"there is no alternative" (TINA)

26 results back to index

pages: 286 words: 79,305

99%: Mass Impoverishment and How We Can End It by Mark Thomas

"there is no alternative" (TINA), "World Economic Forum" Davos, 2013 Report for America's Infrastructure - American Society of Civil Engineers - 19 March 2013, additive manufacturing, Alan Greenspan, Albert Einstein, anti-communist, autonomous vehicles, bank run, banks create money, behavioural economics, bitcoin, business cycle, call centre, Cambridge Analytica, central bank independence, circular economy, complexity theory, conceptual framework, creative destruction, credit crunch, CRISPR, declining real wages, distributed ledger, Donald Trump, driverless car, Erik Brynjolfsson, eurozone crisis, fake news, fiat currency, Filter Bubble, full employment, future of work, Gini coefficient, gravity well, income inequality, inflation targeting, Internet of things, invisible hand, ITER tokamak, Jeff Bezos, jimmy wales, job automation, Kickstarter, labour market flexibility, laissez-faire capitalism, Larry Ellison, light touch regulation, Mark Zuckerberg, market clearing, market fundamentalism, Martin Wolf, Modern Monetary Theory, Money creation, money: store of value / unit of account / medium of exchange, Nelson Mandela, Nick Bostrom, North Sea oil, Occupy movement, offshore financial centre, Own Your Own Home, Peter Thiel, Piper Alpha, plutocrats, post-truth, profit maximization, quantitative easing, rent-seeking, Robert Solow, Ronald Reagan, Second Machine Age, self-driving car, Silicon Valley, smart cities, Steve Jobs, The Great Moderation, The Wealth of Nations by Adam Smith, Tyler Cowen, warehouse automation, wealth creators, working-age population

. , 2016 29 Benton, 2016 30 Boczkowski, 2016 31 Carney, Mark, ‘Keeping the patient alive: Monetary policy in a time of great disruption’, World Economic Forum, 6 December 2016 32 Agerholm, 2016 33 BBC, 2016 34 Harris & Eddy, 2016 35 Spiegelhalter, 2016 36 Harris & Eddy, 2016 37 Phys.org 2016 38 Yeats, 1920 39 Suskind, 2004 40 Nyhan & Reifler, 2006 Chapter 9: Myths and Metaphors 1 Popper, 1953 2 OECD, 2019 3 Library of Congress, 2015 4 OECD, 2010 5 Cowen, 2013 6 Blanchard & Leigh, Growth Forecast Errors and Fiscal Multipliers, 2013 7 Batini, Eyraud, & Weber, 2014 8 Cameron, Economy: There is no alternative TINA is back, 2013 9 Bank of England, 2015 10 Sky News, 2009 11 McLeay, Radia, & Thomas, 2014 12 Merkel, 2008 13 Federal Reserve Bank of St Louis, 2019 14 Office for National Statistics, 2016 15 Bennett, 2016 16 Rothwell, 2014 17 Payscale.com 2018 18 Smith, 1776 19 Chang, 2010 20 Hughes, 2017 21 Say, 1821 22 Kumar, 2015 23 Nalebuff & Bradenburger, 1996 24 Edward S.

…

. , 2015 16 Romney, Mitt Romney’s ‘47 Per cent’ Comments, 2012 17 Lansley & Mack, Breadline Britain, 2015 18 Aldrick, 2018 19 See Figure 40 20 See Appendix on website 21 Harrison, 1998 22 McMillan, 2008 23 Wilson & Wilson, 2007 24 McKinsey Global Institute, 2016 25 Islam, 2012 26 Bierce, 1911 Chapter 12: Catch-23 – The Narrative of Unaffordability 1 Heller, 1961 2 Cameron, Economy: There is no alternative TINA is back, 2013 3 Saez & Zucman, 2014 4 IRS, 2015 5 Ferrara, 2014 6 Dynan, Skinner, & Zeldes, 2004 7 UK Debt Bombshell, 2016. 8 Companies House, 2016 9 Office for Budget Responsibility, 2015 10 Chantril, 2015 11 Mason, Rowena, ‘Government raised bar for funding of flood defence schemes’, The Guardian, 11 February 2014 12 Bank of England, 2015 13 Turner, Between Debt and the Devil, 2016 14 Krugman, Be Ready To Mint That Coin, 2013 15 General government gross debt was £1,763.8 billion at the end of the financial year ending March 2018 according to the Office for National Statistics, 2018 16 Stone, 2015 17 Turnbull, 2015 18 Kaufmann, 2015 19 DeLong, 2015 Part 3: Building The Future 1 eupedia, 2016 Chapter 13: 50 Shades of Capitalism 1 Rand, 1946 2 CIA, 2015 3 Wee, 2013 4 IMF, 2015 5 World Happiness Report, 2015 Chapter 14: The Victimless Revolution 1 Kennedy, 1962 2 International Energy Agency, 2015 3 Ashley & Greenemeier, 2013 4 OECD, 2015 5 United Nations Population Division, 2017 6 Congressional Budget Office, 2014 7 Lopez, 2013 8 Dolan, 2013 9 Forbes, 2016 10 O’Brien, 2014 11 Haaretz, 2014 12 Wood, 2011 13 Osnos, Evan, ‘Doomsday Prep for the Super-Rich’, The New Yorker, 22 January 2017 14 Dynan, Skinner, & Zeldes, 2004 Chapter 15: The Abundance Manifesto 1 Statement from Prime Minister Theresa May, 2016 2 Armstrong, 1982 3 Alston, 2018 4 The IPPR Commission on Economic Justice, 2018 5 Mazzucato, 2013 6 Hammond, 2013 7 Treasury, 2013 8 Castella, 2015 9 Pitt, 2008 10 Department for Environment, Food and Rural Affairs, 2015 11 Burn-Callander, 2015 12 American Society of Civil Engineers, 2016 13 Davis, 2016 14 Murphy P. , 2016 15 Burgess, Ford, Guthrie, & Toplensky, 2016 16 IMF, 2008 17 Haldane, 2010 18 Independent Commission on Banking, 2011 19 King, 2016 20 RSA, 2017 21 topendsports.com 2016 22 United Nations, 2017 23 Chantril, 2015 24 Beveridge, 1942 25 Beveridge, 1942 Chapter 16: Your Role in the Change 1 Walker, 2013 2 Bank of England, 2019 3 Alston, 2018 Acknowledgements This book would not exist without data.

Rogue States by Noam Chomsky

"there is no alternative" (TINA), Alan Greenspan, anti-communist, Asian financial crisis, Berlin Wall, Branko Milanovic, Bretton Woods, business cycle, capital controls, classic study, collective bargaining, colonial rule, creative destruction, cuban missile crisis, declining real wages, deskilling, digital capitalism, Edward Snowden, experimental subject, Fall of the Berlin Wall, floating exchange rates, land reform, liberation theology, Mahbub ul Haq, Mikhail Gorbachev, Monroe Doctrine, new economy, Nixon triggered the end of the Bretton Woods system, no-fly zone, oil shock, precautionary principle, public intellectual, RAND corporation, Silicon Valley, strikebreaker, structural adjustment programs, Tobin tax, union organizing, Washington Consensus

The UNCTAD proposals were summarily dismissed by the great powers, along with the call for a “new international order” generally; the US, in particular, insists that “development is not a right,” and that it is “preposterous” and a “dangerous incitement” to hold otherwise in accord with the socioeconomic provisions of the Universal Declaration of Human Rights, which the US rejects.35 The world did move—or more accurately, was moved—towards a new international economic order, but along a different course, catering to the needs of a different sector, namely its designers—hardly a surprise, any more than one should be surprised that in standard doctrine the instituted form of “globalization” should be depicted as an inexorable process to which “there is no alternative” (TINA), as Margaret Thatcher thoughtfully declared. One early UNCTAD proposal was a program for stabilizing commodity prices, routine practice within the industrial countries by means of public subsidy, though it was threatened briefly in the US when Congress was taken over in 1994 by right-wing elements that seemed to believe their own rhetoric, much to the consternation of business leaders who understand that market discipline is for the defenseless, not for them.

…

The conference took special note of what it called the residual “culture of terror,” which lasts after the actual terror declines and has the effect of “domesticating the expectations of the majority,” who abandon any thought of “alternatives different to the demands of the powerful.” They’ve learned the lesson that There Is No Alternative—TINA, as it’s called—Maggie Thatcher’s cruel phrase. The idea is that there is no alternative—that’s now the familiar slogan of the corporate version of globalization. In the dependencies, the great achievement of the terrorist operations has been to destroy the hopes that had been raised in Latin America and Central America in the 1970s, inspired by popular organizing throughout the region and the “preferential option for the poor” of the Church, which was severely punished for that deviation from good behavior.

pages: 576 words: 105,655

Austerity: The History of a Dangerous Idea by Mark Blyth

"there is no alternative" (TINA), accounting loophole / creative accounting, Alan Greenspan, balance sheet recession, bank run, banking crisis, Bear Stearns, Black Swan, book value, Bretton Woods, business cycle, buy and hold, capital controls, Carmen Reinhart, Celtic Tiger, central bank independence, centre right, collateralized debt obligation, correlation does not imply causation, creative destruction, credit crunch, Credit Default Swap, credit default swaps / collateralized debt obligations, currency peg, debt deflation, deindustrialization, disintermediation, diversification, en.wikipedia.org, ending welfare as we know it, Eugene Fama: efficient market hypothesis, eurozone crisis, financial engineering, financial repression, fixed income, floating exchange rates, Fractional reserve banking, full employment, German hyperinflation, Gini coefficient, global reserve currency, Greenspan put, Growth in a Time of Debt, high-speed rail, Hyman Minsky, income inequality, information asymmetry, interest rate swap, invisible hand, Irish property bubble, Joseph Schumpeter, Kenneth Rogoff, liberal capitalism, liquidationism / Banker’s doctrine / the Treasury view, Long Term Capital Management, low interest rates, market bubble, market clearing, Martin Wolf, Minsky moment, money market fund, moral hazard, mortgage debt, mortgage tax deduction, Occupy movement, offshore financial centre, paradox of thrift, Philip Mirowski, Phillips curve, Post-Keynesian economics, price stability, quantitative easing, rent-seeking, reserve currency, road to serfdom, Robert Solow, savings glut, short selling, structural adjustment programs, tail risk, The Great Moderation, The Myth of the Rational Market, The Wealth of Nations by Adam Smith, Tobin tax, too big to fail, Two Sigma, unorthodox policies, value at risk, Washington Consensus, zero-sum game

Why, then, does the idea continue to “dominate the economic thought, both practical and theoretical, of the governing and academic classes of this generation, as it has for a hundred years past” as John Maynard Keynes put in 1936?1 After all, it has been eighty years since Keynes wrote that line, and austerity’s luster has yet to fade. Two answers present themselves to us. The first is a variant of the line popularized by Mrs. Thatcher—“there is no alternative” (TINA). In light of the previous chapter, you might have the impression that this is exactly the case being made in this book. After all, it seems that when you have built a banking system that is too big to bail, and you have thrown away all your other policy tools (control of interest rates, exchange rates, etc.) in a fit of “Europeanness,” there may not be much alternative to austerity, at least in Europe.

…

One year later, in April 2010, Alesina presented a simplified version of this paper at the ECOFIN meeting in Madrid. He began by noting that, unlike previous high-debt occasions, such as the aftermath of World War II, growth is not going to make the Eurozone’s pile of debt disappear. Rather, there is no alternative (TINA) to fiscal adjustment. Happily, “many even sharp reductions of budget deficits have been accompanied and immediately followed by sustained growth rather than recessions even in the very short run,” so long as the policy has been credible, which means decisive and large.149 Once again, expectations of a better future create a better present while falling bond yields create more wealth, again due to expectations effects.150 In terms of actual policy, taxes should not be raised and entitlements should be cut.151 This much is drawn from the previous paper.

pages: 515 words: 142,354

The Euro: How a Common Currency Threatens the Future of Europe by Joseph E. Stiglitz, Alex Hyde-White

"there is no alternative" (TINA), "World Economic Forum" Davos, Alan Greenspan, bank run, banking crisis, barriers to entry, battle of ideas, behavioural economics, Berlin Wall, Bretton Woods, business cycle, buy and hold, capital controls, carbon tax, Carmen Reinhart, cashless society, central bank independence, centre right, cognitive dissonance, collapse of Lehman Brothers, collective bargaining, corporate governance, correlation does not imply causation, credit crunch, Credit Default Swap, currency peg, dark matter, David Ricardo: comparative advantage, disintermediation, diversified portfolio, eurozone crisis, Fall of the Berlin Wall, fiat currency, financial innovation, full employment, George Akerlof, Gini coefficient, global supply chain, Great Leap Forward, Growth in a Time of Debt, housing crisis, income inequality, incomplete markets, inflation targeting, information asymmetry, investor state dispute settlement, invisible hand, Kenneth Arrow, Kenneth Rogoff, knowledge economy, light touch regulation, low interest rates, manufacturing employment, market bubble, market friction, market fundamentalism, Martin Wolf, Mexican peso crisis / tequila crisis, money market fund, moral hazard, mortgage debt, neoliberal agenda, new economy, open economy, paradox of thrift, pension reform, pensions crisis, price stability, profit maximization, purchasing power parity, quantitative easing, race to the bottom, risk-adjusted returns, Robert Shiller, Ronald Reagan, Savings and loan crisis, savings glut, secular stagnation, Silicon Valley, sovereign wealth fund, the payments system, The Rise and Fall of American Growth, The Wealth of Nations by Adam Smith, too big to fail, transaction costs, transfer pricing, trickle-down economics, Washington Consensus, working-age population

The euro was supposed to “serve” the European people; now they are asked to accept lower wages, higher taxes, and lower social benefits, in order to save the euro. And it is not just Europe’s economy that is being sacrificed but, in many ways, confidence in its democracy. The Germans and other leaders in the eurozone have put forward the idea that “there is no alternative” (TINA) to their draconian policies. I have explained how there are—alternatives that would even make the creditors better off. In this concluding chapter, I want to address three questions: Where is the eurozone likely to go? Why is it taking the course that it is—is there something else beneath the surface that is playing out?

…

., 393 in US, 35, 36, 88, 89–92 see also euro single-market principle, 125–26, 231 skilled workers, 134–35 skills, 77 Slovakia, 331 Slovenia, 331 small and medium-sized enterprises (SMEs), 127, 138, 171, 229 small and medium-size lending facility, 246–47, 300, 301, 382 Small Business Administration, 246 small businesses, 153 Smith, Adam, xviii, 24, 39–40, 41 social cohesion, 22 Social Democratic Party, Portugal, 392 social program, 196 Social Security, 90, 91 social solidarity, xix societal capital, 77–78 solar energy, 193, 229 solidarity fund, 373 solidarity fund for stabilization, 244, 254, 264, 301 Soros, George, 390 South Dakota, 90, 346 South Korea, 55 bailout of, 113 sovereign risk, 14, 353 sovereign spreads, 200 sovereign wealth funds, 258 Soviet Union, 10 Spain, 14, 16, 114, 177, 178, 278, 331, 335, 343 austerity opposed by, 59, 207–8, 315 bank bailout of, 179, 199–200, 206 banks in, 23, 186, 199, 200, 242, 270, 354 debt of, 196 debt-to-GDP ratio of, 231 deficits of, 109 economic growth in, 215, 231, 247 gold supply in, 277 independence movement in, xi inequality in, 72, 212, 225–26 inherited debt in, 134 labor reforms proposed for, 155 loans in, 127 low debt in, 87 poverty in, 261 real estate bubble in, 25, 108, 109, 114–15, 126, 198, 301, 302 regional independence demanded in, 307 renewable energy in, 229 sovereign spread of, 200 spread in, 332 structural reform in, 70 surplus in, 17, 88 threat of breakup of, 270 trade deficits in, 81, 119 unemployment in, 63, 161, 231, 235, 332, 338 Spanish bonds, 114, 199, 200 spending, cutting, 196–98 spread, 332 stability, 147, 172, 261, 301, 364 automatic, 244 bubble and, 264 central banks and, 8 as collective action problem, 246 solidarity fund for, 54, 244, 264 Stability and Growth Pact, 245 standard models, 211–13 state development banks, 138 steel companies, 55 stock market, 151 stock market bubble, 200–201 stock market crash (1929), 18, 95 stock options, 259, 359 structural deficit, 245 Structural Funds, 243 structural impediments, 215 structural realignment, 252–56 structural reforms, 9, 18, 19–20, 26–27, 214–36, 239–71, 307 from austerity to growth, 263–65 banking union, 241–44 and climate change, 229–30 common framework for stability, 244–52 counterproductive, 222–23 debt restructuring and, 265–67 of finance, 228–29 full employment and growth, 256–57 in Greece, 20, 70, 188, 191, 214–36 growth and, 232–35 shared prosperity and, 260–61 and structural realignment, 252–56 of trade deficits, 216–17 trauma of, 224 as trivial, 214–15, 217–20, 233 subsidiarity, 8, 41–42, 263 subsidies: agricultural, 45, 197 energy, 197 sudden stops, 111 Suharto, 314 suicide, 82, 344 Supplemental Nutrition Assistance Program (SNAP), 91 supply-side effects: in Greece, 191, 215–16 of investments, 367 surpluses, fiscal, 17, 96, 312, 379 primary, 187–88 surpluses, trade, see trade surpluses “Swabian housewife,” 186, 245 Sweden, 12, 46, 307, 313, 331, 335, 339 euro referendum of, 58 refugees into, 320 Switzerland, 44, 307 Syria, 321, 342 Syriza party, 309, 311, 312–13, 315, 377 Taiwan, 55 tariffs, 40 tax avoiders, 74, 142–43, 227–28, 261 taxes, 142, 290, 315 in Canada, 191 on capital, 356 on carbon, 230, 260, 265, 368 consumption, 193–94 corporate, 189–90, 227, 251 cross-border, 319, 384 and distortions, 191 in EU, 8, 261 and fiat currency, 284 and free mobility of goods and capital, 260–61 in Greece, 16, 142, 192, 193–94, 227, 367–68 ideal system for, 191 IMF’s warning about high, 190 income, 45 increase in, 190–94 inequality and, 191 inheritance, 368 land, 191 on luxury cars, 265 progressive, 248 property, 192–93, 227 Reagan cuts to, 168, 210 shipping, 227, 228 as stimulative, 368 on trade surpluses, 254 value-added, 190, 192 tax evasion, in Greece, 190–91 tax laws, 75 tax revenue, 190–96 Taylor, John, 169 Taylor rule, 169 tech bubble, 250 technology, 137, 138–39, 186, 211, 217, 251, 258, 265, 300 and new financial system, 274–76, 283–84 telecoms, 55 Telmex, 369 terrorism, 319 Thailand, 113 theory of the second best, 27–28, 48 “there is no alternative” (TINA), 306, 311–12 Tocqueville, Alexis de, xiii too-big-to-fail banks, 360 tourism, 192, 286 trade: and contractionary expansion, 209 US push for, 323 trade agreements, xiv–xvi, 357 trade balance, 81, 93, 100, 109 as allegedly self-correcting, 98–99, 101–3 and wage flexibility, 104–5 trade barriers, 40 trade deficits, 89, 139 aggregate demand weakened by, 111 chit solution to, 287–88, 290, 299–300, 387, 388–89 control of, 109–10, 122 with currency pegs, 110 and fixed exchange rates, 107–8, 118 and government spending, 107–8, 108 of Greece, 81, 194, 215–16, 222, 285–86 structural reform of, 216–17 traded goods, 102, 103, 216 trade integration, 393 trade surpluses, 88, 118–21, 139–40, 350–52 discouragement of, 282–84, 299–300 of Germany, 118–19, 120, 139, 253, 293, 299, 350–52, 381–82, 391 tax on, 254, 351, 381–82 Transatlantic Trade and Investment Partnership, xv, 323 transfer price system, 376 Trans-Pacific Partnership, xv, 323 Treasury bills, US, 204 Trichet, Jean-Claude, 100–101, 155, 156, 164–65, 251 trickle-down economics, 362 Troika, 19, 20, 26, 55, 56, 58, 60, 69, 99, 101–3, 117, 119, 135, 140–42, 178, 179, 184, 195, 274, 294, 317, 362, 370–71, 373, 376, 377, 386 banks weakened by, 229 conditions of, 201 discretion of, 262 failure to learn, 312 Greek incomes lowered by, 80 Greek loan set up by, 202 inequality created by, 225–26 poor forecasting of, 307 predictions by, 249 primary surpluses and, 187–88 privatization avoided by, 194 programs of, 17–18, 21, 155–57, 179–80, 181, 182–83, 184–85, 187–93, 196, 197–98, 202, 204, 205, 207, 208, 214–16, 217, 218–23, 225–28, 229, 231, 233–34, 273, 278, 308, 309–11, 312, 313, 314, 315–16, 323–24, 348, 366, 379, 392 social contract torn up by, 78 structural reforms imposed by, 214–16, 217, 218–23, 225–38 tax demand of, 192 and tax evasion, 367 see also European Central Bank (ECB); European Commission; International Monetary Fund (IMF) trust, xix, 280 Tsipras, Alexis, 61–62, 221, 273, 314 Turkey, 321 UBS, 355 Ukraine, 36 unemployment, 3, 64, 68, 71–72, 110, 111, 122, 323, 336, 342 as allegedly self-correcting, 98–101 in Argentina, 267 austerity and, 209 central banks and, 8, 94, 97, 106, 147 ECB and, 163 in eurozone, 71, 135, 163, 177–78, 181, 331 and financing investments, 186 in Finland, 296 and future income, 77 in Greece, xi, 71, 236, 267, 331, 338, 342 increased by capital, 264 interest rates and, 43–44 and internal devaluation, 98–101, 104–6 migration and, 69, 90, 135, 140 natural rate of, 172–73 present-day, in Europe, 210 and rise of Hitler, 338, 358 and single currency, 88 in Spain, 63, 161, 231, 235, 332, 338 and structural reforms, 19 and trade deficits, 108 in US, 3 youth, 3, 64, 71 unemployment insurance, 91, 186, 246, 247–48 UNICEF, 72–73 unions, 101, 254, 335 United Kingdom, 14, 44, 46, 131, 307, 331, 332, 340 colonies of, 36 debt of, 202 inflation target set in, 157 in Iraq War, 37 light regulations in, 131 proposed exit from EU by, 4, 270 United Nations, 337, 350, 384–85 creation of, 38 and lower rates of war, 196 United States: banking system in, 91 budget of, 8, 45 and Canada’s 1990 expansion, 209 Canada’s free trade with, 45–46, 47 central bank governance in, 161 debt-to-GDP of, 202, 210–11 financial crisis originating in, 65, 68, 79–80, 128, 296, 302 financial system in, 228 founding of, 319 GDP of, xiii Germany’s borrowing from, 187 growing working-age population of, 70 growth in, 68 housing bubble in, 108 immigration into, 320 migration in, 90, 136, 346 monetary policy in financial crisis of, 151 in NAFTA, xiv 1980–1981 recessions in, 76 predatory lending in, 310 productivity in, 71 recovery of, xiii, 12 rising inequality in, xvii, 333 shareholder capitalism of, 21 Small Business Administration in, 246 structural reforms needed in, 20 surpluses in, 96, 187 trade agenda of, 323 unemployment in, 3, 178 united currency in, 35, 36, 88, 89–92 United States bonds, 350 unskilled workers, 134–35 value-added tax, 190, 192 values, 57–58 Varoufakis, Yanis, 61, 221, 309 velocity of circulation, 167 Venezuela, 371 Versaille, Treaty of, 187 victim blaming, 9, 15–17, 177–78, 309–11 volatility: and capital market integration, 28 in exchange rates, 48–49 Volcker, Paul, 157, 168 wage adjustments, 100–101, 103, 104–5, 155, 216–17, 220–22, 338, 361 wages, 19, 348 expansionary policies on, 284–85 Germany’s constraining of, 41, 42–43 lowered in Germany, 105, 333 wage stagnation, in Germany, 13 war, change in attitude to, 38, 196 Washington Consensus, xvi Washington Mutual, 91 wealth, divergence in, 139–40 Weil, Jonathan, 360 welfare, 196 West Germany, 6 Whitney, Meredith, 360 wind energy, 193, 229 Wolf, Martin, 385 worker protection, 56 workers’ bargaining rights, 19, 221, 255 World Bank, xv, xvii, 10, 61, 337, 357, 371 World Trade Organization, xiv youth: future of, xx–xxi unemployment of, 3, 64, 71 Zapatero, José Luis Rodríguez, xiv, 155, 362 zero lower bound, 106 ALSO BY JOSEPH E.

pages: 662 words: 180,546

Never Let a Serious Crisis Go to Waste: How Neoliberalism Survived the Financial Meltdown by Philip Mirowski

"there is no alternative" (TINA), Adam Curtis, Alan Greenspan, Alvin Roth, An Inconvenient Truth, Andrei Shleifer, asset-backed security, bank run, barriers to entry, Basel III, Bear Stearns, behavioural economics, Berlin Wall, Bernie Madoff, Bernie Sanders, Black Swan, blue-collar work, bond market vigilante , bread and circuses, Bretton Woods, Brownian motion, business cycle, capital controls, carbon credits, Carmen Reinhart, Cass Sunstein, central bank independence, cognitive dissonance, collapse of Lehman Brothers, collateralized debt obligation, complexity theory, constrained optimization, creative destruction, credit crunch, Credit Default Swap, credit default swaps / collateralized debt obligations, crony capitalism, dark matter, David Brooks, David Graeber, debt deflation, deindustrialization, democratizing finance, disinformation, do-ocracy, Edward Glaeser, Eugene Fama: efficient market hypothesis, experimental economics, facts on the ground, Fall of the Berlin Wall, financial deregulation, financial engineering, financial innovation, Flash crash, full employment, George Akerlof, Glass-Steagall Act, Goldman Sachs: Vampire Squid, Greenspan put, Hernando de Soto, housing crisis, Hyman Minsky, illegal immigration, income inequality, incomplete markets, information asymmetry, invisible hand, Jean Tirole, joint-stock company, junk bonds, Kenneth Arrow, Kenneth Rogoff, Kickstarter, knowledge economy, l'esprit de l'escalier, labor-force participation, liberal capitalism, liquidity trap, loose coupling, manufacturing employment, market clearing, market design, market fundamentalism, Martin Wolf, money market fund, Mont Pelerin Society, moral hazard, mortgage debt, Naomi Klein, Nash equilibrium, night-watchman state, Northern Rock, Occupy movement, offshore financial centre, oil shock, Pareto efficiency, Paul Samuelson, payday loans, Philip Mirowski, Phillips curve, Ponzi scheme, Post-Keynesian economics, precariat, prediction markets, price mechanism, profit motive, public intellectual, quantitative easing, race to the bottom, random walk, rent-seeking, Richard Thaler, road to serfdom, Robert Shiller, Robert Solow, Ronald Coase, Ronald Reagan, Savings and loan crisis, savings glut, school choice, sealed-bid auction, search costs, Silicon Valley, South Sea Bubble, Steven Levy, subprime mortgage crisis, tail risk, technoutopianism, The Chicago School, The Great Moderation, the map is not the territory, The Myth of the Rational Market, the scientific method, The Theory of the Leisure Class by Thorstein Veblen, The Wisdom of Crowds, theory of mind, Thomas Kuhn: the structure of scientific revolutions, Thorstein Veblen, Tobin tax, tontine, too big to fail, transaction costs, Tyler Cowen, vertical integration, Vilfredo Pareto, War on Poverty, Washington Consensus, We are the 99%, working poor

The reason this may be significant for a larger audience outside of the cognoscenti of the economics profession is that, after the crash, very few economists have been willing to seriously entertain and evaluate the prospect that the dominant macroeconomic theory helped cause the crisis, by masking the buildup of instabilities before the crisis, and frustrating repair activity afterward.3 This underappreciated phenomenon has been then further confounded when journalists have been prompted to repeat a fair number of fallacies about the current state of economics, under the tutelage of a select coterie of informants. The shape of things is rarely as solid as they have been there portrayed, and this, too, has direct bearing upon the Nine Lives of Neoliberalism. The mantra that “There Is No Alternative” (colloquially, TINA) has been a very powerful incantation in the neoliberal rucksack; as we have already suggested in chapter 2, the role of ignorance looms quite large in formal neoliberal theory. Although there exist an infinite number of potential ways to revise and repair neoclassical economics (since there are an uncountable infinity of flaws), what has been striking about the crisis is the relatively small number of such revisions that have dominated the discourse concerning “what is to be done” about economics (outside of stubborn denial).

…

Tea Party about aspects of Ayn Rand and Cochrane on demonstrators as example of metamorphosis of protest movement influence of jump-start of Koch-funded front organizations and left on origins of on Paul Revere Purity of Populist Expression Tea Party Express Team Greed Team Regulation Tellmann, Ute Ten Commandments of Neoclassicism Thaler, Richard Thatcher, Margaret The Theatre and Its Double (Artaud) Theory of the Leisure Class (Veblen) There Is No Alternative (TINA) Thirteen Commandments Thirteenth Amendment This Time Is Different (Rogoff and Reinhart) Thoma, Mark Thomas, Bill Thurn, Max The Time Machine (Wells) TINA (There Is No Alternative) Tkacik, Maureen Tobin, James Tobin tax “Too Big to Bail” (Ferguson and Johnson) Toxic assets TransUnion Treasury Department about Ausubel on on Bear Stearns “Break the Glass” memo on Inside Job Paulson on pressure from public defense of Rajan on revolving door between Goldman Sachs and Rubin leaves Trichet, Jean-Claude Trier, Lars von Troubled Asset Relief Program.

pages: 586 words: 160,321

The Euro and the Battle of Ideas by Markus K. Brunnermeier, Harold James, Jean-Pierre Landau

"there is no alternative" (TINA), Affordable Care Act / Obamacare, Alan Greenspan, asset-backed security, bank run, banking crisis, battle of ideas, Bear Stearns, Ben Bernanke: helicopter money, Berlin Wall, Bretton Woods, Brexit referendum, business cycle, capital controls, Capital in the Twenty-First Century by Thomas Piketty, Celtic Tiger, central bank independence, centre right, collapse of Lehman Brothers, collective bargaining, credit crunch, Credit Default Swap, cross-border payments, currency peg, currency risk, debt deflation, Deng Xiaoping, different worldview, diversification, Donald Trump, Edward Snowden, en.wikipedia.org, Fall of the Berlin Wall, financial deregulation, financial repression, fixed income, Flash crash, floating exchange rates, full employment, Future Shock, German hyperinflation, global reserve currency, income inequality, inflation targeting, information asymmetry, Irish property bubble, Jean Tirole, Kenneth Rogoff, Les Trente Glorieuses, low interest rates, Martin Wolf, mittelstand, Money creation, money market fund, Mont Pelerin Society, moral hazard, negative equity, Neil Kinnock, new economy, Northern Rock, obamacare, offshore financial centre, open economy, paradox of thrift, pension reform, Phillips curve, Post-Keynesian economics, price stability, principal–agent problem, quantitative easing, race to the bottom, random walk, regulatory arbitrage, rent-seeking, reserve currency, risk free rate, road to serfdom, secular stagnation, short selling, Silicon Valley, South China Sea, special drawing rights, tail risk, the payments system, too big to fail, Tyler Cowen, union organizing, unorthodox policies, Washington Consensus, WikiLeaks, yield curve

Interestingly, Bismarck had similar problems with certain fiscally irresponsible states (Fürstentümer) within a loose confederation (North German Bund) prior to the foundation of German Empire in 1871.17 The French and Italian approach was to push ahead with the monetary union and hope that the missing elements would fall into place in due time. Crises might erupt, but they might be useful to follow through with the next steps at a time when “there is no alternative” (TINA principle). Such a fait accompli strategy was part of the European integration process from the beginning, but it also estranged the project from the general public. In a similar spirit, the introduction of joint liability through Eurobonds might resolve the current crisis, but the moral hazard implication would lead to further crises in the future—which would hopefully enforce through the TINA principle further integration rather than mutual resentment.

…

., 142 Rathenau, Walter, 59–60 recapitalization, 203–4; of banks, 357; direct, 195–97 recessions, 143 Rechtsstaat (rule of law), 57–58 redemption pact, 112–13 redenomination risks, 226–27 refinancing, 321, 344 refugee crisis, 39–40, 378, 379, 381–82 Regling, Klaus, 24, 128, 146 Rehn, Olli, 306–7 Reichsbank Law (1924; Germany), 344 renminbi (Chinese currency), 281–82 Renzi, Matteo, 8, 36, 248 repo rate, 164 repos (sale and repurchase agreements), 164, 321; ELAs as, 322 reputation, in monetary policy, 91–93 reversal rate, 190–91 ring-fencng of assets, 213–14 risk-bearing capital, 204–6 Ritschl, Albrecht, 62–63 Rocard, Michel, 47 Rodrik, Dani, 375 Ronaldo, Cristiano, 192 Roncaglia, Alessandro, 238 Roosevelt, Franklin Delano, 102, 177 Röpke, Wilhelm, 60, 61, 65 Rostand, Edmond, 71 Rostowski, Jacek, 263 Rougier, Louis, 65 Roumeliotis, Panagotis, 303 Rueff, Jacques, 55, 67–68, 71, 72, 77 ruler model, 143 Russia, 283–86; Crimea annexed by, 36, 381; debts of, 295 Rüstow, Alexander, 65 Sachs, Jeffrey, 250, 266 safe assets, 182–83, 222–26 sale and repurchase agreements (repos), 164, 321 Samaras, Antonis, 230, 231 Santo e Silva, José Maria do Espírito, 201 Sapin, Michel, 39, 163, 233 Sapir, Jacques, 73 Saraceno, Pasquale, 238 Sargent, Thomas, 110, 252 Sarkozy, Nicolas, 1, 87; on Berlusconi, 246; Cameron and, 272; economic philosophy of, 73; on EFSF, 128–29; in election of 2012, 33–34; after flash crash, 25; on Greek debt restructuring, 119, 121, 307; on IMF, 297; meets with Berlusconi, 336; Merkel and, 28, 328–30; on Schuldenbremse, 149–50; Strauss-Kahn nominated as IMF director by, 22, 295–96; on Weber, 347–48 Sauvy, Alfred, 67 savings banks (Sparkassen), 160 Say, Jean-Baptiste, 6, 57, 69–70 Say’s Law, 69 Sberbank Europe AG, 283–84 Scandinavian Currency Union, 252 Schäuble, Wolfgang, 7; asssassination attempt against, 25; on Cyprus, 200, 341; in debate with Summers, 147; on deposit insurance, 221; Draghi and, 354; European Monetary Fund proposed by, 20, 297; on exiting from euro area, 228; Gaithner and, 263; on Greece, 232, 264–66; IMF and, 24; Outright Monetary Transactions supported by, 123; on saving eurp, 5; Varoufakis and, 231 Schengen agreement, 249 Schlesinger, Helmut, 325 Schmidt, Christoph, 64 Schmidt, Helmut, 48 Schmoller, Gustav, 58 Schröder, Gerhard, 146, 285 Schuldenbremse, 150 Schulz, Martin, 37 Scotland, 278 Scottish National Party (SNP), 278 secular stagnation, 143 Securities Markets Program (SMP), 335, 345–49 Seehofer, Horst, 63 Sen, Amartya, 73 Shafik, Nemat, 304 Shakespeare, William, 267, 383 short-term funding, 169–70 Sicily (Italy), 241 Siemens (firm), 49 Sikorski, Radek, 285 Single Bank Resolution Fund, 220, 221 Single European Act (1986), 22–23, 81 Single Resolution Mechanism, 220–21 Single Supervisory Mechanism (SSM), 371–72 Sinn, Hans-Werner, 63, 228, 266, 325, 359 Sinn Fein (Irish party), 232 Slovakia, 130 small and medium enterprises (SMEs), 49 Smith, Adam, 57 Smithianismus, 58 Snowden, Edward, 269 Socialist Party (France), 35, 37, 46 Social Security Act (US; 1935), 102 Société Générale (French bank), 159, 166 Sohmen, Egon, 55 solidarity, 380 solvency, 116, 118–19; liquidity versus, 125–28, 215, 380 Sombart, Werner, 58 Sorel, Albert, 43–44 Soros, George, 81–82, 163, 265, 267 sovereign debt, 89; foreign owned, 214; IMF on, 291–95; liquidity risk and, 332–33; restructuring of, 126–27 Sovereign Debt Reduction Mechanism (SDRM), 294 Soviet Union, 47 Spain: bank mergers in, 174; capital flows to, 167–68; diabolic loop in, 183; direct recapitalization of banks in, 196–97; ECB and, 94, 336; economic stimulus in, 148; ESM and, 353; euro crisis in, 31, 32; European Parliament elections in, 36; GDP boost in, 118; during global financial crisis, 261–62; IMF and, 310; inflation rate in, 178; national debt of, 121, 127–28; under Philip II, 96; Podemos in, 232; sovereign debt of, 224; zombie banks in, 189 special drawing rights (SDRs), 132–33, 281, 292; IMF and, 307–9 special purpose vehicle (SPV), 25 Spielberg, Steven, 45 spillover risk, 180–82 Spitzenkandidaten, 376 Sraffa, Piero, 11, 238 Staatswissenschaft, 57 Stability and Growth Pact (SGP), 28–29, 86, 92, 99; German attempts to repair, 148–50; negotiations leading to, 135–36; rules of, 146 Stark, Jürgen, 87, 135, 301, 350 Steinbrück, Peer, 163 Steinnson, Jon, 142 Stiglitz, Joseph, 73, 250 stimulus, debate over austerity versus, 148–54 Strauss-Kahn, Dominique, 73; arrest and resignation of, 304–5; during Greek crises, 298; as IMF managing director, 22, 260, 288, 295–96, 307; in troika, 301, 303, 304 stress tests for banks, 217, 254–55 structural conditionality, 301 subsidiary sovereign debts, 121 Süddeutsche Zeitung (newspaper), 64 Suharto, 293 Summers, Lawrence, 143, 144, 147, 151 Svensson, Lars, 53 Sweden, 381 Syrian refugee crisis, 39–40, 285–86, 382 Syriza party (Greece), 38, 152–53, 231, 232, 342 systemic risk, 180–82, 388 Szász, André, 85 tail risk, 389–90 TARGET2, 226–27, 302, 307, 323–25; Greece and, 343 targeted longer-term refinancing operations (TLTROs), 352, 360, 366 taxes: on Cypriot bank deposits, 199; in Cyprus, 340; financial transactions taxes, 205; in Ireland, 338 Taylor, John, 311 technological liquidity, 161 temporary monopoly rents, 203–4 terrorism, 36, 382 Tesobono crisis (Mexico), 292 Thatcher, Margaret, 92, 273; on single European market, 274; TINA (There Is No Alternative) principle of, 145 Thorning-Schmidt, Helle, 272 Tietmeyer, Hans, 132, 212, 316, 369 time-inconsistency problem, 87–88 TINA (There Is No Alternative) principle, 145 Tirole, Jean, 72 Tobin, James, 188 Tocqueville, Alexis de, 42, 43 Tomasi di Lampedusa, Giuseppe, 242 transfer unions, 106–11 Treaty on the Functioning of the European Union, 27, 220, 316 Tremonti, Giulio, 335 Trichet, Jean-Claude, 94; on Deauville agreement, 30; as ECB president, 316–18; on ECB’s price stability mandate, 320; on European Union, 374; Greek debt and, 304; on IMF, 23, 327–28; on Ireland, 338, 339; on Italy, 246; on private sector involvement, 329–31; on purchasing government bonds, 345; replaced by Draghi, 349–50; on unity of euro areas, 170 trilemma of international macroeconomics, 75–76 troika (European Commission, IMF, and ECB; the institutions), 25, 328; Greek adjustment program and, 334; IMF in, 300–304 Trump, Donald, 256 Tsipras, Alexis: at Brussels meeting, 266; elected prime minister of Greece, 342; in Greek election of 2014, 231; on IMF, 311–12; referendum called by, 232; Soros and, 267 Tusk, Donald, 20, 27, 275 UKIP Party, 276 Ukraine, 36, 284; conflict between Russia and, 285–86, 381; debts of, 295 unemployment: countries with high rates of, 108–9; Euro-wide unemployment insurance, 101–3 Unicredit (Italian bank), 215 unions, 51–53 United Kingdom, 241; Anglo-Saxon financial capitalism in, 162–63; under Brown, 267–70; under Cameron, 270–72; on ECB intervention, 131; economic theory in, 375; European Parliament elections in, 37; gold standard used by, 90–91; Icelandic assets seized by, 213; on IMF board, 296, 305; national debt of, 121; nineteenth-century economic philosophy in, 58; not in euro area, 249; reputation in monetary policy of, 91–92; threatened exit from European Union by, 272–79; withdraws from European Exchange Rate Mechanism, 82 United States: Anglo-Saxon financial capitalism in, 162–63; bankruptcies in, 256–59; banks and capital market in, 159; bilateral operation with Mexico, 21; divisions on economic theory in, 375; dollar currency of, 46–47; economic history of, 251–54; economic perspective of, 249–51; euro crisis and, 261–67; federal assumption of states’ debts in, 110–11; Federal Reserve System in, 95, 314; Greek exit and, 230; housing bubble in, 170; on IMF board, 296; international inflation tied to, 55; labor mobility in, 104; Landesbanken investments in, 165; New Deal programs in, 102; as polarizing influence, 286; Treasury bonds of, 224, 361 universal banking, 159–60 unsecured interbank markets, 164 Uruguay, 295 Valls, Manuel, 35, 182 vampire banks, 189, 205 Van Rompuy, Herman, 20, 23, 122, –219 Varoufakis, Yanis, 231, 233, 267, 342 Vesti, 239–40 Vienna initiative, 21 Vietnam War, 55 VLTROs (very long-term refinancing operations), 345–46, 349–52, 357 volatility paradox, 104, 182 Voltaire, 124 von Mises, Ludwig, 65 von Rompuy, Herman, 151, 304 wages, 106–7 Wagner, Adolph, 58 Waigel, Theo, 135 Walters, Alan, 79 Warsh, Kevin, 363 Washington Consensus, 79, 290 Weber, Axel: on IMF, 297; on monetary targeting, 53; resignation of, 345, 348; on Secondary Market Purchase program, 25; on Securities Markets Program, 347 Weber, Max, 2, 4 Weidmann, Jens: Bundesbank president, 307; as Bundesbank president, 132; Draghi and, 354; on European Union vulnerabilites, 66; on Goethe, 356–57; on IMF, 22; on VLTROs, 350 Weimar Republic, 44, 46; Great Inflation in, 54–55; Hayek on, 59 Welcker, Carl Theodor, 57–58 West LB (German bank), 165 White, Harry Dexter, 288–91 wholesale funding, 163–64 William III (king, England), 88 Wolf, Martin, 151, 268 World Bank, 269, 288 Wren-Lewis, Simon, 250 Xi Jinping, 275, 282 Yugoslavia, 47 Zapatero, José Luis, 23, 261–62, 336 zero lower bound (ZLB), 140, 364 Zhejiang Geely Group (Chinese firm), 282 Zhou Xiaochuan, 281 zombie banks, 188, 189, 205

pages: 385 words: 111,807

A Pelican Introduction Economics: A User's Guide by Ha-Joon Chang

"there is no alternative" (TINA), Affordable Care Act / Obamacare, Alan Greenspan, Albert Einstein, antiwork, AOL-Time Warner, Asian financial crisis, asset-backed security, bank run, banking crisis, banks create money, Bear Stearns, Berlin Wall, bilateral investment treaty, borderless world, Bretton Woods, British Empire, call centre, capital controls, central bank independence, Charles Babbage, collateralized debt obligation, colonial rule, Corn Laws, corporate governance, corporate raider, creative destruction, Credit Default Swap, credit default swaps / collateralized debt obligations, David Ricardo: comparative advantage, deindustrialization, discovery of the americas, Eugene Fama: efficient market hypothesis, eurozone crisis, experimental economics, Fall of the Berlin Wall, falling living standards, financial deregulation, financial engineering, financial innovation, flying shuttle, Ford Model T, Francis Fukuyama: the end of history, Frederick Winslow Taylor, full employment, George Akerlof, Gini coefficient, Glass-Steagall Act, global value chain, Goldman Sachs: Vampire Squid, Gordon Gekko, Great Leap Forward, greed is good, Gunnar Myrdal, Haber-Bosch Process, happiness index / gross national happiness, high net worth, income inequality, income per capita, information asymmetry, intangible asset, interchangeable parts, interest rate swap, inventory management, invisible hand, Isaac Newton, James Watt: steam engine, Johann Wolfgang von Goethe, John Maynard Keynes: Economic Possibilities for our Grandchildren, John Maynard Keynes: technological unemployment, joint-stock company, joint-stock limited liability company, Joseph Schumpeter, knowledge economy, laissez-faire capitalism, land bank, land reform, liberation theology, manufacturing employment, Mark Zuckerberg, market clearing, market fundamentalism, Martin Wolf, means of production, Mexican peso crisis / tequila crisis, Neal Stephenson, Nelson Mandela, Northern Rock, obamacare, offshore financial centre, oil shock, open borders, Pareto efficiency, Paul Samuelson, post-industrial society, precariat, principal–agent problem, profit maximization, profit motive, proprietary trading, purchasing power parity, quantitative easing, road to serfdom, Robert Shiller, Ronald Coase, Ronald Reagan, savings glut, scientific management, Scramble for Africa, search costs, shareholder value, Silicon Valley, Simon Kuznets, sovereign wealth fund, spinning jenny, structural adjustment programs, The Great Moderation, The Market for Lemons, The Spirit Level, The Theory of the Leisure Class by Thorstein Veblen, The Wealth of Nations by Adam Smith, Thorstein Veblen, trade liberalization, transaction costs, transfer pricing, trickle-down economics, Vilfredo Pareto, Washington Consensus, working-age population, World Values Survey

Behind every economic policy and corporate action that affects our lives – the minimum wage, outsourcing, social security, food safety, pensions and what not – lies some economic theory that either has inspired those actions or, more frequently, is providing justification of what those in power want to do anyway. Only when we know that there are different economic theories will we be able to tell those in power that they are wrong to tell us that ‘there is no alternative’ (TINA), as Margaret Thatcher once infamously put it in defence of her controversial policies. When we learn how much intellectual common ground there is between supposed ‘enemy factions’ in economics, we can more effectively resist those who try to polarize the debate by portraying everything in black and white.

pages: 347 words: 99,317

Bad Samaritans: The Guilty Secrets of Rich Nations and the Threat to Global Prosperity by Ha-Joon Chang

"there is no alternative" (TINA), "World Economic Forum" Davos, affirmative action, Albert Einstein, banking crisis, Big bang: deregulation of the City of London, bilateral investment treaty, borderless world, Bretton Woods, British Empire, Brownian motion, business cycle, call centre, capital controls, central bank independence, colonial rule, Corn Laws, corporate governance, David Ricardo: comparative advantage, Deng Xiaoping, Doha Development Round, en.wikipedia.org, export processing zone, falling living standards, Fellow of the Royal Society, financial deregulation, financial engineering, fixed income, foreign exchange controls, Francis Fukuyama: the end of history, income inequality, income per capita, industrial robot, Isaac Newton, joint-stock company, Joseph Schumpeter, Kenneth Rogoff, Kickstarter, land reform, liberal world order, liberation theology, low skilled workers, market bubble, market fundamentalism, Martin Wolf, means of production, mega-rich, moral hazard, Nelson Mandela, offshore financial centre, oil shock, price stability, principal–agent problem, Ronald Reagan, South Sea Bubble, structural adjustment programs, The Wealth of Nations by Adam Smith, trade liberalization, transfer pricing, urban sprawl, World Values Survey

Many more stories like this can be told, but they all suggest that international trade negotiations are a highly lopsided affair; it is like a war where some people fight with pistols while the others engage in aerial bombardment. Are the Bad Samaritans winning? Margaret Thatcher, the British prime minister who spearheaded the neo-liberal counter-revolution, once famously dismissed her critics saying that ‘There is no alternative’. The spirit of this argument – known as TINA (There Is No Alternative) – permeates the way globalization is portrayed by the Bad Samaritans. The Bad Samaritans like to present globalization as an inevitable result of relentless developments in the technologies of communication and transportation. They like to portray their critics as backward-looking ‘modern-day Luddites’30 who ‘fight over who owns which olive tree’.

…

Going against this historical tide only produces disasters, it is argued, as evidenced by the collapse of the world economy during the inter-war period and by the failures of state-led industrialization in the developing countries in the 1960s and the 1970s. It is argued that there is only one way to survive the historic tidal force that is globalization, and that is to put on the one-size-fits-all Golden Straitjacket which virtually all the successful economies have allegedly worn on their way to prosperity. There is no alternative. In this chapter, I have shown that the TINA conclusion stems from a fundamentally defective understanding of the forces driving globalization and a distortion of history to fit the theory. Free trade was often imposed on, rather than chosen by, weaker countries. Most countries that had the choice did not choose free trade for more than brief periods.

pages: 309 words: 96,434

Ground Control: Fear and Happiness in the Twenty First Century City by Anna Minton

"there is no alternative" (TINA), Abraham Maslow, Albert Einstein, Berlin Wall, Big bang: deregulation of the City of London, Boris Johnson, Broken windows theory, call centre, crack epidemic, credit crunch, deindustrialization, East Village, energy security, Evgeny Morozov, Francis Fukuyama: the end of history, gentrification, ghettoisation, high-speed rail, hiring and firing, housing crisis, illegal immigration, invisible hand, Jane Jacobs, Jaron Lanier, Kickstarter, moral panic, new economy, New Urbanism, race to the bottom, rent control, Richard Florida, Right to Buy, Silicon Valley, Steven Pinker, the built environment, The Death and Life of Great American Cities, The Spirit Level, trickle-down economics, University of East Anglia, urban decay, urban renewal, white flight, white picket fence, World Values Survey, young professional

pages: 181 words: 50,196

The Rich and the Rest of Us by Tavis Smiley

"there is no alternative" (TINA), affirmative action, Affordable Care Act / Obamacare, An Inconvenient Truth, back-to-the-land, benefit corporation, Bernie Madoff, Bernie Sanders, Buckminster Fuller, Corrections Corporation of America, Credit Default Swap, death of newspapers, deindustrialization, ending welfare as we know it, F. W. de Klerk, fixed income, full employment, housing crisis, Howard Zinn, income inequality, job automation, liberation theology, Mahatma Gandhi, mass incarceration, mega-rich, military-industrial complex, Nelson Mandela, new economy, obamacare, Occupy movement, plutocrats, profit motive, Ralph Waldo Emerson, Ronald Reagan, shareholder value, Silicon Valley, Steve Jobs, traffic fines, trickle-down economics, War on Poverty, We are the 99%, white flight, women in the workforce, working poor

We need leaders in the prophetic Christian tradition, like Rauschenbusch, King, and Gandhi. They must stoke the embers of righteous indignation into an almighty, inextinguishable blaze. When it comes to poverty, America has adhered to “TINA” (“there is no alternative”), the slogan attributed to former British Prime Minister Margaret Thatcher. We propose replacing TINA with TIALA: “There is another loving alternative.” Here now we wish to ask the central question raised by the Reverend Dr. Mark Taylor: “Whatever happened to the notion of love in our public discourse?” We should perhaps define what we mean when we use the slippery term “love.”

pages: 1,066 words: 273,703

Crashed: How a Decade of Financial Crises Changed the World by Adam Tooze

"there is no alternative" (TINA), "World Economic Forum" Davos, Affordable Care Act / Obamacare, Alan Greenspan, Apple's 1984 Super Bowl advert, Asian financial crisis, asset-backed security, bank run, banking crisis, Basel III, Bear Stearns, Berlin Wall, Bernie Sanders, Big bang: deregulation of the City of London, bond market vigilante , book value, Boris Johnson, bread and circuses, break the buck, Bretton Woods, Brexit referendum, BRICs, British Empire, business cycle, business logic, capital controls, Capital in the Twenty-First Century by Thomas Piketty, Carmen Reinhart, Celtic Tiger, central bank independence, centre right, collateralized debt obligation, company town, corporate governance, credit crunch, Credit Default Swap, credit default swaps / collateralized debt obligations, currency manipulation / currency intervention, currency peg, currency risk, dark matter, deindustrialization, desegregation, Detroit bankruptcy, Dissolution of the Soviet Union, diversification, Doha Development Round, Donald Trump, Edward Glaeser, Edward Snowden, en.wikipedia.org, energy security, eurozone crisis, Fall of the Berlin Wall, family office, financial engineering, financial intermediation, fixed income, Flash crash, forward guidance, friendly fire, full employment, global reserve currency, global supply chain, global value chain, Goldman Sachs: Vampire Squid, Growth in a Time of Debt, high-speed rail, housing crisis, Hyman Minsky, illegal immigration, immigration reform, income inequality, interest rate derivative, interest rate swap, inverted yield curve, junk bonds, Kenneth Rogoff, large denomination, light touch regulation, Long Term Capital Management, low interest rates, margin call, Martin Wolf, McMansion, Mexican peso crisis / tequila crisis, military-industrial complex, mittelstand, money market fund, moral hazard, mortgage debt, mutually assured destruction, negative equity, new economy, Nixon triggered the end of the Bretton Woods system, Northern Rock, obamacare, Occupy movement, offshore financial centre, oil shale / tar sands, old-boy network, open economy, opioid epidemic / opioid crisis, paradox of thrift, Peter Thiel, Ponzi scheme, Post-Keynesian economics, post-truth, predatory finance, price stability, private sector deleveraging, proprietary trading, purchasing power parity, quantitative easing, race to the bottom, reserve currency, risk tolerance, Ronald Reagan, Savings and loan crisis, savings glut, secular stagnation, Silicon Valley, South China Sea, sovereign wealth fund, special drawing rights, Steve Bannon, structural adjustment programs, tail risk, The Great Moderation, Tim Cook: Apple, too big to fail, trade liberalization, upwardly mobile, Washington Consensus, We are the 99%, white flight, WikiLeaks, women in the workforce, Works Progress Administration, yield curve, éminence grise

Merkel promised an affirmative Bundestag vote for May 7. The question was whether the markets would give Europe that long. Merkel presented the rescue package to the German Bundestag on Wednesday, May 5. It was, she declared, “alternativlos”—without alternative.49 Merkel’s rewording of Margaret Thatcher’s famous pronouncement—there is no alternative (TINA)—was to become notorious. Meanwhile, that same day Greece was rocked by a general strike that mobilized both main wings of the Greek labor movement and shut down transport and public services. In Athens protesters fought running battles with riot police. As the parliamentarians debated the austerity program in committee, a firebomb crashed through the window of a branch of Marfin Bank, setting the building alight and killing three staff members.

pages: 334 words: 98,950

Bad Samaritans: The Myth of Free Trade and the Secret History of Capitalism by Ha-Joon Chang

"there is no alternative" (TINA), "World Economic Forum" Davos, affirmative action, Albert Einstein, Big bang: deregulation of the City of London, bilateral investment treaty, borderless world, Bretton Woods, British Empire, Brownian motion, business cycle, call centre, capital controls, central bank independence, colonial rule, Corn Laws, corporate governance, David Ricardo: comparative advantage, Deng Xiaoping, Doha Development Round, en.wikipedia.org, export processing zone, falling living standards, Fellow of the Royal Society, financial deregulation, financial engineering, fixed income, foreign exchange controls, Francis Fukuyama: the end of history, income inequality, income per capita, industrial robot, Isaac Newton, joint-stock company, Joseph Schumpeter, Kenneth Rogoff, Kickstarter, land reform, liberal world order, liberation theology, low skilled workers, market bubble, market fundamentalism, Martin Wolf, means of production, mega-rich, moral hazard, Nelson Mandela, offshore financial centre, oil shock, price stability, principal–agent problem, Ronald Reagan, South Sea Bubble, structural adjustment programs, The Wealth of Nations by Adam Smith, trade liberalization, transfer pricing, urban sprawl, World Values Survey

Many more stories like this could be told, but they all suggest that international trade negotiations are a highly lopsided affair; it is like a war where some people fight with pistols while the others engage in aerial bombardment. Are the Bad Samaritans winning? Margaret Thatcher, the British prime minister who spearheaded the neo-liberal counter-revolution, once famously dismissed her critics saying that ‘There is no alternative’. The spirit of this argument – known as TINA (There Is No Alternative) – permeates the way globalization is portrayed by the Bad Samaritans. The Bad Samaritans like to present globalization as an inevitable result of relentless developments in the technologies of communication and transportation. They like to portray their critics as backward-looking ‘modern-day Luddites’30 who ‘fight over who owns which olive tree’.

pages: 1,037 words: 294,916

Before the Storm: Barry Goldwater and the Unmaking of the American Consensus by Rick Perlstein

"there is no alternative" (TINA), affirmative action, Alan Greenspan, Alvin Toffler, anti-communist, anti-work, antiwork, Berlin Wall, bread and circuses, Bretton Woods, business climate, card file, collective bargaining, company town, cuban missile crisis, desegregation, distributed generation, Dr. Strangelove, Electric Kool-Aid Acid Test, ending welfare as we know it, George Gilder, haute couture, Henry Ford's grandson gave labor union leader Walter Reuther a tour of the company’s new, automated factory…, Herman Kahn, index card, indoor plumbing, invisible hand, Joan Didion, liberal capitalism, Marshall McLuhan, means of production, military-industrial complex, mortgage debt, New Journalism, Norman Mailer, plutocrats, Project Plowshare, road to serfdom, Robert Bork, rolodex, Ronald Reagan, Rosa Parks, school vouchers, the medium is the message, The Wealth of Nations by Adam Smith, transcontinental railway, union organizing, Upton Sinclair, upwardly mobile, urban renewal, War on Poverty, Watson beat the top human players on Jeopardy!, white picket fence, Works Progress Administration

The analogy wouldn’t be exaggerating what has happened since 1964 too much. It might even be underplaying it. When commentators want to remark on today’s sweeping embrace of market thinking, the retreat of the regulatory state, and America’s military role as the “indispensable nation,” a shorthand rolls off their tongue: “There Is No Alternative”—TINA. But such things have been said before. Go back to 1952. When the first Republican President in twenty years was elected, liberals feared Dwight D. Eisenhower would try to roll back the Democratic achievements of the New Deal—minimum wage and agricultural price supports; the Tennessee Valley Authority, that massive complex of government-built dams that brought electricity to entire swatches of the Southeast that had never seen it before; Social Security; and many, many more.

pages: 193 words: 63,618

The Fair Trade Scandal: Marketing Poverty to Benefit the Rich by Ndongo Sylla

"there is no alternative" (TINA), British Empire, carbon footprint, corporate social responsibility, David Ricardo: comparative advantage, deglobalization, degrowth, Doha Development Round, Food sovereignty, global value chain, illegal immigration, income inequality, income per capita, invisible hand, Joseph Schumpeter, labour mobility, land reform, market fundamentalism, mass immigration, means of production, Mont Pelerin Society, Naomi Klein, non-tariff barriers, offshore financial centre, open economy, Philip Mirowski, plutocrats, price mechanism, purchasing power parity, Ronald Reagan, Scientific racism, selection bias, structural adjustment programs, The Wealth of Nations by Adam Smith, trade liberalization, transaction costs, transatlantic slave trade, trickle-down economics, vertical integration, Washington Consensus, zero-sum game

pages: 222 words: 70,132

Move Fast and Break Things: How Facebook, Google, and Amazon Cornered Culture and Undermined Democracy by Jonathan Taplin

"Friedman doctrine" OR "shareholder theory", "there is no alternative" (TINA), 1960s counterculture, affirmative action, Affordable Care Act / Obamacare, Airbnb, AlphaGo, Amazon Mechanical Turk, American Legislative Exchange Council, AOL-Time Warner, Apple's 1984 Super Bowl advert, back-to-the-land, barriers to entry, basic income, battle of ideas, big data - Walmart - Pop Tarts, Big Tech, bitcoin, Brewster Kahle, Buckminster Fuller, Burning Man, Clayton Christensen, Cody Wilson, commoditize, content marketing, creative destruction, crony capitalism, crowdsourcing, data is the new oil, data science, David Brooks, David Graeber, decentralized internet, don't be evil, Donald Trump, Douglas Engelbart, Douglas Engelbart, Dynabook, Edward Snowden, Elon Musk, equal pay for equal work, Erik Brynjolfsson, Fairchild Semiconductor, fake news, future of journalism, future of work, George Akerlof, George Gilder, Golden age of television, Google bus, Hacker Ethic, Herbert Marcuse, Howard Rheingold, income inequality, informal economy, information asymmetry, information retrieval, Internet Archive, Internet of things, invisible hand, Jacob Silverman, Jaron Lanier, Jeff Bezos, job automation, John Markoff, John Maynard Keynes: technological unemployment, John Perry Barlow, John von Neumann, Joseph Schumpeter, Kevin Kelly, Kickstarter, labor-force participation, Larry Ellison, life extension, Marc Andreessen, Mark Zuckerberg, Max Levchin, Menlo Park, Metcalfe’s law, military-industrial complex, Mother of all demos, move fast and break things, natural language processing, Network effects, new economy, Norbert Wiener, offshore financial centre, packet switching, PalmPilot, Paul Graham, paypal mafia, Peter Thiel, plutocrats, pre–internet, Ray Kurzweil, reality distortion field, recommendation engine, rent-seeking, revision control, Robert Bork, Robert Gordon, Robert Metcalfe, Ronald Reagan, Ross Ulbricht, Sam Altman, Sand Hill Road, secular stagnation, self-driving car, sharing economy, Silicon Valley, Silicon Valley ideology, Skinner box, smart grid, Snapchat, Social Justice Warrior, software is eating the world, Steve Bannon, Steve Jobs, Stewart Brand, tech billionaire, techno-determinism, technoutopianism, TED Talk, The Chicago School, the long tail, The Market for Lemons, The Rise and Fall of American Growth, Tim Cook: Apple, trade route, Tragedy of the Commons, transfer pricing, Travis Kalanick, trickle-down economics, Tyler Cowen, Tyler Cowen: Great Stagnation, universal basic income, unpaid internship, vertical integration, We are as Gods, We wanted flying cars, instead we got 140 characters, web application, Whole Earth Catalog, winner-take-all economy, women in the workforce, Y Combinator, you are the product

pages: 424 words: 115,035

How Will Capitalism End? by Wolfgang Streeck

"there is no alternative" (TINA), accounting loophole / creative accounting, air traffic controllers' union, Airbnb, Alan Greenspan, basic income, behavioural economics, Ben Bernanke: helicopter money, billion-dollar mistake, Bretton Woods, business cycle, capital controls, Capital in the Twenty-First Century by Thomas Piketty, Carmen Reinhart, central bank independence, centre right, Clayton Christensen, collective bargaining, conceptual framework, corporate governance, creative destruction, credit crunch, David Brooks, David Graeber, debt deflation, deglobalization, deindustrialization, disruptive innovation, en.wikipedia.org, eurozone crisis, failed state, financial deregulation, financial innovation, first-past-the-post, fixed income, full employment, Gini coefficient, global reserve currency, Google Glasses, haute cuisine, income inequality, information asymmetry, invisible hand, John Maynard Keynes: Economic Possibilities for our Grandchildren, junk bonds, Kenneth Rogoff, labour market flexibility, labour mobility, late capitalism, liberal capitalism, low interest rates, market bubble, means of production, military-industrial complex, moral hazard, North Sea oil, offshore financial centre, open borders, pension reform, plutocrats, Plutonomy: Buying Luxury, Explaining Global Imbalances, post-industrial society, private sector deleveraging, profit maximization, profit motive, quantitative easing, reserve currency, rising living standards, Robert Gordon, savings glut, secular stagnation, shareholder value, sharing economy, sovereign wealth fund, tacit knowledge, technological determinism, The Future of Employment, The Theory of the Leisure Class by Thorstein Veblen, The Wealth of Nations by Adam Smith, Thorstein Veblen, too big to fail, transaction costs, Uber for X, upwardly mobile, Vilfredo Pareto, winner-take-all economy, Wolfgang Streeck

pages: 353 words: 81,436

Buying Time: The Delayed Crisis of Democratic Capitalism by Wolfgang Streeck

"there is no alternative" (TINA), "World Economic Forum" Davos, activist fund / activist shareholder / activist investor, air traffic controllers' union, Alan Greenspan, banking crisis, basic income, Bretton Woods, business cycle, capital controls, Carmen Reinhart, central bank independence, collective bargaining, corporate governance, creative destruction, currency risk, David Graeber, deindustrialization, Deng Xiaoping, Eugene Fama: efficient market hypothesis, financial deregulation, financial engineering, financial repression, fixed income, full employment, Garrett Hardin, Gini coefficient, Growth in a Time of Debt, income inequality, Joseph Schumpeter, Kenneth Rogoff, Kickstarter, knowledge economy, labour market flexibility, labour mobility, late capitalism, liberal capitalism, low interest rates, means of production, moral hazard, Myron Scholes, Occupy movement, open borders, open economy, Plutonomy: Buying Luxury, Explaining Global Imbalances, profit maximization, risk tolerance, shareholder value, too big to fail, Tragedy of the Commons, union organizing, winner-take-all economy, Wolfgang Streeck

pages: 208 words: 67,582

What About Me?: The Struggle for Identity in a Market-Based Society by Paul Verhaeghe

"there is no alternative" (TINA), Alan Greenspan, autism spectrum disorder, Berlin Wall, call centre, capitalist realism, cognitive dissonance, deskilling, epigenetics, Fall of the Berlin Wall, Francis Fukuyama: the end of history, Gregor Mendel, income inequality, invisible hand, jimmy wales, job satisfaction, knowledge economy, knowledge worker, Louis Pasteur, market fundamentalism, meritocracy, Milgram experiment, mirror neurons, new economy, Panopticon Jeremy Bentham, post-industrial society, Richard Feynman, Silicon Valley, Stanford prison experiment, stem cell, The Spirit Level, ultimatum game, working poor

pages: 327 words: 90,542

The Age of Stagnation: Why Perpetual Growth Is Unattainable and the Global Economy Is in Peril by Satyajit Das

"there is no alternative" (TINA), "World Economic Forum" Davos, 9 dash line, accounting loophole / creative accounting, additive manufacturing, Airbnb, Alan Greenspan, Albert Einstein, Alfred Russel Wallace, Anthropocene, Anton Chekhov, Asian financial crisis, banking crisis, Bear Stearns, Berlin Wall, bitcoin, bond market vigilante , Bretton Woods, BRICs, British Empire, business cycle, business process, business process outsourcing, call centre, capital controls, Capital in the Twenty-First Century by Thomas Piketty, carbon tax, Carmen Reinhart, Clayton Christensen, cloud computing, collaborative economy, colonial exploitation, computer age, creative destruction, cryptocurrency, currency manipulation / currency intervention, David Ricardo: comparative advantage, declining real wages, Deng Xiaoping, deskilling, digital divide, disintermediation, disruptive innovation, Downton Abbey, Emanuel Derman, energy security, energy transition, eurozone crisis, financial engineering, financial innovation, financial repression, forward guidance, Francis Fukuyama: the end of history, full employment, geopolitical risk, gig economy, Gini coefficient, global reserve currency, global supply chain, Goldman Sachs: Vampire Squid, Great Leap Forward, Greenspan put, happiness index / gross national happiness, high-speed rail, Honoré de Balzac, hydraulic fracturing, Hyman Minsky, illegal immigration, income inequality, income per capita, indoor plumbing, informal economy, Innovator's Dilemma, intangible asset, Intergovernmental Panel on Climate Change (IPCC), it is difficult to get a man to understand something, when his salary depends on his not understanding it, It's morning again in America, Jane Jacobs, John Maynard Keynes: technological unemployment, junk bonds, Kenneth Rogoff, Kevin Roose, knowledge economy, knowledge worker, Les Trente Glorieuses, light touch regulation, liquidity trap, Long Term Capital Management, low interest rates, low skilled workers, Lyft, Mahatma Gandhi, margin call, market design, Marshall McLuhan, Martin Wolf, middle-income trap, Mikhail Gorbachev, military-industrial complex, Minsky moment, mortgage debt, mortgage tax deduction, new economy, New Urbanism, offshore financial centre, oil shale / tar sands, oil shock, old age dependency ratio, open economy, PalmPilot, passive income, peak oil, peer-to-peer lending, pension reform, planned obsolescence, plutocrats, Ponzi scheme, Potemkin village, precariat, price stability, profit maximization, pushing on a string, quantitative easing, race to the bottom, Ralph Nader, Rana Plaza, rent control, rent-seeking, reserve currency, ride hailing / ride sharing, rising living standards, risk/return, Robert Gordon, Robert Solow, Ronald Reagan, Russell Brand, Satyajit Das, savings glut, secular stagnation, seigniorage, sharing economy, Silicon Valley, Simon Kuznets, Slavoj Žižek, South China Sea, sovereign wealth fund, Stephen Fry, systems thinking, TaskRabbit, The Chicago School, The Great Moderation, The inhabitant of London could order by telephone, sipping his morning tea in bed, the various products of the whole earth, the market place, the payments system, The Spirit Level, Thorstein Veblen, Tim Cook: Apple, too big to fail, total factor productivity, trade route, transaction costs, uber lyft, unpaid internship, Unsafe at Any Speed, Upton Sinclair, Washington Consensus, We are the 99%, WikiLeaks, Y2K, Yom Kippur War, zero-coupon bond, zero-sum game

pages: 525 words: 153,356

The People: The Rise and Fall of the Working Class, 1910-2010 by Selina Todd

"there is no alternative" (TINA), call centre, collective bargaining, conceptual framework, credit crunch, deindustrialization, deskilling, different worldview, Downton Abbey, financial independence, full employment, income inequality, longitudinal study, manufacturing employment, meritocracy, Neil Kinnock, New Urbanism, Red Clydeside, rent control, Right to Buy, rising living standards, scientific management, sexual politics, strikebreaker, The Spirit Level, unemployed young men, union organizing, upwardly mobile, urban renewal, Winter of Discontent, women in the workforce, work culture , young professional

pages: 741 words: 179,454

Extreme Money: Masters of the Universe and the Cult of Risk by Satyajit Das

"RICO laws" OR "Racketeer Influenced and Corrupt Organizations", "there is no alternative" (TINA), "World Economic Forum" Davos, affirmative action, Alan Greenspan, Albert Einstein, algorithmic trading, Andy Kessler, AOL-Time Warner, Asian financial crisis, asset allocation, asset-backed security, bank run, banking crisis, banks create money, Basel III, Bear Stearns, behavioural economics, Benoit Mandelbrot, Berlin Wall, Bernie Madoff, Big bang: deregulation of the City of London, Black Swan, Bonfire of the Vanities, bonus culture, book value, Bretton Woods, BRICs, British Empire, business cycle, buy the rumour, sell the news, capital asset pricing model, carbon credits, Carl Icahn, Carmen Reinhart, carried interest, Celtic Tiger, clean water, cognitive dissonance, collapse of Lehman Brothers, collateralized debt obligation, corporate governance, corporate raider, creative destruction, credit crunch, Credit Default Swap, credit default swaps / collateralized debt obligations, currency risk, Daniel Kahneman / Amos Tversky, deal flow, debt deflation, Deng Xiaoping, deskilling, discrete time, diversification, diversified portfolio, Doomsday Clock, Dr. Strangelove, Dutch auction, Edward Thorp, Emanuel Derman, en.wikipedia.org, Eugene Fama: efficient market hypothesis, eurozone crisis, Everybody Ought to Be Rich, Fall of the Berlin Wall, financial engineering, financial independence, financial innovation, financial thriller, fixed income, foreign exchange controls, full employment, Glass-Steagall Act, global reserve currency, Goldman Sachs: Vampire Squid, Goodhart's law, Gordon Gekko, greed is good, Greenspan put, happiness index / gross national happiness, haute cuisine, Herman Kahn, high net worth, Hyman Minsky, index fund, information asymmetry, interest rate swap, invention of the wheel, invisible hand, Isaac Newton, James Carville said: "I would like to be reincarnated as the bond market. You can intimidate everybody.", job automation, Johann Wolfgang von Goethe, John Bogle, John Meriwether, joint-stock company, Jones Act, Joseph Schumpeter, junk bonds, Kenneth Arrow, Kenneth Rogoff, Kevin Kelly, laissez-faire capitalism, load shedding, locking in a profit, Long Term Capital Management, Louis Bachelier, low interest rates, margin call, market bubble, market fundamentalism, Market Wizards by Jack D. Schwager, Marshall McLuhan, Martin Wolf, mega-rich, merger arbitrage, Michael Milken, Mikhail Gorbachev, Milgram experiment, military-industrial complex, Minsky moment, money market fund, Mont Pelerin Society, moral hazard, mortgage debt, mortgage tax deduction, mutually assured destruction, Myron Scholes, Naomi Klein, National Debt Clock, negative equity, NetJets, Network effects, new economy, Nick Leeson, Nixon shock, Northern Rock, nuclear winter, oil shock, Own Your Own Home, Paul Samuelson, pets.com, Philip Mirowski, Phillips curve, planned obsolescence, plutocrats, Ponzi scheme, price anchoring, price stability, profit maximization, proprietary trading, public intellectual, quantitative easing, quantitative trading / quantitative finance, Ralph Nader, RAND corporation, random walk, Ray Kurzweil, regulatory arbitrage, Reminiscences of a Stock Operator, rent control, rent-seeking, reserve currency, Richard Feynman, Richard Thaler, Right to Buy, risk free rate, risk-adjusted returns, risk/return, road to serfdom, Robert Shiller, Rod Stewart played at Stephen Schwarzman birthday party, rolodex, Ronald Reagan, Ronald Reagan: Tear down this wall, Satyajit Das, savings glut, shareholder value, Sharpe ratio, short selling, short squeeze, Silicon Valley, six sigma, Slavoj Žižek, South Sea Bubble, special economic zone, statistical model, Stephen Hawking, Steve Jobs, stock buybacks, survivorship bias, tail risk, Teledyne, The Chicago School, The Great Moderation, the market place, the medium is the message, The Myth of the Rational Market, The Nature of the Firm, the new new thing, The Predators' Ball, The Theory of the Leisure Class by Thorstein Veblen, The Wealth of Nations by Adam Smith, Thorstein Veblen, too big to fail, trickle-down economics, Turing test, two and twenty, Upton Sinclair, value at risk, Yogi Berra, zero-coupon bond, zero-sum game

pages: 613 words: 151,140

No Such Thing as Society by Andy McSmith

"there is no alternative" (TINA), anti-communist, Ayatollah Khomeini, Berlin Wall, Big bang: deregulation of the City of London, Black Monday: stock market crash in 1987, Bob Geldof, Boris Johnson, British Empire, Brixton riot, Bullingdon Club, call centre, cuban missile crisis, Etonian, F. W. de Klerk, Farzad Bazoft, feminist movement, fixed income, Francis Fukuyama: the end of history, friendly fire, full employment, glass ceiling, God and Mammon, greed is good, illegal immigration, index card, John Bercow, Kickstarter, liberal capitalism, light touch regulation, Live Aid, loadsamoney, long peace, means of production, Mikhail Gorbachev, mortgage debt, mutually assured destruction, negative equity, Neil Kinnock, Nelson Mandela, North Sea oil, Northern Rock, old-boy network, popular capitalism, Right to Buy, Ronald Reagan, Rubik’s Cube, Sloane Ranger, South Sea Bubble, spread of share-ownership, Stephen Fry, strikebreaker, Suez crisis 1956, The Chicago School, union organizing, upwardly mobile, urban decay, Winter of Discontent, young professional

pages: 169 words: 52,744

Big Capital: Who Is London For? by Anna Minton

"there is no alternative" (TINA), Airbnb, Berlin Wall, Big bang: deregulation of the City of London, Boris Johnson, Capital in the Twenty-First Century by Thomas Piketty, collateralized debt obligation, Credit Default Swap, credit default swaps / collateralized debt obligations, Donald Trump, eurozone crisis, Fall of the Berlin Wall, Frank Gehry, gentrification, high net worth, high-speed rail, housing crisis, illegal immigration, Kickstarter, land bank, land value tax, market design, new economy, New Urbanism, offshore financial centre, payday loans, post-truth, quantitative easing, rent control, rent gap, Right to Buy, Russell Brand, sovereign wealth fund, the built environment, The Wealth of Nations by Adam Smith, urban renewal, working poor

pages: 300 words: 106,520

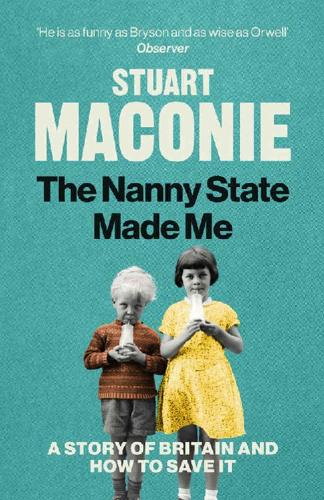

The Nanny State Made Me: A Story of Britain and How to Save It by Stuart Maconie

"there is no alternative" (TINA), banking crisis, basic income, Bernie Sanders, Big Tech, bitcoin, Black Lives Matter, Boris Johnson, British Empire, Bullingdon Club, cognitive dissonance, collective bargaining, Corn Laws, David Attenborough, Desert Island Discs, don't be evil, Downton Abbey, driverless car, Elon Musk, Etonian, Extinction Rebellion, failed state, fake news, Francis Fukuyama: the end of history, full employment, G4S, gentrification, Golden age of television, Gordon Gekko, greed is good, Greta Thunberg, helicopter parent, hiring and firing, housing crisis, Jeremy Corbyn, job automation, Mark Zuckerberg, market fundamentalism, Marshall McLuhan, North Sea oil, Own Your Own Home, plutocrats, post-truth, post-war consensus, rent control, retail therapy, Right to Buy, road to serfdom, Russell Brand, Silicon Valley, Stephen Fry, surveillance capitalism, The Chicago School, universal basic income, Winter of Discontent

pages: 767 words: 208,933

Liberalism at Large: The World According to the Economist by Alex Zevin