Andy Kessler

24 results back to index

pages: 270 words: 75,803

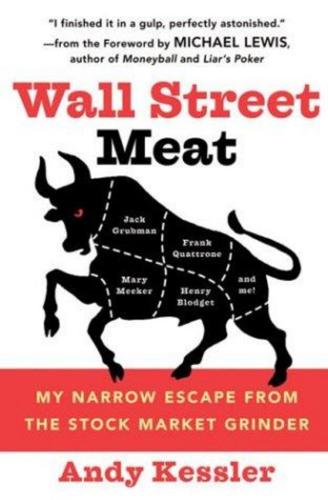

Wall Street Meat by Andy Kessler

accounting loophole / creative accounting, Alan Greenspan, Andy Kessler, automated trading system, banking crisis, Bob Noyce, George Gilder, index fund, Jeff Bezos, John Bogle, junk bonds, market bubble, Mary Meeker, Menlo Park, Michael Milken, Pepto Bismol, pets.com, Robert Metcalfe, rolodex, Salesforce, Sand Hill Road, Silicon Valley, Small Order Execution System, Steve Jobs, technology bubble, undersea cable, Y2K

This was a nice piece of revisionist history, in an attempt by Ruvkun to selfinstall a backbone. So I sent an email to Frank (in Eliot Spitzer’s archives now, no doubt): To: Frank Quattrone From: Andy Kessler It must have been Rick Ruvkun’s shadow (the one he is still afraid of) that put out that Hold. Hang in there . . . Andy I was trying to be nice. Hey, maybe I did give a rat’s ass. Later that evening, I got an email back from Frank: 222 Spitzer Fixer To: Andy Kessler From: Frank Quattrone How about writing an article about how you pressured Bill Brady into taking Mediavision public? Now that was a low blow, but a well deserved one on my part.

…

West, 221 Valentine, Don, 169 Velocity Capital Management, 170–71, 180, 191–94 255 Index Venrock, 137 Vonderschmitt, Bernie, 94 Vortex, 214 Waddell and Read, 28 Wagner, Todd, 178 Wait, Jarett, 206–7 Wallach, Andrew, 11–12, 29, 162 Wall Street banking and, 91 casino metaphor, 147 how money is made on, 90–91 individual investors and, 237 IPOs and, 115 Wall Street Journal, 67, 112–13, 178, 222 Wasserman, Lew, 157 256 Weil, Ulrich, 25 Weill, Sandy, 216–17, 227 Wein, Byron, 111–12, 143, 153 Wellcome Trust, 143 White Weld, 14 Wilson, Fred, 203 Wilson, Pete, 62 Winnick, Gary, 213, 220 WorldCom, 1, 38, 219, 220, 226–27, 229 Xilinx, 94, 114–16 Yahoo, 169 Yamamoto, Takatoshi, 151 About the Author ANDY KESSLER worked on Wall Street for nearly twenty years as a research analyst, investment banker, venture capitalist, and hedge fund manager. He has written for the Wall Street Journal, Forbes, Thestreet.com, and the American Spectator, and appeared on CNBC, CNN, Nightline, and Dateline NBC. He lives in northern California with his wife and four sons. Visit www.AuthorTracker.com for exclusive information on your favorite HarperCollins author. Credits Designed by Amy Hill Copyright WALL STREET MEAT. Copyright © 2003, 2004 by Andy Kessler. All rights reserved under International and Pan-American Copyright Conventions.

…

My Narrow Escape from the Stock Market Grinder ANDY KESSLER For Nancy and the Boys Contents Foreword by Michael Lewis v Introduction 1 C HAPTER 1 Right 51% of the Time C HAPTER 2 Piranhas 19 C HAPTER 3 You’re in the Entertainment Business 41 C HAPTER 4 Bull Run 50 C HAPTER 5 Time to Get Serious 70 C HAPTER 6 Wheeling and Dealing at Morgan 88 C HAPTER 7 Up, then Tanked 114 C HAPTER 8 Kicking Off the ’90s 121 C HAPTER 9 Something about Mary 132 C HAPTER 10 Netscape IPO 165 C HAPTER 11 Quacking Ducks 172 C HAPTER 12 Price Targets as a Marketing Tool 181 C HAPTER 13 Synthetic Goldman Sachs 195 C HAPTER 14 The Ax Syndrome 209 C HAPTER 15 Spitzer Fixer 219 5 Afterword 233 Index 247 About the Author Credits Cover Copyright About the Publisher Foreword by Michael Lewis J ack Grubman, Frank Quattrone, Mary Meeker, and Henry Blodget, were Wall Street’s best-known promoters of the Internettelecom boom.

pages: 361 words: 86,921

The End of Medicine: How Silicon Valley (And Naked Mice) Will Reboot Your Doctor by Andy Kessler

airport security, Andy Kessler, Bear Stearns, bioinformatics, Buckminster Fuller, call centre, Dean Kamen, digital divide, El Camino Real, employer provided health coverage, full employment, George Gilder, global rebalancing, Law of Accelerating Returns, low earth orbit, Metcalfe’s law, moral hazard, Network effects, off-the-grid, pattern recognition, personalized medicine, phenotype, Ray Kurzweil, Richard Feynman, Sand Hill Road, Silicon Valley, stem cell, Steve Jurvetson, vertical integration

I couldn’t quite ask it that way, but in effect, that’s what I wanted to know. To: John Simpson From: Andy Kessler Subject: one question dr. simpson, we met on the soccer fields. that jean-claude is something else, he must have your genes. i have just one question for you. if imaging really does get cheap enough and we can find all this stuff that causes heart attacks and strokes, is there some device or procedure that will actually do preventative care, i.e. remove all that plaque before a heart attack or stroke? thanks, andy kessler From: John Simpson To: Andy Kessler Subject: Re: one question I am about to start a procedure but the short answer is “YES” (and you should learn how to use capital letters).

…

Chapter 44 To the Hutch I got an email from Don Listwin: To: Andy Kessler From: Don Listwin Subject: Hutch I’m heading up to the Hutch on Tuesday morning. If you want to join me, I’ll introduce to Lee and some of the other folks. Don I responded almost immediately. To: Don Listwin From: Andy Kessler Subject: Re: Hutch i’ve rearranged my tuesday so it turns out that now i am free, and can join you on your trip to the hutch. Just let me know what flight you are on and i’ll book tickets today. it may take a day or two, but i’ll have to find my tie in the back of my closet. andy The next day, I got this note: To: Andy Kessler From: Don Listwin Subject: Re: Re: Hutch Tail# N725CC out of San Jose. 9 a.m.

…

The End of Medicine HOW SILICON VALLEY (AND NAKED MICE) WILL REBOOT YOUR DOCTOR Andy Kessler To Nancy, my life sustainer Contents Introduction Chapter 1 Broken Neck? Chapter 2 Physical Part I Chapter 3 In the Cath Lab Chapter 4 What the Hell Am I Doing Here? Chapter 5 Echo/Nuclear Chapter 6 Do Doctors Scale? Chapter 7 Zap It Out Chapter 8 Blood Tests Chapter 9 CAVE Chapter 10 LASIK Chapter 11 The Big Three Chapter 12 Magic Pill Chapter 13 Meeting Gary Glazer Part II Chapter 14 The Dish Chapter 15 Close to Home Chapter 16 Cholesterol Conspiracy?

pages: 77 words: 18,414

How to Kick Ass on Wall Street by Andy Kessler

Andy Kessler, Bear Stearns, Bernie Madoff, buttonwood tree, call centre, collateralized debt obligation, eat what you kill, family office, fixed income, hiring and firing, invention of the wheel, invisible hand, London Whale, low interest rates, margin call, NetJets, Nick Leeson, pets.com, risk tolerance, Silicon Valley, sovereign wealth fund, time value of money, too big to fail, value at risk

How to Kick Ass On Wall Street Andy Kessler Author of Wall Street Meat, Running Money and Eat People Copyright © 2012 by Andy Kessler All rights reserved, including the right of reproduction in whole or in part in any form. Escape Velocity Press www.andykessler.com Introduction All right! You got a job on Wall Street. Way to go. Welcome aboard. If history is any guide, you’re wicked smart, a great athlete and know somebody. Or any combo of the above. Don’t matter. You got the job. Feels good, right? When you got the offer, you were probably as pumped as Will Ferrell in Semi-Pro, “Yes!

…

Send me an email at akessler@velcap.com with KAWS or Kick Ass on Wall Street in the subject line and I’ll put you on my mailing list. Feedback is welcome, good or bad. I have a thick skin. And tell me what you’re doing, how you’re doing and how this helped. You can find most of the other stuff I’ve written at www.andykessler.com. Good luck and kick some ass on Wall Street. Andy Kessler

pages: 218 words: 63,471

How We Got Here: A Slightly Irreverent History of Technology and Markets by Andy Kessler

Albert Einstein, Andy Kessler, animal electricity, automated trading system, bank run, Big bang: deregulation of the City of London, Black Monday: stock market crash in 1987, Bletchley Park, Bob Noyce, Bretton Woods, British Empire, buttonwood tree, Charles Babbage, Claude Shannon: information theory, Corn Laws, cotton gin, Dennis Ritchie, Douglas Engelbart, Edward Lloyd's coffeehouse, Fairchild Semiconductor, fiat currency, fixed income, floating exchange rates, flying shuttle, Fractional reserve banking, full employment, GPS: selective availability, Grace Hopper, invention of the steam engine, invention of the telephone, invisible hand, Isaac Newton, Jacquard loom, James Hargreaves, James Watt: steam engine, John von Neumann, joint-stock company, joint-stock limited liability company, Joseph-Marie Jacquard, Ken Thompson, Kickstarter, Leonard Kleinrock, Marc Andreessen, Mary Meeker, Maui Hawaii, Menlo Park, Metcalfe's law, Metcalfe’s law, military-industrial complex, Mitch Kapor, Multics, packet switching, pneumatic tube, price mechanism, probability theory / Blaise Pascal / Pierre de Fermat, profit motive, proprietary trading, railway mania, RAND corporation, Robert Metcalfe, Silicon Valley, Small Order Execution System, South Sea Bubble, spice trade, spinning jenny, Steve Jobs, Suez canal 1869, supply-chain management, supply-chain management software, systems thinking, three-martini lunch, trade route, transatlantic slave trade, tulip mania, Turing machine, Turing test, undersea cable, UUNET, Wayback Machine, William Shockley: the traitorous eight

t=andykessler20&o=1&p=8&l=as1&asins=0060840978&fc1=000000&=1&lc1=00 00ff&bc1=000000<1=_blank&IS2=1&f=ifr&bg1=ffffff&f=ifr ALSO BY ANDY KESSLER Wall Street Meat: Jack Grubman, Frank Quattrone, Mary Meeker, Henry Blodget and me Running Money: Hedge Fund Honchos, Monster Markets and My Hunt for the Big Score Coming in 2006: The End of Medicine: Tales of Naked Mice, 3D Guts and Rebooting Doctors How We Got Here A Silicon Valley and Wall Street Primer . A Slightly Irreverent History of Technology And Markets Andy Kessler Copyright © 2005 by Andy Kessler All rights reserved, including the right of reproduction in whole or in part in any form.

…

Standage, Tom, 1998, The Victorian Internet – The Remarkable Story of the Telegraph and the Nineteenth Century On-Line Pioneers, Berkeley Sylla, Richard, 1998, The First Great IPO, Financial History Magazine Issue, 64 Thurston, Robert, 1878, A History of the Growth of the Steam-Engine Weightman, Gavin, 2003, Signor Marconi’s Magic Box – The Most Remarkable Invention of the 19th Century and the Amateur Inventor Whose Genius Sparked a Revolution, Da Capo Press About the Author Andy Kessler is a former electrical engineer turned Wall Street analyst turned investment banker turned venture capitalist turned hedge fund manager turned writer and author. His book Wall Street Meat: Jack Grubman, Frank Quattrone, Mary Meeker, Henry Blodget and me was published in March of 2003. The follow on, Running Money: Hedge Fund Honchos, Monster Markets and My Hunt for the Big Score, was published by HarperCollins in September of 2004.

…

Andy is a frequent contributor to the Wall Street Journal op-ed page and has written for Forbes Magazine, Wired, the LA Times, and The American Spectator magazine as well as techcentralstation.com and thestreet.com websites. He has even written a piece of fiction for Slate - bet you can’t find it. Andy Kessler was co-founder and President of Velocity Capital Management, an investment firm based in Palo Alto, California, that provided funding for private and public technology and communications companies. Private investments included Real Networks, Inktomi, Alteon WebSystems, Centillium and Silicon Image.

pages: 323 words: 92,135

Running Money by Andy Kessler

Alan Greenspan, Andy Kessler, Apple II, bioinformatics, Bob Noyce, British Empire, business intelligence, buy and hold, buy low sell high, call centre, Charles Babbage, Corn Laws, cotton gin, Douglas Engelbart, Fairchild Semiconductor, family office, flying shuttle, full employment, General Magic , George Gilder, happiness index / gross national happiness, interest rate swap, invisible hand, James Hargreaves, James Watt: steam engine, joint-stock company, joint-stock limited liability company, junk bonds, knowledge worker, Leonard Kleinrock, Long Term Capital Management, mail merge, Marc Andreessen, margin call, market bubble, Mary Meeker, Maui Hawaii, Menlo Park, Metcalfe’s law, Michael Milken, Mitch Kapor, Network effects, packet switching, pattern recognition, pets.com, railway mania, risk tolerance, Robert Metcalfe, Sand Hill Road, Silicon Valley, South China Sea, spinning jenny, Steve Jobs, Steve Wozniak, Suez canal 1869, Toyota Production System, TSMC, UUNET, zero-sum game

See Internet Western Digital, 128 Whitaker Investments, 176 Whitney, Eli, 67 wide area networks, 188, 199 Wilkinson, John, 51–52, 56–57, 78, 101, 268 William Morris Agency, 196 Windows, 197, 247, 259, 274, 276, 277 Winnick, Gary, 183, 187, 290 Winstar, 179 Wintel, 265, 277 wireless technology, 179, 296 worker training, 122 World Bank, 264 WorldCom, 225, 290 Worldtalk, 106 Wozniak, Steve, 128 Wynn, Steve, 50 Xanadu, 118 Xerox PARC (Palo Alto Research Center), 118, 189, 190–91 Xilinx, 130, 131 Yahoo, 92, 93, 136, 143, 223, 247 Yamaichi, 160 Yamamoto, Takatoshi, 154–61 yen-carry trade, 162–65, 168, 292 Z80 home computer, 127 Zilog, 127 Zona, Hank, 131 Zoran, 96 About the Author Andy Kessler is the author of the book that rippled through the financial world, Wall Street Meat: My Narrow Escape from the Stock Market Grinder. He has written for the Wall Street Journal, Forbes, TheStreet.com and the American Spectator, and appeared on CNBC, CNN, Nightline and Dateline NBC. He lives in northern California. Visit www.AuthorTracker.com for exclusive information on your favorite HarperCollins author. ALSO BY ANDY KESSLER Wall Street Meat Credits Designed by Nancy Singer Copyright RUNNING MONEY. Copyright © 2004 by Andy Kessler. All rights reserved under International and Pan-American Copyright Conventions.

…

> > > Running Money > > > > Hedge Fund Honchos, Monster Markets and My Hunt for the Big Score > > > > > Andy Kessler For Nancy and our bookends, Kyle and Brett, and our books, Kur t and R yan > > > Contents Ssangyong Sweat 1 Part I Raising Funds 7 Part II Revolution 37 Part III Searching for Scale 87 Part IV Intellectual Property 115 Part V The Next Barrier 173 Part VI Burst 221 Part VII The Margin Surplus 231 Part VIII Epilogue 285 Acknowledgments 297 Index 299 About the Author Other Books by Andy Kessler Credits Cover Copyright About the Publisher > > > Ssangyong Sweat This market really sucks.

pages: 165 words: 47,193

The End of Work: Why Your Passion Can Become Your Job by John Tamny

Albert Einstein, Andy Kessler, Apollo 13, asset allocation, barriers to entry, basic income, Bernie Sanders, cloud computing, commoditize, David Ricardo: comparative advantage, do what you love, Downton Abbey, future of work, George Gilder, haute cuisine, income inequality, Jeff Bezos, knowledge economy, Larry Ellison, Mark Zuckerberg, Palm Treo, Peter Thiel, profit motive, Saturday Night Live, Silicon Valley, Stephen Hawking, Steve Ballmer, Steve Jobs, There's no reason for any individual to have a computer in his home - Ken Olsen, trickle-down economics, universal basic income, upwardly mobile, Yogi Berra

CONTENTS FOREWORD INTRODUCTION CHAPTER ONE Why College Football Players Should Major in College Football CHAPTER TWO Intelligence and Passion Don’t Stop at Football CHAPTER THREE Education Isn’t Meaningless, But It’s Grossly Overrated CHAPTER FOUR What Was Once Silly Is Now Serious CHAPTER FIVE Abundant Profits Make Possible the Work That Isn’t CHAPTER SIX The Millennial Generation Will Be the Richest Yet—Until the Next One CHAPTER SEVEN My Story CHAPTER EIGHT The “Venture Buyer” CHAPTER NINE Why We Need People with Money to Burn CHAPTER TEN Love Your Robot, Love Your Job CHAPTER ELEVEN Come Inside and Turn on the Xbox, You Have Work to Do ACKNOWLEDGMENTS NOTES FOREWORD Andy Kessler What do you do? We all get asked this at meetings, interviews, cocktail parties, everywhere. It’s almost as if the person asking is trying to put you in some cubby and figure out how you tick by branding you as a certain type of person, which magically unlocks the mystery to your personality.

…

Our productive lives become a blessing rather than a burden. And every one of us contributes, not just some self-selected elite. Wealth gets created for a wider and wider swath of workers, rather than distributed by policy wonks. Once you think, any job is possible. And it won’t feel like a job. Get ready for a life of adventure. Andy Kessler, the co-founder and former president of Velocity Capital Management, is the author of Eat People: And Other Unapologetic Rules for Game-Changing Entrepreneurs. INTRODUCTION “Man’s work begins with his job; his profession. Having a vocation is something of a miracle, like falling in love.”1 —Hyman Rickover In the fall of 2014, my wife and I attended a Fleetwood Mac concert in Washington, D.C.

…

Dvorak, “Apple should pull the plug on the iPhone,” MarketWatch, March 28, 2007, https://www.marketwatch.com/story/apple-should-pull-the-plug-on-the-iphone. 9.MacDailyNews, “RIM half-CEO doesn’t see threat from Apple’s iPhone,” February 12, 2007. 10.Gregory Korte, “Through executive orders, Obama tests power as purchaser-in-chief,” USA Today, October 11, 2015. 11.Andy Kessler, “Robots, 3-D Printers and Other Looming Innovations,” Wall Street Journal, August 7, 2013. 12.Stewart Wolpin, “Commercial GPS Turns 25: How the Unwanted Military Tech Found Its True Calling,” Mashable, May 25, 2014. 13.Steven F. Hayward, The Age of Reagan: The Fall of the Old Liberal Order (Roseville, Calif.: Forum, 2001), 290. 14.Ibid., 7. 15.

pages: 290 words: 83,248

The Greed Merchants: How the Investment Banks Exploited the System by Philip Augar

Alan Greenspan, Andy Kessler, AOL-Time Warner, barriers to entry, Bear Stearns, Berlin Wall, Big bang: deregulation of the City of London, Bonfire of the Vanities, business cycle, buttonwood tree, buy and hold, capital asset pricing model, Carl Icahn, commoditize, corporate governance, corporate raider, crony capitalism, cross-subsidies, deal flow, equity risk premium, financial deregulation, financial engineering, financial innovation, fixed income, Glass-Steagall Act, Gordon Gekko, high net worth, information retrieval, interest rate derivative, invisible hand, John Meriwether, junk bonds, Long Term Capital Management, low interest rates, Martin Wolf, Michael Milken, new economy, Nick Leeson, offshore financial centre, pensions crisis, proprietary trading, regulatory arbitrage, risk free rate, Sand Hill Road, shareholder value, short selling, Silicon Valley, South Sea Bubble, statistical model, systematic bias, Telecommunications Act of 1996, The Chicago School, The Predators' Ball, The Wealth of Nations by Adam Smith, transaction costs, tulip mania, value at risk, yield curve

., America’s second largest long-distance telecommunications carrier before it went bankrupt in July 2002,37 alleged how spinning worked: ‘Since 1996, Salomon repeatedly allocated thousands of hot IPO shares to the same top executives of the same telecommunications companies. In return, these executives, who were all in the position to determine or influence the selection of their company’s financial advisers or underwriters, repeatedly directed to Salomon investment banking business worth many millions of dollars.’38 Laddering was a variation on the theme. Andy Kessler, a former investment analyst and hedge fund manager, explained how it worked: ‘Fund managers promised to buy more IPO shares in the open market on the first day of an IPO to ladder the deal, causing or perhaps just perpetuating the first day pop in the share price.’39 As their losses mounted and details emerged of the investment banks’ duplicity, the investing public got very angry.

…

But history shows that it pays to be sceptical with the investment banks. Indeed one of the handful of top executives at one of America’s leading investment banks told me: ‘Going forward, Spitzer’s reforms will turn out a complete failure. He could have gone for structure but didn’t. Keeping Spitzer away from the model was an extraordinary management achievement.’7 Andy Kessler, the former analyst and fund manager, was equally forthright: ‘It seems to me that Wall Street management reached into the pockets of their shareholders and paid big fines so they could keep the status quo.’8 The survival of integration beyond the global settlement, the role it played in the scandals during the last years of the twentieth century and the potential it leaves for future problems therefore make it essential to understand fully how it works.

…

Naive, foolish, cynical or greedy analysts had talked the market up at a time when cool, clear, conflict-free thinking might have prevented the excesses. If ever a group of professionals missed a chance to justify their existence and compensation, this was surely it. The investment bankers must also bear some responsibility. They brought many companies to the market that lacked a track record or a viable business plan. Andy Kessler, who moved from Morgan Stanley’s research department to the venture capital industry on the West Coast, believed that the investment bankers lowered their standards after the Netscape IPO of 1995: ‘Investment bankers used to insist on two consecutive quarters of profits before taking a company public.

pages: 272 words: 64,626

Eat People: And Other Unapologetic Rules for Game-Changing Entrepreneurs by Andy Kessler

23andMe, Abraham Maslow, Alan Greenspan, Andy Kessler, bank run, barriers to entry, Bear Stearns, behavioural economics, Berlin Wall, Bob Noyce, bread and circuses, British Empire, business cycle, business process, California gold rush, carbon credits, carbon footprint, Cass Sunstein, cloud computing, collateralized debt obligation, collective bargaining, commoditize, computer age, Cornelius Vanderbilt, creative destruction, disintermediation, Douglas Engelbart, Dutch auction, Eugene Fama: efficient market hypothesis, fiat currency, Firefox, Fractional reserve banking, George Gilder, Gordon Gekko, greed is good, income inequality, invisible hand, James Watt: steam engine, Jeff Bezos, job automation, Joseph Schumpeter, junk bonds, Kickstarter, knowledge economy, knowledge worker, Larry Ellison, libertarian paternalism, low skilled workers, Mark Zuckerberg, McMansion, Michael Milken, Money creation, Netflix Prize, packet switching, personalized medicine, pets.com, prediction markets, pre–internet, profit motive, race to the bottom, Richard Thaler, risk tolerance, risk-adjusted returns, Silicon Valley, six sigma, Skype, social graph, Steve Jobs, The Wealth of Nations by Adam Smith, transcontinental railway, transfer pricing, vertical integration, wealth creators, Yogi Berra

Stephen’s Green, Dublin 2, Ireland (a division of Penguin Books Ltd); Penguin Books Australia Ltd, 250 Camberwell Road, Camberwell, Victoria 3124, Australia (a division of Pearson Australia Group Pty Ltd); Penguin Books India Pvt Ltd, 11 Community Centre, Panchsheel Park, New Delhi – 110 017, India; Penguin Group (NZ), 67 Apollo Drive, Rosedale, North Shore 0632, New Zealand (a division of Pearson New Zealand Ltd); Penguin Books (South Africa) (Pty) Ltd, 24 Sturdee Avenue, Rosebank, Johannesburg 2196, South Africa Penguin Books Ltd, Registered Offices: 80 Strand, London WC2R ORL, England First published in 2011 by Portfolio / Penguin, a member of Penguin Group (USA) Inc. Copyright © Andy Kessler, 2011 All rights reserved LIBRARY OF CONGRESS CATALOGING IN PUBLICATION DATA Kessler, Andy. Eat people : unapologetic rules for entrepreneurial success / Andy Kessler. p. cm. Includes index. eISBN : 978-1-101-47562-1 1. Entrepreneurship. 2. Technological innovations—Economic aspects. 3. New products. 4. Value. 5. Economics. I. Title. HB615.K396 2011 658.4’09—dc22 2010039727 Set in Minion Without limiting the rights under copyright reserved above, no part of this publication may be reproduced, stored in or introduced into a retrieval system, or transmitted, in any form or by any means (electronic, mechanical, photocopying, recording or otherwise), without the prior written permission of both the copyright owner and the above publisher of this book.

pages: 308 words: 84,713

The Glass Cage: Automation and Us by Nicholas Carr

Airbnb, Airbus A320, Andy Kessler, Atul Gawande, autonomous vehicles, Bernard Ziegler, business process, call centre, Captain Sullenberger Hudson, Charles Lindbergh, Checklist Manifesto, cloud computing, cognitive load, computerized trading, David Brooks, deep learning, deliberate practice, deskilling, digital map, Douglas Engelbart, driverless car, drone strike, Elon Musk, Erik Brynjolfsson, Evgeny Morozov, Flash crash, Frank Gehry, Frank Levy and Richard Murnane: The New Division of Labor, Frederick Winslow Taylor, future of work, gamification, global supply chain, Google Glasses, Google Hangouts, High speed trading, human-factors engineering, indoor plumbing, industrial robot, Internet of things, Ivan Sutherland, Jacquard loom, James Watt: steam engine, job automation, John Maynard Keynes: Economic Possibilities for our Grandchildren, John Maynard Keynes: technological unemployment, Kevin Kelly, knowledge worker, low interest rates, Lyft, machine readable, Marc Andreessen, Mark Zuckerberg, means of production, natural language processing, new economy, Nicholas Carr, Norbert Wiener, Oculus Rift, pattern recognition, Peter Thiel, place-making, plutocrats, profit motive, Ralph Waldo Emerson, RAND corporation, randomized controlled trial, Ray Kurzweil, recommendation engine, robot derives from the Czech word robota Czech, meaning slave, scientific management, Second Machine Age, self-driving car, Silicon Valley, Silicon Valley ideology, software is eating the world, Stephen Hawking, Steve Jobs, systems thinking, tacit knowledge, TaskRabbit, technological determinism, technological solutionism, technoutopianism, TED Talk, The Wealth of Nations by Adam Smith, turn-by-turn navigation, Tyler Cowen, US Airways Flight 1549, Watson beat the top human players on Jeopardy!, William Langewiesche

He pointed to aviation as an example: “A computerized brain known as the autopilot can fly a 787 jet unaided, but irrationally we place human pilots in the cockpit to babysit the autopilot ‘just in case.’ ”1 The news that a person was driving the Google car that crashed in 2011 prompted a writer at a prominent technology blog to exclaim, “More robo-drivers!”2 Commenting on the struggles of Chicago’s public schools, Wall Street Journal writer Andy Kessler remarked, only half-jokingly, “Why not forget the teachers and issue all 404,151 students an iPad or Android tablet?”3 In a 2012 essay, the respected Silicon Valley venture capitalist Vinod Khosla suggested that health care will be much improved when medical software—which he dubs “Doctor Algorithm”—goes from assisting primary-care physicians in making diagnoses to replacing the doctors entirely.

…

Chapter Seven: AUTOMATION FOR THE PEOPLE 1.Kevin Kelly, “Better than Human: Why Robots Will—and Must—Take Our Jobs,” Wired, January 2013. 2.Jay Yarow, “Human Driver Crashes Google’s Self Driving Car,” Business Insider, August 5, 2011, businessinsider.com/googles-self-driving-cars-get-in-their-first-accident-2011-8. 3.Andy Kessler, “Professors Are About to Get an Online Education,” Wall Street Journal, June 3, 2013. 4.Vinod Khosla, “Do We Need Doctors or Algorithms?,” TechCrunch, January 10, 2012, techcrunch.com/2012/01/10/doctors-or-algorithms. 5.Gerald Traufetter, “The Computer vs. the Captain: Will Increasing Automation Make Jets Less Safe?

pages: 393 words: 91,257

The Coming of Neo-Feudalism: A Warning to the Global Middle Class by Joel Kotkin

"RICO laws" OR "Racketeer Influenced and Corrupt Organizations", "World Economic Forum" Davos, Admiral Zheng, Alvin Toffler, Andy Kessler, autonomous vehicles, basic income, Bernie Sanders, Big Tech, bread and circuses, Brexit referendum, call centre, Capital in the Twenty-First Century by Thomas Piketty, carbon credits, carbon footprint, Cass Sunstein, clean water, company town, content marketing, Cornelius Vanderbilt, creative destruction, data science, deindustrialization, demographic transition, deplatforming, don't be evil, Donald Trump, driverless car, edge city, Elon Musk, European colonialism, Evgeny Morozov, financial independence, Francis Fukuyama: the end of history, Future Shock, gentrification, gig economy, Gini coefficient, Google bus, Great Leap Forward, green new deal, guest worker program, Hans Rosling, Herbert Marcuse, housing crisis, income inequality, informal economy, Jane Jacobs, Jaron Lanier, Jeff Bezos, Jeremy Corbyn, job automation, job polarisation, job satisfaction, Joseph Schumpeter, land reform, liberal capitalism, life extension, low skilled workers, Lyft, Marc Benioff, Mark Zuckerberg, market fundamentalism, Martin Wolf, mass immigration, megacity, Michael Shellenberger, Nate Silver, new economy, New Urbanism, Northpointe / Correctional Offender Management Profiling for Alternative Sanctions, Occupy movement, Parag Khanna, Peter Thiel, plutocrats, post-industrial society, post-work, postindustrial economy, postnationalism / post nation state, precariat, profit motive, public intellectual, RAND corporation, Ray Kurzweil, rent control, Richard Florida, road to serfdom, Robert Gordon, Salesforce, Sam Altman, San Francisco homelessness, Satyajit Das, sharing economy, Sidewalk Labs, Silicon Valley, smart cities, Social Justice Warrior, Steve Jobs, Stewart Brand, superstar cities, technological determinism, Ted Nordhaus, The Death and Life of Great American Cities, The future is already here, The Future of Employment, The Rise and Fall of American Growth, Thomas L Friedman, too big to fail, trade route, Travis Kalanick, Uber and Lyft, uber lyft, universal basic income, unpaid internship, upwardly mobile, Virgin Galactic, We are the 99%, Wolfgang Streeck, women in the workforce, work culture , working-age population, Y Combinator

.: Belknap/Harvard, 2014), 174; “Richest people in the world,” CBS News, https://www.cbsnews.com/pictures/richest-people-in-world-forbes/12/. 12 Carter Coudriet, “13 Under 40: Here Are The Youngest Billionaires On The Forbes 400 2019,” Forbes, October 31, 2019, https://www.forbes.com/sites/cartercoudriet/2019/10/02/forbes-400-youngest-under-40-zuckerberg-spiegel/#7fd35f5a5a0e. 13 Sally French, “China has 9 of the world’s 20 biggest companies,” Market Watch, May 31, 2018, https://www.marketwatch.com/story/china-has-9-of-the-worlds-20-biggest-tech-companies-2018-05-31. 14 Farhad Manjoo, “Tech’s ‘Frightful 5’ Will Dominate Digital Life for Foreseeable Future,” New York Times, January 20, 2016, https://www.nytimes.com/2016/01/21/technology/techs-frightful-5-will-dominate-digital-life-for-foreseeable-future.html; Dana Mattioli, “Takeovers Roar to Life as Companies Hear Footsteps From Tech Giants,” Wall Street Journal, November 20, 2017, https://www.wsj.com/articles/takeovers-roar-to-life-as-companies-hear-footsteps-from-tech-giants-1511200327. 15 “Why startups are leaving Silicon Valley,” Economist, August 30, 2018, https://www.economist.com/leaders/2018/08/30/why-startups-are-leaving-silicon-valley; Rex Crum, “Let’s make a deal: SV150 firms spent $41 billion on acquisitions in 2016,” Mercury News, May 1, 2017, https://www.mercurynews.com/2017/05/01/lets-make-a-deal-acquisitions-were-all-over-the-sv150-in-2016/; “Too much of a good thing,” Economist, March 26, 2016, https://www.economist.com/brieing/2016/03/26/too-much-of-a-good-thing. 16 Christopher Mims, “Why Free Is Too High a Price for Facebook and Google,” Wall Street Journal, June 8, 2019, https://www.wsj.com/articles/why-free-is-too-high-a-price-for-facebook-and-google-11559966411; Andy Kessler, “Antitrust Can’t Catch Big Tech,” Wall Street Journal, September 14, 2019, https://www.wsj.com/articles/antitrust-cant-catch-big-tech-11568577387; David Dayen, “Trump’s Antitrust Cops Fail to Police Big Business—Again,” American Prospect, July 24, 2019, https://prospect.org/power/trump-s-antitrust-cops-fail-police-big-business-again/; Andrew Orlowski, “Google had Obama’s ear during antitrust probe,” Register, August 18, 2016, https://www.theregister.co.uk/2016/08/18/google_had_obamas_ear_on_antitrust_probe/. 17 Bryan Clark, “Facebook’s new ‘early bird’ spy tool is just tip of the iceberg,” Next Web, August 10, 2017, https://thenextweb.com/insider/2017/08/10/facebooks-new-early-bird-spy-tool-is-just-the-tip-of-the-iceberg/#; Betsy Morris and Deepa Seetharaman, “The New Copycats: How Facebook Squashes Competition from Startups,” Wall Street Journal, August 9, 2017, https://www.wsj.com/articles/the-new-copycats-how-facebook-squashes-competition-from-startups-1502293444. 18 Crunchbase, Google Acquisitions, updated January 15, 2020, https://wwwcrunchbase.com/organization/google/acquisitions/acquisitions_list#section-acquisitions; Ben Popper, “Failure is a feature: how Google stays sharp gobbling up startups,” The Verge, September 17, 2012, https://www.theverge.com/2012/9/17/3322854/google-startup-mergers-acquisitions-failure-is-a-feature; Tim Wu and Stuart A.

…

Wall Street Journal, October 3, 2018, https://www.wsj.com/articles/ben-franklin-who-1538608727; Colleen Flaherty, “The Vanishing History Major,” Inside Higher Ed, November 27, 2018, https://www.insidehighered.com/news/2018/11/27/new-analysis-history-major-data-says-ield-new-low-can-it-be-saved. 32 Henri Pirenne, Mohammed and Charlemagne (Cleveland: Meridian, 1957), 118; Roderick Seidenberg, Post-historic Man: An Inquiry (New York: Viking, 1974), 179. 33 Glenn Harlan Reynolds, “Robert Zubrin makes ‘The Case for Space,’” USA Today, May 7, 2019, https://www.usatoday.com/story/opinion/2019/05/07/spacex-blue-origin-virgin-galactic-robert-zubrin-case-space-column/1119446001/. 34 David Pilling, Bending Adversity: Japan and the Art of Survival (New York: Penguin, 2014), 119, 177–79; Karel van Wolferen, The Enigma of Japanese Power: People and Politics in a Stateless Nation (New York: Knopf, 1989), 2–3. 35 Andy Kessler, “Zuckerberg’s Opiate for the Masses,” Wall Street Journal, June 18, 2017, https://www.wsj.com/articles/zuckerbergs-opiate-for-the-masses-1497821885. 36 Catherine Clifford, “About half of Americans support giving residents up to $2000 a month when robots take their jobs,” CNBC, December 19, 2016, https://www.cnbc.com/2016/12/19/about-half-of-americans-support-giving-residents-up-to-2000-a-month-when-robots-take-our-jobs.html. 37 Patrick Hoare, “European Social Survey (ESS) reveal findings about attitudes toward Universal Basic Income across Europe,” Basic Income, January 20, 2018, https://basicincome.org/news/2018/01/europe-european-social-survey-ess-reveal-findings-attitudes-toward-universal-basic-income-across-europe/; Andrew Russell, “What Do Canadians think of basic income?

pages: 185 words: 43,609

Zero to One: Notes on Startups, or How to Build the Future by Peter Thiel, Blake Masters

Airbnb, Alan Greenspan, Albert Einstein, Andrew Wiles, Andy Kessler, Berlin Wall, clean tech, cloud computing, crony capitalism, discounted cash flows, diversified portfolio, do well by doing good, don't be evil, Elon Musk, eurozone crisis, Fairchild Semiconductor, heat death of the universe, income inequality, Jeff Bezos, Larry Ellison, Lean Startup, life extension, lone genius, Long Term Capital Management, Lyft, Marc Andreessen, Mark Zuckerberg, Max Levchin, minimum viable product, Nate Silver, Network effects, new economy, Nick Bostrom, PalmPilot, paypal mafia, Peter Thiel, pets.com, power law, profit motive, Ralph Waldo Emerson, Ray Kurzweil, self-driving car, shareholder value, Sheryl Sandberg, Silicon Valley, Silicon Valley startup, Singularitarianism, software is eating the world, Solyndra, Steve Jobs, strong AI, Suez canal 1869, tech worker, Ted Kaczynski, Tesla Model S, uber lyft, Vilfredo Pareto, working poor

Dale Earnhardt Jr. needn’t feel threatened by them, but the Guardian worries (on behalf of the millions of chauffeurs and cabbies in the world) that self-driving cars “could drive the next wave of unemployment.” Everyone expects computers to do more in the future—so much more that some wonder: 30 years from now, will there be anything left for people to do? “Software is eating the world,” venture capitalist Marc Andreessen has announced with a tone of inevitability. VC Andy Kessler sounds almost gleeful when he explains that the best way to create productivity is “to get rid of people.” Forbes captured a more anxious attitude when it asked readers: Will a machine replace you? Futurists can seem like they hope the answer is yes. Luddites are so worried about being replaced that they would rather we stop building new technology altogether.

pages: 444 words: 151,136

Endless Money: The Moral Hazards of Socialism by William Baker, Addison Wiggin

Alan Greenspan, Andy Kessler, asset allocation, backtesting, bank run, banking crisis, Bear Stearns, Berlin Wall, Bernie Madoff, Black Swan, bond market vigilante , book value, Branko Milanovic, bread and circuses, break the buck, Bretton Woods, BRICs, business climate, business cycle, capital asset pricing model, carbon tax, commoditize, corporate governance, correlation does not imply causation, credit crunch, Credit Default Swap, crony capitalism, cuban missile crisis, currency manipulation / currency intervention, debt deflation, Elliott wave, en.wikipedia.org, Fall of the Berlin Wall, feminist movement, fiat currency, fixed income, floating exchange rates, foreign exchange controls, Fractional reserve banking, full employment, German hyperinflation, Great Leap Forward, housing crisis, income inequality, index fund, inflation targeting, Joseph Schumpeter, Kickstarter, laissez-faire capitalism, land bank, land reform, liquidity trap, Long Term Capital Management, lost cosmonauts, low interest rates, McMansion, mega-rich, military-industrial complex, Money creation, money market fund, moral hazard, mortgage tax deduction, naked short selling, negative equity, offshore financial centre, Ponzi scheme, price stability, proprietary trading, pushing on a string, quantitative easing, RAND corporation, rent control, rent stabilization, reserve currency, risk free rate, riskless arbitrage, Ronald Reagan, Savings and loan crisis, school vouchers, seigniorage, short selling, Silicon Valley, six sigma, statistical arbitrage, statistical model, Steve Jobs, stocks for the long run, Tax Reform Act of 1986, The Great Moderation, the scientific method, time value of money, too big to fail, Two Sigma, upwardly mobile, War on Poverty, Yogi Berra, young professional

Many if not most may still be nationalized should the crisis worsen beyond the assumptions of the not-so-stressful “stress test” regulators conducted in early 2009. Here is where Limbaugh veers away from conservatism: He quotes former hedge fund manager and Morgan Stanley semiconductor analyst Andy Kessler, who projects that the U.S. government will profit by as much as $2.2 trillion from its ownership of mortgages and derivatives obtained through the GSEs and the TARP bailout facility. Kessler may indeed be correct, and he hints that this would happen because “. . . the Treasury and the Federal Reserve get to cheat . . . with lots of levers (they) can and will pump capital into the U.S. economy to get it moving again.

…

Information sourced from the CCH Standard Federal Tax Reporter, a Notes 12. 13. 14. 15. 16. 17. 391 Walters Kluwer business. http://dontmesswithtaxes.typepad.com/dont_mess_ with_taxes/2008/04/the-out-of-cont.html. Limbaugh, Rush, Who Do You Trust?, Opening Monologue: September 25, 2008, http://www.rushlimbaugh.com/home/daily/site_092508/content/ 01125108.guest.html. Ibid. Andy Kessler, “The Paulson Plan Will Make Money for Taxpayers,” Wall Street Journal, September 25, 2008, http://online.wsj.com/article/ SB122230704116773989.html?mod=googlenews_wsj. Rush, Limbaugh, Who Do You Trust?, Opening Monologue: September 25, 2008, http://www.rushlimbaugh.com/home/daily/site_092508/content/ 01125108.guest.html.

pages: 176 words: 55,819

The Start-Up of You: Adapt to the Future, Invest in Yourself, and Transform Your Career by Reid Hoffman, Ben Casnocha

Airbnb, Andy Kessler, Apollo 13, Benchmark Capital, Black Swan, business intelligence, Cal Newport, Clayton Christensen, commoditize, David Brooks, Donald Trump, Dunbar number, en.wikipedia.org, fear of failure, follow your passion, future of work, game design, independent contractor, information security, Jeff Bezos, job automation, Joi Ito, late fees, lateral thinking, Marc Andreessen, Mark Zuckerberg, Max Levchin, Menlo Park, out of africa, PalmPilot, Paul Graham, paypal mafia, Peter Thiel, public intellectual, recommendation engine, Richard Bolles, risk tolerance, rolodex, Salesforce, shareholder value, Sheryl Sandberg, side project, Silicon Valley, Silicon Valley startup, social web, Steve Jobs, Steve Wozniak, the strength of weak ties, Tony Hsieh, transaction costs, Tyler Cowen

Consider the Social Security tax that comes out of your paycheck like you would a loan to a second cousin who has a drug problem—you might get paid back, but don’t count on it. 5. “Cost-Cutting Strategies in the Downturn: A Delicate Balancing Act,” May 2009, http://www.towerswatson.com/assets/pdf/610/CostCutting-RB_12–29–09.pdf 6. Andy Kessler, “Is Your Job an Endangered Species?” Wall Street Journal, February 17, 2011, http://online.wsj.com/article/SB10001424052748703439504576116340050218236.html 7. See the links in Will Wilkinson’s discussion, “Are ATMs Stealing Jobs?” The Economist, June 15, 2011, http://www.economist.com/blogs/democracyinamerica/2011/06/technology-and-unemployment 8.

pages: 330 words: 91,805

Peers Inc: How People and Platforms Are Inventing the Collaborative Economy and Reinventing Capitalism by Robin Chase

Airbnb, Amazon Web Services, Andy Kessler, Anthropocene, Apollo 13, banking crisis, barriers to entry, basic income, Benevolent Dictator For Life (BDFL), bike sharing, bitcoin, blockchain, Burning Man, business climate, call centre, car-free, carbon tax, circular economy, cloud computing, collaborative consumption, collaborative economy, collective bargaining, commoditize, congestion charging, creative destruction, crowdsourcing, cryptocurrency, data science, deal flow, decarbonisation, different worldview, do-ocracy, don't be evil, Donald Shoup, Elon Musk, en.wikipedia.org, Ethereum, ethereum blockchain, Eyjafjallajökull, Ferguson, Missouri, Firefox, Free Software Foundation, frictionless, Gini coefficient, GPS: selective availability, high-speed rail, hive mind, income inequality, independent contractor, index fund, informal economy, Intergovernmental Panel on Climate Change (IPCC), Internet of things, Jane Jacobs, Jeff Bezos, jimmy wales, job satisfaction, Kickstarter, Kinder Surprise, language acquisition, Larry Ellison, Lean Startup, low interest rates, Lyft, machine readable, means of production, megacity, Minecraft, minimum viable product, Network effects, new economy, Oculus Rift, off-the-grid, openstreetmap, optical character recognition, pattern recognition, peer-to-peer, peer-to-peer lending, peer-to-peer model, Post-Keynesian economics, Richard Stallman, ride hailing / ride sharing, Ronald Coase, Ronald Reagan, Salesforce, Satoshi Nakamoto, Search for Extraterrestrial Intelligence, self-driving car, shareholder value, sharing economy, Silicon Valley, six sigma, Skype, smart cities, smart grid, Snapchat, sovereign wealth fund, Steve Crocker, Steve Jobs, Steven Levy, TaskRabbit, The Death and Life of Great American Cities, The Future of Employment, the long tail, The Nature of the Firm, Tragedy of the Commons, transaction costs, Turing test, turn-by-turn navigation, Uber and Lyft, uber lyft, vertical integration, Zipcar

“Taxicab,” Wikipedia, http://en.wikipedia.org/wiki/Taxicab. 13. “Taxicabs of the United Kingdom,” Wikipedia, http://en.wikipedia.org/wiki/Taxicabs_of_the_United_Kingdom#cite_note-The_Knowledge-3. 14. Jeff Bercovici, “Uber’s Ratings Terrorize Drivers and Trick Riders. Why Not Fix Them?” Forbes.com, August 14, 2014. 15. Andy Kessler, “Brian Chesky: The ‘Sharing Economy’ and Its Enemies,” Wall Street Journal, January 17, 2014. 16. “Freelancing in America: A National Survey of the New Workforce,” 2014, independent study commissioned by the Freelancers Union and ElanceoDesk, http://chaoscc.ro/wp-content/uploads/2014/09/freelancinginamerica_report-1.pdf. 17.

pages: 146 words: 43,446

The New New Thing: A Silicon Valley Story by Michael Lewis

Alan Greenspan, Albert Einstein, Andy Kessler, Benchmark Capital, business climate, classic study, creative destruction, data acquisition, Fairchild Semiconductor, family office, high net worth, invention of the steam engine, invisible hand, Ivan Sutherland, Jeff Bezos, Larry Ellison, Marc Andreessen, Mary Meeker, Menlo Park, PalmPilot, pre–internet, risk tolerance, Sand Hill Road, Silicon Valley, Silicon Valley startup, tech worker, the new new thing, Thorstein Veblen, wealth creators, Y2K

"Hyperion is a beautiful boat," he said, and I knew when he said it what the next word would be. "But..." His finger traced the lines of his new boat, which was still no more than a figment of his imagination. Pure possibility. A smile lengthened across his face. Hyperion was nice, but this... this was the perfect boat. Page 269 Acknowledgments Andy Kessler and Fred Kittler introduced me to the Valley, and helped make this book what it is. Jim and Nancy Rutter Clark put up with a writer in ways that no one should have to. Clark has made a career of taking risks others avoid. He took another when he let me talk my way into his life, and I'll always be grateful for that.

pages: 347 words: 97,721

Only Humans Need Apply: Winners and Losers in the Age of Smart Machines by Thomas H. Davenport, Julia Kirby

"World Economic Forum" Davos, AI winter, Amazon Robotics, Andy Kessler, Apollo Guidance Computer, artificial general intelligence, asset allocation, Automated Insights, autonomous vehicles, basic income, Baxter: Rethink Robotics, behavioural economics, business intelligence, business process, call centre, carbon-based life, Clayton Christensen, clockwork universe, commoditize, conceptual framework, content marketing, dark matter, data science, David Brooks, deep learning, deliberate practice, deskilling, digital map, disruptive innovation, Douglas Engelbart, driverless car, Edward Lloyd's coffeehouse, Elon Musk, Erik Brynjolfsson, estate planning, financial engineering, fixed income, flying shuttle, follow your passion, Frank Levy and Richard Murnane: The New Division of Labor, Freestyle chess, game design, general-purpose programming language, global pandemic, Google Glasses, Hans Lippershey, haute cuisine, income inequality, independent contractor, index fund, industrial robot, information retrieval, intermodal, Internet of things, inventory management, Isaac Newton, job automation, John Markoff, John Maynard Keynes: Economic Possibilities for our Grandchildren, John Maynard Keynes: technological unemployment, Joi Ito, Khan Academy, Kiva Systems, knowledge worker, labor-force participation, lifelogging, longitudinal study, loss aversion, machine translation, Mark Zuckerberg, Narrative Science, natural language processing, Nick Bostrom, Norbert Wiener, nuclear winter, off-the-grid, pattern recognition, performance metric, Peter Thiel, precariat, quantitative trading / quantitative finance, Ray Kurzweil, Richard Feynman, risk tolerance, Robert Shiller, robo advisor, robotic process automation, Rodney Brooks, Second Machine Age, self-driving car, Silicon Valley, six sigma, Skype, social intelligence, speech recognition, spinning jenny, statistical model, Stephen Hawking, Steve Jobs, Steve Wozniak, strong AI, superintelligent machines, supply-chain management, tacit knowledge, tech worker, TED Talk, the long tail, transaction costs, Tyler Cowen, Tyler Cowen: Great Stagnation, Watson beat the top human players on Jeopardy!, Works Progress Administration, Zipcar

Two More Fields, Same Five Steps Now that you’ve got a clear understanding of the difference in the five ways of stepping, let’s think about how they translate to a couple of other realms of knowledge work: teaching and financial advising. As we’ve already noted, teachers are threatened in their roles as personalized curriculum designers and transmitters of content; technology can do both of these functions quite well. While some rabble-rousers (notably Andy Kessler, a former hedge fund manager) argue that teachers will (and should) disappear with the rise of these technologies, it’s more likely that teachers’ roles will simply adapt. We’re inclined to believe Thomas Arnett, a researcher on innovation in education, who predicts technology will “automate tasks such as taking attendance, handing back assignments, and checking multiple choice or fill-in-the-blank answers on tests and quizzes”—and even that it will “take care of some basic instruction and give [teachers] real-time data for tailoring lessons to student needs”—but that many aspects of teaching will remain too vital and essentially human to be replaced.14 Teachers who step up in a technology-rich environment will, for example, do the big-picture planning of curriculum units, and the overall questions of what must be taught.

pages: 379 words: 108,129

An Optimist's Tour of the Future by Mark Stevenson

23andMe, Albert Einstein, Alvin Toffler, Andy Kessler, Apollo 11, augmented reality, bank run, Boston Dynamics, carbon credits, carbon footprint, carbon-based life, clean water, computer age, decarbonisation, double helix, Douglas Hofstadter, Dr. Strangelove, Elon Musk, flex fuel, Ford Model T, Future Shock, Great Leap Forward, Gregor Mendel, Gödel, Escher, Bach, Hans Moravec, Hans Rosling, Intergovernmental Panel on Climate Change (IPCC), Internet of things, invention of agriculture, Isaac Newton, Jeff Bezos, Kevin Kelly, Law of Accelerating Returns, Leonard Kleinrock, life extension, Louis Pasteur, low earth orbit, mutually assured destruction, Naomi Klein, Nick Bostrom, off grid, packet switching, peak oil, pre–internet, private spaceflight, radical life extension, Ray Kurzweil, Richard Feynman, Rodney Brooks, Scaled Composites, self-driving car, Silicon Valley, smart cities, social intelligence, SpaceShipOne, stem cell, Stephen Hawking, Steven Pinker, Stewart Brand, strong AI, synthetic biology, TED Talk, the scientific method, Virgin Galactic, Wall-E, X Prize

Why is it that your sister always gets colds but you rarely do? Did Uncle Bob get heart disease due to one burger too many? Was it always written in his code? Or is he the victim of some yet unfound link between eating mustard sandwiches and working in a laundry? Why do some of us develop an allergy to latex? Why can a bee sting send skateboarding legend Andy Kessler into fatal cardiac arrest, but not me – and why is it the more times you’re stung, the more likely you are to develop a potentially fatal allergy? Or to put it another way, how does Keith Richards stay alive? At one end of the scale there are some conditions that are ‘in the genes.’ This is genetic determinism that’s as unforgiving as Richard Dawkins in a bible class.

pages: 405 words: 105,395

Empire of the Sum: The Rise and Reign of the Pocket Calculator by Keith Houston

Ada Lovelace, Alan Turing: On Computable Numbers, with an Application to the Entscheidungsproblem, Andy Kessler, Apollo 11, Apollo 13, Apple II, Bletchley Park, Boris Johnson, Charles Babbage, classic study, clockwork universe, computer age, Computing Machinery and Intelligence, double entry bookkeeping, Edmond Halley, Fairchild Semiconductor, Fellow of the Royal Society, Grace Hopper, human-factors engineering, invention of movable type, invention of the telephone, Isaac Newton, Johann Wolfgang von Goethe, Johannes Kepler, John Markoff, John von Neumann, Jony Ive, Kickstarter, machine readable, Masayoshi Son, Menlo Park, meta-analysis, military-industrial complex, Mitch Kapor, Neil Armstrong, off-by-one error, On the Revolutions of the Heavenly Spheres, orbital mechanics / astrodynamics, pattern recognition, popular electronics, QWERTY keyboard, Ralph Waldo Emerson, Robert X Cringely, side project, Silicon Valley, skunkworks, SoftBank, Steve Jobs, Steve Wozniak, The Home Computer Revolution, the payments system, Turing machine, Turing test, V2 rocket, William Shockley: the traitorous eight, Works Progress Administration, Yom Kippur War

., “Oral History Panel,” 10. 45 Faggin, “Making of the First Microprocessor,” 12. 46 Faggin, “Making of the First Microprocessor,” 13, 17. 47 Faggin, “Making of the First Microprocessor,” 14–15. 48 Faggin, “Making of the First Microprocessor,” 16; “MCS-4 Micro Computer Set Users Manual” (Santa Clara, CA: Intel, March 1973), 4. 49 “The Story of the Intel® 4004” (Santa Clara, CA: Intel), accessed October 8, 2021, https://www.intel.co.uk/content/www/uk/en/history/museum-story-of-intel-4004.html. 50 Faggin et al., “Oral History Panel,” 18–19. 51 “Busicom 141-PF,” IPSJ Computer Museum (Information Processing Society of Japan), accessed October 8, 2021, https://museum.ipsj.or.jp/en/heritage/Busicom_141-PF.html. 52 Andy Kessler, “The Chip That Changed the World,” Wall Street Journal, 2021, https://www.wsj.com/articles/the-chip-that-changed-the-world-microprocessor-computing-transistor-breakthrough-intel-11636903999; “Busicom Catalogue,” n.d., 11. 53 Fields et al., “U.S. Firms Gird for Calculator Battle,” 83. 54 Nicholas Valéry, “Shopping Around for a Calculator,” New Scientist, May 31, 1973, 549. 55 Gerald M.

pages: 373 words: 112,822

The Upstarts: How Uber, Airbnb, and the Killer Companies of the New Silicon Valley Are Changing the World by Brad Stone

Affordable Care Act / Obamacare, Airbnb, Amazon Web Services, Andy Kessler, autonomous vehicles, Ben Horowitz, Benchmark Capital, Boris Johnson, Burning Man, call centre, Chuck Templeton: OpenTable:, collaborative consumption, data science, Didi Chuxing, Dr. Strangelove, driverless car, East Village, fake it until you make it, fixed income, gentrification, Google X / Alphabet X, growth hacking, Hacker News, hockey-stick growth, housing crisis, inflight wifi, Jeff Bezos, John Zimmer (Lyft cofounder), Justin.tv, Kickstarter, Lyft, Marc Andreessen, Marc Benioff, Mark Zuckerberg, Menlo Park, Mitch Kapor, Necker cube, obamacare, PalmPilot, Paul Graham, peer-to-peer, Peter Thiel, power law, race to the bottom, rent control, ride hailing / ride sharing, Ruby on Rails, San Francisco homelessness, Sand Hill Road, self-driving car, semantic web, sharing economy, side project, Silicon Valley, Silicon Valley startup, Skype, SoftBank, South of Market, San Francisco, Startup school, Steve Jobs, TaskRabbit, tech bro, TechCrunch disrupt, Tony Hsieh, transportation-network company, Travis Kalanick, Uber and Lyft, Uber for X, uber lyft, ubercab, Y Combinator, Y2K, Zipcar

“Disrupt Backstage: Travis Kalanick,” YouTube video, June 22, 2011, https://youtu.be/0-uiO-P9yEg. 2. Ilene Lelchuk, “Probe Clears 2 S.F. Elections Officials; Case Against 3rd Remains Unclear,” SFGate, December 12, 2001, http://www.sfgate.com/politics/article/Probe-clears-2-S-F-elections-officials-Case-2841381.php. 3. Andy Kessler, “Travis Kalanick: The Transportation Trustbuster,” Wall Street Journal, January 25, 2013, http://www.wsj.com/articles/SB10001424127887324235104578244231122376480. 4. “Disrupt Backstage: Travis Kalanick,” YouTube video. 5. “Travis Kalanick Startup Lessons from the Jam Pad—Tech Cocktail Startup Mixology,” YouTube video, May 5, 2011, https://youtu.be/VMvdvP02f-Y. 6.

pages: 455 words: 133,322

The Facebook Effect by David Kirkpatrick

"World Economic Forum" Davos, Andy Kessler, AOL-Time Warner, Benchmark Capital, billion-dollar mistake, Burning Man, delayed gratification, demand response, don't be evil, global village, happiness index / gross national happiness, Howard Rheingold, Jeff Bezos, Marc Andreessen, Marc Benioff, Mark Zuckerberg, Marshall McLuhan, Max Levchin, Menlo Park, Network effects, Peter Thiel, rolodex, Salesforce, Sand Hill Road, sharing economy, Sheryl Sandberg, Silicon Valley, Silicon Valley startup, Skype, social graph, social software, social web, SoftBank, Startup school, Steve Ballmer, Steve Jobs, Stewart Brand, the payments system, The Wealth of Nations by Adam Smith, UUNET, Whole Earth Review, winner-take-all economy, Y Combinator, Yochai Benkler

The CEO Page 166 “I want to stress the importance of being young”: Mark Coker, “Start-Up Advice For Entrepreneurs, From Y Combinator Startup School,” Venturebeat, March 26, 2007, http://venturebeat.com/2007/03/26/start-up-advice-for-entrepreneurs-from-y-combinator-start-up-school/ (accessed November 28, 2009). 169 But at the end of March, BusinessWeek’s online edition: Steve Rosenbush, “Facebook’s on the Block,” BusinessWeek, March 28, 2006, http://www.businessweek.com/technology/content/mar2006/tc20060327_215976.htm (accessed November 15, 2009). 170 But to Zuckerberg, what was more significant: Ibid. 171 Another imitator, which launched around the same time in China: Baloun, Inside Facebook, 95. 173 He also quoted a sociologist who speculated: Cassidy, “Me Media.” 174 who he had met while: Lacy, 162. 174 After some negotiation, Zuckerberg: Lacy, 162. 176 A week after the program launched: Rob Walker, “A For-Credit Course,” New York Times, September 30, 2007, http://www.nytimes.com/2007/09/30/magazine/30wwInconsumed-t.html (accessed December 27, 2009). 177 As part of the deal the ad giant: email from Brandee Barker, Facebook public relations, December 11, 2009. 9. 2006 Page 184 Peter Thiel, older but very sympathetic: Lacy, 165. 186 Some nights, unable to sleep: David Kushner, “The Baby Billionaires of Silicon Valley,” Rolling Stone, November 16, 2006, http://rollingstone.com/news/story/12286036/the_baby_billionaires_of_silicon_valley (accessed November 28, 2009). 186 “I hope he doesn’t sell it”: Kevin Colleran, interview with the author. 190 Within about three hours the group’s membership: Tracy Samantha Schmidt, “Inside the Backlash Against Facebook,” Time, September 6, 2006, www.time.com/time/nation/article/0,8599,1532225,00.html (accessed December 11, 2009). 190 And there were about five hundred other protest groups: Brandon Moore, “Student users say new Facebook feed borders on stalking,” Arizona Daily Wildcat, September 8, 2006, http://wildcat.arizona.edu/2.2257/student-users-say-new-facebook-feed-borders-on-stalking-1.177273 (accessed December 11, 2009). 190 “Chuck Norris come save us”: Layla Aslani, “Users Rebel Against Facebook Feature,” Michigan Daily, September 7, 2006, http://www.michigandaily.com/content/users-rebel-against-facebook-feature (accessed December 11, 2009). 190 “You shouldn’t be forced to have a Web log”: Moore, “Student Users.” 190 “I’m really creeped out”: Aslani, “Users Rebel.” 191 But Zuckerberg, in New York on a promotional trip: Andrew Kessler, “Weekend Interview with Facebook’s Mark Zuckerberg,” Wall Street Journal, March 24, 2007, http://www.andykessler.com/andy_kessler/2007/03/wsj_weekend_int.html (accessed December 11, 2009). 10. Privacy Page 200 As one expert in privacy law recently asked: James Grimmelmann, “Saving Facebook,” Iowa Law Review (2009), http://www.law.uiowa.edu/journals/ilr/Issue%20PDFs/ILR_94–4_Grimmelmann.pdf (accessed December 11, 2009). 201 “At every turn, it seems Facebook makes it more difficult”: Marc Rotenberg, “Online Friends At What Price?

pages: 441 words: 136,954

That Used to Be Us by Thomas L. Friedman, Michael Mandelbaum

addicted to oil, Affordable Care Act / Obamacare, Alan Greenspan, Albert Einstein, Amazon Web Services, American Society of Civil Engineers: Report Card, Andy Kessler, Ayatollah Khomeini, bank run, barriers to entry, Bear Stearns, Berlin Wall, blue-collar work, Bretton Woods, business process, call centre, carbon footprint, carbon tax, Carmen Reinhart, Cass Sunstein, centre right, Climatic Research Unit, cloud computing, collective bargaining, corporate social responsibility, cotton gin, creative destruction, Credit Default Swap, crowdsourcing, delayed gratification, drop ship, energy security, Fall of the Berlin Wall, fear of failure, full employment, Google Earth, illegal immigration, immigration reform, income inequality, Intergovernmental Panel on Climate Change (IPCC), job automation, Kenneth Rogoff, knowledge economy, Lean Startup, low interest rates, low skilled workers, Mark Zuckerberg, market design, mass immigration, more computing power than Apollo, Network effects, Nixon triggered the end of the Bretton Woods system, obamacare, oil shock, PalmPilot, pension reform, precautionary principle, proprietary trading, Report Card for America’s Infrastructure, rising living standards, Ronald Reagan, Rosa Parks, Saturday Night Live, shareholder value, Silicon Valley, Silicon Valley startup, Skype, Steve Jobs, the long tail, the scientific method, Thomas L Friedman, too big to fail, University of East Anglia, vertical integration, WikiLeaks

But white- and blue-collar routine work shrinks, gets squeezed on pay, or just vanishes. The net result of the “rising demand for highly educated workers performing abstract tasks and for less-educated workers performing ‘manual’ or service tasks is the partial hollowing out or polarization of employment opportunities,” conclude Katz and Autor. Andy Kessler, a former hedge fund manager and the author of Eat People: And Other Unapologetic Rules for Game-Changing Entrepreneurs, published a piece in The Wall Street Journal (February 17, 2011) proposing an even simpler and more evocative typology of the new labor market: Forget blue-collar and white-collar.

pages: 494 words: 142,285

The Future of Ideas: The Fate of the Commons in a Connected World by Lawrence Lessig

AltaVista, Andy Kessler, AOL-Time Warner, barriers to entry, Bill Atkinson, business process, Cass Sunstein, commoditize, computer age, creative destruction, dark matter, decentralized internet, Dennis Ritchie, disintermediation, disruptive innovation, Donald Davies, Erik Brynjolfsson, Free Software Foundation, Garrett Hardin, George Gilder, Hacker Ethic, Hedy Lamarr / George Antheil, history of Unix, Howard Rheingold, Hush-A-Phone, HyperCard, hypertext link, Innovator's Dilemma, invention of hypertext, inventory management, invisible hand, Jean Tirole, Jeff Bezos, John Gilmore, John Perry Barlow, Joseph Schumpeter, Ken Thompson, Kenneth Arrow, Larry Wall, Leonard Kleinrock, linked data, Marc Andreessen, Menlo Park, Mitch Kapor, Network effects, new economy, OSI model, packet switching, peer-to-peer, peer-to-peer model, price mechanism, profit maximization, RAND corporation, rent control, rent-seeking, RFC: Request For Comment, Richard Stallman, Richard Thaler, Robert Bork, Ronald Coase, Search for Extraterrestrial Intelligence, SETI@home, Silicon Valley, smart grid, software patent, spectrum auction, Steve Crocker, Steven Levy, Stewart Brand, systematic bias, Ted Nelson, Telecommunications Act of 1996, the Cathedral and the Bazaar, The Chicago School, tragedy of the anticommons, Tragedy of the Commons, transaction costs, vertical integration, Yochai Benkler, zero-sum game

Thus, “the availability of a commons creates incentives that make possible decentralization of content-production.” Benkler, “The Commons,” 68. 8 “These units are so small as to make the transaction costs involved in negotiating allocation of exclusive property rights to them prohibitive.” Benkler, “Overcoming Agoraphobia,” 174. 9 See, e.g., Andy Kessler, velcap.com, “Steal This Bandwidth!,” e-mail on file with author, June 19, 2001 (“The FCC should set aside some not-for-profit spectrum specifically for wireless access, probably at the same time they auction 3G licenses, and keep encouraging the grassroots to run with new technology.”). 10 Telephone interview with Alex Lightman, January 31, 2001. 11 Ibid. 12 Telephone interview with Dave Hughes, November 13, 2000. 13 Federal Communications Commission, “Creation of Low Power Radio Service,” January 27, 2000, at http://www.fcc.gov/Bureaus/Mass_Media/Orders/2000/fcc00019.doc. 14 Harry First, “Property, Commons, and the First Amendment: Towards a Core Common Infrastructure” (White Paper of the First Amendment Program at the Brennan Center for Justice at New York University School of Law, 2001), 42-44. 15 Departments of Commerce, Justice, and State, the Judiciary and Related Agencies Appropriations Act, 2001, H.R. 4942, enacting into law H.R. 5548, 106th Congress, Title VI §632 (2000) (enacted). 16 See Bob Brewin, “Airports Ground Use of Wireless: Safety, Loss of Income from Pay Phones Cited,” Computerworld (February 19, 2001): 1, http://computerworld.com/ cwi/story/0,1199,NAV47_STO57817_NLTpm,00.html. 17 The real aim of the airports, organized under “wirelessairport.org,” appears to be to develop a proprietary, exclusive architecture for wireless technologies within airports, to permit them to extract rents from the technology's use. 18 See, e.g., Hazlett, “The Wireless Craze,” 42 (“The burden of proof is on the potential entrant.

pages: 444 words: 127,259

Super Pumped: The Battle for Uber by Mike Isaac

"Susan Fowler" uber, "World Economic Forum" Davos, activist fund / activist shareholder / activist investor, Airbnb, Albert Einstein, always be closing, Amazon Web Services, Andy Kessler, autonomous vehicles, Ayatollah Khomeini, barriers to entry, Bay Area Rapid Transit, Benchmark Capital, Big Tech, Burning Man, call centre, Cambridge Analytica, Chris Urmson, Chuck Templeton: OpenTable:, citizen journalism, Clayton Christensen, cloud computing, corporate governance, creative destruction, data science, Didi Chuxing, don't be evil, Donald Trump, driverless car, Elon Musk, end-to-end encryption, fake news, family office, gig economy, Google Glasses, Google X / Alphabet X, Greyball, Hacker News, high net worth, hockey-stick growth, hustle culture, impact investing, information security, Jeff Bezos, John Markoff, John Zimmer (Lyft cofounder), Kevin Roose, Kickstarter, Larry Ellison, lolcat, Lyft, Marc Andreessen, Marc Benioff, Mark Zuckerberg, Masayoshi Son, mass immigration, Menlo Park, Mitch Kapor, money market fund, moral hazard, move fast and break things, Network effects, new economy, off grid, peer-to-peer, pets.com, Richard Florida, ride hailing / ride sharing, Salesforce, Sand Hill Road, self-driving car, selling pickaxes during a gold rush, shareholder value, Shenzhen special economic zone , Sheryl Sandberg, side hustle, side project, Silicon Valley, Silicon Valley startup, skunkworks, Snapchat, SoftBank, software as a service, software is eating the world, South China Sea, South of Market, San Francisco, sovereign wealth fund, special economic zone, Steve Bannon, Steve Jobs, stock buybacks, super pumped, TaskRabbit, tech bro, tech worker, the payments system, Tim Cook: Apple, Travis Kalanick, Uber and Lyft, Uber for X, uber lyft, ubercab, union organizing, upwardly mobile, Vision Fund, WeWork, Y Combinator

Chapter 9: CHAMPION’S MINDSET 82 Kalanick once said onstage: Liz Gannes, “Travis Kalanick: Uber Is Raising More Money to Fight Lyft and the ‘Asshole’ Taxi Industry,” Recode, May 28, 2014, https://www.recode.net/2014/5/28/11627354/travis-kalanick-uber-is-raising-more-money-to-fight-lyft-and-the. 82 “There’s been so much corruption”: Andy Kessler, “Travis Kalanick: The Transportation Trustbuster,” Wall Street Journal, January 25, 2013, https://www.wsj.com/articles/SB10001424127887324235104578244231122376480. 83 “we’re crushing it”: Alexia Tsotsis, “Spotted! Secret Ubers on the Streets of Seattle,” TechCrunch, https://techcrunch.com/2011/07/25/uber-seattle/. 84 “incredibly hot chicks”: Adam Withnall, “Uber France Apologises for Sexist Promotion Offering Men Free Rides with ‘Incredibly Hot Chicks’ as Drivers,” Independent, October 23, 2014, https://www.independent.co.uk/life-style/gadgets-and-tech/uber-france-apologises-for-sexist-promotion-offering-men-free-rides-with-incredibly-hot-chicks-as-9813087.html. 87 “Could Uber reach a point”: Bill Gurley, “How to Miss by a Mile: An Alternative Look at Uber’s Potential Market Size,” Above the Crowd (blog), July 11, 2014, http://abovethecrowd.com/2014/07/11/how-to-miss-by-a-mile-an-alternative-look-at-ubers-potential-market-size/. 87 In a policy paper published: Travis Kalanick, “Principled Innovation: Addressing the Regulatory Ambiguity Ridesharing Apps,” April 12, 2013, http://www.benedelman.org/uber/uber-policy-whitepaper.pdf. 87 “nervous breakdowns”: Swisher, “Bonnie Kalanick.” 88 Kalanick would tweet: Travis Kalanick (@travisk), “@johnzimmer you’ve got a lot of catching up to do . . .

pages: 629 words: 142,393

The Future of the Internet: And How to Stop It by Jonathan Zittrain

A Declaration of the Independence of Cyberspace, algorithmic bias, Amazon Mechanical Turk, Andy Kessler, barriers to entry, behavioural economics, book scanning, Brewster Kahle, Burning Man, c2.com, call centre, Cass Sunstein, citizen journalism, Citizen Lab, Clayton Christensen, clean water, commoditize, commons-based peer production, corporate governance, Daniel Kahneman / Amos Tversky, digital divide, disruptive innovation, distributed generation, en.wikipedia.org, end-to-end encryption, Firefox, folksonomy, Free Software Foundation, game design, Hacker Ethic, Howard Rheingold, Hush-A-Phone, illegal immigration, index card, informal economy, information security, Internet Archive, jimmy wales, John Markoff, John Perry Barlow, license plate recognition, loose coupling, mail merge, Morris worm, national security letter, old-boy network, One Laptop per Child (OLPC), OSI model, packet switching, peer-to-peer, post-materialism, pre–internet, price discrimination, profit maximization, radical decentralization, Ralph Nader, RFC: Request For Comment, RFID, Richard Stallman, Richard Thaler, risk tolerance, Robert Bork, Robert X Cringely, SETI@home, Silicon Valley, Skype, slashdot, software patent, Steve Ballmer, Steve Jobs, Ted Nelson, Telecommunications Act of 1996, the Cathedral and the Bazaar, the long tail, The Nature of the Firm, The Wisdom of Crowds, Tragedy of the Commons, web application, wikimedia commons, Yochai Benkler, zero-sum game

Netanel argues that the sorts of principle-based checks in most democracies, such as antidiscrimination principles and equality in the basic rights of citizenship, are not sustainable in an unregulated cyberspace environment. As applied in this case, Netanel’s argument might cast doubt on the net worth of “tricks” or technologies that seem to simultaneously promote democracy and undermine state sovereignty. See id. at 412—27 (discussing cyberpopulism); cf Andy Kessler, Network Solutions, WALL ST. J., Mar. 24, 2007, at A11 (describing the communities enabled by Facebook, in which user-specified preferences and privacy are carefully maintained in order to facilitate user openness). 90. LAWRENCE LESSIG, CODE: VERSION 2.0, 309 (2006). 91. In this case, the distinction is not between conduct rules and decision rules, but between conduct rules and enforcement.

pages: 741 words: 179,454

Extreme Money: Masters of the Universe and the Cult of Risk by Satyajit Das

"RICO laws" OR "Racketeer Influenced and Corrupt Organizations", "there is no alternative" (TINA), "World Economic Forum" Davos, affirmative action, Alan Greenspan, Albert Einstein, algorithmic trading, Andy Kessler, AOL-Time Warner, Asian financial crisis, asset allocation, asset-backed security, bank run, banking crisis, banks create money, Basel III, Bear Stearns, behavioural economics, Benoit Mandelbrot, Berlin Wall, Bernie Madoff, Big bang: deregulation of the City of London, Black Swan, Bonfire of the Vanities, bonus culture, book value, Bretton Woods, BRICs, British Empire, business cycle, buy the rumour, sell the news, capital asset pricing model, carbon credits, Carl Icahn, Carmen Reinhart, carried interest, Celtic Tiger, clean water, cognitive dissonance, collapse of Lehman Brothers, collateralized debt obligation, corporate governance, corporate raider, creative destruction, credit crunch, Credit Default Swap, credit default swaps / collateralized debt obligations, currency risk, Daniel Kahneman / Amos Tversky, deal flow, debt deflation, Deng Xiaoping, deskilling, discrete time, diversification, diversified portfolio, Doomsday Clock, Dr. Strangelove, Dutch auction, Edward Thorp, Emanuel Derman, en.wikipedia.org, Eugene Fama: efficient market hypothesis, eurozone crisis, Everybody Ought to Be Rich, Fall of the Berlin Wall, financial engineering, financial independence, financial innovation, financial thriller, fixed income, foreign exchange controls, full employment, Glass-Steagall Act, global reserve currency, Goldman Sachs: Vampire Squid, Goodhart's law, Gordon Gekko, greed is good, Greenspan put, happiness index / gross national happiness, haute cuisine, Herman Kahn, high net worth, Hyman Minsky, index fund, information asymmetry, interest rate swap, invention of the wheel, invisible hand, Isaac Newton, James Carville said: "I would like to be reincarnated as the bond market. You can intimidate everybody.", job automation, Johann Wolfgang von Goethe, John Bogle, John Meriwether, joint-stock company, Jones Act, Joseph Schumpeter, junk bonds, Kenneth Arrow, Kenneth Rogoff, Kevin Kelly, laissez-faire capitalism, load shedding, locking in a profit, Long Term Capital Management, Louis Bachelier, low interest rates, margin call, market bubble, market fundamentalism, Market Wizards by Jack D. Schwager, Marshall McLuhan, Martin Wolf, mega-rich, merger arbitrage, Michael Milken, Mikhail Gorbachev, Milgram experiment, military-industrial complex, Minsky moment, money market fund, Mont Pelerin Society, moral hazard, mortgage debt, mortgage tax deduction, mutually assured destruction, Myron Scholes, Naomi Klein, National Debt Clock, negative equity, NetJets, Network effects, new economy, Nick Leeson, Nixon shock, Northern Rock, nuclear winter, oil shock, Own Your Own Home, Paul Samuelson, pets.com, Philip Mirowski, Phillips curve, planned obsolescence, plutocrats, Ponzi scheme, price anchoring, price stability, profit maximization, proprietary trading, public intellectual, quantitative easing, quantitative trading / quantitative finance, Ralph Nader, RAND corporation, random walk, Ray Kurzweil, regulatory arbitrage, Reminiscences of a Stock Operator, rent control, rent-seeking, reserve currency, Richard Feynman, Richard Thaler, Right to Buy, risk free rate, risk-adjusted returns, risk/return, road to serfdom, Robert Shiller, Rod Stewart played at Stephen Schwarzman birthday party, rolodex, Ronald Reagan, Ronald Reagan: Tear down this wall, Satyajit Das, savings glut, shareholder value, Sharpe ratio, short selling, short squeeze, Silicon Valley, six sigma, Slavoj Žižek, South Sea Bubble, special economic zone, statistical model, Stephen Hawking, Steve Jobs, stock buybacks, survivorship bias, tail risk, Teledyne, The Chicago School, The Great Moderation, the market place, the medium is the message, The Myth of the Rational Market, The Nature of the Firm, the new new thing, The Predators' Ball, The Theory of the Leisure Class by Thorstein Veblen, The Wealth of Nations by Adam Smith, Thorstein Veblen, too big to fail, trickle-down economics, Turing test, two and twenty, Upton Sinclair, value at risk, Yogi Berra, zero-coupon bond, zero-sum game

The top five executives at Bear Stearns and Lehman pocketed cash bonuses exceeding $300 million and $150 million respectively (in 2009 U.S. dollars). Although the earnings on which the remuneration was based were reversed in 2008, the executives did not return the payments received.36 Salli Krawcheck, a former CFO at Citi, observed: “it’s better to be an investment bank employee than shareholder.”37 Andy Kessler, a former Wall Street research analyst, noted: “Wall Street is just a compensation scheme.... They literally exist to pay out half their revenue as compensation. And that’s what gets them into trouble every so often—it’s just a game of generating revenue, because the players know they will get half of it back.”38 There were crumbs from the bankers’ feast for all.

pages: 351 words: 102,379

Too big to fail: the inside story of how Wall Street and Washington fought to save the financial system from crisis--and themselves by Andrew Ross Sorkin

"World Economic Forum" Davos, affirmative action, Alan Greenspan, Andy Kessler, Asian financial crisis, Bear Stearns, Berlin Wall, book value, break the buck, BRICs, business cycle, Carl Icahn, collapse of Lehman Brothers, collateralized debt obligation, creative destruction, credit crunch, Credit Default Swap, credit default swaps / collateralized debt obligations, deal flow, Dr. Strangelove, Emanuel Derman, Fall of the Berlin Wall, fear of failure, financial engineering, fixed income, Glass-Steagall Act, Goldman Sachs: Vampire Squid, housing crisis, indoor plumbing, invisible hand, junk bonds, Ken Thompson, London Interbank Offered Rate, Long Term Capital Management, low interest rates, margin call, market bubble, Michael Milken, Mikhail Gorbachev, money market fund, moral hazard, naked short selling, NetJets, Northern Rock, oil shock, paper trading, proprietary trading, risk tolerance, Robert Shiller, rolodex, Ronald Reagan, Savings and loan crisis, savings glut, shareholder value, short selling, sovereign wealth fund, supply-chain management, too big to fail, uptick rule, value at risk, éminence grise

“statutory resolution regime for nonbanks”: Ben Bernanke, “Reducing Systemic Risk,” Federal Reserve Bank of Kansas City’s Annual Economic Symposium,” Jackson Hole, Wyoming, August 22, 2008. Moody’s cuts its ratings: Jody Shenn, “Fannie, Freddie Preferred Stock Downgraded by Moody’s,” Bloomberg News, August 22, 2008. having shorted subprime before anyone else: Andy Kessler, “The Paulson Plan Will Make Money for Taxpayers,” Wall Street Journal, September 25, 2008. analyst report issued by Goldman Sachs raising questions about the firm: Hugh Son, “AIG Falls as Goldman Says a Capital Raise Is ‘Likely,’” Bloomberg News, August 19, 2008. As the company had warned in an SEC filing: Figures are from AIG’s 10-Q filing on August 6, 2008.