Kōnosuke Matsushita

8 results back to index

Not for Bread Alone: A Business Ethos, a Management Ethic by 松下幸之助

fear of failure, intangible asset, Kōnosuke Matsushita

FOR A Business Ethos, A Management Ethic Konosuke Matsushita The author is founder, and presently executive advisor, of Matsushita Electric Industrial Company, Ltd. KONOSUKE MATSUSHITA was born in 1894. the youngest of eight children of a fa rm er. Undeterred by chronic illness and meager funds, he started his business in a single rented room. He went on to build one of the biggest and most respected electrical appliance firms in the world. This volume, containing his observations and insights over the years, is testimony to the quality of experience that has helped make Mr. Matsushita the manager par excellence in Japanese, and world, industry.

…

Youth is eternal for those Who are full of faith and hope And greet the challenges of each new day With courage and conftdence. KONOSUKE MATSUSHITA May 1984 16 Introduction Konosuke Matsushita was born November 27, 1894, the third son and youngest of eight children of Masakusu, a rice farmer, and his wife Tokue, in the countryside of Wakayama prefecture, an agricultural region southeast of Os aka. His father was a member of the local assembly and was employed for a time in the village government offICes. The Matsushita family held lands passed down for generations and was quite well off, and Konosuke's early childhood was happy and carefree. But in 1899, the family went through a profound crisis.

…

The Si noJapanese War of 1894-95 was followed by a period of economic growth, and stock and commodities exchanges were set up throughout the country as a means of stimulating local industry. Many people were caught up in the rush of speculation, and Konosuke's father was one of them. Not long after he began investing in the local exchange, catastrophe came; the market crashed, and Masakusu lost his entire holdings, including the ancestral home and lands. Following upon that disaster, both of Konosuke's two older brothers died, and Masakusu, unable to lead his family out of destitution himself, pinned his hopes on Konosuke, who 17 NOT FOR BREAD ALONE became the Matsushita heir at the age of four. At nine, Konosuke left primary school and went alone to live in Osaka, where he became an apprentice in a charcoal brazier shop.

pages: 254 words: 61,387

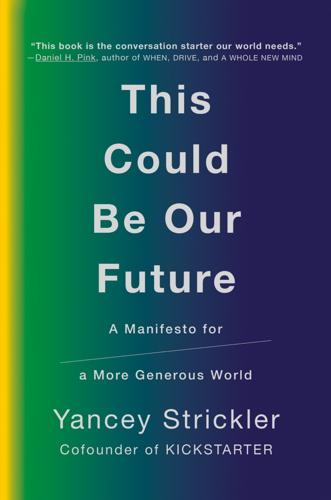

This Could Be Our Future: A Manifesto for a More Generous World by Yancey Strickler

"Friedman doctrine" OR "shareholder theory", "World Economic Forum" Davos, Abraham Maslow, accelerated depreciation, Adam Curtis, basic income, benefit corporation, Big Tech, big-box store, business logic, Capital in the Twenty-First Century by Thomas Piketty, Cass Sunstein, cognitive dissonance, corporate governance, Daniel Kahneman / Amos Tversky, data science, David Graeber, Donald Trump, Doomsday Clock, Dutch auction, effective altruism, Elon Musk, financial independence, gender pay gap, gentrification, global supply chain, Hacker News, housing crisis, Ignaz Semmelweis: hand washing, invention of the printing press, invisible hand, Jeff Bezos, job automation, John Maynard Keynes: Economic Possibilities for our Grandchildren, John Nash: game theory, Joi Ito, Joseph Schumpeter, Kickstarter, Kōnosuke Matsushita, Larry Ellison, Louis Pasteur, Mark Zuckerberg, medical bankruptcy, Mr. Money Mustache, new economy, Oculus Rift, off grid, offshore financial centre, Parker Conrad, Ralph Nader, RAND corporation, Richard Thaler, Ronald Reagan, Rutger Bregman, self-driving car, shareholder value, Silicon Valley, Simon Kuznets, Snapchat, Social Responsibility of Business Is to Increase Its Profits, Solyndra, stem cell, Steve Jobs, stock buybacks, TechCrunch disrupt, TED Talk, The Wealth of Nations by Adam Smith, Thomas Kuhn: the structure of scientific revolutions, Travis Kalanick, Tyler Cowen, universal basic income, white flight, Zenefits

Called Not for Bread Alone, it was a series of essays from the long career of a Japanese businessman named Konosuke Matsushita. Matsushita led an extraordinary life. In 1918, he started one of the first electrical companies in Japan, which he ran for more than forty years. That company continues to operate today under the name Panasonic. Not for Bread Alone shares philosophies and lessons from Matsushita’s long career, which is remarkable not just for its longevity but also for its broader idea of prosperity. Here’s Matsushita addressing his employees in 1932: “The mission of a manufacturer is to overcome poverty, to relieve society as a whole from the misery of poverty and bring it wealth.

…

Financial targets would remain to ensure sustainability and profitability, but goals and metrics associated with Bentoist values would be elevated alongside them. The organization would shift from a singular focus on financial maximization to a dual focus on financial performance and creating value in whatever ways its mission called for. This would bring every organization closer to the “spirit of coexistence and co-prosperity” that Konosuke Matsushita said companies and societies should share. “Every company, no matter how small, ought to have clear-cut goals apart from the pursuit of profit, purposes that justify its existence among us,” he wrote. “Such goals are an avocation, a secular mission to the world.” For a company whose mission focuses on improving the health of the earth, the environmental impact of its products should be as serious a concern as the company’s profitability.

…

Schumacher, Small Is Beautiful: Economics as If People Mattered Joseph Stiglitz, Amartya Sen, and Jean-Paul Fitoussi, Mismeasuring Our Lives: Why GDP Doesn’t Add Up Business Yvon Chouinard, Let My People Go Surfing: The Education of a Reluctant Businessman Phil Knight, Shoe Dog: A Memoir by the Creator of Nike Michael Lewis, Liar’s Poker Konosuke Matsushita, Not for Bread Alone Daniel H. Pink, Drive: The Surprising Truth About What Motivates Us Financial Independence Retire Early Chris Martenson and Adam Taggart, Prosper! How to Prepare for the Future and Create a World Worth Inheriting Medicine Siddhartha Mukherjee, The Emperor of All Maladies: A Biography of Cancer David Wootton, Bad Medicine: Doctors Doing Harm Since Hippocrates FURTHER WATCHING The Adam Curtis films The Trap, The Century of Self, and HyperNormalisation NOTES INTRODUCTION front page of China Daily: The China Daily headline ran on October 27, 2017.

pages: 827 words: 239,762

The Golden Passport: Harvard Business School, the Limits of Capitalism, and the Moral Failure of the MBA Elite by Duff McDonald

"Friedman doctrine" OR "shareholder theory", "World Economic Forum" Davos, activist fund / activist shareholder / activist investor, Affordable Care Act / Obamacare, Albert Einstein, Apollo 13, barriers to entry, Bayesian statistics, Bear Stearns, Bernie Madoff, Bob Noyce, Bonfire of the Vanities, business cycle, business process, butterfly effect, capital asset pricing model, Capital in the Twenty-First Century by Thomas Piketty, Carl Icahn, Clayton Christensen, cloud computing, collateralized debt obligation, collective bargaining, commoditize, compensation consultant, corporate governance, corporate raider, corporate social responsibility, creative destruction, deskilling, discounted cash flows, disintermediation, disruptive innovation, Donald Trump, eat what you kill, Fairchild Semiconductor, family office, financial engineering, financial innovation, Frederick Winslow Taylor, full employment, George Gilder, glass ceiling, Glass-Steagall Act, global pandemic, Gordon Gekko, hiring and firing, Ida Tarbell, impact investing, income inequality, invisible hand, Jeff Bezos, job-hopping, John von Neumann, Joseph Schumpeter, junk bonds, Kenneth Arrow, Kickstarter, Kōnosuke Matsushita, London Whale, Long Term Capital Management, market fundamentalism, Menlo Park, Michael Milken, new economy, obamacare, oil shock, pattern recognition, performance metric, Pershing Square Capital Management, Peter Thiel, planned obsolescence, plutocrats, profit maximization, profit motive, pushing on a string, Ralph Nader, Ralph Waldo Emerson, RAND corporation, random walk, rent-seeking, Ronald Coase, Ronald Reagan, Sam Altman, Sand Hill Road, Saturday Night Live, scientific management, shareholder value, Sheryl Sandberg, Silicon Valley, Skype, Social Responsibility of Business Is to Increase Its Profits, Steve Jobs, Steve Jurvetson, survivorship bias, TED Talk, The Nature of the Firm, the scientific method, Thorstein Veblen, Tragedy of the Commons, union organizing, urban renewal, vertical integration, Vilfredo Pareto, War on Poverty, William Shockley: the traitorous eight, women in the workforce, Y Combinator

“I’ll take care of everything,” Bower replied.15 Bower ran into problems when Hotta told him in December 1980 that he didn’t think he deserved the honor of such a distinction. But Hotta offered to talk to his friend Konosuke Matsushita, the wealthiest man in Japan, to see if he would accept such an honor. That conversation took place in January 1981, and Matsushita accepted. In November 1981, McArthur visited Matsushita in Japan to pick up the check, and the Matsushita Chair of Leadership was born. Earlier that year, Bower had also been instrumental in defending the case method from an attack by Harvard president Derek Bok. We will return to this episode in chapter 38, but for now suffice it to say that not much of major import happened at HBS without Bower’s involvement.

…

“She is happy to have what amounts to a corporate governance fraud as a face to the international business community. . . .”22 On the subject of individual entrepreneurship, it’s a sign that a professor has made it at HBS when they’re able to institutionalize their consulting by starting an actual company to handle all that outside business, with a hilarious number of them using the word institute in their name. There is John Kotter’s Kotter Institute. (Like Kanter, Kotter sees no problem in enjoying a company’s largesse while simultaneously promoting it. In 2006, while serving as the Konosuke Matsushita Professor of Leadership at HBS, he wrote a book, Matsushita Leadership, in praise of the company’s founder.) There is Dr. Harry Levinson’s Levinson Institute. Clayton Christensen’s nonprofit Christensen Institute applies his theories about disruption to health care and education, while the for-profit Innosight does the same thing for business.

…

Paul, 153, 155, 203, 205, 206, 208, 402, 403 Mark, Rebecca, 514 marketing, 168, 286 “Marketing Myopia” (Levitt), 261–63, 296 Markkula, Mike, 320 Marriott, Richard, 401–2 Marshall, George, 229 Martin, Boyce F., 234 Martin, Roger, 235, 283, 363–64, 419, 461 Massachusetts Institute of Technology (MIT), 25, 121, 124, 244; Sloan School of Management, 80, 309, 392, 394 Masters of Private Equity and Venture Capital, The (Finkel), 127 Matsushita, Konosuke, 206; HBS endowed chair, 205–6 Matsushita Leadership (Kotter), 409 Matthews, John, 436 May, George O., 26 Mayers, Frank, 169 Mayo, Anthony, 350 Mayo, Elton, 37, 76–90, 111, 118, 186, 222, 244, 308, 355; as fraud, 78, 88; Hawthorne study, 83–85, 87, 88; at HBS, 81–90, 93; human relations movement, 217; “The Mayo Weekend,” 90; Rockefeller funding, 81, 82–83, 90; theories of, 77–80, 84–86, 112, 113, 133, 212, 315 MBA Oath, 565, 567–68 MBAs: Amazon and, 10, 90; Champion article and, 552; class of ’49, 167–74; critics of, 210, 290–92, 483–89, 564–65; Enron and, 512–17; ethical lapses and, 437; “failure equals success,” 172; financial crisis of 2007–10 and, 546–53, 566; in Galbraith’s “technostructure,” 342; HBS grads as most desirable, 356, 461; innovation and, 120–21; Jensen and erosion of higher ideals, 382; MBAs awarded, 144, 217, 461; McKinsey and, 199, 202, 206, 207–8, 338, 460, 474, 548–49; need for questioned, 494–95; postwar economic boom and, 180; running America, 276, 289 (see also Bush, George W.); salary increase, 383; Schwarzman on, 470–71; six problems of, 292; students enrolled as, 150; Thiel’s opinion of, 120; U.S. institutions offering, 193; weakness of, 194–95; women, 203; working on Wall Street, 10, 96, 359, 369.

pages: 790 words: 253,035

Powerhouse: The Untold Story of Hollywood's Creative Artists Agency by James Andrew Miller

Affordable Care Act / Obamacare, Airbnb, Albert Einstein, Bonfire of the Vanities, business process, collective bargaining, corporate governance, do what you love, Donald Trump, Easter island, family office, financial engineering, independent contractor, interchangeable parts, Joan Didion, junk bonds, Kickstarter, Kōnosuke Matsushita, Larry Ellison, obamacare, out of africa, rolodex, Ronald Reagan, Saturday Night Live, Silicon Valley, Skype, SoftBank, stem cell, Steve Jobs, traveling salesman, union organizing, vertical integration

In addition to the scripts he read himself, Michael always relied on the head reader for a lot of his material. I remember one task that fell far outside of the norm, though: When Michael was heading to Japan for one of the first big—and secret—meetings with Matsushita, he wanted coverage of all of the writings of Konosuke Matsushita, the founder of the company—what we know as Panasonic. So I had to read all of his books and all of his key writings, and provide Michael with a full rundown on what drove Matsushita-san, what he believed, and how he built his company. MICHAEL OVITZ: Sandy ran the whole business group, a department with something like eight MBAs in it. I asked Sandy to tell me what other Japanese companies might be interested in the film or media business.

…

Ron Hubbard Kate Hudson Arianna Huffington John Hughes Nobuyuki Idei Bob Iger Henry Ishii Doug Ivester Hugh Jackman Michael Jackson Craig Jacobson Stanley Jaffe Lebron James Mort Janklow Jay-Z Jefferson Airplane Jerky Boys Steve Jobs Earvin “Magic” Johnson Mark Johnson Peter Johnson Angelina Jolie Jerry Jones Barry Josephson Nancy Josephson Robert Kamen Stan Kamen Art Kaminsky Garry Kasparov Jeffrey Katzenberg Phil Kaufman Max Kellerman Don Keough Irvin Kershner Callie Khouri Nicole Kidman Simon Kinberg Stephen King George Kirby Kevin Kline Phil Knight Johnny Knoxville Paul Kohner Ted Koppel Ted Kotcheff Jim Lampley Eugene Landy Jessica Lange Sherry Lansing Tom Lassally Abe Lastfogel Martin Lawrence Norman Lear Heath Ledger Chris Lee Brian Leetch Nat Lefkowitz Kim LeMasters Jay Leno John Lesher David Letterman Gary Levine Randy Levine Barry Levinson Steven Levinson Mike Levy Roy Lichtenstein Ed Limato David Lindy John Logan Eva Longoria Jennifer Lopez Jon Lovitz David Lynch Larry Lyttle Ali MacGraw Madonna Albert Magnoli Frank Mancuso Michael Mann Ricky Martin Steve Martin Konosuke Matsushita Elaine May Melissa McCarthy Mark McCormack Guy McElwaine Don McGuire Chris Meledandri John Mellencamp Sue Mengers Burgess Meredith Barry Meyer Ellen Meyer Kelly Meyer Al Michaels Lorne Michaels Jimmy Miller Rand Miller Robyn Miller Milli Vanilli Yvette Mimieux David Miscavige Matthew Modine Les Moonves Demi Moore Tommy Mottola Rupert Murdoch Brian Murphy Eddie Murphy Bill Murray Mike Myers Bahman Naraghi Nicholas Negroponte Lynn Nesbit Paul Newman Mike Nichols Jack Nicholson Christopher Nolan Bob O’Connor Carroll O’Connor Adam Oates Norio Ogha Masao Ohashi Brian Oliver Mo Ostin Dave Ovitz Judy Ovitz Al Pacino Manny Pacquiao Sarah Jessica Parker Dolly Parton Alexander Payne I.

…

SANDY CLIMAN: After several strategy discussions, the JVC team reported back to Matsushita management. Like scouts who are replaced by soldiers, Matsushita took over discussions with us, and JVC was out of the picture, never to be seen again. Matsushita contacted Ovitz in the fall of 1989 and hired him as a consultant. Ovitz then assembled a team that included New York law firm Simpson Thacher & Bartlett to represent Matsushita in the United States, as well as Herbert Allen of the Allen & Company investment firm and public relations firm Adams and Rinehart. For its initial meeting with Ovitz, Matsushita sent executive vice president Masahiko Hirata; the firm’s decision to send a senior executive showed Ovitz that it was serious about acquiring a Hollywood studio.

pages: 295 words: 89,441

Aiming High: Masayoshi Son, SoftBank, and Disrupting Silicon Valley by Atsuo Inoue

Adam Neumann (WeWork), air freight, Apple II, bitcoin, Black Lives Matter, business climate, cloud computing, coronavirus, COVID-19, fixed income, game design, George Floyd, hive mind, information security, interest rate swap, Internet of things, Jeff Bezos, Kickstarter, Kōnosuke Matsushita, Larry Ellison, lateral thinking, Masayoshi Son, off grid, popular electronics, self-driving car, shareholder value, sharing economy, Silicon Valley, social distancing, SoftBank, Steve Ballmer, Steve Jobs, Steve Wozniak, TikTok, Vision Fund, WeWork

With manual labour putting a strain on your body, intellectual work was the only option for Son. Son, however, didn’t have any money or the connections to get that kind of work. There was one and only one thing he could do, he decided. He would come up with inventions, patent the ideas, then sell them on. Matsushita Konosuke, the ‘God of Management’ and founder of Panasonic, had got his start at a small factory. Another business forebear Son looked up to, his first steps towards becoming a global electronics magnate had been the invention of the two-way socket and the bullet-shaped bicycle lamp. Son now had his precedent – it was time to start inventing things.

…

Son was furious at Nishi’s way of doing business – it just wasn’t fair – but thinking more broadly about the future of the personal computer he would do whatever it took to stymie Nishi’s plan for a monopoly. He would have to take on Nishi head-on whilst bedridden. The first time Nishi and Son had met was the summer of 1977 at Matsushita Electric Industrial in Osaka, whilst Son was still studying at Berkeley. Introducing the two to each other was Maeda Hirokazu, Matsushita’s Head of Technology R&D, who for whatever reason did so in English. Son was at Matsushita as, having concluded his deal with Sharp for the pocket translator, he was going to be signing other agreements for similar hand-held learning devices. Nishi was introduced to Son by Maeda with the words, ‘This fella’s quite an interesting character.’

…

The judge would see them. Chapter 10 Contract signed and dated In the summer of 1977 Son had written to 50 Japanese home appliance manufacturers detailing his intent to develop a talking electronic translator, making plans to visit the 10 or so who replied in person, amongst which were Canon, Omron, Casio, Matsushita Electric Industrial (now Panasonic) and Sharp. He took advantage of the summer holidays and travelled back to Japan with Mozer in tow. Son’s younger brother Taizo – who at the time was yet to enter primary school – can still vividly recall his older brother coming home, the whole family gathering around as Son and Mozer gave a demonstration of their prototype talking translator.

pages: 195 words: 60,471

Hello, Habits by Fumio Sasaki

behavioural economics, bounce rate, Jeff Bezos, Kōnosuke Matsushita, Richard Thaler, Stanford marshmallow experiment, Stephen Hawking, Steve Jobs, TED Talk, Walter Mischel

You might as well make a bold change if you can’t do it While we’re on the subject of the importance of setting objectives, there’s a story I like that I want to share. Matsushita Electric (called Panasonic today) is said to have set up a plan to reduce its electricity bill by 10 percent in order to cut back on costs. This didn’t go well. When its executives gathered and discussed what they should and shouldn’t do, the company’s founder Konosuke Matsushita is said to have said: “All right. Then we will change our objective and aim for a reduction by half instead of 10 percent.” An objective of a 10 percent reduction is tough, because it involves superficial techniques.

pages: 807 words: 154,435

Radical Uncertainty: Decision-Making for an Unknowable Future by Mervyn King, John Kay

Airbus A320, Alan Greenspan, Albert Einstein, Albert Michelson, algorithmic trading, anti-fragile, Antoine Gombaud: Chevalier de Méré, Arthur Eddington, autonomous vehicles, availability heuristic, banking crisis, Barry Marshall: ulcers, battle of ideas, Bear Stearns, behavioural economics, Benoit Mandelbrot, bitcoin, Black Swan, Boeing 737 MAX, Bonfire of the Vanities, Brexit referendum, Brownian motion, business cycle, business process, capital asset pricing model, central bank independence, collapse of Lehman Brothers, correlation does not imply causation, credit crunch, cryptocurrency, cuban missile crisis, Daniel Kahneman / Amos Tversky, David Ricardo: comparative advantage, DeepMind, demographic transition, discounted cash flows, disruptive innovation, diversification, diversified portfolio, Donald Trump, Dutch auction, easy for humans, difficult for computers, eat what you kill, Eddington experiment, Edmond Halley, Edward Lloyd's coffeehouse, Edward Thorp, Elon Musk, Ethereum, Eugene Fama: efficient market hypothesis, experimental economics, experimental subject, fear of failure, feminist movement, financial deregulation, George Akerlof, germ theory of disease, Goodhart's law, Hans Rosling, Helicobacter pylori, high-speed rail, Ignaz Semmelweis: hand washing, income per capita, incomplete markets, inflation targeting, information asymmetry, invention of the wheel, invisible hand, Jeff Bezos, Jim Simons, Johannes Kepler, John Maynard Keynes: Economic Possibilities for our Grandchildren, John Snow's cholera map, John von Neumann, Kenneth Arrow, Kōnosuke Matsushita, Linda problem, Long Term Capital Management, loss aversion, Louis Pasteur, mandelbrot fractal, market bubble, market fundamentalism, military-industrial complex, Money creation, Moneyball by Michael Lewis explains big data, Monty Hall problem, Nash equilibrium, Nate Silver, new economy, Nick Leeson, Northern Rock, nudge theory, oil shock, PalmPilot, Paul Samuelson, peak oil, Peter Thiel, Philip Mirowski, Phillips curve, Pierre-Simon Laplace, popular electronics, power law, price mechanism, probability theory / Blaise Pascal / Pierre de Fermat, quantitative trading / quantitative finance, railway mania, RAND corporation, reality distortion field, rent-seeking, Richard Feynman, Richard Thaler, risk tolerance, risk-adjusted returns, Robert Shiller, Robert Solow, Ronald Coase, sealed-bid auction, shareholder value, Silicon Valley, Simon Kuznets, Socratic dialogue, South Sea Bubble, spectrum auction, Steve Ballmer, Steve Jobs, Steve Wozniak, Suez crisis 1956, Tacoma Narrows Bridge, Thales and the olive presses, Thales of Miletus, The Chicago School, the map is not the territory, The Market for Lemons, The Nature of the Firm, The Signal and the Noise by Nate Silver, The Wealth of Nations by Adam Smith, The Wisdom of Crowds, Thomas Bayes, Thomas Davenport, Thomas Malthus, Toyota Production System, transaction costs, ultimatum game, urban planning, value at risk, world market for maybe five computers, World Values Survey, Yom Kippur War, zero-sum game

Another of the few business strategy writers worth reading, Henry Mintzberg, describes the problem created by the approaches to business caricatured by the weekend strategy retreats as follows: ‘We are often, in the business world, over-led and undermanaged . . . Senior management is supposedly seeing the big picture but, in dysfunctional cases, is not in touch with the details.’ 4 Mintzberg continues with a quotation from Konosuke Matsushita, founder of Panasonic Corp., asserting that ‘Big things and little things are my job. Middle level arrangements can be delegated.’ So, Mintzberg summarises, ‘In other words, you construct the big picture out of the little details. It’s like painting a painting; you paint it one brush stroke at a time.’

…

., 188 Leeson, Nick, 411 Lehman Brothers, failure of (2008), 5 , 36 , 158–9 , 267 , 410–11 , 412 Leonardo da Vinci, 219 , 421 , 428 LeRoy, Stephen, 74 , 78 Let’s Make a Deal (US quiz show), 62–3 , 65 , 69 Lewis, Michael, 135 , 215 ; The Undoing Project , 121 , 393–4 Libet, Benjamin, 171 LIBOR scandal, 192 Libratus (poker-playing computer), 263 life expectancy, 43 , 56 , 57 , 161 , 232–3 Lincoln, Abraham, 266 , 269 , 290 Literary Digest , 240 , 390 Livy (Roman historian), 54 , 186 , 187 Lloyds Bank, 325 Lloyd’s of London, 55–6 , 322–4 , 325 , 326 Loch Ness monster, 325 , 326 Loewenstein, George, 128–9 , 135 , 310 London School of Economics, 339 , 382–3 Long Term Capital Management, 153 , 309 Louis XIV, King of France, 411 Lucas, Robert, 36 , 92 , 93 , 338–9 , 341 , 345 , 346 , 348 , 354 Maa-speaking people of East Africa, 160–1 , 189 MacArthur, Douglas, 292–3 , 420 Macartney, Lord, 419 Mackay, Charles, Extraordinary Popular Delusions and the Madness of Crowds , 315 Malthus, Thomas, 253 , 358–61 , 362–3 Mandelbrot, Benoit, 238 Manhattan grid plan, 424–5 Manville, Brook, 374 Mao Tse-tung, 4–5 , 292 Markowitz, Harry, 307 , 308 , 309–10 , 318 , 320 , 332 , 333 , 366 Márquez, Gabriel García, 226 Marshall, Alfred, 276 , 381 , 382 Marshall, Barry, 284 , 306 Marshall, George, 292 Marxism, 220 Mary Celeste mystery (1872), 33–4 , 44 Mary Poppins (film, 1964), 306 mathematical reasoning, xiv , 12 , 19 , 42–3 , 47 , 53–4 , 93 , 343 , 401 , 404–5 ; appropriate use of, 383 ; fixed point theorems, 254 ; fractal geometry, 238–9 ; ‘grand auction’ of Arrow and Debreu, 343–5 ; and historical narratives, 188 ; small world applications of, 175–6 Matsushita, Konosuke, 410 Mauss, Marcel, The Gift (1925), 190–1 Max Planck Institute, Berlin, 152 maximising behaviour, xiv , 258 , 381–2 ; ‘ambiguity aversion’ concept, 135 ; and evolutionary rationality, 157 , 158 , 166–7 ; and greed, 127–8 , 409 ; limits to, xiv–xv , 41–4 , 152 , 171–2 , 310 , 345 , 382 , 400–1 , 435–44 ; maximising expected utility, 108 , 111–14 , 115–18 , 129–30 , 400 ; and utilitarian theory, 110–11 Maxwell, Robert, 312 , 313 May, Robert, 375 Maynard, John, 156 McHugh, Dodd, 425 McLaren racing team, 391 McNamara, Robert, 281–2 , 298–300 McRaven, Admiral William, 298 Meadow, Professor Sir Roy, 197–8 , 200 , 201 medicine, 22 , 32 , 39–40 , 88–9 , 383 , 384 , 387 ; computer technologies, 185–6 ; doctors’ decision-making, 184–6 , 194 , 398–9 ; HIV infections, 375–6 ; infectious diseases, 282–3 , 285 ; puerperal fever, 282–3 , 306 ; ‘randomised controlled trials’ (RCTs), 243–5 ; screening for cancer, 66–7 , 206 ; stomach ulcers, 284 , 306 ; twentieth century improvements, 57 ; and uncertainty, 44–5 mercantilism, 249 Mercier, Hugo, 162 , 272 , 415 Méré, Chevalier de, 53 , 59 , 60 , 61 Merton, Robert C., 309 Merton, Robert K., 35–6 , 309 MESSENGER (NASA probe), 18–19 , 26 , 35 , 218 , 394 meteorology, 23 , 43 , 101–2 , 406 Michelangelo, 421 , 428 Michelson, Albert, 430 Microsoft, 29 , 30–1 migration, 369–70 , 372 ; European to USA, 427 military campaigns and strategy, 3–4 , 24–6 , 292–3 , 294–5 , 298–300 , 412–13 , 433 military-industrial complex, 294 Mill, John Stuart, 110 , 429–30 ; System of Logic (1843), 70 Miller, Arthur, Death of a Salesman , 220 Ming emperors, 419 Mintzberg, Henry, 296 , 410 Mirowski, Philip, 388 MMR triple vaccine, 394 mobile phones, 30–1 , 38–9 , 257 , 344 models: appropriate use of, 376–7 ; of Canadian fisheries, 368–9 , 370 , 371–2 , 423 ; consulting firms, 180 , 182–3 , 275–6 , 365 , 370–1 , 405 ; EU migration models, 370 , 372 ; invented numbers in, 320 , 363–4 , 365 , 371 , 373 , 404 , 405 , 423 ; maps as not the territory, 391–4 ; microeconomic research, 382 , 392 ; misuse/abuse of, 312–13 , 320 , 368–76 , 405 ; at NASA, 373–4 , 391–2 ; policy-based evidence, 370–1 , 373–4 , 405 , 412–13 ; and public consultation, 372 ; reproduction of large/real-world, 390–2 ; role of incentives/targets, 409 ; stationarity as assumed, 333 , 339 , 340–1 , 349 , 350 , 366–7 , 371–2 ; as tools, 384–6 ; transport modelling, 363–5 , 370 , 371 , 372 , 396 , 404 , 407 ; WebTAG, 363–4 , 365 , 371 , 404 , 407 ; WHO HIV model, 375–6 ; see also economic models; small world models Moivre, Abraham de, 57–8 , 233 money supply, 96 Moneyball (film, 2011), 273 MONIAC (Monetary National Income Analogue Computer) machine, 339 ‘Monte Carlo simulations’, 365 Montgomery, Bernard Law, 293 Moore, Dudley, 97 Morgenstern, Oskar, 111 , 133 , 435–7 Moses, Robert, 425 Mourinho, José, 265 Mrs White’s Chocolate House (St James’s), 55 Murray, Bill, 419 Musk, Elon, 128 , 130 , 307 Mussabini, Sam, 273 mutualisation: in insurance markets, 325–6 ; and !

When Cultures Collide: Leading Across Cultures by Richard D. Lewis

Ayatollah Khomeini, British Empire, business climate, business process, colonial exploitation, corporate governance, Easter island, global village, haute cuisine, hiring and firing, invention of writing, Kōnosuke Matsushita, lateral thinking, Mahatma Gandhi, mass immigration, Nelson Mandela, new economy, oil shale / tar sands, old-boy network, open borders, profit maximization, profit motive, Scramble for Africa, Silicon Valley, trade route, transaction costs, upwardly mobile, urban sprawl, women in the workforce

Great leaders captivated willing disciples through sheer charisma—Alexander the Great, Caesar, Tamerlane, Hernan Cortés, Simón Bolívar, Kemal Atatürk, Mahatma Gandhi, Winston Churchill, Chou-en-Lai and Nelson Mandela are a few who come to mind. In the modern era, business leaders have occasionally shown the charismatic and visionary leadership that attracts loyal followers; examples are Henry Ford, Akio Morita, Konosuke Matsushita and Richard Branson. Religion has also played a major role in mass-motivation throughout the historical era. Twenty-First Century Aspirations If you consider the main cultural categories I introduced in Chapter 3— linear-active, multi-active and reactive—you can discern differences in the motivational patterns of cultural groups in each category, both in terms of traditional features and developing aspirations as a new century of opportunity gets under way.

…

Minoan collective rule—one of the earliest examples we know about—inspired a similar type of leadership both in the Greek city–states and later in Rome. In another hemisphere, Mayan and North American Indians held similar traditions. In the business world, a series of individuals have also demonstrated outstanding abilities and success in leadership—Ford, Rockefeller, Agneli, Berlusconi, Barnevik, Gyllenhammer, Iacocca, Geneen, Matsushita and Morita are some of them. It is now common for leadership and authority also to be vested in boards of directors or management committees. 108 WHEN CULTURES COLLIDE USA UK for ec country managers ts s tan da rd d as casual leadership ize rolli ng g rly arte qu repo rtin HQ upper/middle managers make individual decisions STRUCTURED INDIVIDUALISM FRANCE SWEDEN GERMANY autocratic primus inter pares hierarchy, consensus ASIA LATIN/ARAB INDONESIA military Chinese using know-how consensus rule nepotism NETHERLANDS Figure 7.2 Leadership Styles STATUS, LEADERSHIP AND ORGANIZATION 109 JAPAN for ra s tific atio personal approach n official channel id ea s icie pol RUSSIA ideas ideas ringi-sho consensus ideas sub-team trusted, efficient lieutenant slow implementation AUSTRALIA one of the mates SPAIN FINLAND officer helps out in crisis INDIA Trade Group family sons, nephews human force traditional organized quick result 110 WHEN CULTURES COLLIDE The way in which a cultural group goes about structuring its commercial and industrial enterprises or other types of organizations usually reflects to a considerable degree the manner in which it itself is organized.

pages: 7,371 words: 186,208

The Long Twentieth Century: Money, Power, and the Origins of Our Times by Giovanni Arrighi

anti-communist, Asian financial crisis, barriers to entry, Bretton Woods, British Empire, business climate, business logic, business process, classic study, colonial rule, commoditize, Corn Laws, creative destruction, cuban missile crisis, David Ricardo: comparative advantage, declining real wages, deindustrialization, double entry bookkeeping, European colonialism, Fairchild Semiconductor, financial independence, financial intermediation, floating exchange rates, gentrification, Glass-Steagall Act, Great Leap Forward, income inequality, informal economy, invisible hand, joint-stock company, Joseph Schumpeter, Kōnosuke Matsushita, late capitalism, London Interbank Offered Rate, means of production, Meghnad Desai, military-industrial complex, Money creation, money: store of value / unit of account / medium of exchange, new economy, offshore financial centre, oil shock, Peace of Westphalia, post-Fordism, profit maximization, Project for a New American Century, RAND corporation, reserve currency, scientific management, spice trade, Strategic Defense Initiative, Suez canal 1869, the market place, The Nature of the Firm, The Wealth of Nations by Adam Smith, Thorstein Veblen, trade liberalization, trade route, transaction costs, transatlantic slave trade, transcontinental railway, upwardly mobile, vertical integration, Yom Kippur War

Wr ana’ Human Progress, New York: Norton 1968. Neumann, Franz, Be/7emot/7: 77Je Structure and Practice of National Socialism, London: Gollancz 1942. Nussbaum, Arthur, A Concise History of the Law of Nations, New York: Macmillan 1950. O’Connor, James, 771e Fiscal Crisis of the State, New York: St Martin’s Press 1973. Odaka, Konosuke, “Is the Division of Labor Limited by the Extent of the Market? A Study of Automobile Parts Production in East and Southeast Asia,” in K. Ohkawa, G. Ranis, and L. Meissner, eds., ]apan and the Developing Countries: A Comparative Analysis, Oxford: Basil Blackwell 1985,pp.389-425. Ofle, Claus, Disorganized Capitalism: Contemporary Transformations of W/or/e ana’ Politics, Cambridge, MA: MIT University Press 1985.

…

What cultural and political barriers could not stop, the barriers to entry built into the very structure of US corporate capitalism did. The complexities of US corporate life proved to be more insurmountable INTRODUCTION 19 barriers to entry for Japanese money than cultural hostility and political mistrust. The biggest ever Japanese takeovers in the United States — Sony’s takeover of Columbia Pictures in 1989, and Matsushita’s takeover of MCA the following year — failed completely in their objective. When the Sony deal was struck, the media over-reacted and Newswee/e‘s cover talked of Japan’s “invasion” of Hollywood. And yet, as Bill Emmott wrote in the op-ed page of the New York Times (26 November 1993: A19), less than two years passed before it became clear that the scares and hyperbole had got it wrong. . . .