butterfly effect

80 results back to index

pages: 396 words: 112,748

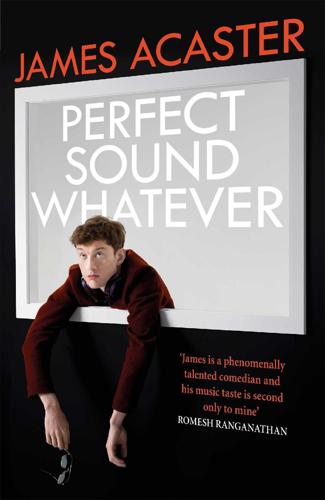

Chaos: Making a New Science by James Gleick

Benoit Mandelbrot, business cycle, butterfly effect, cellular automata, Claude Shannon: information theory, discrete time, Edward Lorenz: Chaos theory, experimental subject, Georg Cantor, Henri Poincaré, Herbert Marcuse, Isaac Newton, iterative process, John von Neumann, Louis Pasteur, mandelbrot fractal, military-industrial complex, Murray Gell-Mann, Norbert Wiener, pattern recognition, power law, Richard Feynman, scientific management, Stephen Hawking, stochastic process, trade route

In weather, for example, this translates into what is only half-jokingly known as the Butterfly Effect—the notion that a butterfly stirring the air today in Peking can transform storm systems next month in New York. When the explorers of chaos began to think back on the genealogy of their new science, they found many intellectual trails from the past. But one stood out clearly. For the young physicists and mathematicians leading the revolution, a starting point was the Butterfly Effect. The Butterfly Effect Physicists like to think that all you have to do is say, these are the conditions, now what happens next?

…

The repetition disappeared. The Butterfly Effect was no accident; it was necessary. Suppose small perturbations remained small, he reasoned, instead of cascading upward through the system. Then when the weather came arbitrarily close to a state it had passed through before, it would stay arbitrarily close to the patterns that followed. For practical purposes, the cycles would be predictable—and eventually uninteresting. To produce the rich repertoire of real earthly weather, the beautiful multiplicity of it, you could hardly wish for anything better than a Butterfly Effect. The Butterfly Effect acquired a technical name: sensitive dependence on initial conditions.

…

A butterfly can flap its wings in Peking, and in Central Park you get rain instead of sunshine.” By then the Butterfly Effect was well on its way to becoming a pop-culture cliché: inspiring at least two movies, an entry in Bartlett’s Quotations, a music video, and a thousand Web sites and blogs. (Only the place names keep changing: the butterfly flaps its wings in Brazil, Peru, China, California, Tahiti, and South America, and the rain/hurricane/tornado/storm arrives in Texas, Florida, New York, Nebraska, Kansas, and Central Park.) After the big hurricanes of 2006, Physics Today published an article titled “Battling the Butterfly Effect,” whimsically blaming butterflies in battalions: “Visions of Lepidoptera terrorist training camps spring suddenly to mind.”

pages: 250 words: 79,360

Escape From Model Land: How Mathematical Models Can Lead Us Astray and What We Can Do About It by Erica Thompson

Alan Greenspan, Bayesian statistics, behavioural economics, Big Tech, Black Swan, butterfly effect, carbon tax, coronavirus, correlation does not imply causation, COVID-19, data is the new oil, data science, decarbonisation, DeepMind, Donald Trump, Drosophila, Emanuel Derman, Financial Modelers Manifesto, fudge factor, germ theory of disease, global pandemic, hindcast, I will remember that I didn’t make the world, and it doesn’t satisfy my equations, implied volatility, Intergovernmental Panel on Climate Change (IPCC), John von Neumann, junk bonds, Kim Stanley Robinson, lockdown, Long Term Capital Management, moral hazard, mouse model, Myron Scholes, Nate Silver, Neal Stephenson, negative emissions, paperclip maximiser, precautionary principle, RAND corporation, random walk, risk tolerance, selection bias, self-driving car, social distancing, Stanford marshmallow experiment, statistical model, systematic bias, tacit knowledge, tail risk, TED Talk, The Great Moderation, The Great Resignation, the scientific method, too big to fail, trolley problem, value at risk, volatility smile, Y2K

This is partly why the exponential increase in computing power has resulted in only linear improvements to the lead time of useful weather forecasts. The problems caused by the Butterfly Effect have an obvious solution. Just measure the initial conditions more accurately and you’ll get a more accurate forecast. As the importance of initialisation has become more and more clear, weather-observing systems have been massively improved over the last century, now assimilating near-real-time data from satellites, aeroplanes, ships, weather stations, radiosonde balloons, radar systems and more. There is also a slightly less obvious solution to the Butterfly Effect, one that has prompted huge changes in the way that weather forecasts are made and communicated.

…

But for complex and nonlinear systems like the weather, small model errors can instead result in large prediction errors even over short timescales. This is the Hawkmoth Effect. When the Butterfly Effect strikes, our forecasts start off accurate and then become imprecise, but they do not become misleading. When the Hawkmoth Effect strikes, our forecasts start off accurate, then they can become misleading (see Figure 3). Imprecision is not a sin, and it need not cause bad decisions as long as we know to expect it. When a forecast is misleading, however, it can cause us to do the wrong thing in mistaken expectation that we know what will happen. The Hawkmoth Effect is analogous to the Butterfly Effect, but rather than sensitivity to the initial condition, it describes sensitivity to the model structure.

…

The initial conditions were real-world measurements and there were only a finite number of dimensions in which they might be wrong: the position of a basketball can only be incorrect by being too far up, down, left, right, forward and/or back. We can systematically try a range of possibilities that encompass the actual position of the ball. That’s why the Butterfly Effect is solvable: we can know that the true outcome is somewhere within the range of predicted outcomes. Figure 3: The solution to the Butterfly Effect is to run a perfect model with lots of different initial conditions (solid lines). The fuzzy circle on the left shows the range of measurement uncertainty around the correct initial condition, and the fuzzy circle at top right shows the resulting imprecise forecast.

Super Thinking: The Big Book of Mental Models by Gabriel Weinberg, Lauren McCann

Abraham Maslow, Abraham Wald, affirmative action, Affordable Care Act / Obamacare, Airbnb, Albert Einstein, anti-pattern, Anton Chekhov, Apollo 13, Apple Newton, autonomous vehicles, bank run, barriers to entry, Bayesian statistics, Bernie Madoff, Bernie Sanders, Black Swan, Broken windows theory, business process, butterfly effect, Cal Newport, Clayton Christensen, cognitive dissonance, commoditize, correlation does not imply causation, crowdsourcing, Daniel Kahneman / Amos Tversky, dark pattern, David Attenborough, delayed gratification, deliberate practice, discounted cash flows, disruptive innovation, Donald Trump, Douglas Hofstadter, Dunning–Kruger effect, Edward Lorenz: Chaos theory, Edward Snowden, effective altruism, Elon Musk, en.wikipedia.org, experimental subject, fake news, fear of failure, feminist movement, Filter Bubble, framing effect, friendly fire, fundamental attribution error, Goodhart's law, Gödel, Escher, Bach, heat death of the universe, hindsight bias, housing crisis, if you see hoof prints, think horses—not zebras, Ignaz Semmelweis: hand washing, illegal immigration, imposter syndrome, incognito mode, income inequality, information asymmetry, Isaac Newton, Jeff Bezos, John Nash: game theory, karōshi / gwarosa / guolaosi, lateral thinking, loss aversion, Louis Pasteur, LuLaRoe, Lyft, mail merge, Mark Zuckerberg, meta-analysis, Metcalfe’s law, Milgram experiment, minimum viable product, moral hazard, mutually assured destruction, Nash equilibrium, Network effects, nocebo, nuclear winter, offshore financial centre, p-value, Paradox of Choice, Parkinson's law, Paul Graham, peak oil, Peter Thiel, phenotype, Pierre-Simon Laplace, placebo effect, Potemkin village, power law, precautionary principle, prediction markets, premature optimization, price anchoring, principal–agent problem, publication bias, recommendation engine, remote working, replication crisis, Richard Feynman, Richard Feynman: Challenger O-ring, Richard Thaler, ride hailing / ride sharing, Robert Metcalfe, Ronald Coase, Ronald Reagan, Salesforce, school choice, Schrödinger's Cat, selection bias, Shai Danziger, side project, Silicon Valley, Silicon Valley startup, speech recognition, statistical model, Steve Jobs, Steve Wozniak, Steven Pinker, Streisand effect, sunk-cost fallacy, survivorship bias, systems thinking, The future is already here, The last Blockbuster video rental store is in Bend, Oregon, The Present Situation in Quantum Mechanics, the scientific method, The Wisdom of Crowds, Thomas Kuhn: the structure of scientific revolutions, Tragedy of the Commons, transaction costs, uber lyft, ultimatum game, uranium enrichment, urban planning, vertical integration, Vilfredo Pareto, warehouse robotics, WarGames: Global Thermonuclear War, When a measure becomes a target, wikimedia commons

He illustrated this concept by saying that the path of a tornado could be affected by a butterfly flapping its wings weeks before, sending air particles on a slightly different path than they would have otherwise traveled, which then gets amplified over time and ultimately results in a different path for the tornado. This metaphor has been popularized in many forms of entertainment, including by Jeff Goldblum’s character in the 1993 movie Jurassic Park and in the 2004 movie The Butterfly Effect, starring Ashton Kutcher. THE BUTTERFLY EFFECT The fact that you are surrounded by chaotic systems is a key reason why adaptability is so important to your success. While it is a good idea to plan ahead, you cannot accurately predict the circumstances you will face. No one plans to lose their spouse at a young age, or to graduate from college during an economic downturn.

…

We’re sure you can point to times in your history when a small change led to a big effect in your life. It’s the “what if” game. What if you hadn’t gone to that event that led to meeting your spouse? What if you had moved into that other apartment? What if you had struck up a relationship with a different teacher or mentor? That’s the butterfly effect at the most personal level. One way to more systematically take advantage of the butterfly effect is using the super model of luck surface area, coined by entrepreneur Jason Roberts. You may recall from geometry that the surface area of an object is how much area the surface of an object covers. In the same way that it is a lot easier to catch a fish if you cast a wide net, your personal luck surface area will increase as you interact with more people in more diverse situations.

…

A&P, 70 absence of evidence is not the evidence of absence, 167 A/B testing, 136 Accidental Empires (Cringley), 253 accountability, 275 acne, 169–71 activation energy, 112–13 actor-observer bias (self-serving bias), 21, 272 Adams, John, 222 adaptability, 121, 129 ad hominem, 226 adverse selection, 46–47 advertising, 103–4, 120, 262 advisers, 44, 45, 296 Affordable Care Act (ACA), 46, 47 Afghanistan, 54, 243 agent, 44–45 aggregation, 205 aggression, obnoxious, 264 agreeableness, 250 AIDS, 233 Airbnb, 276, 288, 292 air pollution, 41 air travel, 53–54 Aldi, 70 Alexander, Christopher, 92 algorithms, 94, 97 Allen, David, 76 all-nighter, 83 alpha, 161, 182 al-Qaeda, 52, 54 alternative hypothesis, 163, 164, 166, 167 altruism, effective, 80 alumni, 119 Amazon, 61, 70, 95–96, 283, 290, 300 American Revolution, 221–22, 239, 240 American Statistical Association, 168 Amway, 217 analysis paralysis, 60–62, 93 anchoring, 14–15, 30, 199 anecdotal evidence, 133, 139, 146 antibiotics, 37, 47–49 Antifragile (Taleb), 2, 105 antifragility, 2–3, 31–33 anti-patterns, 93 AOL, 106 Apollo 13, 4 appeasement, 237 Apple, 103, 104, 231, 241, 258, 289–91, 305, 309 iPad, 290 iPod, 296–97 Newton, 290 approval ratings, 152–54, 158 arbitrage, 282–83 Archilochus, 254 Archimedes, 78 arguing from first principles, 4–7, 31, 207 Ariely, Dan, 14, 222–23 arithmetic, ix–x, 23–24, 30, 178 arms races, 209–12, 214 Ashley Madison, 229 Associated Press (AP), 306 asymmetric information, 45–47 atomic bomb, see nuclear weapons Atwood, Jeff, 253 authority, 219–20, 226 automation, 95, 310 availability bias, 15–18, 30, 33, 300 average, 146, 187 Avon, 217 Aztecs, 243–44 babies, 198, 279 sleep and, 131–32 babysitters, 222 backfire effect, 26 back-of-the-envelope calculation, 299 bacteria, 47–49, 295 bait and switch, 228, 229 bandwagon effect, 202 barriers to entry and barriers to exit, 305 baseball, 83, 145–46, 289 base rate, 157, 159, 160 base rate fallacy, 157, 158, 170 BATNA (best alternative to a negotiated agreement), 77 Battle of Heraclea, 239 Battle of Tsushima, 241 Bayes’ theorem and Bayesian statistics, 157–60 beachhead, 300–301 Beatles, 105 Beautiful Mind, A, 213 beliefs, 103, 107 bell curve (normal distribution), 150–52, 153, 163–66, 191 Bell Labs, 89 benefit of the doubt, 20 benefits: cost-benefit analysis, 177–86, 189, 194 eliminating, 224 net, 181–82, 184 Berlin, Isaiah, 254 Bernoulli distribution, 152 best practices, 92 beta, 162, 182 Better Angels of Our Nature, The (Pinker), 144 Bezos, Jeff, 61–62, 286–87 bias, 3, 139 availability, 15–18, 30, 33, 300 confirmation, 26–28, 33, 103, 159 disconfirmation, 27 groupthink, 201–3 hidden, 139–43 hindsight, 271–72 nonresponse, 140, 142, 143 observer-expectancy, 136, 139 optimistic probability, 33 present, 85, 87, 93, 113 publication, 170, 173 response, 142, 143 selection, 139–40, 143, 170 self-serving, 21, 272 survivorship, 140–43, 170, 272 Big Short, The (Lewis), 289 bike-shedding, 75, 93 Bird, Larry, 246 birth lottery, 21–22, 69 black-and-white thinking, 126–28, 168, 272 black boxes, 94–95 Black Flags rebellion, 276 blackouts, electric, 120 black swan events, 190–91, 193 Blank, Steve, 294 bleeding them dry, 239 blinded experiments, 136 Blockbuster, 106 blowback, 54 Boaty McBoatface, RSS, 35 body mass index (BMI), 137 body temperature, 146–50 boiling frog, 55, 56, 58, 60 bonds, 180, 184 Bonne, Rose, 58 Boot, Max, 239 boots on the ground, 279 Boston Common, 36–38, 42 Boyd, John, 294 Bradley, Bill, 248 brainstorming, 201–3 Brandeis, Louis, 307 breast cancer, 156–57, 160–61 Breathalyzer tests, 157–58, 160 Brexit, 206, 305 bright spots, 300 bring in reinforcements, 279 British Medical Journal (BMJ), 136–37 broken windows theory, 235–36 Broderick, Matthew, 230 Brody, William, 290–91 Brookings Institution, 306 brute force solution, 93, 97 Bryson, Bill, 50 budget, 38, 74–75, 81, 95, 113 national, 75–76 Buffett, Warren, viii, 69, 286, 302, 317, 318 burning bridges, 243 burnout, 82, 83 Burns, Robert, 49 burn the boats, 244 Bush, George H. W., 104 business case, 207 butterfly effect, 121, 122, 125, 201 Butterfly Effect, The, 121 Butterworth, Brian, x buyout, leveraged, 79 bystander effect, 259 cable television, 69, 100, 106 Caesar, Julius, 244 calculus, 291 call your bluff, 238 cameras, 302–3, 308–10 campaign finance reform, 110 Campbell, Donald T., 49–50 Campbell’s law, 49–50 cancer: breast, 156–57, 160–61 clusters of, 145 lung, 133–34, 137 cap-and-trade systems, 42–43 capital, cost of, 76, 77, 179, 182 careers, 300–301 decisions about, 5–6, 57, 175–77, 201, 207, 296 design patterns and, 93 entry barriers and, 305 licensing and, 306–7 Carfax, 46 Cargill, Tom, 89 cargo cults, 315–16 caring personally, 263–64 car market, 46–47 Carrey, Jim, 229 carrot-and-stick model, 232 cascading failures, 120, 192 casinos, 220, 226 cast a wide net, 122 catalyst, 112–13, 115, 119 Catherine II, Empress, 228 causal loop diagrams, 192–93 causation, correlation and, 134, 135 cellphones, 116–17 center of gravity, 112 central limit theorem, 152–53, 163 central tendency, 147 chain reaction, viii, 114, 120 Challenger, 31–33 challenging directly, 263–64 change, 100–101, 112–13, 129 resistance to, 110–11 chaos, 124 balance between order and, 128 chaos theory, 121 chaotic systems, 120–21, 124, 125 Chatelier’s principle, 193–94 cheating, 50 Chekhov, Anton, 124 chess, 242 chilling effect, 52–54 China, 231, 276 choice, 62 paradox of, 62–63 Christensen, Clayton, 296, 297, 310 Cialdini, Robert, 215–17, 219–21 circle of competence, 317–18 climate change, 42, 55, 56, 104, 105, 183, 192 Clinton, Hillary, 70, 97 clustering illusion, 144–45 CNN, 220 Coase, Ronald, 42 Coase theorem, 42–43 cobra effect, 50–52 Coca-Cola, 305 cognitive dissonance, 27–29, 216 coin flips, 143–44, 154–55, 158–59 Cold War, 209, 235 collateral damage, 53–54, 231 collective intelligence, 205 collectivist versus individualist, in organizational culture, 274 college, 209–10 choice of, 58–60 rankings of, 50, 137 Collins, Jim, 109, 254 commandos, in organizations and projects, 253–54 commitment, 87–88 escalation of, 91 influence model of, 216, 220 commodities, 283 commons, 36–38, 43 Common Sense (Paine), 221–22 communication, high-context and low-context, 273–74 competence, circle of, 317–18 competition: and crossing the chasm, 312 moats and, 302–5 perfect, 283 regulatory capture and, 305 sustainable competitive advantage, 283, 285 complexity, complex systems, 185–86, 192, 194 diagrams and, 192–93 simulations and, 192–94 compound interest, 69, 85 Concorde fallacy, 91 conditional probability, 156 Confederate leaders, 113 confidence intervals, 154–56, 159 confidence level, 154, 155, 161 confirmation bias, 26–28, 33, 103, 159 conflict, 209, 226 arms races, 209–12, 214 game theory and, see game theory confounding factor, 134–35, 139 conjunction fallacy, 9–10 conscientiousness, 250 consensus, 202 consensus-contrarian matrix, 285–86, 290 consequence-conviction matrix, 265–66 consequences, 35 unintended, 35–36, 53–55, 57, 64–65, 192, 232 containment, 233, 237 contests, 35–36 context-switching, 71, 74 continental drift, 24–25, 289 contrarian-consensus matrix, 285–86, 290 Contrarian’s Guide to Leadership, The (Sample), 28 control group, 136 conventional wisdom, 5 convergent thinking, 203 conviction-consequence matrix, 265–66 cooperation, 215, 226 tit-for-tat, 214–15 correlations, 134, 135, 139 corruption, 307 Cortés, Hernán, 243–44 cost-benefit analysis, 177–86, 189, 194 Costco, 70 cost of capital, 76, 77, 179, 182 cost of doing business, 232 counterfactual thinking, 201, 272, 309–10 cramming, 83, 262 credible intervals, 159 crime, 16, 161, 231, 232 broken windows theory and, 235–36 Cringley, Robert X., 253 critical mass, viii–x, 114–15, 117, 119, 120, 129, 194, 308 critical thinking, 201 crossing the chasm, 311–12 crossing the Rubicon, 244 crowdsourcing, 203–6, 286 culture, 113, 273 organizational, 107–8, 113, 273–80, 293 customers, 300 development of, 294 personas for, 300 types of, 298–300 winner-take-most markets and, 308 Cutco, 217 Danziger, Shai, 63 dark patterns, 226–29 Potemkin villages, 228–29 Darley, John, 259 Darwin, Charles, 100, 101, 291 data, 130–31, 143, 146, 301 binary, 152 dredging of, 169–70 in graphs, see graphs mean in, 146, 149, 151 meta-analysis of, 172–73 outliers in, 148 streaks and clusters in, 144 variance in, 149 see also experiments; statistics dating, 8–10, 95 daycare center, 222–23 deadlines, 89 death, causes of, 17 death by a thousand cuts, 38 debate, 225 decisions, 1–2, 11, 31, 127, 129, 131–33, 175, 209 business case and, 207 choices and, 62–63 cost-benefit analysis in, 177–86, 189, 194 decision fatigue and, 63–64 decision tree in, 186–90, 194, 215 Eisenhower Decision Matrix, 72–74, 89, 124, 125 irreversible, 61–62, 223–24 opportunity cost and, 76–77, 80, 83, 179, 182, 188, 305 past, analyzing, 201, 271–72 pro-con list in, 175–78, 185, 189 reversible, 61–62 sequences of, 144 small, tyranny of, 38, 55 utilitarianism and, 189–90 Declaration of Independence, 222 deep work, 72, 76, 88, 278 default effect, 87–88 Defense, U.S.

pages: 409 words: 105,551

Team of Teams: New Rules of Engagement for a Complex World by General Stanley McChrystal, Tantum Collins, David Silverman, Chris Fussell

Airbus A320, Albert Einstein, Apollo 11, Atul Gawande, autonomous vehicles, bank run, barriers to entry, Black Swan, Boeing 747, butterfly effect, call centre, Captain Sullenberger Hudson, Chelsea Manning, clockwork universe, crew resource management, crowdsourcing, driverless car, Edward Snowden, Flash crash, Frederick Winslow Taylor, global supply chain, Henri Poincaré, high batting average, Ida Tarbell, information security, interchangeable parts, invisible hand, Isaac Newton, Jane Jacobs, job automation, job satisfaction, John Nash: game theory, knowledge economy, Mark Zuckerberg, Mohammed Bouazizi, Nate Silver, Neil Armstrong, Pierre-Simon Laplace, pneumatic tube, radical decentralization, RAND corporation, scientific management, self-driving car, Silicon Valley, Silicon Valley startup, Skype, Steve Jobs, supply-chain management, systems thinking, The Wealth of Nations by Adam Smith, urban sprawl, US Airways Flight 1549, vertical integration, WikiLeaks, zero-sum game

Tiny eddies of air can be influenced by an almost immeasurably small event—something like the fluttering of a butterfly’s wings—and these eddies can affect larger currents, which in turn alter the way cold and warm fronts build—a chain of events that can magnify the initial disturbance exponentially, thereby completely undermining attempts to make reliable predictions. Lorenz’s program had been correct. When, several years later, Lorenz presented a paper about his findings, he titled it “Does the Flap of a Butterfly’s Wings in Brazil Set Off a Tornado in Texas?” The phrase “the butterfly effect” entered the world.* • • • Lorenz’s butterfly effect is a physical manifestation of the phenomenon of complexity—not “complexity” in the sense that we use the term in daily life, a catchall for things that are not simple or intuitive, but complexity in a more restrictive, technical, and baffling sense. This kind of complexity is difficult to define; those who study it often fall back on Supreme Court justice Potter Stewart’s comment on obscenity: “I know it when I see it.”

…

Because of speed and interdependence, street vendor Tarek al-Tayeb Mohamed Bouazizi could set off a chain of events that toppled multiple governments faster than the rest of the world could even process the news. Of course, there were successful revolutionaries and butterfly-effect phenomena before the information age, but new technologies have created an unprecedented proliferation of opportunities for small, historically disenfranchised actors to have a butterfly effect. Some of this has positive consequences, like entrepreneurial success. Other manifestations are devastating: terrorists, insurgents, and cybercriminals have taken advantage of speed and interdependence to cause death and wreak havoc.

…

A small change at the start of a chess game—say, moving a pawn to A3 instead of A4—can lead to a completely different result, just as the flapping of one of Lorenz’s butterflies might create huge, nonlinear havoc down the line. A reductionist instruction card would be useless for playing chess—the interactions generate too many possibilities. • • • The significance of Lorenz’s butterfly effect is not, however, just the nonlinear escalation of a minor input into a major output. There’s uncertainty involved; the amplification of the disturbance is not the product of a single, constant, identifiable magnifying factor—any number of seemingly insignificant inputs might—or might not—result in nonlinear escalation.

Exploring Everyday Things with R and Ruby by Sau Sheong Chang

Alfred Russel Wallace, bioinformatics, business process, butterfly effect, cloud computing, Craig Reynolds: boids flock, data science, Debian, duck typing, Edward Lorenz: Chaos theory, Gini coefficient, income inequality, invisible hand, p-value, price stability, Ruby on Rails, Skype, statistical model, stem cell, Stephen Hawking, text mining, The Wealth of Nations by Adam Smith, We are the 99%, web application, wikimedia commons

We have discussed emergent behavior, where small local rules result in complex, macro-level, group behavior. The pattern we have observed here, rather than emergent behavior, can be classified as a kind of “butterfly effect”; see the sidebar Butterfly Effect. Figure 8-6. Population fluctuation swings, resulting in extinction of the roids Butterfly Effect In chaos theory, the butterfly effect is the sensitive dependence on initial conditions, where a small change somewhere in a nonlinear system can result in large differences at a later stage. This name was coined by Edward Lorenz, one of the pioneers of chaos theory (and no relation to Max Lorenz of the Lorenz curve fame).

…

We observed that it is difficult to reach a state where a population is stable enough to survive for a long time. Very often, population fluctuations involve crazy swings that eventually end with the extinction of the society, even with identical starting parameters. We observed that a small effect can ripple down, causing unexpected changes—a phenomenon known as the butterfly effect. The final scenario dealt with evolution. We simulated natural selection by getting the offspring of the roids to inherit traits of their parents. These traits were specially designed to influence the survivability of the roids over a period of time. We anticipated that, if natural selection occurred, the traits of the roid population would move toward those that allow it to best survive.

…

: (question mark, colon), in Ruby ternary conditional expression, if and unless > (right angle bracket), The R Console, Variables and Functions -> assignment operator, R, Variables and Functions > R console prompt, The R Console ' ' (single quotes), enclosing Ruby strings, Strings [ ] (square brackets), Vectors, Matrices, Data frames accessing subset of R data frame, Data frames enclosing R matrix indexes, Matrices enclosing R vector indexes, Vectors [[ ]] (square brackets, double), enclosing single R vector index, Vectors A aes() function, R, Aesthetics An Inquiry into the Nature and Causes of the Wealth of Nations (University of Chicago Press), The Invisible Hand apply() function, R, Interpreting the Data Armchair Economist (Free Press), How to Be an Armchair Economist array() function, R, Arrays arrays, R, Arrays–Arrays arrays, Ruby, Arrays and hashes–Arrays and hashes, Arrays and hashes artificial society, Money (see Utopia example) as.Date() function, R, Number of Messages by Day of the Month ascultation, Auscultation assignment operators, R, Variables and Functions at sign, double (@@), preceding Ruby class variables, Class methods and variables attr keyword, Ruby, Classes and objects Audacity audio editor, Homemade Digital Stethoscope average, Interpreting the Data (see mean() function, R) Axtell, Robert (researcher), It’s a Good Life Growing Artificial Societies: Social Science from the Bottom Up (Brookings Institution Press/MIT Press), It’s a Good Life B backticks (` `), enclosing R operators as functions, Variables and Functions bar charts, Plotting charts, Interpreting the Data–Interpreting the Data, The Second Simulation–The Second Simulation, The Third Simulation–The Third Simulation, The Final Simulation–The Final Simulation barplot() function, R, Plotting charts batch mode, R, Sourcing Files and the Command Line Bioconductor repository, Packages birds flocking, Schooling Fish and Flocking Birds (see flocking example) bmp() function, R, Basic Graphs Boids algorithm, Schooling Fish and Flocking Birds–The Origin of Boids Box, George Edward Pelham (statistician), regarding usefulness of models, The Simple Scenario break keyword, R, Conditionals and Loops brew command, Installing Ruby using your platform’s package management tool butterfly effect, The Changes C c() function, R, Vectors CALO Project, The Emailing Habits of Enron Executives camera, pulse oximeter using, Homemade Pulse Oximeter case expression, Ruby, case expression chaos theory, The Changes charts, Charting–Adjustments, Plotting charts, Statistical transformation, Geometric object, Interpreting the Data–Interpreting the Data, Interpreting the Data–Interpreting the Data, Interpreting the Data–Interpreting the Data, The Second Simulation, The Second Simulation–The Second Simulation, The Third Simulation–The Third Simulation, The Third Simulation–The Third Simulation, The Final Simulation–The Final Simulation, The Final Simulation–The Final Simulation, Analyzing the Simulation–Analyzing the Simulation, Analyzing the Second Simulation–Analyzing the Second Simulation, Number of Messages by Day of the Month–Number of Messages by Hour of the Day, Generating the Heart Sounds Waveform–Generating the Heart Sounds Waveform, Generating the Heartbeat Waveform and Calculating the Heart Rate–Generating the Heartbeat Waveform and Calculating the Heart Rate, Money–Money, Money–Money, Implementation bar charts, Plotting charts, Interpreting the Data–Interpreting the Data, The Second Simulation–The Second Simulation, The Third Simulation–The Third Simulation, The Final Simulation–The Final Simulation histograms, Statistical transformation, Geometric object, Money–Money line charts, Interpreting the Data–Interpreting the Data, Analyzing the Simulation–Analyzing the Simulation, Analyzing the Second Simulation–Analyzing the Second Simulation Lorenz curves, Money–Money scatterplots, Interpreting the Data–Interpreting the Data, The Second Simulation, The Third Simulation–The Third Simulation, The Final Simulation–The Final Simulation, Number of Messages by Day of the Month–Number of Messages by Hour of the Day, Implementation waveforms, Generating the Heart Sounds Waveform–Generating the Heart Sounds Waveform, Generating the Heartbeat Waveform and Calculating the Heart Rate–Generating the Heartbeat Waveform and Calculating the Heart Rate class methods, Ruby, Class methods and variables class variables, Ruby, Class methods and variables–Class methods and variables classes, R, Programming R classes, Ruby, Classes and objects–Classes and objects code examples, Using Code Examples (see example applications) colon (:), Symbols, Vectors creating R vectors, Vectors preceding Ruby symbols, Symbols comma-separated value (CSV) files, Importing data from text files (see CSV files) Comprehensive R Archive Network (CRAN), Packages conditionals, R, Conditionals and Loops conditionals, Ruby, Conditionals and loops–case expression contact information for this book, How to Contact Us conventions used in this book, Conventions Used in This Book cor() function, R, The R Console Core library, Ruby, Requiring External Libraries corpus, Text Mining correlation, R, The R Console CRAN (Comprehensive R Archive Network), Packages CSV (comma-separated value) files, Importing data from text files, The First Simulation–The First Simulation, The First Simulation, Interpreting the Data, The Simulation, Extracting Data from Sound–Extracting Data from Sound, Extracting Data from Video extracting video data to, Extracting Data from Video extracting WAV data to, Extracting Data from Sound–Extracting Data from Sound reading data from, Interpreting the Data writing data to, The First Simulation–The First Simulation, The Simulation csv library, Ruby, The First Simulation, The Simulation, Grab and Parse curl utility, Ruby Version Manager (RVM) D data, Data, Data, Everywhere–Data, Data, Everywhere, Bringing the World to Us, Importing Data–Importing data from a database, Importing data from text files, The First Simulation–The First Simulation, Interpreting the Data, How to Be an Armchair Economist, The Simulation, Grab and Parse–Grab and Parse, The Emailing Habits of Enron Executives–The Emailing Habits of Enron Executives, Homemade Digital Stethoscope–Extracting Data from Sound, Extracting Data from Sound–Extracting Data from Sound, Homemade Pulse Oximeter–Extracting Data from Video, Extracting Data from Video analyzing, Data, Data, Everywhere–Data, Data, Everywhere, Bringing the World to Us, How to Be an Armchair Economist charts for, How to Be an Armchair Economist (see charts) obstacles to, Data, Data, Everywhere–Data, Data, Everywhere simulations for, Bringing the World to Us (see simulations) audio, from stethoscope, Homemade Digital Stethoscope–Extracting Data from Sound CSV files for, Importing data from text files, The First Simulation–The First Simulation, Interpreting the Data, The Simulation, Extracting Data from Sound–Extracting Data from Sound, Extracting Data from Video from Enron, The Emailing Habits of Enron Executives–The Emailing Habits of Enron Executives from Gmail, Grab and Parse–Grab and Parse importing, R, Importing Data–Importing data from a database video, from pulse oximeter, Homemade Pulse Oximeter–Extracting Data from Video data frames, R, Data frames–Data frames data mining, The Idea data.frame() function, R, Data frames database, importing data from, Importing data from a database–Importing data from a database dbConnect() function, R, Importing data from a database dbGet() function, R, Importing data from a database DBI packages, R, Importing data from a database–Importing data from a database Debian system, installing Ruby on, Installing Ruby using your platform’s package management tool def keyword, Ruby, Classes and objects dimnames() function, R, Matrices distribution, normal, Money dollar sign ($), preceding R list item names, Lists doodling example, Shoes doodler–Shoes doodler double quotes (" "), enclosing Ruby strings, Strings duck typing, Ruby, Code like a duck–Code like a duck dynamic typing, Ruby, Code like a duck–Code like a duck E economics example, A Simple Market Economy–A Simple Market Economy, The Producer–The Producer, The Consumer–The Consumer, Some Convenience Methods–Some Convenience Methods, The Simulation–The Simulation, Analyzing the Simulation–Analyzing the Simulation, The Producer–The Producer, The Consumer–The Consumer, Market–Market, The Simulation–The Simulation, Analyzing the Second Simulation–Analyzing the Second Simulation, Price Controls–Price Controls charts for, Analyzing the Simulation–Analyzing the Simulation, Analyzing the Second Simulation–Analyzing the Second Simulation Consumer class for, The Consumer–The Consumer, The Consumer–The Consumer Market class for, Some Convenience Methods–Some Convenience Methods, Market–Market modeling, A Simple Market Economy–A Simple Market Economy price controls analysis, Price Controls–Price Controls Producer class for, The Producer–The Producer, The Producer–The Producer simulations for, The Simulation–The Simulation, The Simulation–The Simulation email example, Grab and Parse–Grab and Parse, The Emailing Habits of Enron Executives–The Emailing Habits of Enron Executives, Number of Messages by Day of the Month–Number of Messages by Day of the Month, Number of Messages by Day of the Month–Number of Messages by Hour of the Day, MailMiner–MailMiner, Number of Messages by Day of Week–Number of Messages by Hour of the Day, Interactions–Comparative Interactions, Text Mining–Text Mining charts for, Number of Messages by Day of the Month–Number of Messages by Hour of the Day content of messages, analyzing, Text Mining–Text Mining data for, Grab and Parse–Grab and Parse Enron data for, The Emailing Habits of Enron Executives–The Emailing Habits of Enron Executives interactions in email, analyzing, Interactions–Comparative Interactions number of messages, analyzing, Number of Messages by Day of the Month–Number of Messages by Day of the Month, Number of Messages by Day of Week–Number of Messages by Hour of the Day R package for, creating, MailMiner–MailMiner emergent behavior, The Origin of Boids (see also flocking example) Enron Corporation scandal, The Emailing Habits of Enron Executives Epstein, Joshua (researcher), It’s a Good Life Growing Artificial Societies: Social Science from the Bottom Up (Brookings Institution Press/MIT Press), It’s a Good Life equal sign (=), assignment operator, R, Variables and Functions Euclidean distance, Roids evolution, Evolution example applications, Using Code Examples, Shoes stopwatch–Shoes stopwatch, Shoes doodler–Shoes doodler, The R Console–Sourcing Files and the Command Line, Data frames–Introducing ggplot2, qplot–qplot, Statistical transformation–Geometric object, Adjustments–Adjustments, Offices and Restrooms, A Simple Market Economy, Grab and Parse, My Beating Heart, Schooling Fish and Flocking Birds, Money artificial utopian society, Money (see Utopia example) birds flocking, Schooling Fish and Flocking Birds (see flocking example) doodling, Shoes doodler–Shoes doodler economics, A Simple Market Economy (see economics example) email, Grab and Parse (see email example) fuel economy, qplot–qplot, Adjustments–Adjustments heartbeat, My Beating Heart (see heartbeat example) height and weight, The R Console–Sourcing Files and the Command Line league table, Data frames–Introducing ggplot2 movie database, Statistical transformation–Geometric object permission to use, Using Code Examples restrooms, Offices and Restrooms (see restrooms example) stopwatch, Shoes stopwatch–Shoes stopwatch expressions, R, Programming R external libraries, Ruby, Requiring External Libraries–Requiring External Libraries F factor() function, R, Factors, Text Mining factors, R, Factors–Factors FFmpeg library, Extracting Data from Video, Extracting Data from Video field of vision (FOV), Roids fish, schools of, Schooling Fish and Flocking Birds (see flocking example) flocking example, Schooling Fish and Flocking Birds–The Origin of Boids, The Origin of Boids, Simulation–Simulation, Roids–Roids, The Boid Flocking Rules–Putting in Obstacles, The Boid Flocking Rules–The Boid Flocking Rules, A Variation on the Rules–A Variation on the Rules, Going Round and Round–Going Round and Round, Putting in Obstacles–Putting in Obstacles Boids algorithm for, Schooling Fish and Flocking Birds–The Origin of Boids centering path for, Going Round and Round–Going Round and Round obstacles in path for, Putting in Obstacles–Putting in Obstacles research regarding, A Variation on the Rules–A Variation on the Rules Roid class for, Roids–Roids rules for, The Origin of Boids, The Boid Flocking Rules–The Boid Flocking Rules simulations for, Simulation–Simulation, The Boid Flocking Rules–Putting in Obstacles flows, Shoes, Shoes stopwatch fonts used in this book, Conventions Used in This Book–Conventions Used in This Book for loop, R, Conditionals and Loops format() function, R, Number of Messages by Day of the Month FOV (field of vision), Roids fuel economy example, qplot–qplot, Adjustments–Adjustments function class, R, Programming R functions, R, Variables and Functions–Variables and Functions G GAM (generalized addictive model), The Changes gem command, Ruby, Requiring External Libraries .gem file extension, Requiring External Libraries generalized addictive model (GAM), The Changes Gentleman, Robert (creator of R), Introducing R geom_bar() function, R, Interpreting the Data, The Second Simulation, The Final Simulation geom_histogram() function, R, Geometric object geom_line() function, R, Analyzing the Simulation geom_point() function, R, Plot, Interpreting the Data, Generating the Heart Sounds Waveform geom_smooth() function, R, Interpreting the Data ggplot() function, R, Plot ggplot2 package, R, Introducing ggplot2–Adjustments Gini coefficient, Money Git utility, Ruby Version Manager (RVM) Gmail, retrieving message data from, Grab and Parse–Grab and Parse graphics device, opening, Basic Graphs graphics package, R, Basic Graphs graphs, Charting (see charts) Growing Artificial Societies: Social Science from the Bottom Up (Brookings Institution Press/MIT Press), It’s a Good Life H hash mark, curly brackets (#{ }), enclosing Ruby string escape sequences, Strings hashes, Ruby, Arrays and hashes–Arrays and hashes heart, diagram of, Generating the Heart Sounds Waveform heartbeat example, My Beating Heart, My Beating Heart, My Beating Heart, Homemade Digital Stethoscope, Homemade Digital Stethoscope, Homemade Digital Stethoscope–Extracting Data from Sound, Generating the Heart Sounds Waveform–Generating the Heart Sounds Waveform, Generating the Heart Sounds Waveform, Finding the Heart Rate–Finding the Heart Rate, Homemade Pulse Oximeter–Homemade Pulse Oximeter, Homemade Pulse Oximeter–Extracting Data from Video, Generating the Heartbeat Waveform and Calculating the Heart Rate–Generating the Heartbeat Waveform and Calculating the Heart Rate, Generating the Heartbeat Waveform and Calculating the Heart Rate–Generating the Heartbeat Waveform and Calculating the Heart Rate charts for, Generating the Heart Sounds Waveform–Generating the Heart Sounds Waveform, Generating the Heartbeat Waveform and Calculating the Heart Rate–Generating the Heartbeat Waveform and Calculating the Heart Rate data for, Homemade Digital Stethoscope–Extracting Data from Sound, Homemade Pulse Oximeter–Extracting Data from Video audio from stethoscope, Homemade Digital Stethoscope–Extracting Data from Sound video from pulse oximeter, Homemade Pulse Oximeter–Extracting Data from Video heart rate, My Beating Heart, Finding the Heart Rate–Finding the Heart Rate, Generating the Heartbeat Waveform and Calculating the Heart Rate–Generating the Heartbeat Waveform and Calculating the Heart Rate finding from video file, Generating the Heartbeat Waveform and Calculating the Heart Rate–Generating the Heartbeat Waveform and Calculating the Heart Rate finding from WAV file, Finding the Heart Rate–Finding the Heart Rate health parameters for, My Beating Heart heart sounds, My Beating Heart, My Beating Heart, Homemade Digital Stethoscope, Generating the Heart Sounds Waveform health parameters for, My Beating Heart recording, Homemade Digital Stethoscope types of, My Beating Heart, Generating the Heart Sounds Waveform homemade pulse oximeter for, Homemade Pulse Oximeter–Homemade Pulse Oximeter homemade stethoscope for, Homemade Digital Stethoscope height and weight example, The R Console–Sourcing Files and the Command Line here-documents, Ruby, Strings hex editor, Extracting Data from Sound histograms, Statistical transformation, Geometric object, Money–Money Homebrew tool, Installing Ruby using your platform’s package management tool hyphen (-), Variables and Functions, Variables and Functions -> assignment operator, R, Variables and Functions <- assignment operator, R, Variables and Functions I icons used in this book, Conventions Used in This Book if expression, R, Conditionals and Loops if expression, Ruby, if and unless–if and unless Ihaka, Ross (creator of R), Introducing R ImageMagick library, Extracting Data from Video IMAP (Internet Message Access Protocol), Grab and Parse importing data, R, Importing Data–Importing data from a database inheritance, Ruby, Inheritance–Inheritance initialize method, Ruby, Classes and objects inner product, Roids–Roids installation, Installing Ruby–Installing Ruby using your platform’s package management tool, Installing Shoes–Installing Shoes, Introducing R, Installing packages–Installing packages R, Introducing R R packages, Installing packages–Installing packages Ruby, Installing Ruby–Installing Ruby using your platform’s package management tool Shoes, Installing Shoes–Installing Shoes Internet Message Access Protocol (IMAP), Grab and Parse Internet Message Format, The Emailing Habits of Enron Executives invisible hand metaphor, The Invisible Hand irb application, Running Ruby–Running Ruby J jittering, Adjustments jpeg() function, R, Basic Graphs L Landsburg, Stephen E.

pages: 346 words: 92,984

The Lucky Years: How to Thrive in the Brave New World of Health by David B. Agus

"World Economic Forum" Davos, active transport: walking or cycling, Affordable Care Act / Obamacare, Albert Einstein, Apollo 11, autism spectrum disorder, butterfly effect, clean water, cognitive dissonance, CRISPR, crowdsourcing, Danny Hillis, Drosophila, Edward Jenner, Edward Lorenz: Chaos theory, en.wikipedia.org, epigenetics, fake news, Kickstarter, Larry Ellison, longitudinal study, Marc Benioff, medical residency, meta-analysis, microbiome, microcredit, mouse model, Murray Gell-Mann, Neil Armstrong, New Journalism, nocebo, parabiotic, pattern recognition, personalized medicine, phenotype, placebo effect, publish or perish, randomized controlled trial, risk tolerance, Salesforce, statistical model, stem cell, Steve Jobs, Thomas Malthus, wikimedia commons

In the early 1960s, he noticed that small differences in a dynamic system such as the atmosphere could give rise to vast and often unexpected results. These observations ultimately led him to develop what became known as the butterfly effect, a term that grew out of an academic paper he presented in 1972 entitled “Predictability: Does the Flap of a Butterfly’s Wings in Brazil Set Off a Tornado in Texas?”7 The butterfly effect has significant relevance in all matters of health. We are each agents of change in the Lucky Years; we are each butterflies flapping our wings in a space-time continuum on earth. How we live today affects how we are tomorrow.

…

CLICK HERE TO SIGN UP or visit us online to sign up at eBookNews.SimonandSchuster.com Contents NOTE TO READERS EPIGRAPH LIST OF ILLUSTRATIONS INTRODUCTION DESTINY OF THE SPECIES Welcome to the Lucky Years CHAPTER 1 THE CENTURY OF BIOLOGY The Cure Is Already Inside You CHAPTER 2 THIS ISN’T SCIENCE FICTION The Power of Technology to Extend Your Life CHAPTER 3 THE FUTURE YOU How Your Small Data in the Context of Big Data Will Save You CHAPTER 4 THE DAWN OF PRECISION MEDICINE How to Manage Its Power and Perils CHAPTER 5 TAKE THE TWO-WEEK CHALLENGE How to Measure and Interpret Your Own Data CHAPTER 6 THE DANGER OF MISINFORMATION How to Know Whom and What to Trust CHAPTER 7 A BODY IN MOTION TENDS TO STAY LUCKY The One Supplement You’re Not Getting Enough Of CHAPTER 8 WONDER DRUGS THAT WORK Sleep, Sex, Touching, and Tools to Tame Inflammation CHAPTER 9 THE BUTTERFLY EFFECT Get Ready to Flap Your Wings ACKNOWLEDGMENTS ABOUT THE AUTHOR NOTES INDEX NOTE TO READERS This publication contains the opinions and ideas of its author. It is intended to provide helpful and informative materials on the subjects addressed in the publication. It is sold with the understanding that the author and publisher are not engaged in rendering medical, health, or any other kind of professional services in the book.

…

The Lucky Years are already here. And even though we’re entering a high-tech era of medicine, the same old ancient secrets to a good, long life are still relevant. Nothing will ever be able to substitute for things like sleep, sex, and touch—and perhaps gnawing on the bark of a willow tree. CHAPTER 9 The Butterfly Effect Get Ready to Flap Your Wings All religions, arts, and sciences are branches of the same tree. All these aspirations are directed toward ennobling man’s life, lifting it from the sphere of mere physical existence, and leading the individual toward freedom. —Albert Einstein Medicine is a science of uncertainty and an art of probability.

pages: 414 words: 101,285

The Butterfly Defect: How Globalization Creates Systemic Risks, and What to Do About It by Ian Goldin, Mike Mariathasan

air freight, air traffic controllers' union, Andrei Shleifer, Asian financial crisis, asset-backed security, bank run, barriers to entry, Basel III, Bear Stearns, behavioural economics, Berlin Wall, biodiversity loss, Bretton Woods, BRICs, business cycle, butterfly effect, carbon tax, clean water, collapse of Lehman Brothers, collateralized debt obligation, complexity theory, connected car, credit crunch, Credit Default Swap, credit default swaps / collateralized debt obligations, David Ricardo: comparative advantage, deglobalization, Deng Xiaoping, digital divide, discovery of penicillin, diversification, diversified portfolio, Douglas Engelbart, Douglas Engelbart, Edward Lorenz: Chaos theory, energy security, eurozone crisis, Eyjafjallajökull, failed state, Fairchild Semiconductor, Fellow of the Royal Society, financial deregulation, financial innovation, financial intermediation, fixed income, Gini coefficient, Glass-Steagall Act, global pandemic, global supply chain, global value chain, global village, high-speed rail, income inequality, information asymmetry, Jean Tirole, John Snow's cholera map, Kenneth Rogoff, light touch regulation, Long Term Capital Management, market bubble, mass immigration, megacity, moral hazard, Occupy movement, offshore financial centre, open economy, precautionary principle, profit maximization, purchasing power parity, race to the bottom, RAND corporation, regulatory arbitrage, reshoring, risk free rate, Robert Solow, scientific management, Silicon Valley, six sigma, social contagion, social distancing, Stuxnet, supply-chain management, systems thinking, tail risk, TED Talk, The Great Moderation, too big to fail, Toyota Production System, trade liberalization, Tragedy of the Commons, transaction costs, uranium enrichment, vertical integration

It seeks to overcome the benign neglect of systemic risk, which is not sustainable, and promote a more resilient and inclusive globalization. To this end, it considers different dimensions of the problem, offering a number of conceptual tools and lessons for managing the challenges of globalization and systemic risk. The butterfly effect has become widely known to signify systems in which a small change in one place can lead to major differences in a remote and unconnected system. The name of the effect has origins in the work of Edward Lorenz, who illustrated how a hurricane’s formation may be contingent on whether a distant butterfly had, days or weeks before, flapped its wings.1 The effect was subsequently taken up in chaos theory, which draws on a long tradition of examining the unexpected consequences of changes to initial conditions in physics.

…

The waters devastated the production plants of car manufacturers like Honda, Nissan, and Toyota and halted the operations of computing firms such as Toshiba and Western Digital. The World Economic Forum (WEF) concluded in 2012 that these widespread consequences had occurred because of an “efficient … supply chain which did not leave much room for catastrophic events.”23 The proverb that lends its name to the butterfly effect says that the fluttering of a butterfly’s wings in Brazil can cause a storm in the United States. In this case a storm in Thailand caused the fluttering of shareholders’ balance sheets in California as Intel saw profits fall by over $1 billion in the last quarter of 2011 alone.24 It is worth noting that the systemic effects of the 2011 Thailand floods are by no means unique or unprecedented.

…

With better management there is the potential for all citizens to share in our world’s magnificent achievements, the most impressive of which could be yet to come. Notes PREFACE 1. Edward N. Lorenz, 1963, “Deterministic Nonperiodic Flow,” Journal of the Atmospheric Sciences 20 (2): 130–141. The original metaphor referred to the flapping of a seagull’s wings. The term “butterfly effect” was coined later by a colleague, Phil Merilees, as the title for one of Lorenz’s talks. See Tim Palmer, 2009, “Edward Norton Lorenz, 23 May 1916–16 April 2008,” Biographical Memoirs of Fellows of the Royal Society 55: 139–155, esp. 145 ff. ACKNOWLEDGMENTS 1. Ian Goldin and Tiffany Vogel, 2010, “Global Governance and Systemic Risk in the 21st Century: Lessons from the Financial Crisis,” Global Policy 1 (1): 4–15.

pages: 208 words: 70,860

Paradox: The Nine Greatest Enigmas in Physics by Jim Al-Khalili

Albert Einstein, Albert Michelson, anthropic principle, Arthur Eddington, butterfly effect, clockwork universe, complexity theory, dark matter, Edmond Halley, Edward Lorenz: Chaos theory, Ernest Rutherford, Henri Poincaré, Higgs boson, invention of the telescope, Isaac Newton, Johannes Kepler, Laplace demon, Large Hadron Collider, luminiferous ether, Magellanic Cloud, Olbers’ paradox, Pierre-Simon Laplace, Schrödinger's Cat, Search for Extraterrestrial Intelligence, The Present Situation in Quantum Mechanics, time dilation, Wilhelm Olbers

Poincaré had discovered that the way a system of even just three interacting bodies evolves in time cannot be knowable exactly—let alone one involving all bodies in the solar system (at least, all the planets and their moons, along with the Sun). But the implications of this discovery would have to wait another three-quarters of a century. THE BUTTERFLY EFFECT Let’s give our all-powerful computer the far more modest task of predicting the way the balls on a pool table will scatter when hit by the cue ball at the start of a game. Every ball on the table will be knocked in some way and most will undergo multiple collisions, many bouncing off each other and the sides of the table.

…

This is why it is so difficult to make long-term weather predictions, since we can never know to infinite accuracy all the variables that affect the real weather. It’s just like the pool-table example, only far more complicated. We can now know with reasonable reliability if it will rain in a few days’ time, but we can never know if will rain on this date next year. It was this profound realization that led Lorenz to coin the term “the butterfly effect.” The idea of the flap of a butterfly’s wings having a far-reaching ripple-type effect on subsequent events seems to have first appeared in a short story called “A Sound of Thunder,” written in 1952 by Ray Bradbury. The idea was borrowed by Lorenz, who popularized it as the now familiar notion of the flapping of a butterfly’s wings somewhere leading months later to a hurricane on the other side of the world.

…

That future would be knowable only if we were able to view the whole of space and time from the outside. But for us, and our consciousnesses, embedded within space-time, that future is never knowable to us. It is that very unpredictability that gives us an open future. The choices we make are, to us, real choices, and because of the butterfly effect, tiny changes brought about by our different decisions can lead to very different outcomes, and hence different futures. So, thanks to chaos theory, our future is never knowable to us. You might prefer to say that the future is preordained and that our free will is just an illusion—but the point remains that our actions still determine which of the infinite number of possible futures is the one that gets played out.

pages: 338 words: 104,815

Nobody's Fool: Why We Get Taken in and What We Can Do About It by Daniel Simons, Christopher Chabris

Abraham Wald, Airbnb, artificial general intelligence, Bernie Madoff, bitcoin, Bitcoin "FTX", blockchain, Boston Dynamics, butterfly effect, call centre, Carmen Reinhart, Cass Sunstein, ChatGPT, Checklist Manifesto, choice architecture, computer vision, contact tracing, coronavirus, COVID-19, cryptocurrency, DALL-E, data science, disinformation, Donald Trump, Elon Musk, en.wikipedia.org, fake news, false flag, financial thriller, forensic accounting, framing effect, George Akerlof, global pandemic, index fund, information asymmetry, information security, Internet Archive, Jeffrey Epstein, Jim Simons, John von Neumann, Keith Raniere, Kenneth Rogoff, London Whale, lone genius, longitudinal study, loss aversion, Mark Zuckerberg, meta-analysis, moral panic, multilevel marketing, Nelson Mandela, pattern recognition, Pershing Square Capital Management, pets.com, placebo effect, Ponzi scheme, power law, publication bias, randomized controlled trial, replication crisis, risk tolerance, Robert Shiller, Ronald Reagan, Rubik’s Cube, Sam Bankman-Fried, Satoshi Nakamoto, Saturday Night Live, Sharpe ratio, short selling, side hustle, Silicon Valley, Silicon Valley startup, Skype, smart transportation, sovereign wealth fund, statistical model, stem cell, Steve Jobs, sunk-cost fallacy, survivorship bias, systematic bias, TED Talk, transcontinental railway, WikiLeaks, Y2K

Classification: LCC BF637.D42 S55 2023 | DDC 177/.3—dc23/eng/20230322 LC record available at https://lccn.loc.gov/2022049503 ISBNs: 9781541602236 (hardcover), 9781541602243 (ebook) E3-20230519-JV-NF-ORI CONTENTS Cover Title Page Copyright Introduction PART 1: HABITS Chapter 1: Focus—Think About What’s Missing Chapter 2: Prediction—Expect to Be Surprised Chapter 3: Commitment—Be Careful When You Assume Chapter 4: Efficiency—Ask More Questions PART 2: HOOKS Chapter 5: Consistency—Appreciate the Value of Noise Chapter 6: Familiarity—Discount What You Think You Know Chapter 7: Precision—Take Appropriate Measures Chapter 8: Potency—Be Wary of “Butterfly Effects” Conclusion: Somebody’s Fool Acknowledgments Discover More Notes About the Authors Also by the Authors Praise for Nobody’s Fool Explore book giveaways, sneak peeks, deals, and more. Tap here to learn more. INTRODUCTION “Once in a while, we can all be fooled by something.”

…

In this chapter, we’ve seen how easily we can be hooked by precisely stated claims that aren’t justified—mistaken inferences drawn from erroneous model assumptions, overgeneralization based on small samples, and too-perfect predictions of future events. In the next chapter, we’ll discuss the ways in which we’re hooked by claims of potency—offers in which the benefits or effects are out of proportion to the costs or causes involved. CHAPTER 8 POTENCY—BE WARY OF “BUTTERFLY EFFECTS” According to the popular science cliché, a butterfly flapping its wings in Brazil can cause a tornado in Texas. We find potency unduly persuasive, when in reality, we should be wary whenever anyone claims that a big effect can come from a small cause. In 2021, American social media influencer Caroline Calloway launched her own brand of essential oils with a marketing blitz to her more than 600,000 Instagram followers.

…

The notion that unscrambling sentences for a few minutes unconsciously spread to the general idea of aging and thence to the association between aging and walking speed, thereby causing someone to walk more slowly in a different place some time later, is implausible in light of what we know from decades of rigorous priming research.14 Nonetheless, there was a chance that Bargh had discovered one of those extraordinarily rare butterfly effects. Rather than accept the potency of these metaphorical priming results at face value or dismiss them out of hand, we decided to check for ourselves. We worked with our students to replicate a more recent finding from the Bargh group that followed the same priming logic. That study, published in Science in 2008, tested the idea that experiencing physical warmth would activate the concept of warmth, thereby priming other meanings of warmth, including interpersonal warmth, and leading people to judge other people to be “warmer.”

pages: 360 words: 85,321

The Perfect Bet: How Science and Math Are Taking the Luck Out of Gambling by Adam Kucharski

Ada Lovelace, Albert Einstein, Antoine Gombaud: Chevalier de Méré, beat the dealer, behavioural economics, Benoit Mandelbrot, Bletchley Park, butterfly effect, call centre, Chance favours the prepared mind, Claude Shannon: information theory, collateralized debt obligation, Computing Machinery and Intelligence, correlation does not imply causation, diversification, Edward Lorenz: Chaos theory, Edward Thorp, Everything should be made as simple as possible, Flash crash, Gerolamo Cardano, Henri Poincaré, Hibernia Atlantic: Project Express, if you build it, they will come, invention of the telegraph, Isaac Newton, Johannes Kepler, John Nash: game theory, John von Neumann, locking in a profit, Louis Pasteur, Nash equilibrium, Norbert Wiener, p-value, performance metric, Pierre-Simon Laplace, probability theory / Blaise Pascal / Pierre de Fermat, quantitative trading / quantitative finance, random walk, Richard Feynman, Ronald Reagan, Rubik’s Cube, statistical model, The Design of Experiments, Watson beat the top human players on Jeopardy!, zero-sum game

The problem, which is known as “sensitive dependence on initial conditions,” means that even if we collect detailed measurements about a process—whether a roulette spin or a tropical storm—a small oversight could have dramatic consequences. Seventy years before mathematician Edward Lorenz gave a talk asking “Does the flap of a butterfly’s wings in Brazil set off a tornado in Texas?” Poincaré had outlined the “butterfly effect.” Lorenz’s work, which grew into chaos theory, focused chiefly on prediction. He was motivated by a desire to make better forecasts about the weather and to find a way to see further into the future. Poincaré was interested in the opposite problem: How long does it take for a process to become random?

…

According to Neil Johnson, who led the research, these events are a world away from the kind of situations covered by traditional financial theories. “Humans are unable to participate in real time,” he said, “and instead, an ultrafast ecology of robots rises up to take control.” WHEN PEOPLE TALK ABOUT chaos theory, they often focus on the physics side of things. They might mention Edward Lorenz and his work on forecasting and the butterfly effect: the unpredictability of the weather, and the tornado caused by the flap of an insect’s wings. Or they might recall the story of the Eudaemons and roulette prediction, and how the trajectory of a billiard ball can be sensitive to initial conditions. Yet chaos theory has reached beyond the physical sciences.

…

“Roy Walford, 79; Eccentric UCLA Scientist Touted Food Restriction.” Los Angeles Times, May 1, 2004. http://articles.latimes.com/2004/may/01/local/me-walford1. 7Many have told the tale: Ethier, “Testing for Favorable Numbers.” 7When Wilson published his data: Ethier, “Testing for Favorable Numbers.” 9Poincaré had outlined the “butterfly effect: Gleick, James. Chaos: Making a New Science (New York: Open Road, 2011). 9The Zodiac may be regarded: Poincaré, Science and Method. 10Blaise Pascal invented roulette: Bass, Thomas. The Newtonian Casino (London: Penguin, 1990). 10The orbiting roulette ball: The majority of details and quotes in this section are taken from Thorp, Edward.

pages: 266 words: 86,324

The Drunkard's Walk: How Randomness Rules Our Lives by Leonard Mlodinow

Albert Einstein, Alfred Russel Wallace, Antoine Gombaud: Chevalier de Méré, Atul Gawande, behavioural economics, Brownian motion, butterfly effect, correlation coefficient, Daniel Kahneman / Amos Tversky, data science, Donald Trump, feminist movement, forensic accounting, Gary Kildall, Gerolamo Cardano, Henri Poincaré, index fund, Isaac Newton, law of one price, Monty Hall problem, pattern recognition, Paul Erdős, Pepto Bismol, probability theory / Blaise Pascal / Pierre de Fermat, RAND corporation, random walk, Richard Feynman, Ronald Reagan, Stephen Hawking, Steve Jobs, The Wealth of Nations by Adam Smith, The Wisdom of Crowds, Thomas Bayes, V2 rocket, Watson beat the top human players on Jeopardy!

But actually that does happen—for instance, if the extra time you spent caused you to cross paths with your future wife at the train station or to miss being hit by a car that sped through a red light. In fact, Lorenz’s story is itself an example of the butterfly effect, for if he hadn’t taken the minor decision to extend his calculation employing the shortcut, he would not have discovered the butterfly effect, a discovery which sparked a whole new field of mathematics. When we look back in detail on the major events of our lives, it is not uncommon to be able to identify such seemingly inconsequential random events that led to big changes.

…

After all, the satellites that collect weather data can measure parameters to only two or three decimal places, and so they cannot even track a difference as tiny as that between 0.293416 and 0.293. But Lorenz found that such small differences led to massive changes in the result.2 The phenomenon was dubbed the butterfly effect, based on the implication that atmospheric changes so small they could have been caused by a butterfly flapping its wings can have a large effect on subsequent global weather patterns. That notion might sound absurd—the equivalent of the extra cup of coffee you sip one morning leading to profound changes in your life.

…

In this experiment, as one song or another by chance got an early edge in downloads, its seeming popularity influenced future shoppers. It’s a phenomenon that is well-known in the movie industry: moviegoers will report liking a movie more when they hear beforehand how good it is. In this example, small chance influences created a snowball effect and made a huge difference in the future of the song. Again, it’s the butterfly effect. In our lives, too, we can see through the microscope of close scrutiny that many major events would have turned out differently were it not for the random confluence of minor factors, people we’ve met by chance, job opportunities that randomly came our way. For example, consider the actor who, for seven years starting in the late 1970s, lived in a fifth-floor walk-up on Forty-ninth Street in Manhattan, struggling to make a name for himself.

pages: 226 words: 59,080

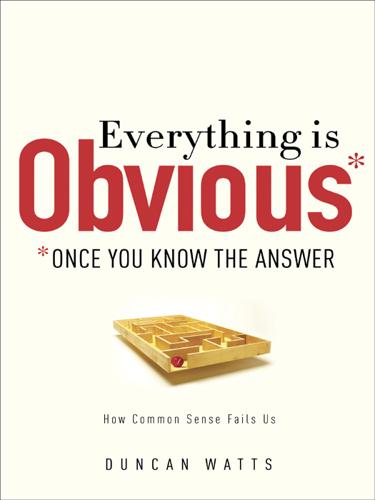

Economics Rules: The Rights and Wrongs of the Dismal Science by Dani Rodrik

airline deregulation, Alan Greenspan, Albert Einstein, bank run, barriers to entry, behavioural economics, Bretton Woods, business cycle, butterfly effect, capital controls, carbon tax, Carmen Reinhart, central bank independence, collective bargaining, congestion pricing, Daniel Kahneman / Amos Tversky, David Ricardo: comparative advantage, distributed generation, Donald Davies, Edward Glaeser, endogenous growth, Eugene Fama: efficient market hypothesis, Everything should be made as simple as possible, Fellow of the Royal Society, financial deregulation, financial innovation, floating exchange rates, fudge factor, full employment, George Akerlof, Gini coefficient, Growth in a Time of Debt, income inequality, inflation targeting, informal economy, information asymmetry, invisible hand, Jean Tirole, Joseph Schumpeter, Kenneth Arrow, Kenneth Rogoff, labor-force participation, liquidity trap, loss aversion, low skilled workers, market design, market fundamentalism, minimum wage unemployment, oil shock, open economy, Pareto efficiency, Paul Samuelson, price elasticity of demand, price stability, prisoner's dilemma, profit maximization, public intellectual, quantitative easing, randomized controlled trial, rent control, rent-seeking, Richard Thaler, risk/return, Robert Shiller, school vouchers, South Sea Bubble, spectrum auction, The Market for Lemons, the scientific method, The Wealth of Nations by Adam Smith, Thomas Kuhn: the structure of scientific revolutions, Thomas Malthus, trade liberalization, trade route, ultimatum game, University of East Anglia, unorthodox policies, Vilfredo Pareto, Washington Consensus, white flight

Interestingly, the immediate example that Watts deploys is the economy: “The U.S. economy, for example, is the product of the individual actions of millions of people, as well as hundreds of thousands of firms, thousands of government agencies, and countless other external and internal factors, ranging from the weather in Texas to interest rates in China.”21 As Watts notes, disturbances in one part of the economy—say, in mortgage finance—can be amplified and produce major shocks for the entire economy, as in the “butterfly effect” from chaos theory. It is interesting that Watts would point to the economy, since efforts to construct large-scale economic models have been singularly unproductive to date. To put it even more strongly, I cannot think of an important economic insight that has come out of such models. In fact, they have often led us astray.

…

., 1n Boulding, Kenneth, 11 bounded rationality, 203 Bowles, Samuel, 71n Brazil: antipoverty programs of, 4 globalization and, 166 Bretton Woods Conference (1944), 1–2 Britain, Great, property rights and, 98 bubbles, 152–58 business cycles, 125–37 balanced budgets and, 171 capital flow in, 127 classical economics and, 126–27, 129, 137 inflation in, 126–27, 133, 135, 137 new classical models and, 130–34, 136–37 butterfly effect, 39 California, University of: at Berkeley, 107, 136, 147 at Los Angeles, 139 Cameron, David, 109 capacity utilization rates, 130 capital, neoclassical distribution theory and, 122, 124 capital flow: in business cycles, 127 economic growth and, 17–18, 114, 164–67 globalization and, 164–67 growth diagnostics and, 90 speculation and, 2 capitalism, 118–24, 127, 144, 205, 207 carbon, emissions quotas vs. taxes in reduction of, 188–90, 191–92 Card, David, 57 Carlyle, Thomas, 118 carpooling, 192, 193–94 cartels, 95 Cartwright, Nancy, 20, 22n, 29 cash grants, 4, 55, 105–6 Cassidy, John, 157n Central Bank of India, 154 Chang, Ha-Joon, 11 chaos theory, butterfly effect and, 39 Chicago, University of, 131, 152 Chicago Board of Trade, 55 Chile, antipoverty programs and, 4 China, People’s Republic of, 156, 163, 164 cigarette industry, taxation and, 27–28 Clark, John Bates, 119 “Classical Gold Standard, The: Some Lessons for Today” (Bordo), 127n classical unemployment, 126 climate change, 188–90, 191–92 climate modeling, 38, 40 Cochrane, John, 131 coffee, 179, 185 Colander, David, 85 collective bargaining, 124–25, 143 Colombia, educational vouchers in, 24 colonialism, developmental economics and, 206–7 “Colonial Origins of Comparative Development, The” (Acemoglu, Robinson, and Johnson), 206–7 Columbia University, 2, 108 commitment, in game theory, 33 comparative advantage, 52–55, 58n, 59–60, 139, 170 compensation for risk models, 110 competition, critical assumptions in, 28–29 complementarities, 42 computable general equilibrium (CGE) models, 41 computational models, 38, 41 computers, model complexity and, 38 Comte, Auguste, 81 conditional cash transfer (CCT) programs, 4, 105–6 congestion pricing, 2–3 Constitution, U.S., 187 construction industry, Great Recession and, 156 consumers, consumption, 119, 129, 130, 132, 136, 167 cross-price elasticity in, 180–81 consumer’s utility, 119 contextual truths, 20, 174 contingency, 25, 145, 173–74, 185 contracts, 88, 98, 161, 205 coordination models, 16–17, 42, 200 corn futures, 55 corruption, 87, 89, 91 costs, behavioral economics and, 70 Cotterman, Nancy, xiv Cournot, Antoine-Augustin, 13n Cournot competition, 68 credibility, in game theory, 33 “Credible Worlds, Capacities and Mechanisms” (Sugden), 172n credit rating agencies, 155 credit rationing, 64–65 critical assumptions, 18, 26–29, 94–98, 150–51, 180, 183–84, 202 cross-price elasticity, 180–81 Cuba, 57 currency: appreciation of, 60, 167 depreciation of, 153 economic growth and, 163–64, 167 current account deficits, 153 Curry, Brendan, xv Dahl, Gordon B., 151n Darwin, Charles, 113 Davis, Donald, 108 day care, 71, 190–91 Debreu, Gerard, 49–51 debt, national, 153 decision trees, 89–90, 90 DeLong, Brad, 136 democracy, social sciences and, 205 deposit insurance, 155 depreciation, currency, 153 Depression, Great, 2, 128, 153 deregulation, 143, 155, 158–59, 162, 168 derivatives, 153, 155 deterrence, in game theory, 33 development economics, 75–76, 86–93, 90, 159–67, 169, 201, 202 colonial settlement and, 206–7 institutions and, 98, 161, 202, 205–7 reform fatigue and, 88 diagnostic analysis, 86–93, 90, 97, 110–11 Dijkgraaf, Robbert, xiv “Dirtying White: Why Does Benn Steil’s History of Bretton Woods Distort the Ideas of Harry Dexter White?”

…

., 1n Boulding, Kenneth, 11 bounded rationality, 203 Bowles, Samuel, 71n Brazil: antipoverty programs of, 4 globalization and, 166 Bretton Woods Conference (1944), 1–2 Britain, Great, property rights and, 98 bubbles, 152–58 business cycles, 125–37 balanced budgets and, 171 capital flow in, 127 classical economics and, 126–27, 129, 137 inflation in, 126–27, 133, 135, 137 new classical models and, 130–34, 136–37 butterfly effect, 39 California, University of: at Berkeley, 107, 136, 147 at Los Angeles, 139 Cameron, David, 109 capacity utilization rates, 130 capital, neoclassical distribution theory and, 122, 124 capital flow: in business cycles, 127 economic growth and, 17–18, 114, 164–67 globalization and, 164–67 growth diagnostics and, 90 speculation and, 2 capitalism, 118–24, 127, 144, 205, 207 carbon, emissions quotas vs. taxes in reduction of, 188–90, 191–92 Card, David, 57 Carlyle, Thomas, 118 carpooling, 192, 193–94 cartels, 95 Cartwright, Nancy, 20, 22n, 29 cash grants, 4, 55, 105–6 Cassidy, John, 157n Central Bank of India, 154 Chang, Ha-Joon, 11 chaos theory, butterfly effect and, 39 Chicago, University of, 131, 152 Chicago Board of Trade, 55 Chile, antipoverty programs and, 4 China, People’s Republic of, 156, 163, 164 cigarette industry, taxation and, 27–28 Clark, John Bates, 119 “Classical Gold Standard, The: Some Lessons for Today” (Bordo), 127n classical unemployment, 126 climate change, 188–90, 191–92 climate modeling, 38, 40 Cochrane, John, 131 coffee, 179, 185 Colander, David, 85 collective bargaining, 124–25, 143 Colombia, educational vouchers in, 24 colonialism, developmental economics and, 206–7 “Colonial Origins of Comparative Development, The” (Acemoglu, Robinson, and Johnson), 206–7 Columbia University, 2, 108 commitment, in game theory, 33 comparative advantage, 52–55, 58n, 59–60, 139, 170 compensation for risk models, 110 competition, critical assumptions in, 28–29 complementarities, 42 computable general equilibrium (CGE) models, 41 computational models, 38, 41 computers, model complexity and, 38 Comte, Auguste, 81 conditional cash transfer (CCT) programs, 4, 105–6 congestion pricing, 2–3 Constitution, U.S., 187 construction industry, Great Recession and, 156 consumers, consumption, 119, 129, 130, 132, 136, 167 cross-price elasticity in, 180–81 consumer’s utility, 119 contextual truths, 20, 174 contingency, 25, 145, 173–74, 185 contracts, 88, 98, 161, 205 coordination models, 16–17, 42, 200 corn futures, 55 corruption, 87, 89, 91 costs, behavioral economics and, 70 Cotterman, Nancy, xiv Cournot, Antoine-Augustin, 13n Cournot competition, 68 credibility, in game theory, 33 “Credible Worlds, Capacities and Mechanisms” (Sugden), 172n credit rating agencies, 155 credit rationing, 64–65 critical assumptions, 18, 26–29, 94–98, 150–51, 180, 183–84, 202 cross-price elasticity, 180–81 Cuba, 57 currency: appreciation of, 60, 167 depreciation of, 153 economic growth and, 163–64, 167 current account deficits, 153 Curry, Brendan, xv Dahl, Gordon B., 151n Darwin, Charles, 113 Davis, Donald, 108 day care, 71, 190–91 Debreu, Gerard, 49–51 debt, national, 153 decision trees, 89–90, 90 DeLong, Brad, 136 democracy, social sciences and, 205 deposit insurance, 155 depreciation, currency, 153 Depression, Great, 2, 128, 153 deregulation, 143, 155, 158–59, 162, 168 derivatives, 153, 155 deterrence, in game theory, 33 development economics, 75–76, 86–93, 90, 159–67, 169, 201, 202 colonial settlement and, 206–7 institutions and, 98, 161, 202, 205–7 reform fatigue and, 88 diagnostic analysis, 86–93, 90, 97, 110–11 Dijkgraaf, Robbert, xiv “Dirtying White: Why Does Benn Steil’s History of Bretton Woods Distort the Ideas of Harry Dexter White?”

pages: 198 words: 57,703

The World According to Physics by Jim Al-Khalili

accounting loophole / creative accounting, Albert Einstein, butterfly effect, clockwork universe, cognitive dissonance, cosmic microwave background, cosmological constant, dark matter, double helix, Ernest Rutherford, fake news, Fellow of the Royal Society, germ theory of disease, gravity well, heat death of the universe, Higgs boson, information security, Internet of things, Isaac Newton, Large Hadron Collider, Murray Gell-Mann, post-truth, power law, publish or perish, quantum entanglement, Richard Feynman, Schrödinger's Cat, Stephen Hawking, supercomputer in your pocket, the scientific method, time dilation

Crucially, this does not mean that such knowledge couldn’t in principle be known—since in a deterministic universe the future is already preordained—it is just that, in practice, we would need to know the current conditions of the Earth’s climate to astonishing accuracy and have stupendous computational power to feed in all the data to make a precise simulation that could then be evolved mathematically to give a reliable prediction. It is this chaotic unpredictability that give rise to the famous ‘butterfly effect’: the idea that the tiny, seemingly inconsequential disturbance of the air caused by the flapping of a butterfly’s wings on one side of the world could gradually develop and grow until it dramatically affected the course of a hurricane on the other side of the world. This does not mean that there is a specific butterfly to which we can trace the cause of a hurricane, but rather that any tiny changes to the initial conditions can give rise to widely varying outcomes if we continue to evolve the system in time.

…

There is another way in which unpredictability and the appearance of randomness come into physics, and that is through the phenomenon of chaotic behaviour. Chaos appears in nature when there is an instability within a system, such that tiny changes to the way the system evolves over time can quickly grow. There’s that butterfly effect again. Sometimes even simple systems following simple, deterministic physical laws can behave in highly unpredictable and complex ways that seem to be truly random. But unlike in the quantum domain, where we don’t know whether unpredictability is due to true indeterminism or not,3 the unpredictability of a chaotic system is not—despite initial appearances—due to true randomness.

…