The inhabitant of London could order by telephone, sipping his morning tea in bed, the various products of the whole earth

18 results back to index

pages: 95 words: 6,448

Mending the Net: Toward Universal Basic Incomes by Chris Oestereich

Abraham Maslow, basic income, en.wikipedia.org, future of work, Future Shock, Overton Window, profit motive, rent-seeking, The Future of Employment, The inhabitant of London could order by telephone, sipping his morning tea in bed, the various products of the whole earth, universal basic income

First Edition Publisher: The Wicked Problems Collaborative LLC 1) Economics 2) Sociology 3) Politics 10 9 8 7 6 5 4 3 2 1 The Wicked Problems Collaborative connect@wickedproblemscollaborative.com @WPCollaborative http://wickedproblemscollaborative.com Cover photo: Nikodem Nijaki (under the Creative Commons Attribution-Share Alike 3.0 Unported license) Contents Opening Volley Introduction 1. Food, Water, & Shelter – From Basic Needs to Basic Income 2. An Economic Shock Absorber Now What? Parting Shot Next About the Author References Opening Volley The inhabitant of London could order by telephone, sipping his morning tea in bed, the various products of the whole earth, in such quantity as he might see fit, and reasonably expect their early delivery upon his doorstep; he could at the same moment and by the same means adventure his wealth in the natural resources and new enterprises of any quarter of the world, and share, without exertion or even trouble, in their prospective fruits and advantages; or he could decide to couple the security of his fortunes with the good faith of the townspeople of any substantial municipality in any continent that fancy or information might recommend.

pages: 270 words: 73,485

Hubris: Why Economists Failed to Predict the Crisis and How to Avoid the Next One by Meghnad Desai

3D printing, Alan Greenspan, bank run, banking crisis, Bear Stearns, Berlin Wall, Big bang: deregulation of the City of London, Bretton Woods, BRICs, British Empire, business cycle, Capital in the Twenty-First Century by Thomas Piketty, Carmen Reinhart, central bank independence, collapse of Lehman Brothers, collateralized debt obligation, correlation coefficient, correlation does not imply causation, creative destruction, Credit Default Swap, credit default swaps / collateralized debt obligations, David Ricardo: comparative advantage, deindustrialization, demographic dividend, Eugene Fama: efficient market hypothesis, eurozone crisis, experimental economics, Fall of the Berlin Wall, financial innovation, Financial Instability Hypothesis, floating exchange rates, full employment, German hyperinflation, Glass-Steagall Act, Gunnar Myrdal, Home mortgage interest deduction, imperial preference, income inequality, inflation targeting, invisible hand, Isaac Newton, Joseph Schumpeter, Kenneth Arrow, Kenneth Rogoff, laissez-faire capitalism, liquidity trap, Long Term Capital Management, low interest rates, market bubble, market clearing, means of production, Meghnad Desai, Mexican peso crisis / tequila crisis, mortgage debt, Myron Scholes, negative equity, Northern Rock, oil shale / tar sands, oil shock, open economy, Paul Samuelson, Phillips curve, Post-Keynesian economics, price stability, purchasing power parity, pushing on a string, quantitative easing, reserve currency, rising living standards, risk/return, Robert Shiller, Robert Solow, Ronald Reagan, savings glut, secular stagnation, seigniorage, Silicon Valley, Simon Kuznets, subprime mortgage crisis, The Chicago School, The Great Moderation, The inhabitant of London could order by telephone, sipping his morning tea in bed, the various products of the whole earth, The Wealth of Nations by Adam Smith, Tobin tax, too big to fail, women in the workforce

The Gold Standard kept countries on a tight leash, enforcing balanced budgets and a money supply beyond manipulation by governments. The Bank of England acquired a prestige, unequaled since, as the benign regulator of the global economy. All was well in the best of all possible worlds. As Keynes put it in his controversial book The Economic Consequences of the Peace, The inhabitant of London could order by telephone, sipping his morning tea in bed, the various products of the whole earth, in such quantities as he might see fit, and reasonably expect their early delivery upon his doorstep; he could at the same moment and by the same means adventure his wealth in the natural resources and new enterprises of any quarter of the world, and share without exertion or even trouble, in their prospective fruits and advantages; or he could decide to couple the security of his fortunes with the good faith of the townspeople of any substantial municipality in any continent that fancy or information might recommend.

pages: 561 words: 87,892

Losing Control: The Emerging Threats to Western Prosperity by Stephen D. King

"World Economic Forum" Davos, Admiral Zheng, Alan Greenspan, asset-backed security, barriers to entry, Berlin Wall, Bernie Madoff, Bretton Woods, BRICs, British Empire, business cycle, capital controls, Celtic Tiger, central bank independence, collateralized debt obligation, corporate governance, credit crunch, crony capitalism, currency manipulation / currency intervention, currency peg, David Ricardo: comparative advantage, demographic dividend, demographic transition, Deng Xiaoping, Diane Coyle, Fall of the Berlin Wall, financial deregulation, financial innovation, fixed income, foreign exchange controls, Francis Fukuyama: the end of history, full employment, G4S, George Akerlof, German hyperinflation, Gini coefficient, Great Leap Forward, guns versus butter model, hiring and firing, income inequality, income per capita, inflation targeting, invisible hand, Isaac Newton, junk bonds, knowledge economy, labour market flexibility, labour mobility, liberal capitalism, low interest rates, low skilled workers, market clearing, Martin Wolf, mass immigration, Meghnad Desai, Mexican peso crisis / tequila crisis, Naomi Klein, new economy, old age dependency ratio, Paul Samuelson, Ponzi scheme, price mechanism, price stability, purchasing power parity, rent-seeking, reserve currency, rising living standards, Ronald Reagan, Savings and loan crisis, savings glut, Silicon Valley, Simon Kuznets, sovereign wealth fund, spice trade, statistical model, technology bubble, The Great Moderation, The inhabitant of London could order by telephone, sipping his morning tea in bed, the various products of the whole earth, The Market for Lemons, The Wealth of Nations by Adam Smith, Thomas Malthus, trade route, transaction costs, Washington Consensus, We are all Keynesians now, women in the workforce, working-age population, Y2K, Yom Kippur War

Its pre-First World War protagonists were nicely lampooned by John Maynard Keynes in his Economic Consequences of the Peace8 in a much quoted, yet highly relevant, passage caricaturing a typical English gentleman in the summer of 1914. The complacency it reveals is commonplace today: The inhabitant of London could order by telephone, sipping his morning tea in bed, the various products of the whole earth, in such quantity as he might see fit, and reasonably expect their early delivery upon his doorstep; he could at the same moment and by the same means adventure his wealth in the natural resources and new enterprises of any quarter of the world, and share, without exertion or even trouble, in their prospective fruits and advantages … The projects and politics of militarism and imperialism, of racial and cultural rivalries, of monopolies, restrictions, and exclusion … were little more than the amusements of his daily newspaper, and appeared to exercise almost no influence at all on the ordinary course of social and economic life, the internationalisation of which was nearly complete in practice.

pages: 289 words: 86,165

Ten Lessons for a Post-Pandemic World by Fareed Zakaria

"there is no alternative" (TINA), 15-minute city, AlphaGo, An Inconvenient Truth, anti-fragile, Asian financial crisis, basic income, Bernie Sanders, Boris Johnson, butterfly effect, Capital in the Twenty-First Century by Thomas Piketty, car-free, carbon tax, central bank independence, clean water, cloud computing, colonial rule, contact tracing, coronavirus, COVID-19, Credit Default Swap, David Graeber, Day of the Dead, deep learning, DeepMind, deglobalization, Demis Hassabis, Deng Xiaoping, digital divide, Dominic Cummings, Donald Trump, Edward Glaeser, Edward Jenner, Elon Musk, Erik Brynjolfsson, failed state, financial engineering, Francis Fukuyama: the end of history, future of work, gentrification, George Floyd, gig economy, Gini coefficient, global pandemic, global reserve currency, global supply chain, green new deal, hiring and firing, housing crisis, imperial preference, income inequality, Indoor air pollution, invention of the wheel, Jane Jacobs, Jeff Bezos, Jeremy Corbyn, John Maynard Keynes: Economic Possibilities for our Grandchildren, John Snow's cholera map, junk bonds, lockdown, Long Term Capital Management, low interest rates, manufacturing employment, Marc Andreessen, Mark Zuckerberg, Martin Wolf, means of production, megacity, Mexican peso crisis / tequila crisis, middle-income trap, Monroe Doctrine, Nate Silver, Nick Bostrom, oil shock, open borders, out of africa, Parag Khanna, Paris climate accords, Peter Thiel, plutocrats, popular capitalism, Productivity paradox, purchasing power parity, remote working, reserve currency, reshoring, restrictive zoning, ride hailing / ride sharing, Ronald Reagan, secular stagnation, Silicon Valley, social distancing, software is eating the world, South China Sea, Steve Bannon, Steve Jobs, Steven Pinker, Suez crisis 1956, TED Talk, the built environment, The Death and Life of Great American Cities, The inhabitant of London could order by telephone, sipping his morning tea in bed, the various products of the whole earth, The Spirit Level, The Wealth of Nations by Adam Smith, Thomas L Friedman, Tim Cook: Apple, trade route, UNCLOS, universal basic income, urban planning, Washington Consensus, white flight, Works Progress Administration, zoonotic diseases

The technological revolutions that drove the era were stunning—telegraphs, telephones, radio, trains, steamships, automobiles, and electric lighting. Trade had swelled to unprecedented levels. Describing that heady time, the economist John Maynard Keynes observed that people were getting used to previously unimaginable conveniences: “The inhabitant of London could order by telephone, sipping his morning tea in bed, the various products of the whole Earth, in such quantity as he might see fit, and reasonably expect their early delivery upon his doorstep.” People traveled abroad without passports and communicated across borders in a way that they never before had. Tens of millions of immigrants had settled in new lands like America, Canada, and Australia.

The Ages of Globalization by Jeffrey D. Sachs

Admiral Zheng, AlphaGo, Big Tech, biodiversity loss, British Empire, Cape to Cairo, circular economy, classic study, colonial rule, Columbian Exchange, Commentariolus, coronavirus, cotton gin, COVID-19, cuban missile crisis, decarbonisation, DeepMind, demographic transition, Deng Xiaoping, domestication of the camel, Donald Trump, en.wikipedia.org, endogenous growth, European colonialism, general purpose technology, global supply chain, Great Leap Forward, greed is good, income per capita, invention of agriculture, invention of gunpowder, invention of movable type, invention of the steam engine, invisible hand, Isaac Newton, James Watt: steam engine, job automation, John von Neumann, joint-stock company, lockdown, Louis Pasteur, low skilled workers, mass immigration, Nikolai Kondratiev, ocean acidification, out of africa, packet switching, Pax Mongolica, precision agriculture, profit maximization, profit motive, purchasing power parity, rewilding, South China Sea, spinning jenny, Suez canal 1869, systems thinking, The inhabitant of London could order by telephone, sipping his morning tea in bed, the various products of the whole earth, The Wealth of Nations by Adam Smith, trade route, transatlantic slave trade, Turing machine, Turing test, urban planning, warehouse robotics, Watson beat the top human players on Jeopardy!, wikimedia commons, zoonotic diseases

Though Spain had acquired the first global empire, it never commanded the oceans as did Britain. In his post–World War I masterwork, The Economic Consequences of the Peace, John Maynard Keynes vividly described this interconnected prewar world from the vantage point of London just before the onset of World War I. The inhabitant of London could order by telephone, sipping his morning tea in bed, the various products of the whole earth, in such quantity as he might see fit, and reasonably expect their early delivery upon his doorstep; he could at the same moment and by the same means adventure his wealth in the natural resources and new enterprises of any quarter of the world, and share, without exertion or even trouble, in their prospective fruits and advantages; or he could decide to couple the security of his fortunes with the good faith of the townspeople of any substantial municipality in any continent that fancy or information might recommend.

pages: 298 words: 95,668

Milton Friedman: A Biography by Lanny Ebenstein

Abraham Wald, affirmative action, Alan Greenspan, banking crisis, Berlin Wall, Bretton Woods, business cycle, classic study, Deng Xiaoping, Fall of the Berlin Wall, fiat currency, floating exchange rates, Francis Fukuyama: the end of history, full employment, Hernando de Soto, hiring and firing, inflation targeting, invisible hand, Joseph Schumpeter, Kenneth Arrow, Lao Tzu, liquidity trap, means of production, Modern Monetary Theory, Mont Pelerin Society, Myron Scholes, Pareto efficiency, Paul Samuelson, Phillips curve, Ponzi scheme, price stability, public intellectual, rent control, road to serfdom, Robert Bork, Robert Solow, Ronald Coase, Ronald Reagan, Sam Peltzman, school choice, school vouchers, secular stagnation, Simon Kuznets, stem cell, The Chicago School, The inhabitant of London could order by telephone, sipping his morning tea in bed, the various products of the whole earth, The Wealth of Nations by Adam Smith, Thorstein Veblen, zero-sum game

Indeed, in The Economic Consequences of the Peace, Keynes wrote: What an extraordinary episode in the economic progress of man that age was which came to an end in August, 1914!... [L]ife offered conveniences, comforts, and amenities beyond the compass of the richest and most powerful monarchs of other ages. The inhabitant of London could order by telephone, sipping his morning tea in bed, the various products of the whole earth... He could secure . . . cheap and comfortable means of transit to any country or climate without passport and could then proceed abroad to foreign quarters....But, most important of all, he regarded this state of affairs as normal, certain, and permanent....

pages: 327 words: 90,542

The Age of Stagnation: Why Perpetual Growth Is Unattainable and the Global Economy Is in Peril by Satyajit Das

"there is no alternative" (TINA), "World Economic Forum" Davos, 9 dash line, accounting loophole / creative accounting, additive manufacturing, Airbnb, Alan Greenspan, Albert Einstein, Alfred Russel Wallace, Anthropocene, Anton Chekhov, Asian financial crisis, banking crisis, Bear Stearns, Berlin Wall, bitcoin, bond market vigilante , Bretton Woods, BRICs, British Empire, business cycle, business process, business process outsourcing, call centre, capital controls, Capital in the Twenty-First Century by Thomas Piketty, carbon tax, Carmen Reinhart, Clayton Christensen, cloud computing, collaborative economy, colonial exploitation, computer age, creative destruction, cryptocurrency, currency manipulation / currency intervention, David Ricardo: comparative advantage, declining real wages, Deng Xiaoping, deskilling, digital divide, disintermediation, disruptive innovation, Downton Abbey, Emanuel Derman, energy security, energy transition, eurozone crisis, financial engineering, financial innovation, financial repression, forward guidance, Francis Fukuyama: the end of history, full employment, geopolitical risk, gig economy, Gini coefficient, global reserve currency, global supply chain, Goldman Sachs: Vampire Squid, Great Leap Forward, Greenspan put, happiness index / gross national happiness, high-speed rail, Honoré de Balzac, hydraulic fracturing, Hyman Minsky, illegal immigration, income inequality, income per capita, indoor plumbing, informal economy, Innovator's Dilemma, intangible asset, Intergovernmental Panel on Climate Change (IPCC), it is difficult to get a man to understand something, when his salary depends on his not understanding it, It's morning again in America, Jane Jacobs, John Maynard Keynes: technological unemployment, junk bonds, Kenneth Rogoff, Kevin Roose, knowledge economy, knowledge worker, Les Trente Glorieuses, light touch regulation, liquidity trap, Long Term Capital Management, low interest rates, low skilled workers, Lyft, Mahatma Gandhi, margin call, market design, Marshall McLuhan, Martin Wolf, middle-income trap, Mikhail Gorbachev, military-industrial complex, Minsky moment, mortgage debt, mortgage tax deduction, new economy, New Urbanism, offshore financial centre, oil shale / tar sands, oil shock, old age dependency ratio, open economy, PalmPilot, passive income, peak oil, peer-to-peer lending, pension reform, planned obsolescence, plutocrats, Ponzi scheme, Potemkin village, precariat, price stability, profit maximization, pushing on a string, quantitative easing, race to the bottom, Ralph Nader, Rana Plaza, rent control, rent-seeking, reserve currency, ride hailing / ride sharing, rising living standards, risk/return, Robert Gordon, Robert Solow, Ronald Reagan, Russell Brand, Satyajit Das, savings glut, secular stagnation, seigniorage, sharing economy, Silicon Valley, Simon Kuznets, Slavoj Žižek, South China Sea, sovereign wealth fund, Stephen Fry, systems thinking, TaskRabbit, The Chicago School, The Great Moderation, The inhabitant of London could order by telephone, sipping his morning tea in bed, the various products of the whole earth, the market place, the payments system, The Spirit Level, Thorstein Veblen, Tim Cook: Apple, too big to fail, total factor productivity, trade route, transaction costs, uber lyft, unpaid internship, Unsafe at Any Speed, Upton Sinclair, Washington Consensus, We are the 99%, WikiLeaks, Y2K, Yom Kippur War, zero-coupon bond, zero-sum game

Geographer Jared Diamond thought the effects may be more severe: “population and environmental problems created by non-sustainable resource use will ultimately get solved one way or another: if not by pleasant means of our own choice, then by unpleasant and unchosen means, such as the ones that Malthus initially envisioned.”10 In the period after World War II, economic growth benefited from the remarkable expansion in global trade and capital flows. Similarly, in an interesting parallel, increases in trade, the free movement of capital, and travel also facilitated growth and prosperity before 1914. John Maynard Keynes celebrated this earlier golden age: “The inhabitant of London could order by telephone, sipping his morning tea in bed, the various products of the whole earth, in such quantity as he might see fit, and reasonably expect their early delivery upon his doorstep; he could at the same moment and by the same means adventure his wealth in the natural resources and new enterprises of any quarter of the world, and share, without exertion or even trouble, in their prospective fruits and advantages.”1 Keynes's Londoner came to regard “this state of affairs as normal, certain, and permanent, except in the direction of further improvement, and any deviation from it as aberrant, scandalous, and avoidable.”

pages: 550 words: 89,316

The Sum of Small Things: A Theory of the Aspirational Class by Elizabeth Currid-Halkett

assortative mating, back-to-the-land, barriers to entry, Bernie Sanders, biodiversity loss, BRICs, Capital in the Twenty-First Century by Thomas Piketty, clean water, cognitive dissonance, David Brooks, deindustrialization, Deng Xiaoping, discrete time, disruptive innovation, Downton Abbey, East Village, Edward Glaeser, en.wikipedia.org, Etonian, fixed-gear, food desert, Ford Model T, gentrification, Geoffrey West, Santa Fe Institute, income inequality, iterative process, knowledge economy, longitudinal study, Mason jar, means of production, NetJets, new economy, New Urbanism, plutocrats, post scarcity, post-industrial society, profit maximization, public intellectual, Richard Florida, selection bias, Sheryl Sandberg, Silicon Valley, systems thinking, tacit knowledge, The Design of Experiments, the High Line, The inhabitant of London could order by telephone, sipping his morning tea in bed, the various products of the whole earth, the long tail, the market place, The Theory of the Leisure Class by Thorstein Veblen, Thorstein Veblen, Tony Hsieh, Tyler Cowen, Tyler Cowen: Great Stagnation, upwardly mobile, Veblen good, women in the workforce

That system is more complex … [But if we] create more scale, more support for local economies and farmers, we can encourage more wide-scale regenerative production practices.15 FASHION AND THE NOT-MADE-IN-CHINA MOVEMENT In 1919, in his treatise, The Economic Consequences of the Peace, John Maynard Keynes, commenting on the diversity of consumer choice at his disposal, remarked that “The inhabitant of London could order by telephone, sipping his morning tea in bed, the various products of the whole earth.”16 This observation was pre–World War II and pre-globalization as we know it. Yet in many ways fashion has returned to a pre–mass produced world where point of origin matters as it did with Indian tea and Persian silk. Fast women’s fashion in the form of H&M and Forever 21, and the standardized goods made en masse and anonymously in China, Vietnam, and Mexico, have made Western consumers less interested in the big, global brands, particularly those that are produced in far-flung parts of the world with a slapped-on American label.

pages: 376 words: 109,092

Paper Promises by Philip Coggan

accounting loophole / creative accounting, activist fund / activist shareholder / activist investor, Alan Greenspan, balance sheet recession, bank run, banking crisis, barriers to entry, Bear Stearns, Berlin Wall, Bernie Madoff, Black Monday: stock market crash in 1987, Black Swan, bond market vigilante , Bretton Woods, British Empire, business cycle, call centre, capital controls, Carmen Reinhart, carried interest, Celtic Tiger, central bank independence, collapse of Lehman Brothers, collateralized debt obligation, credit crunch, Credit Default Swap, credit default swaps / collateralized debt obligations, currency manipulation / currency intervention, currency peg, currency risk, debt deflation, delayed gratification, diversified portfolio, eurozone crisis, Fall of the Berlin Wall, falling living standards, fear of failure, financial innovation, financial repression, fixed income, floating exchange rates, full employment, German hyperinflation, global reserve currency, Goodhart's law, Greenspan put, hiring and firing, Hyman Minsky, income inequality, inflation targeting, Isaac Newton, John Meriwether, joint-stock company, junk bonds, Kenneth Rogoff, Kickstarter, labour market flexibility, Les Trente Glorieuses, light touch regulation, Long Term Capital Management, low interest rates, manufacturing employment, market bubble, market clearing, Martin Wolf, Minsky moment, Money creation, money market fund, money: store of value / unit of account / medium of exchange, moral hazard, mortgage debt, Myron Scholes, negative equity, Nick Leeson, Northern Rock, oil shale / tar sands, paradox of thrift, peak oil, pension reform, plutocrats, Ponzi scheme, price stability, principal–agent problem, purchasing power parity, quantitative easing, QWERTY keyboard, railway mania, regulatory arbitrage, reserve currency, Robert Gordon, Robert Shiller, Ronald Reagan, savings glut, short selling, South Sea Bubble, sovereign wealth fund, special drawing rights, Suez crisis 1956, The Chicago School, The Great Moderation, The inhabitant of London could order by telephone, sipping his morning tea in bed, the various products of the whole earth, The Wealth of Nations by Adam Smith, time value of money, too big to fail, trade route, tulip mania, value at risk, Washington Consensus, women in the workforce, zero-sum game

The arrival of steamships in the mid-nineteenth century opened up the possibility of exporting wheat from the US and meat from Argentina to the hungry European markets. The result was an agricultural depression in Britain. But by shifting workers from relatively unproductive farming into manufacturing, it gave a kick-start to European growth. In the words of Keynes, The inhabitant of London could order by telephone, sipping his morning tea in bed, the various products of the whole earth . . . he could at the same time and by the same means adventure his wealth in the natural resources and new enterprise of any quarter of the world . . . he could secure forthwith, if he wished, cheap and comfortable means of transit to any country or climate without passport or other formality.4 This system tied countries closely together in economic terms.

pages: 460 words: 107,454

Stakeholder Capitalism: A Global Economy That Works for Progress, People and Planet by Klaus Schwab, Peter Vanham

"Friedman doctrine" OR "shareholder theory", "World Economic Forum" Davos, 3D printing, additive manufacturing, agricultural Revolution, air traffic controllers' union, Anthropocene, Apple II, Asian financial crisis, Asperger Syndrome, basic income, Berlin Wall, Big Tech, biodiversity loss, bitcoin, Black Lives Matter, blockchain, blue-collar work, Branko Milanovic, Bretton Woods, British Empire, business process, capital controls, Capital in the Twenty-First Century by Thomas Piketty, car-free, carbon footprint, carbon tax, centre right, clean tech, clean water, cloud computing, collateralized debt obligation, collective bargaining, colonial rule, company town, contact tracing, contact tracing app, Cornelius Vanderbilt, coronavirus, corporate governance, corporate social responsibility, COVID-19, creative destruction, Credit Default Swap, credit default swaps / collateralized debt obligations, cryptocurrency, cuban missile crisis, currency peg, cyber-physical system, decarbonisation, demographic dividend, Deng Xiaoping, Diane Coyle, digital divide, don't be evil, European colonialism, Fall of the Berlin Wall, family office, financial innovation, Francis Fukuyama: the end of history, future of work, gender pay gap, general purpose technology, George Floyd, gig economy, Gini coefficient, global supply chain, global value chain, global village, Google bus, green new deal, Greta Thunberg, high net worth, hiring and firing, housing crisis, income inequality, income per capita, independent contractor, industrial robot, intangible asset, Intergovernmental Panel on Climate Change (IPCC), Internet of things, invisible hand, James Watt: steam engine, Jeff Bezos, job automation, joint-stock company, Joseph Schumpeter, Kenneth Rogoff, Khan Academy, Kickstarter, labor-force participation, lockdown, low interest rates, low skilled workers, Lyft, manufacturing employment, Marc Benioff, Mark Zuckerberg, market fundamentalism, Marshall McLuhan, Martin Wolf, means of production, megacity, microplastics / micro fibres, Mikhail Gorbachev, mini-job, mittelstand, move fast and break things, neoliberal agenda, Network effects, new economy, open economy, Peace of Westphalia, Peter Thiel, precariat, Productivity paradox, profit maximization, purchasing power parity, race to the bottom, reserve currency, reshoring, ride hailing / ride sharing, Ronald Reagan, Salesforce, San Francisco homelessness, School Strike for Climate, self-driving car, seminal paper, shareholder value, Shenzhen special economic zone , Shenzhen was a fishing village, Silicon Valley, Simon Kuznets, social distancing, Social Responsibility of Business Is to Increase Its Profits, special economic zone, Steve Jobs, Steve Wozniak, synthetic biology, TaskRabbit, The Chicago School, The Future of Employment, The inhabitant of London could order by telephone, sipping his morning tea in bed, the various products of the whole earth, the scientific method, TikTok, Tim Cook: Apple, trade route, transfer pricing, Uber and Lyft, uber lyft, union organizing, universal basic income, War on Poverty, We are the 99%, women in the workforce, working poor, working-age population, Yom Kippur War, young professional, zero-sum game

For about a century, trade grew on average 3 percent per year.10 That growth rate propelled exports from a share of 6 percent of global GDP in the early 19th century to 14 percent on the eve of World War I.11 As John Maynard Keynes, the economist, famously observed, in The Economic Consequences of the Peace:12 “What an extraordinary episode in the economic progress of man that age was which came to an end in August 1914! […] The inhabitant of London could order by telephone, sipping his morning tea in bed, the various products of the whole Earth, in such quantity as he might see fit, and reasonably expect their early delivery upon his doorstep.” Keynes also noted a similar situation was also true in the world of investing. Those with the means in New York, Paris, London, or Berlin could also invest in internationally active joint stock companies.

pages: 460 words: 107,454

Stakeholder Capitalism: A Global Economy That Works for Progress, People and Planet by Klaus Schwab

"Friedman doctrine" OR "shareholder theory", "World Economic Forum" Davos, 3D printing, additive manufacturing, agricultural Revolution, air traffic controllers' union, Anthropocene, Apple II, Asian financial crisis, Asperger Syndrome, basic income, Berlin Wall, Big Tech, biodiversity loss, bitcoin, Black Lives Matter, blockchain, blue-collar work, Branko Milanovic, Bretton Woods, British Empire, business process, capital controls, Capital in the Twenty-First Century by Thomas Piketty, car-free, carbon footprint, carbon tax, centre right, clean tech, clean water, cloud computing, collateralized debt obligation, collective bargaining, colonial rule, company town, contact tracing, contact tracing app, Cornelius Vanderbilt, coronavirus, corporate governance, corporate social responsibility, COVID-19, creative destruction, Credit Default Swap, credit default swaps / collateralized debt obligations, cryptocurrency, cuban missile crisis, currency peg, cyber-physical system, decarbonisation, demographic dividend, Deng Xiaoping, Diane Coyle, digital divide, don't be evil, European colonialism, Fall of the Berlin Wall, family office, financial innovation, Francis Fukuyama: the end of history, future of work, gender pay gap, general purpose technology, George Floyd, gig economy, Gini coefficient, global supply chain, global value chain, global village, Google bus, green new deal, Greta Thunberg, high net worth, hiring and firing, housing crisis, income inequality, income per capita, independent contractor, industrial robot, intangible asset, Intergovernmental Panel on Climate Change (IPCC), Internet of things, invisible hand, James Watt: steam engine, Jeff Bezos, job automation, joint-stock company, Joseph Schumpeter, Kenneth Rogoff, Khan Academy, Kickstarter, labor-force participation, lockdown, low interest rates, low skilled workers, Lyft, manufacturing employment, Marc Benioff, Mark Zuckerberg, market fundamentalism, Marshall McLuhan, Martin Wolf, means of production, megacity, microplastics / micro fibres, Mikhail Gorbachev, mini-job, mittelstand, move fast and break things, neoliberal agenda, Network effects, new economy, open economy, Peace of Westphalia, Peter Thiel, precariat, Productivity paradox, profit maximization, purchasing power parity, race to the bottom, reserve currency, reshoring, ride hailing / ride sharing, Ronald Reagan, Salesforce, San Francisco homelessness, School Strike for Climate, self-driving car, seminal paper, shareholder value, Shenzhen special economic zone , Shenzhen was a fishing village, Silicon Valley, Simon Kuznets, social distancing, Social Responsibility of Business Is to Increase Its Profits, special economic zone, Steve Jobs, Steve Wozniak, synthetic biology, TaskRabbit, The Chicago School, The Future of Employment, The inhabitant of London could order by telephone, sipping his morning tea in bed, the various products of the whole earth, the scientific method, TikTok, Tim Cook: Apple, trade route, transfer pricing, Uber and Lyft, uber lyft, union organizing, universal basic income, War on Poverty, We are the 99%, women in the workforce, working poor, working-age population, Yom Kippur War, young professional, zero-sum game

For about a century, trade grew on average 3 percent per year.10 That growth rate propelled exports from a share of 6 percent of global GDP in the early 19th century to 14 percent on the eve of World War I.11 As John Maynard Keynes, the economist, famously observed, in The Economic Consequences of the Peace:12 “What an extraordinary episode in the economic progress of man that age was which came to an end in August 1914! […] The inhabitant of London could order by telephone, sipping his morning tea in bed, the various products of the whole Earth, in such quantity as he might see fit, and reasonably expect their early delivery upon his doorstep.” Keynes also noted a similar situation was also true in the world of investing. Those with the means in New York, Paris, London, or Berlin could also invest in internationally active joint stock companies.

pages: 407 words: 114,478

The Four Pillars of Investing: Lessons for Building a Winning Portfolio by William J. Bernstein

Alan Greenspan, asset allocation, behavioural economics, book value, Bretton Woods, British Empire, business cycle, butter production in bangladesh, buy and hold, buy low sell high, carried interest, corporate governance, cuban missile crisis, Daniel Kahneman / Amos Tversky, Dava Sobel, diversification, diversified portfolio, Edmond Halley, equity premium, estate planning, Eugene Fama: efficient market hypothesis, financial engineering, financial independence, financial innovation, fixed income, George Santayana, German hyperinflation, Glass-Steagall Act, high net worth, hindsight bias, Hyman Minsky, index fund, invention of the telegraph, Isaac Newton, John Bogle, John Harrison: Longitude, junk bonds, Long Term Capital Management, loss aversion, low interest rates, market bubble, mental accounting, money market fund, mortgage debt, new economy, pattern recognition, Paul Samuelson, Performance of Mutual Funds in the Period, quantitative easing, railway mania, random walk, Richard Thaler, risk tolerance, risk/return, Robert Shiller, Savings and loan crisis, South Sea Bubble, stock buybacks, stocks for the long run, stocks for the long term, survivorship bias, Teledyne, The inhabitant of London could order by telephone, sipping his morning tea in bed, the various products of the whole earth, the rule of 72, transaction costs, Vanguard fund, yield curve, zero-sum game

There is no better illustration of the dangers of living and investing in an apparently stable and prosperous era than this passage from Keynes’s The Economic Consequences of the Peace, which chronicles life in Europe just before the lights went out for almost two generations: The inhabitant of London could order by telephone, sipping his morning tea in bed, the various products of the whole earth, in such quantity as he might see fit, and reasonably expect their early delivery upon his doorstep; he could at the same moment and by the same means adventure his wealth in the natural resources and new enterprises of any quarter of the world, and share, without exertion or even trouble, in their prospective fruits and advantages; or he could decide, to couple the security of his fortunes with the good faith of the townspeople of any substantial municipality in any continent that fancy or information might recommend.

pages: 756 words: 120,818

The Levelling: What’s Next After Globalization by Michael O’sullivan

"World Economic Forum" Davos, 3D printing, Airbnb, Alan Greenspan, algorithmic trading, Alvin Toffler, bank run, banking crisis, barriers to entry, Bernie Sanders, Big Tech, bitcoin, Black Swan, blockchain, bond market vigilante , Boris Johnson, Branko Milanovic, Bretton Woods, Brexit referendum, British Empire, business cycle, business process, capital controls, carbon tax, Celtic Tiger, central bank independence, classic study, cloud computing, continuation of politics by other means, corporate governance, credit crunch, CRISPR, cryptocurrency, data science, deglobalization, deindustrialization, disinformation, disruptive innovation, distributed ledger, Donald Trump, driverless car, eurozone crisis, fake news, financial engineering, financial innovation, first-past-the-post, fixed income, gentrification, Geoffrey West, Santa Fe Institute, Gini coefficient, Glass-Steagall Act, global value chain, housing crisis, impact investing, income inequality, Intergovernmental Panel on Climate Change (IPCC), It's morning again in America, James Carville said: "I would like to be reincarnated as the bond market. You can intimidate everybody.", junk bonds, knowledge economy, liberal world order, Long Term Capital Management, longitudinal study, low interest rates, market bubble, minimum wage unemployment, new economy, Northern Rock, offshore financial centre, open economy, opioid epidemic / opioid crisis, Paris climate accords, pattern recognition, Peace of Westphalia, performance metric, Phillips curve, private military company, quantitative easing, race to the bottom, reserve currency, Robert Gordon, Robert Shiller, Robert Solow, Ronald Reagan, Scramble for Africa, secular stagnation, Silicon Valley, Sinatra Doctrine, South China Sea, South Sea Bubble, special drawing rights, Steve Bannon, Suez canal 1869, supply-chain management, The inhabitant of London could order by telephone, sipping his morning tea in bed, the various products of the whole earth, The Rise and Fall of American Growth, The Wealth of Nations by Adam Smith, Thomas Kuhn: the structure of scientific revolutions, total factor productivity, trade liberalization, tulip mania, Valery Gerasimov, Washington Consensus

Economic Consequences of the Peace At the turn of the twentieth century, the first wave of globalization was in full swing, and London was its epicenter. It was gripped by a consumer culture not seen before. John Maynard Keynes captured its spirit in his 1919 book Economic Consequences of the Peace: The inhabitant of London could order by telephone, sipping his morning tea in bed, the various products of the whole earth, in such quantity as he might see fit, and reasonably expect their early delivery upon his doorstep; he could at the same moment and by the same means adventure his wealth in the natural resources and the new enterprises of any quarter of the world, and share, without exertion or trouble, in their prospective fruits and advantages, or he could decide to couple the security of his fortunes with the good faith of the townspeople of any substantial municipality in any continent that fancy or information might recommend.… Most important of all, he regarded this state of affairs as normal, certain and permanent except in the direction of further improvement, and any deviation from it as aberrant, scandalous and avoidable.1 The world Keynes described bears a striking similarity to our own.

pages: 484 words: 136,735

Capitalism 4.0: The Birth of a New Economy in the Aftermath of Crisis by Anatole Kaletsky

"World Economic Forum" Davos, Alan Greenspan, bank run, banking crisis, Bear Stearns, behavioural economics, Benoit Mandelbrot, Berlin Wall, Black Swan, bond market vigilante , bonus culture, Bretton Woods, BRICs, business cycle, buy and hold, Carmen Reinhart, classic study, cognitive dissonance, collapse of Lehman Brothers, Corn Laws, correlation does not imply causation, creative destruction, credit crunch, currency manipulation / currency intervention, currency risk, David Ricardo: comparative advantage, deglobalization, Deng Xiaoping, eat what you kill, Edward Glaeser, electricity market, Eugene Fama: efficient market hypothesis, eurozone crisis, experimental economics, F. W. de Klerk, failed state, Fall of the Berlin Wall, financial deregulation, financial innovation, Financial Instability Hypothesis, floating exchange rates, foreign exchange controls, full employment, geopolitical risk, George Akerlof, global rebalancing, Goodhart's law, Great Leap Forward, Hyman Minsky, income inequality, information asymmetry, invisible hand, Isaac Newton, Joseph Schumpeter, Kenneth Arrow, Kenneth Rogoff, Kickstarter, laissez-faire capitalism, long and variable lags, Long Term Capital Management, low interest rates, mandelbrot fractal, market design, market fundamentalism, Martin Wolf, military-industrial complex, Minsky moment, Modern Monetary Theory, Money creation, money market fund, moral hazard, mortgage debt, Nelson Mandela, new economy, Nixon triggered the end of the Bretton Woods system, Northern Rock, offshore financial centre, oil shock, paradox of thrift, Pareto efficiency, Paul Samuelson, Paul Volcker talking about ATMs, peak oil, pets.com, Ponzi scheme, post-industrial society, price stability, profit maximization, profit motive, quantitative easing, Ralph Waldo Emerson, random walk, rent-seeking, reserve currency, rising living standards, Robert Shiller, Robert Solow, Ronald Reagan, Savings and loan crisis, seminal paper, shareholder value, short selling, South Sea Bubble, sovereign wealth fund, special drawing rights, statistical model, systems thinking, The Chicago School, The Great Moderation, The inhabitant of London could order by telephone, sipping his morning tea in bed, the various products of the whole earth, The Wealth of Nations by Adam Smith, Thomas Kuhn: the structure of scientific revolutions, too big to fail, Vilfredo Pareto, Washington Consensus, zero-sum game

But escape was possible, for any man of capacity or character at all exceeding the average, into the middle and upper classes, for whom life offered, at a low cost and with the least trouble, conveniences, comforts, and amenities beyond the compass of the richest and most powerful monarchs of other ages. The inhabitant of London could order by telephone, sipping his morning tea in bed, the various products of the whole earth, in such quantity as he might see fit, and reasonably expect their early delivery upon his doorstep; he could at the same moment and by the same means adventure his wealth in the natural resources and new enterprises of any quarter of the world, and share, without exertion or even trouble, in their prospective fruits and advantages; or he could decide to couple the security of his fortunes with the good faith of the townspeople of any substantial municipality in any continent that fancy or information might recommend.

pages: 469 words: 146,487

Empire: How Britain Made the Modern World by Niall Ferguson

British Empire, Cape to Cairo, colonial rule, Corn Laws, death from overwork, European colonialism, imperial preference, income per capita, information security, John Harrison: Longitude, joint-stock company, Khartoum Gordon, Khyber Pass, land reform, land tenure, liberal capitalism, Livingstone, I presume, low interest rates, Mahatma Gandhi, mass immigration, military-industrial complex, night-watchman state, Panopticon Jeremy Bentham, profit motive, Scramble for Africa, spice trade, Suez canal 1869, Suez crisis 1956, The inhabitant of London could order by telephone, sipping his morning tea in bed, the various products of the whole earth, the new new thing, The Wealth of Nations by Adam Smith, Thomas Malthus, three-masted sailing ship, trade route, transatlantic slave trade, undersea cable, union organizing, zero-sum game

Writing in 1919, John Maynard Keynes looked back fondly on ‘that extraordinary episode in the economic progress of man … which came to an end in August 1914’: For … the middle and upper classes … life offered, at a low cost and with the least trouble, conveniences, comforts and amenities beyond the compass of the richest and most powerful monarchs of other ages. The inhabitant of London could order by telephone, sipping his morning tea in bed, the various products of the whole earth in such quantity as he might see fit, and reasonably expect their early delivery upon his doorstep; he could at the same moment and by the same means adventure his wealth in the natural resources and new enterprises of any quarter of the world, and share, without exertion or even trouble, in their prospective fruits and advantages … Now, after the fall, it proved extremely difficult to restore the foundations of the pre-war era of globalization.

pages: 632 words: 159,454

War and Gold: A Five-Hundred-Year History of Empires, Adventures, and Debt by Kwasi Kwarteng

accounting loophole / creative accounting, Alan Greenspan, anti-communist, Asian financial crisis, asset-backed security, Atahualpa, balance sheet recession, bank run, banking crisis, Bear Stearns, Big bang: deregulation of the City of London, Bretton Woods, British Empire, business cycle, California gold rush, capital controls, Carmen Reinhart, central bank independence, centre right, collapse of Lehman Brothers, collateralized debt obligation, credit crunch, currency manipulation / currency intervention, Deng Xiaoping, discovery of the americas, Etonian, eurozone crisis, fiat currency, financial engineering, financial innovation, fixed income, floating exchange rates, foreign exchange controls, Francisco Pizarro, full employment, German hyperinflation, Glass-Steagall Act, guns versus butter model, hiring and firing, income inequality, invisible hand, Isaac Newton, it's over 9,000, John Maynard Keynes: Economic Possibilities for our Grandchildren, joint-stock company, joint-stock limited liability company, Joseph Schumpeter, Kenneth Rogoff, labour market flexibility, land bank, liberal capitalism, low interest rates, market bubble, money: store of value / unit of account / medium of exchange, moral hazard, new economy, Nixon triggered the end of the Bretton Woods system, oil shock, plutocrats, Ponzi scheme, price mechanism, quantitative easing, rolodex, Ronald Reagan, South Sea Bubble, subprime mortgage crisis, Suez canal 1869, The inhabitant of London could order by telephone, sipping his morning tea in bed, the various products of the whole earth, the market place, The Wealth of Nations by Adam Smith, too big to fail, War on Poverty, Yom Kippur War

The war which broke out in 1914 would change the financial world for ever and would afford even greater opportunities for the financial power of the United States. 6 London 1914 London, at the beginning of 1914, was a civilized and self-contented city. John Maynard Keynes, a thirty-year-old Cambridge academic, remembered the time well when the inhabitant of London ‘could order by telephone, sipping his morning tea in bed, the various products of the whole earth, in such quantity as he might see fit, and reasonably expect their early delivery upon his doorstep’. This fortunate gentleman ‘could at the same time adventure his wealth in the natural resources and new enterprises of any quarter of the world, and share . . . in their prospective fruits and advantages’.1 In this justly famous passage from his Economic Consequences of the Peace, published in 1919, Keynes remarked on the apparent solidity of this state of affairs, which seemed ‘normal’, ‘certain’ and ‘permanent’.

pages: 497 words: 144,283

Connectography: Mapping the Future of Global Civilization by Parag Khanna

"World Economic Forum" Davos, 1919 Motor Transport Corps convoy, 2013 Report for America's Infrastructure - American Society of Civil Engineers - 19 March 2013, 9 dash line, additive manufacturing, Admiral Zheng, affirmative action, agricultural Revolution, Airbnb, Albert Einstein, amateurs talk tactics, professionals talk logistics, Amazon Mechanical Turk, Anthropocene, Asian financial crisis, asset allocation, autonomous vehicles, banking crisis, Basel III, Berlin Wall, bitcoin, Black Swan, blockchain, borderless world, Boycotts of Israel, Branko Milanovic, BRICs, British Empire, business intelligence, call centre, capital controls, Carl Icahn, charter city, circular economy, clean water, cloud computing, collateralized debt obligation, commoditize, complexity theory, continuation of politics by other means, corporate governance, corporate social responsibility, credit crunch, crony capitalism, crowdsourcing, cryptocurrency, cuban missile crisis, data is the new oil, David Ricardo: comparative advantage, deglobalization, deindustrialization, dematerialisation, Deng Xiaoping, Detroit bankruptcy, digital capitalism, digital divide, digital map, disruptive innovation, diversification, Doha Development Round, driverless car, Easter island, edge city, Edward Snowden, Elon Musk, energy security, Ethereum, ethereum blockchain, European colonialism, eurozone crisis, export processing zone, failed state, Fairphone, Fall of the Berlin Wall, family office, Ferguson, Missouri, financial innovation, financial repression, fixed income, forward guidance, gentrification, geopolitical risk, global supply chain, global value chain, global village, Google Earth, Great Leap Forward, Hernando de Soto, high net worth, high-speed rail, Hyperloop, ice-free Arctic, if you build it, they will come, illegal immigration, income inequality, income per capita, industrial cluster, industrial robot, informal economy, Infrastructure as a Service, interest rate swap, Intergovernmental Panel on Climate Change (IPCC), Internet of things, Isaac Newton, Jane Jacobs, Jaron Lanier, John von Neumann, Julian Assange, Just-in-time delivery, Kevin Kelly, Khyber Pass, Kibera, Kickstarter, LNG terminal, low cost airline, low earth orbit, low interest rates, manufacturing employment, mass affluent, mass immigration, megacity, Mercator projection, Metcalfe’s law, microcredit, middle-income trap, mittelstand, Monroe Doctrine, Multics, mutually assured destruction, Neal Stephenson, New Economic Geography, new economy, New Urbanism, off grid, offshore financial centre, oil rush, oil shale / tar sands, oil shock, openstreetmap, out of africa, Panamax, Parag Khanna, Peace of Westphalia, peak oil, Pearl River Delta, Peter Thiel, Philip Mirowski, Planet Labs, plutocrats, post-oil, post-Panamax, precautionary principle, private military company, purchasing power parity, quantum entanglement, Quicken Loans, QWERTY keyboard, race to the bottom, Rana Plaza, rent-seeking, reserve currency, Robert Gordon, Robert Shiller, Robert Solow, rolling blackouts, Ronald Coase, Scramble for Africa, Second Machine Age, sharing economy, Shenzhen special economic zone , Shenzhen was a fishing village, Silicon Valley, Silicon Valley startup, six sigma, Skype, smart cities, Smart Cities: Big Data, Civic Hackers, and the Quest for a New Utopia, South China Sea, South Sea Bubble, sovereign wealth fund, special economic zone, spice trade, Stuxnet, supply-chain management, sustainable-tourism, systems thinking, TaskRabbit, tech worker, TED Talk, telepresence, the built environment, The inhabitant of London could order by telephone, sipping his morning tea in bed, the various products of the whole earth, Tim Cook: Apple, trade route, Tragedy of the Commons, transaction costs, Tyler Cowen, UNCLOS, uranium enrichment, urban planning, urban sprawl, vertical integration, WikiLeaks, Yochai Benkler, young professional, zero day

Germany’s and America’s huge increase in steel production and industrial output in the late nineteenth century together with the expansion of colonial European railway and shipping networks created an interconnected global economy as had never before been seen. Describing those halcyon days in his famous 1919 treatise, The Economic Consequences of the Peace, John Maynard Keynes wrote, “The inhabitant of London could order by telephone, sipping his morning tea in bed, the various products of the whole earth, in such quantity as he might see fit, and reasonably expect their early delivery upon his doorstep….[He] regarded this state of affairs as normal, certain, and permanent, except in the direction of further improvement, and any deviation from it as aberrant, scandalous, and avoidable.”1 The pre–World War I period was indeed a golden age of globalization—but only for those in charge of it.

pages: 586 words: 159,901

Wall Street: How It Works And for Whom by Doug Henwood

accounting loophole / creative accounting, activist fund / activist shareholder / activist investor, affirmative action, Alan Greenspan, Andrei Shleifer, asset allocation, asset-backed security, bank run, banking crisis, barriers to entry, bond market vigilante , book value, borderless world, Bretton Woods, British Empire, business cycle, buy the rumour, sell the news, capital asset pricing model, capital controls, Carl Icahn, central bank independence, computerized trading, corporate governance, corporate raider, correlation coefficient, correlation does not imply causation, credit crunch, currency manipulation / currency intervention, currency risk, David Ricardo: comparative advantage, debt deflation, declining real wages, deindustrialization, dematerialisation, disinformation, diversification, diversified portfolio, Donald Trump, equity premium, Eugene Fama: efficient market hypothesis, experimental subject, facts on the ground, financial deregulation, financial engineering, financial innovation, Financial Instability Hypothesis, floating exchange rates, full employment, George Akerlof, George Gilder, Glass-Steagall Act, hiring and firing, Hyman Minsky, implied volatility, index arbitrage, index fund, information asymmetry, interest rate swap, Internet Archive, invisible hand, Irwin Jacobs, Isaac Newton, joint-stock company, Joseph Schumpeter, junk bonds, kremlinology, labor-force participation, late capitalism, law of one price, liberal capitalism, liquidationism / Banker’s doctrine / the Treasury view, London Interbank Offered Rate, long and variable lags, Louis Bachelier, low interest rates, market bubble, Mexican peso crisis / tequila crisis, Michael Milken, microcredit, minimum wage unemployment, money market fund, moral hazard, mortgage debt, mortgage tax deduction, Myron Scholes, oil shock, Paul Samuelson, payday loans, pension reform, planned obsolescence, plutocrats, Post-Keynesian economics, price mechanism, price stability, prisoner's dilemma, profit maximization, proprietary trading, publication bias, Ralph Nader, random walk, reserve currency, Richard Thaler, risk tolerance, Robert Gordon, Robert Shiller, Savings and loan crisis, selection bias, shareholder value, short selling, Slavoj Žižek, South Sea Bubble, stock buybacks, The inhabitant of London could order by telephone, sipping his morning tea in bed, the various products of the whole earth, The Market for Lemons, The Nature of the Firm, The Predators' Ball, The Wealth of Nations by Adam Smith, transaction costs, transcontinental railway, women in the workforce, yield curve, zero-coupon bond

Though casual observers treat this borderless world as a recent invention, it's more than a little reminiscent of life before World War I. That idyllic world was nicely evoked by John Maynard Keynes (1988, pp. 11-12), no doubt one of these once-charmed Londoners he wrote about: The inhabitant of London could order by telephone, sipping his morning tea in bed, the various products of the whole earth, in such quantity as he might see fit, and reasonably expect their early delivery upon his doorstep; he could at the same moment and by the same means adventure his wealth in the natural resources and new enterprises of any quarter of the world, and share, without exertion or even trouble, in their prospective fruits and advantages; or he could decide to couple the security of his fortunes with the good faith of the townspeople of any substantial municipality in any continent that fancy or information might recommend.

pages: 524 words: 155,947

More: The 10,000-Year Rise of the World Economy by Philip Coggan

accounting loophole / creative accounting, Ada Lovelace, agricultural Revolution, Airbnb, airline deregulation, Alan Greenspan, Andrei Shleifer, anti-communist, Apollo 11, assortative mating, autonomous vehicles, bank run, banking crisis, banks create money, basic income, Bear Stearns, Berlin Wall, Black Monday: stock market crash in 1987, Bletchley Park, Bob Noyce, Boeing 747, bond market vigilante , Branko Milanovic, Bretton Woods, Brexit referendum, British Empire, business cycle, call centre, capital controls, carbon footprint, carbon tax, Carl Icahn, Carmen Reinhart, Celtic Tiger, central bank independence, Charles Babbage, Charles Lindbergh, clean water, collective bargaining, Columbian Exchange, Columbine, Corn Laws, cotton gin, credit crunch, Credit Default Swap, crony capitalism, cross-border payments, currency peg, currency risk, debt deflation, DeepMind, Deng Xiaoping, discovery of the americas, Donald Trump, driverless car, Easter island, Erik Brynjolfsson, European colonialism, eurozone crisis, Fairchild Semiconductor, falling living standards, financial engineering, financial innovation, financial intermediation, floating exchange rates, flying shuttle, Ford Model T, Fractional reserve banking, Frederick Winslow Taylor, full employment, general purpose technology, germ theory of disease, German hyperinflation, gig economy, Gini coefficient, Glass-Steagall Act, global supply chain, global value chain, Gordon Gekko, Great Leap Forward, greed is good, Greenspan put, guns versus butter model, Haber-Bosch Process, Hans Rosling, Hernando de Soto, hydraulic fracturing, hydroponic farming, Ignaz Semmelweis: hand washing, income inequality, income per capita, independent contractor, indoor plumbing, industrial robot, inflation targeting, Isaac Newton, James Watt: steam engine, job automation, John Snow's cholera map, joint-stock company, joint-stock limited liability company, Jon Ronson, Kenneth Arrow, Kula ring, labour market flexibility, land reform, land tenure, Lao Tzu, large denomination, Les Trente Glorieuses, liquidity trap, Long Term Capital Management, Louis Blériot, low cost airline, low interest rates, low skilled workers, lump of labour, M-Pesa, Malcom McLean invented shipping containers, manufacturing employment, Marc Andreessen, Mark Zuckerberg, Martin Wolf, McJob, means of production, Mikhail Gorbachev, mittelstand, Modern Monetary Theory, moral hazard, Murano, Venice glass, Myron Scholes, Nelson Mandela, Network effects, Northern Rock, oil shale / tar sands, oil shock, Paul Samuelson, Paul Volcker talking about ATMs, Phillips curve, popular capitalism, popular electronics, price stability, principal–agent problem, profit maximization, purchasing power parity, quantitative easing, railway mania, Ralph Nader, regulatory arbitrage, road to serfdom, Robert Gordon, Robert Shiller, Robert Solow, Ronald Coase, Ronald Reagan, savings glut, scientific management, Scramble for Africa, Second Machine Age, secular stagnation, Silicon Valley, Simon Kuznets, South China Sea, South Sea Bubble, special drawing rights, spice trade, spinning jenny, Steven Pinker, Suez canal 1869, TaskRabbit, techlash, Thales and the olive presses, Thales of Miletus, The Great Moderation, The inhabitant of London could order by telephone, sipping his morning tea in bed, the various products of the whole earth, The Rise and Fall of American Growth, The Theory of the Leisure Class by Thorstein Veblen, The Wealth of Nations by Adam Smith, The Wisdom of Crowds, Thomas Malthus, Thorstein Veblen, trade route, Tragedy of the Commons, transaction costs, transatlantic slave trade, transcontinental railway, Triangle Shirtwaist Factory, universal basic income, Unsafe at Any Speed, Upton Sinclair, V2 rocket, Veblen good, War on Poverty, Washington Consensus, Watson beat the top human players on Jeopardy!, women in the workforce, world market for maybe five computers, Yom Kippur War, you are the product, zero-sum game

— 8 — THE FIRST ERA OF GLOBALISATION: 1820–1914 In the 19th century, industrialisation spread well beyond Britain to many parts of Europe, North America and Japan. Globalisation became tangible to ordinary people, rather than being confined to a limited number of luxury goods. By 1914, as John Maynard Keynes wrote, “The inhabitant of London could order by telephone, sipping his morning tea in bed, the various products of the whole earth, in such quantity as he might see fit, and reasonably expect their early delivery upon his doorstep.”1 The period covered by this chapter also saw big changes in transport systems, in the form of railways and steamships. These allowed people to migrate across the world in much larger numbers than ever before (see Chapter 9).

The Rise and Fall of the British Nation: A Twentieth-Century History by David Edgerton

active measures, Arthur Marwick, Berlin Wall, Big bang: deregulation of the City of London, blue-collar work, British Empire, business cycle, call centre, centre right, collective bargaining, colonial exploitation, company town, Corn Laws, corporate governance, deglobalization, deindustrialization, dematerialisation, deskilling, Donald Davies, double helix, Dr. Strangelove, endogenous growth, Etonian, European colonialism, feminist movement, first-past-the-post, full employment, gentrification, imperial preference, James Dyson, knowledge economy, labour mobility, land reform, land value tax, low interest rates, manufacturing employment, means of production, Mikhail Gorbachev, military-industrial complex, Neil Kinnock, new economy, non-tariff barriers, North Sea oil, offshore financial centre, old-boy network, packet switching, Philip Mirowski, Piper Alpha, plutocrats, post-Fordism, post-industrial society, post-truth, post-war consensus, public intellectual, rising living standards, road to serfdom, Ronald Reagan, scientific management, Suez canal 1869, Suez crisis 1956, technological determinism, The inhabitant of London could order by telephone, sipping his morning tea in bed, the various products of the whole earth, trade liberalization, union organizing, very high income, wages for housework, wealth creators, Winter of Discontent, women in the workforce, working poor

Here they are seen in a new light, and in new contexts. 1 The Country with No Name The Englishman has long been used to living in a certain haze as to what his country is – whether England, or England-and-Wales, or Great Britain or the United Kingdom of Great Britain and Northern Ireland or the United Kingdom plus its dependent territories or that larger unit which he used to call the British Empire … Sir Dennis Robertson, speaking to a US audience, 19531 The inhabitant of London could order by telephone, sipping his morning tea in bed, the various products of the whole earth, in such quantity as he might see fit, and reasonably expect their early delivery upon his doorstep; he could at the same moment and by the same means adventure his wealth in the natural resources and new enterprises of any quarter of the world, and share, without exertion or even trouble, in their prospective fruits and advantages … The projects and politics of militarism and imperialism, of racial and cultural rivalries, of monopolies, restrictions, and exclusion, which were to play the serpent to this paradise, were little more than the amusements of his daily newspaper, and appeared to exercise almost no influence at all on the ordinary course of social and economic life, the internationalization of which was nearly complete in practice.

pages: 1,152 words: 266,246

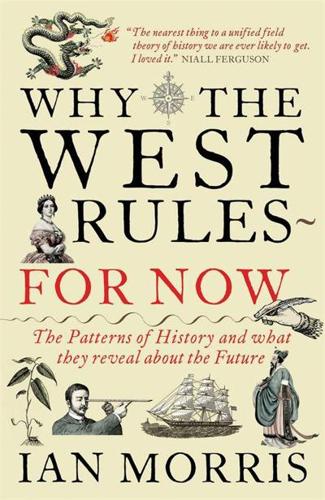

Why the West Rules--For Now: The Patterns of History, and What They Reveal About the Future by Ian Morris

addicted to oil, Admiral Zheng, agricultural Revolution, Albert Einstein, anti-communist, Apollo 11, Arthur Eddington, Atahualpa, Berlin Wall, British Empire, classic study, Columbian Exchange, conceptual framework, cotton gin, cuban missile crisis, defense in depth, demographic transition, Deng Xiaoping, discovery of the americas, Doomsday Clock, Eddington experiment, en.wikipedia.org, falling living standards, Flynn Effect, Ford Model T, Francisco Pizarro, global village, God and Mammon, Great Leap Forward, hiring and firing, indoor plumbing, Intergovernmental Panel on Climate Change (IPCC), invention of agriculture, Isaac Newton, It's morning again in America, James Watt: steam engine, Kickstarter, Kitchen Debate, knowledge economy, market bubble, mass immigration, Medieval Warm Period, Menlo Park, Mikhail Gorbachev, military-industrial complex, mutually assured destruction, New Journalism, out of africa, Peter Thiel, phenotype, pink-collar, place-making, purchasing power parity, RAND corporation, Ray Kurzweil, Ronald Reagan, Scientific racism, sexual politics, Silicon Valley, Sinatra Doctrine, South China Sea, special economic zone, Steve Jobs, Steve Wozniak, Steven Pinker, strong AI, Suez canal 1869, The inhabitant of London could order by telephone, sipping his morning tea in bed, the various products of the whole earth, The Wealth of Nations by Adam Smith, Thomas Kuhn: the structure of scientific revolutions, Thomas L Friedman, Thomas Malthus, trade route, upwardly mobile, wage slave, washing machines reduced drudgery

Looking back on these years in 1919, the economist John Maynard Keynes remembered them as a golden age when for … the [West’s] middle and upper classes, life offered, at a low cost and with the least trouble, conveniences, comforts, and amenities beyond the compass of the richest and most powerful monarchs of other ages. The inhabitant of London could order by telephone, sipping his morning tea in bed, the various products of the whole earth … and reasonably expect their early delivery upon his doorstep; he could at the same moment and by the same means adventure his wealth in the natural resources and new enterprises of any quarter of the world; … He could secure forthwith, if he wished it, cheap and comfortable means of transit to any country or climate without passport or any other formality … and could then proceed abroad to foreign quarters, without knowledge of their religion, language, or customs, bearing coined wealth upon his person, and would consider himself greatly aggrieved and much surprised at the least interference.