, A. (prod.), 2010, Inside Job, United States, Sony Pictures Classics. 19. Stigler, G.J., 1971, ‘The Theory of Economic Regulation’, The Bell Journal of Economics and Management Science, 2 (1), Spring, pp. 3–21. 20. Dekker, S., 2012, Just Culture, Aldershot, Ashgate. 9: Economic policy 1.

…

., 1957, ‘Leader’s Speech’, remarks at Conservative Party rally, Bedford, 20 July. Malkiel, B.G., 2012, A Random Walk down Wall Street, 10th edn, New York and London, W.W. Norton. Manne, H.G., 1965, ‘Mergers and the Market for Corporate Control’, The Journal of Political Economy, 73 (2), April, pp. 110–20. Markopolos, H., 2010, No One Would Listen: A True Financial Thriller, Hoboken, NJ, Wiley. Martin, F., 2013, Money: The Unauthorised Biography, London, Bodley Head. McArdle, M., 2009, ‘Why Goldman Always Wins’, The Atlantic, 1 October. McCardie, J., 1917, Armstrong v. Jackson, 2KB 822. McCullough, D., 1992, Truman, New York, Simon & Schuster. McLean, B., and Elkind, P., 2003, The Smartest Guys in the Room: The Amazing Rise and Scandalous Fall of Enron, New York, Penguin.

pages: 180 words: 61,340

Boomerang: Travels in the New Third World by Michael Lewis

Apollo 11, Bear Stearns, Berlin Wall, Bernie Madoff, Carmen Reinhart, Celtic Tiger, collapse of Lehman Brothers, collateralized debt obligation, Credit Default Swap, credit default swaps / collateralized debt obligations, currency risk, fiat currency, financial engineering, financial thriller, full employment, German hyperinflation, government statistician, Irish property bubble, junk bonds, Kenneth Rogoff, Neil Armstrong, offshore financial centre, pension reform, Ponzi scheme, proprietary trading, Ronald Reagan, Ronald Reagan: Tear down this wall, South Sea Bubble, subprime mortgage crisis, the new new thing, Tragedy of the Commons, tulip mania, women in the workforce

In spirit it reminded me of Bernard Madoff’s investment business. Anyone who looked at Madoff’s returns and understood them could see he was running a Ponzi scheme; only one person who had understood them bothered to blow the whistle, and no one listened to him. (See No One Would Listen: A True Financial Thriller, by Harry Markopolos.) In his negotiations with the unions, the mayor has gotten nowhere. “I understand the police and firefighters,” he says. “They think, We’re the most important, and everyone else goes [gets fired] first.” The police union recently suggested to the mayor that he close the libraries for the other four days.

pages: 309 words: 85,584

Nine Crises: Fifty Years of Covering the British Economy From Devaluation to Brexit by William Keegan

Alan Greenspan, banking crisis, Bear Stearns, Berlin Wall, Big bang: deregulation of the City of London, Boris Johnson, Bretton Woods, Brexit referendum, British Empire, capital controls, congestion charging, deindustrialization, Donald Trump, Etonian, eurozone crisis, Fall of the Berlin Wall, financial engineering, financial innovation, financial thriller, floating exchange rates, foreign exchange controls, full employment, gig economy, inflation targeting, Jeremy Corbyn, Just-in-time delivery, light touch regulation, liquidity trap, low interest rates, Martin Wolf, military-industrial complex, moral hazard, negative equity, Neil Kinnock, Nixon triggered the end of the Bretton Woods system, non-tariff barriers, North Sea oil, Northern Rock, oil shock, Parkinson's law, Paul Samuelson, pre–internet, price mechanism, quantitative easing, Ronald Reagan, school vouchers, short selling, South Sea Bubble, Suez crisis 1956, The Chicago School, transaction costs, tulip mania, Winter of Discontent, Yom Kippur War

There was an added source of concern for some officials, because I had attended a party at the Bank of England on the Friday evening at which the key officials involved in an earlier Whitehall meeting concerning the pound were present, and I spoke to several of them. Months later, I was thanked for the story about the plan to lift the cap by an old FT colleague who was now working in the City. He had placed his faith in our contacts and made a lot of money over the weekend dealing in sterling in Hong Kong. There was a plot there for a financial thriller. Another happy memory of the unwelcome strength of the pound in 1977 is the way that a Treasury friend, Mike Mercer, and I managed over lunch one day to coin a new word – ‘euphobia’ or ‘fear of good news’. Many years later I picked up a copy of Chambers Dictionary to discover that euphobia had made it into the lexicon.

pages: 328 words: 97,711

Talking to Strangers: What We Should Know About the People We Don't Know by Malcolm Gladwell

Berlin Wall, Bernie Madoff, Black Lives Matter, borderless world, crack epidemic, disinformation, Ferguson, Missouri, financial thriller, light touch regulation, Mahatma Gandhi, Milgram experiment, moral panic, Ponzi scheme, Renaissance Technologies, Snapchat

“I gift-wrapped…their priorities”: “Opening Statement of Harry Markopolos,” Public Resource Org, YouTube, video provided courtesy of C-SPAN, February 4, 2009, https://www.youtube.com/watch?v=AF-gzN3ppbE&feature=youtu.be, accessed March 8, 2019. Markopolos biographical info: Harry Markopolos, No One Would Listen: A True Financial Thriller (Hoboken, N.J.: John Wiley & Sons, 2010), p. 11; account of trying to approach Spitzer with brown envelope, pp. 109–111. “a great deal for us…doing business” and “Being deceived…a trade-off” are both from Chapter 11 of Timothy R. Levine, Duped: Truth-Default Theory and the Social Science of Lying and Deception (University of Alabama Press, 2019).

pages: 329 words: 100,162

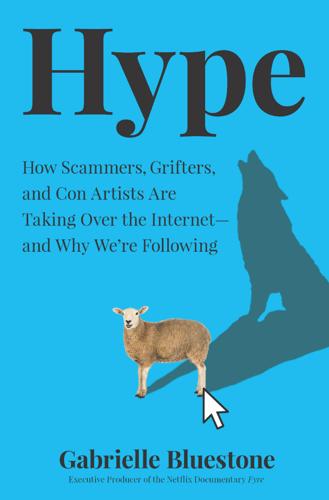

Hype: How Scammers, Grifters, and Con Artists Are Taking Over the Internet―and Why We're Following by Gabrielle Bluestone

Adam Neumann (WeWork), Airbnb, Bellingcat, Bernie Madoff, Bernie Sanders, Big Tech, bitcoin, Black Lives Matter, Burning Man, cashless society, coronavirus, COVID-19, Donald Trump, driverless car, Elon Musk, fake it until you make it, financial thriller, forensic accounting, gig economy, global pandemic, growth hacking, high net worth, hockey-stick growth, hype cycle, Hyperloop, Kevin Roose, lock screen, lockdown, Lyft, Mark Zuckerberg, Masayoshi Son, Mason jar, Menlo Park, Multics, Naomi Klein, Netflix Prize, NetJets, Peter Thiel, placebo effect, post-truth, RFID, ride hailing / ride sharing, Russell Brand, Sand Hill Road, self-driving car, Silicon Valley, Snapchat, social distancing, SoftBank, Steve Jobs, tech billionaire, tech bro, TikTok, Tim Cook: Apple, Travis Kalanick, Uber and Lyft, uber lyft, unpaid internship, upwardly mobile, Vision Fund, WeWork

seq=1. 185.Emily Gosling, "Fyre Festival Designer Oren Aks Opens Up, Reveals Unused Designs + Bizarre Text Convos," AIGA, April 2, 2019, https://eyeondesign.aiga.org/fyre-festival-designer-oren-aks-opens-up-reveals-unused-designs-bizarre-text-convos/. 186.Aleks Eror, "What David Shapiro’s ‘Supremacist’ Teaches Us About Supreme Fuccbois," Highsnobiety, June 16, 2016, https://www.highsnobiety.com/p/david-shapiro-supremacist/. 187.Tom Peters, "The Brand Called You, Fast Company," Fast Company, August, 31, 1997, www.fastcompany.com/28905/brand-called-you. 188.Lee McIntyre, Post-Truth (The MIT Press Essential Knowledge series, February 16, 2018), Page: 175. Book. 189.Harry Markopolos, No One Would Listen : A True Financial Thriller (Hoboken, N.J.: Wiley; Chichester, 2011). Book. 190.Onur Varol et al., "Online Human-Bot Interactions: Detection, Estimation, and Characterization," International AAAI Conference on Web and Social Media, March 27, 2017, https://arxiv.org/pdf/1703.03107.pdf. 191.Michael Newberg, "As Many as 48 Million Twitter Accounts Aren’t People, Says Study," CNBC, March 10, 2017, http://www.cnbc.com/2017/03/10/nearly-48-million-twitter-accounts-could-be-bots-says-study.html. 192.Seung-A Annie Jin and Joe Phua, "Following Celebrities’ Tweets About Brands: The Impact of Twitter-Based Electronic Word-of-Mouth on Consumers’ Source Credibility Perception, Buying Intention, and Social Identification With Celebrities," Journal of Advertising 43, no. 2 (April 3, 2014): 181–95, https://doi.org/10.1080/00913367.2013.827606. 193.BBC, "How Much Does Kylie Jenner Earn on Instagram?

pages: 369 words: 107,073

Madoff Talks: Uncovering the Untold Story Behind the Most Notorious Ponzi Scheme in History by Jim Campbell

algorithmic trading, Bear Stearns, Bernie Madoff, currency risk, delta neutral, family office, fear of failure, financial thriller, fixed income, forensic accounting, full employment, Gordon Gekko, high net worth, index fund, Jim Simons, margin call, merger arbitrage, money market fund, mutually assured destruction, offshore financial centre, payment for order flow, Ponzi scheme, proprietary trading, Renaissance Technologies, risk free rate, riskless arbitrage, Robinhood: mobile stock trading app, Sharpe ratio, short selling, sovereign wealth fund, time value of money, two and twenty, walking around money

The Extraordinary Story of Jared Kushner and Ivanka Trump An excellent behind-the-scenes look at what Madoff’s henchmen and henchwomen were doing to perpetuate their decades-long scheme—Bernie both speaks and lies, while his employees reveal what was really going on inside Manhattan’s Lipstick building. Hundreds should have been prosecuted but less than a dozen were—this is the story. —Harry Markopolos, Madoff whistleblower and author of No One Would Listen: A True Financial Thriller To this day, there is ceaseless speculation about who knew (or did not know) what about the almost-$65-billion Madoff fraud. Jim Campbell puts an end to idle chatter with this book. Yes, Campbell got the Madoff family to open up, but like the veteran interviewer he is, he got so many others involved in this debacle to reveal previously hidden experiences of Madoff as a private man, his so-called investment fund, and how he interacted with both the broader world and his family.

pages: 338 words: 104,815

Nobody's Fool: Why We Get Taken in and What We Can Do About It by Daniel Simons, Christopher Chabris

Abraham Wald, Airbnb, artificial general intelligence, Bernie Madoff, bitcoin, Bitcoin "FTX", blockchain, Boston Dynamics, butterfly effect, call centre, Carmen Reinhart, Cass Sunstein, ChatGPT, Checklist Manifesto, choice architecture, computer vision, contact tracing, coronavirus, COVID-19, cryptocurrency, DALL-E, data science, disinformation, Donald Trump, Elon Musk, en.wikipedia.org, fake news, false flag, financial thriller, forensic accounting, framing effect, George Akerlof, global pandemic, index fund, information asymmetry, information security, Internet Archive, Jeffrey Epstein, Jim Simons, John von Neumann, Keith Raniere, Kenneth Rogoff, London Whale, lone genius, longitudinal study, loss aversion, Mark Zuckerberg, meta-analysis, moral panic, multilevel marketing, Nelson Mandela, pattern recognition, Pershing Square Capital Management, pets.com, placebo effect, Ponzi scheme, power law, publication bias, randomized controlled trial, replication crisis, risk tolerance, Robert Shiller, Ronald Reagan, Rubik’s Cube, Sam Bankman-Fried, Satoshi Nakamoto, Saturday Night Live, Sharpe ratio, short selling, side hustle, Silicon Valley, Silicon Valley startup, Skype, smart transportation, sovereign wealth fund, statistical model, stem cell, Steve Jobs, sunk-cost fallacy, survivorship bias, systematic bias, TED Talk, transcontinental railway, WikiLeaks, Y2K

Donnelly and N. Toscano, The Woman Who Fooled the World: Belle Gibson’s Cancer Con, and the Darkness at the Heart of the Wellness Industry (London: Scribe, 2018). 15. Madoff sources: Interview with SEC Inspector General David Kotz, appendix to audiobook of H. Markopolos, No One Would Listen: A True Financial Thriller (New York: Wiley, 2010); Michael Ocrant, quoted by Markopolos, p. 82; Madoff quotation from video “Roundtable Discussion with Bernard Madoff,” October 20, 2007 [https://www.youtube.com/watch?v=ab1NTIlO-FM]. For more on how confidence works, see Chapter 3 of The Invisible Gorilla. 16. Rick Singer pleaded guilty to charges of racketeering conspiracy, money laundering conspiracy, conspiracy to defraud the United States, and obstruction of justice on March 12, 2019, and agreed to cooperate with the Department of Justice investigation [https://www.justice.gov/usao-ma/investigations-college-admissions-and-testing-bribery-scheme].

pages: 288 words: 16,556

Finance and the Good Society by Robert J. Shiller

Alan Greenspan, Alvin Roth, bank run, banking crisis, barriers to entry, Bear Stearns, behavioural economics, benefit corporation, Bernie Madoff, buy and hold, capital asset pricing model, capital controls, Carmen Reinhart, Cass Sunstein, cognitive dissonance, collateralized debt obligation, collective bargaining, computer age, corporate governance, Daniel Kahneman / Amos Tversky, democratizing finance, Deng Xiaoping, diversification, diversified portfolio, Donald Trump, Edward Glaeser, eurozone crisis, experimental economics, financial engineering, financial innovation, financial thriller, fixed income, full employment, fundamental attribution error, George Akerlof, Great Leap Forward, Ida Tarbell, income inequality, information asymmetry, invisible hand, John Bogle, joint-stock company, Joseph Schumpeter, Kenneth Arrow, Kenneth Rogoff, land reform, loss aversion, Louis Bachelier, Mahatma Gandhi, Mark Zuckerberg, market bubble, market design, means of production, microcredit, moral hazard, mortgage debt, Myron Scholes, Nelson Mandela, Occupy movement, passive investing, Ponzi scheme, prediction markets, profit maximization, quantitative easing, random walk, regulatory arbitrage, Richard Thaler, Right to Buy, road to serfdom, Robert Shiller, Ronald Reagan, selection bias, self-driving car, shareholder value, Sharpe ratio, short selling, Simon Kuznets, Skype, social contagion, Steven Pinker, tail risk, telemarketer, Thales and the olive presses, Thales of Miletus, The Market for Lemons, The Theory of the Leisure Class by Thorstein Veblen, The Wealth of Nations by Adam Smith, Thorstein Veblen, too big to fail, Vanguard fund, young professional, zero-sum game, Zipcar

Geert Rouwenhorst, eds., The Origins of Value: The Financial Innovations That Created Modern Capital Markets, 31–42. New York: Oxford University Press. Marcus, Alan J. 1984. “Deregulation and Bank Financial Policy.” Journal of Banking and Finance 8(4):557–65. Markopolos, Harry. 2011. No One Would Listen: A True Financial Thriller. New York: Wiley. Martel, Gordon. 2008. Origins of the First World War. New York: Pearson Longman. Martin, Sarah B., D. Je Covell, Jane E. Joseph, Himachandra Chebrolu, Charles D. Smith, Thomas H. Kelly, Yang Jiang, and Brian T. Gold. 2007. “Human Experience Seeking Correlates with Hippocampus Volume: Convergent Evidence from Manual Tracing and Voxel-Based Morphometry.”

pages: 320 words: 87,853

The Black Box Society: The Secret Algorithms That Control Money and Information by Frank Pasquale

Adam Curtis, Affordable Care Act / Obamacare, Alan Greenspan, algorithmic trading, Amazon Mechanical Turk, American Legislative Exchange Council, asset-backed security, Atul Gawande, bank run, barriers to entry, basic income, Bear Stearns, Berlin Wall, Bernie Madoff, Black Swan, bonus culture, Brian Krebs, business cycle, business logic, call centre, Capital in the Twenty-First Century by Thomas Piketty, Chelsea Manning, Chuck Templeton: OpenTable:, cloud computing, collateralized debt obligation, computerized markets, corporate governance, Credit Default Swap, credit default swaps / collateralized debt obligations, crowdsourcing, cryptocurrency, data science, Debian, digital rights, don't be evil, drone strike, Edward Snowden, en.wikipedia.org, Evgeny Morozov, Fall of the Berlin Wall, Filter Bubble, financial engineering, financial innovation, financial thriller, fixed income, Flash crash, folksonomy, full employment, Gabriella Coleman, Goldman Sachs: Vampire Squid, Google Earth, Hernando de Soto, High speed trading, hiring and firing, housing crisis, Ian Bogost, informal economy, information asymmetry, information retrieval, information security, interest rate swap, Internet of things, invisible hand, Jaron Lanier, Jeff Bezos, job automation, John Bogle, Julian Assange, Kevin Kelly, Kevin Roose, knowledge worker, Kodak vs Instagram, kremlinology, late fees, London Interbank Offered Rate, London Whale, machine readable, Marc Andreessen, Mark Zuckerberg, Michael Milken, mobile money, moral hazard, new economy, Nicholas Carr, offshore financial centre, PageRank, pattern recognition, Philip Mirowski, precariat, profit maximization, profit motive, public intellectual, quantitative easing, race to the bottom, reality distortion field, recommendation engine, regulatory arbitrage, risk-adjusted returns, Satyajit Das, Savings and loan crisis, search engine result page, shareholder value, Silicon Valley, Snapchat, social intelligence, Spread Networks laid a new fibre optics cable between New York and Chicago, statistical arbitrage, statistical model, Steven Levy, technological solutionism, the scientific method, too big to fail, transaction costs, two-sided market, universal basic income, Upton Sinclair, value at risk, vertical integration, WikiLeaks, Yochai Benkler, zero-sum game

For example, agency critics like Harry Markopolos have berated it for years for failing to catch Bernie Madoff earlier; the (now-deleted) MUI file about him might have led to some accountability for the individuals who failed to follow up on complaints about Madoff. Harry Markopolos, No One Would Listen: A True Financial Thriller (Hoboken, NJ: John Wiley & Sons, Inc., 2010). Past bad behavior can contextualize current accusations. But such a process would also prove embarrassing to the agency itself. Undoubtedly, in some of those cases, materials related to an MUI could raise questions about why personnel involved failed to launch a full-fledged enforcement action. 130.

pages: 428 words: 121,717

Warnings by Richard A. Clarke

"Hurricane Katrina" Superdome, active measures, Albert Einstein, algorithmic trading, anti-communist, artificial general intelligence, Asilomar, Asilomar Conference on Recombinant DNA, Bear Stearns, behavioural economics, Bernie Madoff, Black Monday: stock market crash in 1987, carbon tax, cognitive bias, collateralized debt obligation, complexity theory, corporate governance, CRISPR, cuban missile crisis, data acquisition, deep learning, DeepMind, discovery of penicillin, double helix, Elon Musk, failed state, financial thriller, fixed income, Flash crash, forensic accounting, friendly AI, Hacker News, Intergovernmental Panel on Climate Change (IPCC), Internet of things, James Watt: steam engine, Jeff Bezos, John Maynard Keynes: Economic Possibilities for our Grandchildren, knowledge worker, Maui Hawaii, megacity, Mikhail Gorbachev, money market fund, mouse model, Nate Silver, new economy, Nicholas Carr, Nick Bostrom, nuclear winter, OpenAI, pattern recognition, personalized medicine, phenotype, Ponzi scheme, Ray Kurzweil, Recombinant DNA, Richard Feynman, Richard Feynman: Challenger O-ring, risk tolerance, Ronald Reagan, Sam Altman, Search for Extraterrestrial Intelligence, self-driving car, Silicon Valley, smart grid, statistical model, Stephen Hawking, Stuxnet, subprime mortgage crisis, tacit knowledge, technological singularity, The Future of Employment, the scientific method, The Signal and the Noise by Nate Silver, Tunguska event, uranium enrichment, Vernor Vinge, WarGames: Global Thermonuclear War, Watson beat the top human players on Jeopardy!, women in the workforce, Y2K

David Nakamura and Chico Harlan, “Japanese Nuclear Plant’s Evaluators Cast Aside Threat of Tsunami,” Washington Post, Mar. 23, 2011, www.washingtonpost.com/world/japanese-nuclear-plants-evaluators-cast-aside-threat-of-tsunami/2011/03/22/AB7Rf2KB_story.html (accessed Oct. 4, 2016). CHAPTER 6: THE ACCOUNTANT: MADOFF’S PONZI SCHEME 1. Enormous amounts have been written about the Madoff case, but we benefited particularly from Harry Markopolos’s own book, No One Would Listen: A True Financial Thriller (Hoboken, NJ: Wiley, 2010); Erin Arvedlund, Too Good To Be True: The Rise and Fall of Bernie Madoff (New York: Portfolio, 2009); U.S. Security and Exchange Commission Office of Inspector General, Investigation of Failure of the SEC to Uncover Bernard Madoff’s Ponzi Scheme (Public Version) (2009); and a series of articles by Mark Seal that appeared in Vanity Fair magazine as “The Madoff Chronicles,” in April, June, and September 2009. 2.

pages: 431 words: 132,416

No One Would Listen: A True Financial Thriller by Harry Markopolos

Alan Greenspan, backtesting, barriers to entry, Bernie Madoff, buy and hold, call centre, centralized clearinghouse, correlation coefficient, diversified portfolio, Edward Thorp, Emanuel Derman, Eugene Fama: efficient market hypothesis, family office, financial engineering, financial thriller, fixed income, forensic accounting, high net worth, index card, Long Term Capital Management, Louis Bachelier, low interest rates, Market Wizards by Jack D. Schwager, offshore financial centre, payment for order flow, Ponzi scheme, price mechanism, proprietary trading, quantitative trading / quantitative finance, regulatory arbitrage, Renaissance Technologies, risk-adjusted returns, risk/return, rolodex, Sharpe ratio, statistical arbitrage, too big to fail, transaction costs, two and twenty, your tax dollars at work

Wiley also publishes its books in a variety of electronic formats. Some content that appears in print may not be available in electronic books. For more information about Wiley products, visit our web site at www.wiley.com. Library of Congress Cataloging-in-Publication Data: Markopolos, Harry. No one would listen : a true financial thriller / Harry Markopolos. p. cm. Includes index. eISBN : 978-0-470-62576-7 1. Madoff, Bernard L. 2. Ponzi schemes—United States. 3. Investment advisors—Corrupt practices—United States. 4. Hedge funds—United States. 5. Securities fraud—United States—Prevention. 6. United States. Securities and Exchange Commission—Rules and practice.

pages: 598 words: 169,194

Bernie Madoff, the Wizard of Lies: Inside the Infamous $65 Billion Swindle by Diana B. Henriques

accounting loophole / creative accounting, airport security, Albert Einstein, AOL-Time Warner, banking crisis, Bear Stearns, Bernie Madoff, Black Monday: stock market crash in 1987, break the buck, British Empire, buy and hold, centralized clearinghouse, collapse of Lehman Brothers, computerized trading, corporate raider, diversified portfolio, Donald Trump, dumpster diving, Edward Thorp, financial deregulation, financial engineering, financial thriller, fixed income, forensic accounting, Gordon Gekko, index fund, locking in a profit, low interest rates, mail merge, merger arbitrage, messenger bag, money market fund, payment for order flow, plutocrats, Ponzi scheme, Potemkin village, proprietary trading, random walk, Renaissance Technologies, riskless arbitrage, Ronald Reagan, Savings and loan crisis, short selling, short squeeze, Small Order Execution System, source of truth, sovereign wealth fund, too big to fail, transaction costs, traveling salesman

Bankruptcy Court for the Southern District of New York, p. 15. 73 subsequent lawsuits would claim that the firm’s compliance officer was Peter Madoff’s daughter, Shana: Ibid., p. 14. 73 several hundred clients with traditional brokerage accounts: It cleared those customer trades through Bear Stearns until that firm was taken over in early 2008. 75 Some options traders called his new strategy a “bull spread”: Harry Markopolos, No One Would Listen: A True Financial Thriller (Hoboken, N.J.: John Wiley & Sons, 2010), p. 27. 75 the right (the “option”) to buy or sell that stock at a specific price: The right to buy a stock was called a “call option.” The seller of a call option is promising to let the buyer purchase the shares at a specified price for the term of the option.

pages: 741 words: 179,454

Extreme Money: Masters of the Universe and the Cult of Risk by Satyajit Das

"RICO laws" OR "Racketeer Influenced and Corrupt Organizations", "there is no alternative" (TINA), "World Economic Forum" Davos, affirmative action, Alan Greenspan, Albert Einstein, algorithmic trading, Andy Kessler, AOL-Time Warner, Asian financial crisis, asset allocation, asset-backed security, bank run, banking crisis, banks create money, Basel III, Bear Stearns, behavioural economics, Benoit Mandelbrot, Berlin Wall, Bernie Madoff, Big bang: deregulation of the City of London, Black Swan, Bonfire of the Vanities, bonus culture, book value, Bretton Woods, BRICs, British Empire, business cycle, buy the rumour, sell the news, capital asset pricing model, carbon credits, Carl Icahn, Carmen Reinhart, carried interest, Celtic Tiger, clean water, cognitive dissonance, collapse of Lehman Brothers, collateralized debt obligation, corporate governance, corporate raider, creative destruction, credit crunch, Credit Default Swap, credit default swaps / collateralized debt obligations, currency risk, Daniel Kahneman / Amos Tversky, deal flow, debt deflation, Deng Xiaoping, deskilling, discrete time, diversification, diversified portfolio, Doomsday Clock, Dr. Strangelove, Dutch auction, Edward Thorp, Emanuel Derman, en.wikipedia.org, Eugene Fama: efficient market hypothesis, eurozone crisis, Everybody Ought to Be Rich, Fall of the Berlin Wall, financial engineering, financial independence, financial innovation, financial thriller, fixed income, foreign exchange controls, full employment, Glass-Steagall Act, global reserve currency, Goldman Sachs: Vampire Squid, Goodhart's law, Gordon Gekko, greed is good, Greenspan put, happiness index / gross national happiness, haute cuisine, Herman Kahn, high net worth, Hyman Minsky, index fund, information asymmetry, interest rate swap, invention of the wheel, invisible hand, Isaac Newton, James Carville said: "I would like to be reincarnated as the bond market. You can intimidate everybody.", job automation, Johann Wolfgang von Goethe, John Bogle, John Meriwether, joint-stock company, Jones Act, Joseph Schumpeter, junk bonds, Kenneth Arrow, Kenneth Rogoff, Kevin Kelly, laissez-faire capitalism, load shedding, locking in a profit, Long Term Capital Management, Louis Bachelier, low interest rates, margin call, market bubble, market fundamentalism, Market Wizards by Jack D. Schwager, Marshall McLuhan, Martin Wolf, mega-rich, merger arbitrage, Michael Milken, Mikhail Gorbachev, Milgram experiment, military-industrial complex, Minsky moment, money market fund, Mont Pelerin Society, moral hazard, mortgage debt, mortgage tax deduction, mutually assured destruction, Myron Scholes, Naomi Klein, National Debt Clock, negative equity, NetJets, Network effects, new economy, Nick Leeson, Nixon shock, Northern Rock, nuclear winter, oil shock, Own Your Own Home, Paul Samuelson, pets.com, Philip Mirowski, Phillips curve, planned obsolescence, plutocrats, Ponzi scheme, price anchoring, price stability, profit maximization, proprietary trading, public intellectual, quantitative easing, quantitative trading / quantitative finance, Ralph Nader, RAND corporation, random walk, Ray Kurzweil, regulatory arbitrage, Reminiscences of a Stock Operator, rent control, rent-seeking, reserve currency, Richard Feynman, Richard Thaler, Right to Buy, risk free rate, risk-adjusted returns, risk/return, road to serfdom, Robert Shiller, Rod Stewart played at Stephen Schwarzman birthday party, rolodex, Ronald Reagan, Ronald Reagan: Tear down this wall, Satyajit Das, savings glut, shareholder value, Sharpe ratio, short selling, short squeeze, Silicon Valley, six sigma, Slavoj Žižek, South Sea Bubble, special economic zone, statistical model, Stephen Hawking, Steve Jobs, stock buybacks, survivorship bias, tail risk, Teledyne, The Chicago School, The Great Moderation, the market place, the medium is the message, The Myth of the Rational Market, The Nature of the Firm, the new new thing, The Predators' Ball, The Theory of the Leisure Class by Thorstein Veblen, The Wealth of Nations by Adam Smith, Thorstein Veblen, too big to fail, trickle-down economics, Turing test, two and twenty, Upton Sinclair, value at risk, Yogi Berra, zero-coupon bond, zero-sum game

George Magnus (2009) The Age of Aging: How Demographics Are Changing the Global Economy and Our World, John Wiley, New Jersey. Sebastian Mallaby (2010) More Money Than God: Hedge Funds and the Making of the New Elite, Bloombsbury, London. Benoit Mandlebrot (2004) The (Mis)behavior of Markets, Basic Books, New York. Harry Markapolos (2010) No One Would Listen: A True Financial Thriller, John Wiley, New Jersey. Paul Mason (2009) Meltdown: The End of the Age of Greed, Verso, London. Mark McCormack (1984) What They Don’t Teach You At Harvard Business School: Notes From A Street-Smart Executive, Bantam, New York. Larry McDonald (2009) A Colossal Failure of Common Sense, Ebury Press, London.

pages: 932 words: 307,785

State of Emergency: The Way We Were by Dominic Sandbrook

anti-communist, Apollo 13, Arthur Marwick, back-to-the-land, banking crisis, Bretton Woods, British Empire, centre right, collective bargaining, Corn Laws, David Attenborough, Doomsday Book, edge city, estate planning, Etonian, falling living standards, fear of failure, Fellow of the Royal Society, feminist movement, financial thriller, first-past-the-post, fixed income, full employment, gentrification, German hyperinflation, global pandemic, Herbert Marcuse, mass immigration, meritocracy, moral panic, Neil Kinnock, new economy, New Urbanism, Norman Mailer, North Sea oil, oil shock, Own Your Own Home, post-war consensus, sexual politics, traveling salesman, union organizing, upwardly mobile, urban planning, Winter of Discontent, young professional

The City of London: the last bastion of an institutional conservatism that was otherwise dying out; the last bastion of a stiff-upper-lip Englishness that was on the wane everywhere else; the last bastion, indeed, of the bowler hat. The City: ‘overgrown village, rumour mill, with an atmosphere of a regimental mess and the sense of humour of an Edwardian boys’ paper, full of private language, secret rituals and enough games to last a working lifetime,’ as the narrator puts it in David Jordan’s financial thriller Nile Green (1973). Nowhere better captured its values than Sweetings, the famous restaurant where ‘the City man goes for lunch when he’s nostalgic for his schooldays … Bread and butter, brown and thin and damp, a memory of cricket on the lawn before Evensong. Ginger beer and lemonade. Sherbert.