locking in a profit

26 results back to index

Trade Your Way to Financial Freedom by van K. Tharp

asset allocation, backtesting, book value, Bretton Woods, buy and hold, buy the rumour, sell the news, capital asset pricing model, commodity trading advisor, compound rate of return, computer age, distributed generation, diversification, dogs of the Dow, Elliott wave, high net worth, index fund, locking in a profit, margin call, market fundamentalism, Market Wizards by Jack D. Schwager, passive income, prediction markets, price stability, proprietary trading, random walk, Reminiscences of a Stock Operator, reserve currency, risk tolerance, Ronald Reagan, Savings and loan crisis, Sharpe ratio, short selling, Tax Reform Act of 1986, transaction costs

Her second target was at $407, and her final target was $424 where there was a lot of resistance to any higher movement. Her plan was to sell off her position in thirds at each target level. And on February 17, when the market confirmed her analysis by moving way above the initial entry into the 370 range, she moved her stop to $367.45. She now had locked in a profit of 15 points (that is, 1.2R). Her first target of $391 would give her about a 2R profit. Figure 12.5 Ellen believes a major price break (up or down) will occur on February 16 Figure 12.6 Ellen used Fibonacci retracements to set up her targets Ken—the Spreader-Arbitrager When Ken noticed the band that GOOG was forming, similar to those shown in Figures 12.2 and 12.5, he believed that GOOG would also fill the gap created on Monday.

…

Mary—the Long-Term Trend Follower Mary purchased this ETF in August 2005 and has held it ever since then. She bought it at $36.50, and since then, she has kept a trailing stop of three times the weekly volatility. Currently that stop is at $41.10, so she has locked in a $4.60 profit per share. Her initial risk was about $4.50 per share, so she has a 2R profit right now and has locked in a profit of just over 1R with her current stop. Although the ETF has been in a consolidation pattern for five weeks, she’s hoping the uptrend resumes soon. Dick—the Short-Term Swing Trader Dick set up his bands and discovered that there was strong support at $44, so when EWY bounced off of that level on February 13, Dick took a long position at $44.20 with a stop at $43.20.

…

The chart shows strong price support at $29.60. Since it was close to that level at the close on February 17, Dick sold half of his position at $29.90 for a little less than a 1R profit. He hoped to sell the remainder the next day on a breakdown to $28.80 or lower. His current stop on the rest of his position is $30.80, so he has locked in a profit of 80 cents. Victor—the Value Trader Victor looked at the economic picture behind TOL, and he was impressed. First, TOL earned $4.78 per share for the last fiscal year, giving it a P/E ratio of 6.97. That alone was enough to get Victor interested in the stock from a value perspective.

pages: 200 words: 54,897

Flash Boys: Not So Fast: An Insider's Perspective on High-Frequency Trading by Peter Kovac

bank run, barriers to entry, bash_history, Bernie Madoff, compensation consultant, computerized markets, computerized trading, Flash crash, housing crisis, index fund, locking in a profit, London Whale, market microstructure, merger arbitrage, payment for order flow, prediction markets, price discovery process, proprietary trading, Sergey Aleynikov, Spread Networks laid a new fibre optics cable between New York and Chicago, transaction costs, zero day

They figure that if the stock goes up, they take the profit (and pad their bonus), and if it goes down, they have a cushion of five cents before they have to report a loss to their bosses. That is old Wall Street. But economists and risk managers would beg to differ. They would say that your decisions about the future should only be based on your expectations about the future, not your past performance. The fact that you locked in a profit of five cents a minute ago doesn’t say anything about your ability to make another penny trading in the next minute. If you now lose another four cents, you lost another four cents – you can’t say that you “still made” one cent on the trade. Remarkably, old Wall Street still thinks this way, probably because at the end of the day the trader often reports the net profit of his trading and the customer’s subsidy of his trading – so a four cent loss trading is cushioned by the customer’s five cents, and the trader reports a net profit of one cent.

pages: 499 words: 148,160

Market Wizards: Interviews With Top Traders by Jack D. Schwager

"RICO laws" OR "Racketeer Influenced and Corrupt Organizations", Alan Greenspan, Albert Einstein, asset allocation, backtesting, beat the dealer, Bretton Woods, business cycle, buy and hold, commodity trading advisor, computerized trading, conceptual framework, delta neutral, Edward Thorp, Elliott wave, fixed income, implied volatility, index card, junk bonds, locking in a profit, margin call, market bubble, market fundamentalism, Market Wizards by Jack D. Schwager, Michael Milken, money market fund, Nixon triggered the end of the Bretton Woods system, pattern recognition, Paul Samuelson, Ralph Nelson Elliott, random walk, Reminiscences of a Stock Operator, short selling, Teledyne, transaction costs, uptick rule, yield curve, zero-sum game

For example, if a Japanese electronics manufacturer negotiates an export sale of stereo equipment to the U.S. with payment in dollars to be received six months hence, that manufacturer is vulnerable to a depreciation of the dollar versus the yen during the interim. If the manufacturer wants to assure a fixed price in the local currency (yen) in order to lock in a profit, he can hedge himself by selling the equivalent amount of U.S. dollars in the interbank market for the anticipated date of payment. The banks will quote the manufacturer an exchange rate for the precise amount required, for the specific future date. Speculators trade in the interbank currency market in an effort to profit from their expectations regarding shifts in exchange rates.

…

Are you a self-taught trader, or did another trader teach you worthwhile lessons? I am a self-taught trader who is continually studying both myself and other traders. Do you decide where you are getting out before you get in on a trade? I set protective stops at the same time I enter a trade. I normally move these stops in to lock in a profit as the trend continues. Sometimes, I take profits when a market gets wild. This usually doesn’t get me out any better than waiting for my stops to close in, but it does cut down on the volatility of the portfolio, which helps calm my nerves. Losing a position is aggravating, whereas losing your nerve is devastating.

pages: 575 words: 171,599

The Billionaire's Apprentice: The Rise of the Indian-American Elite and the Fall of the Galleon Hedge Fund by Anita Raghavan

"World Economic Forum" Davos, airport security, Asian financial crisis, asset allocation, Bear Stearns, Bernie Madoff, Boeing 747, British Empire, business intelligence, collapse of Lehman Brothers, collateralized debt obligation, corporate governance, delayed gratification, estate planning, Etonian, glass ceiling, high net worth, junk bonds, kremlinology, Larry Ellison, locking in a profit, Long Term Capital Management, Marc Andreessen, mass immigration, McMansion, medical residency, Menlo Park, new economy, old-boy network, Ponzi scheme, risk tolerance, rolodex, Ronald Reagan, short selling, Silicon Valley, sovereign wealth fund, stem cell, technology bubble, too big to fail

As Hussain fed her details about Google’s poor financial results, Khan passed the information on to Rajaratnam. After one call to him on July 13, Rajaratnam sold all his Google stock and took a $25 million short position. Later that month, when Google reported disappointing financial results as Hussain had predicted it would, Rajaratnam netted millions of dollars in profits. Khan made money too, locking in a profit of more than $500,000. As forthcoming as Khan was about Hussain and Rajaratnam to government officials, she was lying about her trading in Hilton and would not divulge her source for the inside information. When prosecutors asked about the purchases of Hilton stock, Khan said she made the Hilton trades on the advice of her broker.

…

After saying he wanted to be “long into the numbers,” Rengan bet heavily against Arris: Rengan SEC testimony. On July 27, Arris’s stock fell nearly 20 percent: Interactive Data via FactSet Research Systems. Rengan, the only investor in the fund, netted $270,000: US v. Rajaratnam, Franks hearing, Michaelson Arris chronology said Rengan made over $250,000 and Sedna locked in a profit of more than $1.1 million. “u r my heroine”: US v. Rajaratnam, Franks hearing, Michaelson Arris chronology. “It definitely feels like there are less quality women out there”: “Bachelors Compete for Dwindling Supply of Bachelorettes,” FoxNews.com, December 27, 2001. “Arris [thank you] for getting us out”: US v.

pages: 202 words: 66,742

The Payoff by Jeff Connaughton

Alan Greenspan, algorithmic trading, bank run, banking crisis, Bear Stearns, Bernie Madoff, collapse of Lehman Brothers, collateralized debt obligation, corporate governance, Credit Default Swap, credit default swaps / collateralized debt obligations, crony capitalism, cuban missile crisis, desegregation, Flash crash, Glass-Steagall Act, locking in a profit, London Interbank Offered Rate, London Whale, Long Term Capital Management, naked short selling, Neil Kinnock, plutocrats, Ponzi scheme, proprietary trading, risk tolerance, Robert Bork, Savings and loan crisis, short selling, Silicon Valley, TED Talk, too big to fail, two-sided market, uptick rule, young professional

An internal review of a WaMu loan office in Southern California revealed that 83 percent of its loans contained instances of confirmed fraud; in another office, the figure was 58 percent. And what did WaMu management do when it became clear that fraud rates were rising as housing prices began to fall? Rather than curb its reckless practices, it decided to try to sell a higher proportion of these risky, fraud-tainted mortgages into the secondary market, thereby locking in a profit for itself as it spread the contagion into the capital markets. The second hearing showed that OTS had failed abjectly to regulate WaMu and to protect the public from the consequences of WaMu’s excessive risk-taking and toleration of widespread fraud. Although WaMu accounted for 25 percent of OTS’s regulatory portfolio, OTS adopted a laissez-faire approach.

pages: 741 words: 179,454

Extreme Money: Masters of the Universe and the Cult of Risk by Satyajit Das

"RICO laws" OR "Racketeer Influenced and Corrupt Organizations", "there is no alternative" (TINA), "World Economic Forum" Davos, affirmative action, Alan Greenspan, Albert Einstein, algorithmic trading, Andy Kessler, AOL-Time Warner, Asian financial crisis, asset allocation, asset-backed security, bank run, banking crisis, banks create money, Basel III, Bear Stearns, behavioural economics, Benoit Mandelbrot, Berlin Wall, Bernie Madoff, Big bang: deregulation of the City of London, Black Swan, Bonfire of the Vanities, bonus culture, book value, Bretton Woods, BRICs, British Empire, business cycle, buy the rumour, sell the news, capital asset pricing model, carbon credits, Carl Icahn, Carmen Reinhart, carried interest, Celtic Tiger, clean water, cognitive dissonance, collapse of Lehman Brothers, collateralized debt obligation, corporate governance, corporate raider, creative destruction, credit crunch, Credit Default Swap, credit default swaps / collateralized debt obligations, currency risk, Daniel Kahneman / Amos Tversky, deal flow, debt deflation, Deng Xiaoping, deskilling, discrete time, diversification, diversified portfolio, Doomsday Clock, Dr. Strangelove, Dutch auction, Edward Thorp, Emanuel Derman, en.wikipedia.org, Eugene Fama: efficient market hypothesis, eurozone crisis, Everybody Ought to Be Rich, Fall of the Berlin Wall, financial engineering, financial independence, financial innovation, financial thriller, fixed income, foreign exchange controls, full employment, Glass-Steagall Act, global reserve currency, Goldman Sachs: Vampire Squid, Goodhart's law, Gordon Gekko, greed is good, Greenspan put, happiness index / gross national happiness, haute cuisine, Herman Kahn, high net worth, Hyman Minsky, index fund, information asymmetry, interest rate swap, invention of the wheel, invisible hand, Isaac Newton, James Carville said: "I would like to be reincarnated as the bond market. You can intimidate everybody.", job automation, Johann Wolfgang von Goethe, John Bogle, John Meriwether, joint-stock company, Jones Act, Joseph Schumpeter, junk bonds, Kenneth Arrow, Kenneth Rogoff, Kevin Kelly, laissez-faire capitalism, load shedding, locking in a profit, Long Term Capital Management, Louis Bachelier, low interest rates, margin call, market bubble, market fundamentalism, Market Wizards by Jack D. Schwager, Marshall McLuhan, Martin Wolf, mega-rich, merger arbitrage, Michael Milken, Mikhail Gorbachev, Milgram experiment, military-industrial complex, Minsky moment, money market fund, Mont Pelerin Society, moral hazard, mortgage debt, mortgage tax deduction, mutually assured destruction, Myron Scholes, Naomi Klein, National Debt Clock, negative equity, NetJets, Network effects, new economy, Nick Leeson, Nixon shock, Northern Rock, nuclear winter, oil shock, Own Your Own Home, Paul Samuelson, pets.com, Philip Mirowski, Phillips curve, planned obsolescence, plutocrats, Ponzi scheme, price anchoring, price stability, profit maximization, proprietary trading, public intellectual, quantitative easing, quantitative trading / quantitative finance, Ralph Nader, RAND corporation, random walk, Ray Kurzweil, regulatory arbitrage, Reminiscences of a Stock Operator, rent control, rent-seeking, reserve currency, Richard Feynman, Richard Thaler, Right to Buy, risk free rate, risk-adjusted returns, risk/return, road to serfdom, Robert Shiller, Rod Stewart played at Stephen Schwarzman birthday party, rolodex, Ronald Reagan, Ronald Reagan: Tear down this wall, Satyajit Das, savings glut, shareholder value, Sharpe ratio, short selling, short squeeze, Silicon Valley, six sigma, Slavoj Žižek, South Sea Bubble, special economic zone, statistical model, Stephen Hawking, Steve Jobs, stock buybacks, survivorship bias, tail risk, Teledyne, The Chicago School, The Great Moderation, the market place, the medium is the message, The Myth of the Rational Market, The Nature of the Firm, the new new thing, The Predators' Ball, The Theory of the Leisure Class by Thorstein Veblen, The Wealth of Nations by Adam Smith, Thorstein Veblen, too big to fail, trickle-down economics, Turing test, two and twenty, Upton Sinclair, value at risk, Yogi Berra, zero-coupon bond, zero-sum game

The short gold position protected any investor from a sudden unexpected fall in the gold price. If the gold price fell, then the shares would also fall, as MG’s gold reserves would be worth less. The fall in prices would create profits on the short gold position, as you could buy gold at the lower price, deliver it to the buyer at the agreed higher price and lock in a profit. The loss on the shares would be offset by the gain on the short gold position. The position is hedged, free of risk, at least in theory. “My analysis shows that the positions were highly risky.” Mailer is all smiles at my unrelenting assault—he likes offense. The investment strategy is based on the relationship between MG shares and the gold price.

…

Classically, arbitrage took advantage of price differentials between two markets. Assume cocaine is trading at $1,000/ounce in London and $1,100/ounce in New York, and the cost of transportation between the two centers is $25/ounce. An arbitrager could purchase an ounce in London, transport it to New York, and sell it to lock in a profit of $75 ounce without any financial risk. In an arbitrage-free world, where the value of a firm’s debt or equity differed from its intrinsic value driven by its earnings or cash flows, Modigliani and Miller showed that investors would take advantage of any discrepancy in market prices. By investing in different combinations of debt and shares, the investor could create a future income stream of the same size and risk.

pages: 280 words: 73,420

Crapshoot Investing: How Tech-Savvy Traders and Clueless Regulators Turned the Stock Market Into a Casino by Jim McTague

Alan Greenspan, algorithmic trading, automated trading system, Bear Stearns, Bernie Madoff, Bernie Sanders, Black Monday: stock market crash in 1987, Bretton Woods, buttonwood tree, buy and hold, computerized trading, corporate raider, creative destruction, credit crunch, Credit Default Swap, financial innovation, fixed income, Flash crash, High speed trading, housing crisis, index arbitrage, junk bonds, locking in a profit, Long Term Capital Management, machine readable, margin call, market bubble, market fragmentation, market fundamentalism, Myron Scholes, naked short selling, Nixon triggered the end of the Bretton Woods system, pattern recognition, Ponzi scheme, proprietary trading, quantitative trading / quantitative finance, Renaissance Technologies, Ronald Reagan, Sergey Aleynikov, short selling, Small Order Execution System, statistical arbitrage, technology bubble, transaction costs, uptick rule, Vanguard fund, Y2K

The bottom line was that stock prices fell like an avalanche because few people wanted them at that moment.21 Initially, the pickup in velocity was due to “stop loss” orders. These are like ejection seat buttons in a jet fighter. If the jet is falling to earth, the pilot ejects to save his life. Some investors place stop loss orders below the current price of a holding, to lock in a profit. Let’s say the stock is at $30 and the investor paid $20 for it. If he’s suddenly feeling bearish about the market, he could place a stop loss order to sell at the market if the securities price should drop to $28. A market price is the best price available at the time. If the investor is lucky, he’ll get “stopped out” exactly at $28.

pages: 297 words: 77,362

The Nature of Technology by W. Brian Arthur

Andrew Wiles, Boeing 747, business process, Charles Babbage, cognitive dissonance, computer age, creative destruction, double helix, endogenous growth, financial engineering, Geoffrey West, Santa Fe Institute, haute cuisine, James Watt: steam engine, joint-stock company, Joseph Schumpeter, Kenneth Arrow, Kevin Kelly, knowledge economy, locking in a profit, Mars Rover, means of production, Myron Scholes, power law, punch-card reader, railway mania, Recombinant DNA, Silicon Valley, Simon Singh, sorting algorithm, speech recognition, Stuart Kauffman, technological determinism, technological singularity, The Wealth of Nations by Adam Smith, Thomas Kuhn: the structure of scientific revolutions

Such contracts allowed a farmer planting soybeans in Iowa, say, to sell them in six months’ time at the fixed price of $8.40 per bushel, regardless of the market price at that future time. If the price was higher than $8.40 the farmer could sell on the market; if the price was lower he could exercise the option, thus locking in a profit at the cost of purchasing the option contract. The value of the contract “derived” from the actual market value—hence it was called a derivative. In the 1960s, putting a proper price on derivatives contracts was an unsolved problem. Among brokers it was something of a black art, which meant that neither investors nor banks in practice could use these with confidence.

pages: 289 words: 77,532

The Secret Club That Runs the World: Inside the Fraternity of Commodity Traders by Kate Kelly

"Hurricane Katrina" Superdome, Alan Greenspan, Bakken shale, bank run, Bear Stearns, business cycle, commodity super cycle, Credit Default Swap, diversification, fixed income, Gordon Gekko, index fund, light touch regulation, locking in a profit, London Interbank Offered Rate, Long Term Capital Management, margin call, oil-for-food scandal, paper trading, peak oil, Ponzi scheme, proprietary trading, risk tolerance, Ronald Reagan, side project, Silicon Valley, Sloane Ranger, sovereign wealth fund, supply-chain management, the market place

(It was much the same principle that worked for Glencore’s oil marketers, who sourced crude oil from producers in far-flung locations and then shorted crude through the futures market as they waited for the physical shipments to arrive, albeit with more complicated storage and financing fees tacked on at the end.) Then the aluminum-owning hedge fund could sell its warrant to another party, who might wait for aluminum spot prices to rise, locking in a profit. The LME’s increased load-out rate had done little to assuage Coke and other aluminum users. Premiums had gone from about 6.5 cents in 2010 to 11 cents by then, and would rise to a record of nearly 12 cents by the summer of 2013. While Metro was thriving, Goldman’s commodity traders were grappling with a major setback.

pages: 360 words: 85,321

The Perfect Bet: How Science and Math Are Taking the Luck Out of Gambling by Adam Kucharski

Ada Lovelace, Albert Einstein, Antoine Gombaud: Chevalier de Méré, beat the dealer, behavioural economics, Benoit Mandelbrot, Bletchley Park, butterfly effect, call centre, Chance favours the prepared mind, Claude Shannon: information theory, collateralized debt obligation, Computing Machinery and Intelligence, correlation does not imply causation, diversification, Edward Lorenz: Chaos theory, Edward Thorp, Everything should be made as simple as possible, Flash crash, Gerolamo Cardano, Henri Poincaré, Hibernia Atlantic: Project Express, if you build it, they will come, invention of the telegraph, Isaac Newton, Johannes Kepler, John Nash: game theory, John von Neumann, locking in a profit, Louis Pasteur, Nash equilibrium, Norbert Wiener, p-value, performance metric, Pierre-Simon Laplace, probability theory / Blaise Pascal / Pierre de Fermat, quantitative trading / quantitative finance, random walk, Richard Feynman, Ronald Reagan, Rubik’s Cube, statistical model, The Design of Experiments, Watson beat the top human players on Jeopardy!, zero-sum game

The game is 50/50, which means that for a $1.00 bet, a fair return would be $1.00: if a gambler bet on both players, the bettor would come out even. But a bookmaker won’t offer odds that return $1.00. Instead, it might offer a payoff of $0.95. Anyone who bets on both players will therefore end up $0.05 poorer. If the same total amount is wagered on each player, the bookmaker will lock in a profit. But what if most bets go on one of the players? The bookmaker will need to adjust the odds to make sure it stands to gain the same amount regardless of who wins. The new odds might suggest one player is less likely to come out on top. Smart gamblers, who know that both players are equally good, will therefore bet on the one with longer odds.

pages: 318 words: 87,570

Broken Markets: How High Frequency Trading and Predatory Practices on Wall Street Are Destroying Investor Confidence and Your Portfolio by Sal Arnuk, Joseph Saluzzi

algorithmic trading, automated trading system, Bernie Madoff, buttonwood tree, buy and hold, commoditize, computerized trading, corporate governance, cuban missile crisis, financial engineering, financial innovation, Flash crash, Gordon Gekko, High speed trading, latency arbitrage, locking in a profit, machine readable, Mark Zuckerberg, market fragmentation, National best bid and offer, payment for order flow, Ponzi scheme, price discovery process, price mechanism, price stability, proprietary trading, Sergey Aleynikov, Sharpe ratio, short selling, Small Order Execution System, statistical arbitrage, stocks for the long run, stocks for the long term, transaction costs, two-sided market, uptick rule, zero-sum game

Quickly, every algo trading order in a given stock follows each other up or down (or down and up), creating huge, whip-like price movements on relatively little volume. This has led to the development of predatory algo trading strategies. These strategies are designed to cause institutional algo orders to buy or sell shares at prices higher or lower than where the stock had been trading, creating a situation in which the predatory algo can lock in a profit from the artificial increase or decrease in the price. To illustrate, use an institutional algo order pegged to the NBBO with discretion to pay up to $20.10. First, the predatory algo uses methods similar to the liquidity rebate trader to spot this as an institutional algo order. Next, with a bid of $20.01, the predatory algo goes on the attack.

Learn Algorithmic Trading by Sebastien Donadio

active measures, algorithmic trading, automated trading system, backtesting, Bayesian statistics, behavioural economics, buy and hold, buy low sell high, cryptocurrency, data science, deep learning, DevOps, en.wikipedia.org, fixed income, Flash crash, Guido van Rossum, latency arbitrage, locking in a profit, market fundamentalism, market microstructure, martingale, natural language processing, OpenAI, p-value, paper trading, performance metric, prediction markets, proprietary trading, quantitative trading / quantitative finance, random walk, risk tolerance, risk-adjusted returns, Sharpe ratio, short selling, sorting algorithm, statistical arbitrage, statistical model, stochastic process, survivorship bias, transaction costs, type inference, WebSocket, zero-sum game

At this point, the spoofer initiates a short position and cancels all the spoofing bid orders, causing other market participants to do the same. This drive prices back down from these synthetically raised higher prices. When prices have dropped sufficiently, the spoofer then buys at lower prices to cover the short position and lock in a profit. Spoofing algorithms can repeat this over and over in markets that are mostly algorithmically trading and make a lot of money. This, however, is illegal in most markets because it causes market price instability, provides participants with misleading information about available market liquidity, and adversely affects non-algorithmic trading investors/strategies.

Mathematics for Finance: An Introduction to Financial Engineering by Marek Capinski, Tomasz Zastawniak

Black-Scholes formula, Brownian motion, capital asset pricing model, cellular automata, delta neutral, discounted cash flows, discrete time, diversified portfolio, financial engineering, fixed income, interest rate derivative, interest rate swap, locking in a profit, London Interbank Offered Rate, margin call, martingale, quantitative trading / quantitative finance, random walk, risk free rate, short selling, stochastic process, time value of money, transaction costs, value at risk, Wiener process, zero-coupon bond

Assumption 1.6 (No-Arbitrage Principle) There is no admissible portfolio with initial value V (0) = 0 such that V (1) > 0 with non-zero probability. In other words, if the initial value of an admissible portfolio is zero, V (0) = 0, then V (1) = 0 with probability 1. This means that no investor can lock in a profit without risk and with no initial endowment. If a portfolio violating this principle did exist, we would say that an arbitrage opportunity was available. Arbitrage opportunities rarely exist in practice. If and when they do, the gains are typically extremely small as compared to the volume of transactions, making them beyond the reach of small investors.

pages: 311 words: 99,699

Fool's Gold: How the Bold Dream of a Small Tribe at J.P. Morgan Was Corrupted by Wall Street Greed and Unleashed a Catastrophe by Gillian Tett

"World Economic Forum" Davos, accounting loophole / creative accounting, Alan Greenspan, asset-backed security, bank run, banking crisis, Bear Stearns, Black-Scholes formula, Blythe Masters, book value, break the buck, Bretton Woods, business climate, business cycle, buy and hold, collateralized debt obligation, commoditize, creative destruction, credit crunch, Credit Default Swap, credit default swaps / collateralized debt obligations, diversification, easy for humans, difficult for computers, financial engineering, financial innovation, fixed income, Glass-Steagall Act, housing crisis, interest rate derivative, interest rate swap, inverted yield curve, junk bonds, Kickstarter, locking in a profit, Long Term Capital Management, low interest rates, McMansion, Michael Milken, money market fund, mortgage debt, North Sea oil, Northern Rock, Plato's cave, proprietary trading, Renaissance Technologies, risk free rate, risk tolerance, Robert Shiller, Satyajit Das, Savings and loan crisis, short selling, sovereign wealth fund, statistical model, tail risk, The Great Moderation, too big to fail, value at risk, yield curve

Some wanted to protect against expected interest-rate increases, while others believed rates were likely to fall. Players also had different motives for wanting to place bets on future asset prices. Some investors liked derivatives because they wanted to control risk, like the wheat farmers who preferred to lock in a profitable price. Others wanted to use them to make high-risk bets in the hope of making windfall profits. The crucial point about derivatives was that they could do two things: help investors reduce risk or create a good deal more risk. Everything depended on how they were used and on the motives and skills of those who traded in them.

The Global Money Markets by Frank J. Fabozzi, Steven V. Mann, Moorad Choudhry

asset allocation, asset-backed security, bank run, Bear Stearns, Bretton Woods, buy and hold, collateralized debt obligation, credit crunch, currency risk, discounted cash flows, discrete time, disintermediation, Dutch auction, financial engineering, fixed income, Glass-Steagall Act, high net worth, intangible asset, interest rate derivative, interest rate swap, land bank, large denomination, locking in a profit, London Interbank Offered Rate, Long Term Capital Management, margin call, market fundamentalism, money market fund, moral hazard, mortgage debt, paper trading, Right to Buy, short selling, stocks for the long run, time value of money, value at risk, Y2K, yield curve, zero-coupon bond, zero-sum game

The obvious risk from such a strategy is that the level of short-term rates rises during the term of the loan, so that when the loan is refinanced the bank makes a lower profit or a net loss. Managing this risk exposure is the key function of an ALM desk. As well as managing the interest rate risk itself, banks also match assets with liabilities—thus locking in a profit—and diversify their loan book to reduce exposure to one sector of the economy. Another risk factor is liquidity. From a banking and Treasury point of view the term liquidity means funding liquidity, or the “nearness” of money. The most liquid asset is cash. Banks bear several interrelated liquidity risks, including the risk of being unable to pay depositors on demand, an inability to raise funds in the market at reasonable rates, and an insufficient level of funds available with which to make loans.

pages: 385 words: 118,901

Black Edge: Inside Information, Dirty Money, and the Quest to Bring Down the Most Wanted Man on Wall Street by Sheelah Kolhatkar

"RICO laws" OR "Racketeer Influenced and Corrupt Organizations", "World Economic Forum" Davos, Bear Stearns, Bernie Madoff, Carl Icahn, Donald Trump, Fairchild Semiconductor, family office, fear of failure, financial deregulation, hiring and firing, income inequality, junk bonds, light touch regulation, locking in a profit, margin call, Market Wizards by Jack D. Schwager, medical residency, Michael Milken, mortgage debt, p-value, pets.com, Ponzi scheme, proprietary trading, rent control, Ronald Reagan, Savings and loan crisis, short selling, Silicon Valley, Skype, The Predators' Ball

Everyone, particularly Cohen, wanted access to his reports, but Grodin did not like to share them. He had recruited Lee from a brokerage firm called John Hancock Securities, where he worked as an analyst after getting an engineering degree from Duke, and cultivated him at SAC. Using Lee’s “datapoints,” as he called them, Grodin would methodically formulate a trade and quickly lock in a profit, often not a huge one. Cohen preferred a more aggressive approach. If a trade looked good, Cohen thought you should bet as much as you could. There were regular conflicts about getting access to Lee’s research, and shouting matches between Cohen and Grodin erupted with increasing frequency.

pages: 403 words: 119,206

Toward Rational Exuberance: The Evolution of the Modern Stock Market by B. Mark Smith

Alan Greenspan, bank run, banking crisis, book value, business climate, business cycle, buy and hold, capital asset pricing model, compound rate of return, computerized trading, Cornelius Vanderbilt, credit crunch, cuban missile crisis, discounted cash flows, diversified portfolio, Donald Trump, equity risk premium, Eugene Fama: efficient market hypothesis, financial independence, financial innovation, fixed income, full employment, Glass-Steagall Act, income inequality, index arbitrage, index fund, joint-stock company, junk bonds, locking in a profit, Long Term Capital Management, Louis Bachelier, low interest rates, margin call, market clearing, merger arbitrage, Michael Milken, money market fund, Myron Scholes, Paul Samuelson, price stability, prudent man rule, random walk, Richard Thaler, risk free rate, risk tolerance, Robert Bork, Robert Shiller, Ronald Reagan, scientific management, shareholder value, short selling, stocks for the long run, the market place, transaction costs

Within seconds, prices of the S&P 500 index futures had plunged 20.75 points, more than the entire drop on the previous Friday. Normally the index arbitrageurs described in chapter 14 would be expected to step in, buying futures with the intention of selling the stocks included in the index, locking in a profit if the price they paid for the futures contract was less than the aggregate price at which they sold the index stocks. But no one knew with any degree of certainty where stock prices would open in New York. The index arbs sat on their hands, and the futures fell lower and lower. As the 9:30 opening arrived in New York, the market-making specialists on the floor of the New York Stock Exchange struggled to find prices at which they could balance supply and demand and commence trading in the stocks for which they were responsible.

Stock Market Wizards: Interviews With America's Top Stock Traders by Jack D. Schwager

Asian financial crisis, banking crisis, barriers to entry, Bear Stearns, beat the dealer, Black-Scholes formula, book value, commodity trading advisor, computer vision, East Village, Edward Thorp, financial engineering, financial independence, fixed income, implied volatility, index fund, Jeff Bezos, John Meriwether, John von Neumann, junk bonds, locking in a profit, Long Term Capital Management, managed futures, margin call, Market Wizards by Jack D. Schwager, money market fund, Myron Scholes, paper trading, passive investing, pattern recognition, proprietary trading, random walk, risk free rate, risk tolerance, risk-adjusted returns, short selling, short squeeze, Silicon Valley, statistical arbitrage, Teledyne, the scientific method, transaction costs, Y2K

It almost sounds as if you are performing a service. If I understand you correctly, you find buyers and sellers who have different costs or returns, due to a distortion, such as differences in tax treatment. You then devise a transaction based on this difference in which each party ends up better off, and you lock in a profit for performing the transaction. Exactly. The key word you used was service. That's one of the key reasons why the results we have delivered are so different from those of traditional investment managers, who buy and sell and then hope for the best. How could you ever lose in that type of transaction?

The Trade Lifecycle: Behind the Scenes of the Trading Process (The Wiley Finance Series) by Robert P. Baker

asset-backed security, bank run, banking crisis, Basel III, Black-Scholes formula, book value, Brownian motion, business continuity plan, business logic, business process, collapse of Lehman Brothers, corporate governance, credit crunch, Credit Default Swap, diversification, financial engineering, fixed income, functional programming, global macro, hiring and firing, implied volatility, interest rate derivative, interest rate swap, locking in a profit, London Interbank Offered Rate, low interest rates, margin call, market clearing, millennium bug, place-making, prediction markets, proprietary trading, short selling, statistical model, stochastic process, the market place, the payments system, time value of money, too big to fail, transaction costs, value at risk, Wiener process, yield curve, zero-coupon bond

At every price, the profit on the future together with the profit on sale of apples is greater than zero. Profit 0 FIGURE 4.3 Profit curve 5p 10p Price 55 Asset Classes Profit Spot 0 5p 10p Price Future FIGURE 4.4 Profit curve with future So if the grower can find someone prepared to sell a future at the right price and timed for when his apples are ready for market, he can lock in a profit and remove his price risk. The speculator will be selling such futures contracts hoping to find other market participants such as cider manufacturers who will want to buy the equivalent contracts. In this way he can offset his risk and charge a profit in the difference between buy and sell prices.

pages: 369 words: 128,349

Beyond the Random Walk: A Guide to Stock Market Anomalies and Low Risk Investing by Vijay Singal

3Com Palm IPO, Andrei Shleifer, AOL-Time Warner, asset allocation, book value, buy and hold, capital asset pricing model, correlation coefficient, cross-subsidies, currency risk, Daniel Kahneman / Amos Tversky, diversified portfolio, endowment effect, fixed income, index arbitrage, index fund, information asymmetry, information security, junk bonds, liberal capitalism, locking in a profit, Long Term Capital Management, loss aversion, low interest rates, margin call, market friction, market microstructure, mental accounting, merger arbitrage, Myron Scholes, new economy, prediction markets, price stability, profit motive, random walk, Richard Thaler, risk free rate, risk-adjusted returns, risk/return, selection bias, Sharpe ratio, short selling, short squeeze, survivorship bias, Tax Reform Act of 1986, transaction costs, uptick rule, Vanguard fund

There are, however, three conditions under which options might seem attractive. First, if there is significant risk of failure, then the option can limit the loss. Second, an option may be used to lock in gains already earned. For example, if the target in a cash offer has appreciated from $20 to $25, then buying an at-the-money put option would lock in a profit of $5 (less the put premium). Third, in the case of stock mergers, if it is not easy to short-sell, the investor can buy a put option on the acquiring firm’s stock. Other than these special cases, trading the underlying stock is a superior strategy. USING MUTUAL FUNDS Mutual funds that specialize in merger arbitrage are the simplest vehicles for taking advantage of this mispricing.

pages: 349 words: 134,041

Traders, Guns & Money: Knowns and Unknowns in the Dazzling World of Derivatives by Satyajit Das

accounting loophole / creative accounting, Alan Greenspan, Albert Einstein, Asian financial crisis, asset-backed security, Bear Stearns, beat the dealer, Black Swan, Black-Scholes formula, Bretton Woods, BRICs, Brownian motion, business logic, business process, buy and hold, buy low sell high, call centre, capital asset pricing model, collateralized debt obligation, commoditize, complexity theory, computerized trading, corporate governance, corporate raider, Credit Default Swap, credit default swaps / collateralized debt obligations, cuban missile crisis, currency peg, currency risk, disinformation, disintermediation, diversification, diversified portfolio, Edward Thorp, Eugene Fama: efficient market hypothesis, Everything should be made as simple as possible, financial engineering, financial innovation, fixed income, Glass-Steagall Act, Haight Ashbury, high net worth, implied volatility, index arbitrage, index card, index fund, interest rate derivative, interest rate swap, Isaac Newton, job satisfaction, John Bogle, John Meriwether, junk bonds, locking in a profit, Long Term Capital Management, low interest rates, mandelbrot fractal, margin call, market bubble, Marshall McLuhan, mass affluent, mega-rich, merger arbitrage, Mexican peso crisis / tequila crisis, money market fund, moral hazard, mutually assured destruction, Myron Scholes, new economy, New Journalism, Nick Leeson, Nixon triggered the end of the Bretton Woods system, offshore financial centre, oil shock, Parkinson's law, placebo effect, Ponzi scheme, proprietary trading, purchasing power parity, quantitative trading / quantitative finance, random walk, regulatory arbitrage, Right to Buy, risk free rate, risk-adjusted returns, risk/return, Salesforce, Satyajit Das, shareholder value, short selling, short squeeze, South Sea Bubble, statistical model, technology bubble, the medium is the message, the new new thing, time value of money, too big to fail, transaction costs, value at risk, Vanguard fund, volatility smile, yield curve, Yogi Berra, zero-coupon bond

DAS_C06.QXP 8/7/06 4:43 PM Page 169 5 N The perfect storm – risk mismanagement by the numbers 169 They could buy the coupons and corpus separately at a lower price than the 30-year bond itself. They did precisely this, buying the components separately, and selling the 30-year bond short, to lock in a profit. The arbitrage group’s trade made money. Gutenfreund’s trade – which quickly gained the soubriquet ‘the Whale’ – lost a similar sum. Coats, a competitor of Meriwether’s in the battle for succession within the firm, was furious. The trades themselves marked a bundary. The purchase of the bonds represented the old – traditional trading.

pages: 526 words: 144,019

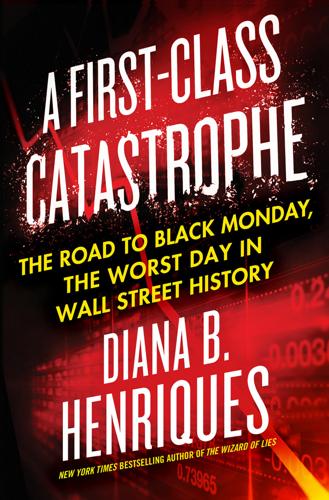

A First-Class Catastrophe: The Road to Black Monday, the Worst Day in Wall Street History by Diana B. Henriques

Alan Greenspan, asset allocation, bank run, banking crisis, Bear Stearns, behavioural economics, Bernie Madoff, Black Monday: stock market crash in 1987, break the buck, buttonwood tree, buy and hold, buy low sell high, call centre, Carl Icahn, centralized clearinghouse, computerized trading, Cornelius Vanderbilt, corporate governance, corporate raider, Credit Default Swap, cuban missile crisis, Dennis Tito, Edward Thorp, Elliott wave, financial deregulation, financial engineering, financial innovation, Flash crash, friendly fire, Glass-Steagall Act, index arbitrage, index fund, intangible asset, interest rate swap, It's morning again in America, junk bonds, laissez-faire capitalism, locking in a profit, Long Term Capital Management, margin call, Michael Milken, money market fund, Myron Scholes, plutocrats, Ponzi scheme, pre–internet, price stability, proprietary trading, quantitative trading / quantitative finance, random walk, Ronald Reagan, Savings and loan crisis, short selling, Silicon Valley, stock buybacks, The Chicago School, The Myth of the Rational Market, the payments system, tulip mania, uptick rule, Vanguard fund, web of trust

A month earlier, Binns attended a meeting of the CFTC’s financial product advisory committee in Washington to defend program trading. (See Reuters, “Big Investors Defend Programmed Trading.”) He had been joined at that meeting by Frederick Grauer, the president of Wells Fargo Investment Advisors. Grauer complained that Wall Street firms traded ahead of the sales by portfolio insurers to lock in a profit, thereby exacerbating the selling pressure in the futures market. This suspicion was, in fact, proven correct by the Brady Commission, which said that seven firms had sold short in immense volume on Friday, October 16, anticipating the sales that portfolio insurers would need to make on Monday.

pages: 598 words: 169,194

Bernie Madoff, the Wizard of Lies: Inside the Infamous $65 Billion Swindle by Diana B. Henriques

accounting loophole / creative accounting, airport security, Albert Einstein, AOL-Time Warner, banking crisis, Bear Stearns, Bernie Madoff, Black Monday: stock market crash in 1987, break the buck, British Empire, buy and hold, centralized clearinghouse, collapse of Lehman Brothers, computerized trading, corporate raider, diversified portfolio, Donald Trump, dumpster diving, Edward Thorp, financial deregulation, financial engineering, financial thriller, fixed income, forensic accounting, Gordon Gekko, index fund, locking in a profit, low interest rates, mail merge, merger arbitrage, messenger bag, money market fund, payment for order flow, plutocrats, Ponzi scheme, Potemkin village, proprietary trading, random walk, Renaissance Technologies, riskless arbitrage, Ronald Reagan, Savings and loan crisis, short selling, short squeeze, Small Order Execution System, source of truth, sovereign wealth fund, too big to fail, transaction costs, traveling salesman

Riskless arbitrage is an age-old strategy for exploiting momentary price differences for the same product in different markets. It could be as simple as ordering cartons of cigarettes by telephone from a vendor in a low-cost state and simultaneously selling them over the phone at a higher price in states where they are more expensive, thereby locking in a profit. Or it could be as complex as using computer software to instantly detect a tiny price differential for a stock trading in two different currencies and execute the trades without human intervention—again, locking in the profit. What distinguished riskless arbitrage from the more familiar “merger arbitrage” of the 1980s—which involved speculating in the securities of stocks involved in possible takeovers—was that a profit could be captured the moment it was perceived, if the trade could be executed quickly enough.

pages: 1,202 words: 424,886

Stigum's Money Market, 4E by Marcia Stigum, Anthony Crescenzi

accounting loophole / creative accounting, Alan Greenspan, Asian financial crisis, asset allocation, asset-backed security, bank run, banking crisis, banks create money, Bear Stearns, Black-Scholes formula, book value, Brownian motion, business climate, buy and hold, capital controls, central bank independence, centralized clearinghouse, corporate governance, credit crunch, Credit Default Swap, cross-border payments, currency manipulation / currency intervention, currency risk, David Ricardo: comparative advantage, disintermediation, distributed generation, diversification, diversified portfolio, Dutch auction, financial innovation, financial intermediation, fixed income, flag carrier, foreign exchange controls, full employment, Glass-Steagall Act, Goodhart's law, Greenspan put, guns versus butter model, high net worth, implied volatility, income per capita, intangible asset, interest rate derivative, interest rate swap, inverted yield curve, junk bonds, land bank, large denomination, locking in a profit, London Interbank Offered Rate, low interest rates, margin call, market bubble, market clearing, market fundamentalism, Money creation, money market fund, mortgage debt, Myron Scholes, offshore financial centre, paper trading, pension reform, Phillips curve, Ponzi scheme, price mechanism, price stability, profit motive, proprietary trading, prudent man rule, Real Time Gross Settlement, reserve currency, risk free rate, risk tolerance, risk/return, Savings and loan crisis, seigniorage, shareholder value, short selling, short squeeze, tail risk, technology bubble, the payments system, too big to fail, transaction costs, two-sided market, value at risk, volatility smile, yield curve, zero-coupon bond, zero-sum game

Funding a 6-month asset with 1-month money would leave a bank that planned to match fund the tail of the asset in need of 5-month money, a maturity in which the market is thinner than, say, 3-month money. If a bank buys 4s against 6s or pursues some similar strategy, it creates an open position in its book and thereby assumes a rate risk. One way it can eliminate that risk while simultaneously locking in a profit from the mismatch is by entering into a forward forward contract; that is, buying money of a fixed maturity for future delivery. In the example above, the appropriate forward forward contract would be for 2-month money to be delivered four months hence. The seller of a forward forward assumes a rate risk because he cannot be sure how much it will cost him to fund that commitment.

…

For example, a farmer growing corn might, before the harvest, sell some portion of his crop to a buyer at a fixed price for delivery at harvest. For the farmer, this transaction reduces risk. To grow corn, the farmer incurs various costs; by selling his corn forward, he guarantees the revenue he will receive for his corn at harvest, and he thus locks in a profit on his operations. That profit may be more or less than what he would have earned if he had waited to sell his crop at harvest at the spot price then prevailing in the cash market (market for immediate delivery) for corn. FUTURES VERSUS FORWARD CONTRACTS Most futures contracts, like many forward contracts, specify that the seller of the contract will deliver to the buyer a specific amount of a specific item at a specific price on a specified future date.

pages: 819 words: 181,185

Derivatives Markets by David Goldenberg

Black-Scholes formula, Brownian motion, capital asset pricing model, commodity trading advisor, compound rate of return, conceptual framework, correlation coefficient, Credit Default Swap, discounted cash flows, discrete time, diversification, diversified portfolio, en.wikipedia.org, financial engineering, financial innovation, fudge factor, implied volatility, incomplete markets, interest rate derivative, interest rate swap, law of one price, locking in a profit, London Interbank Offered Rate, Louis Bachelier, margin call, market microstructure, martingale, Myron Scholes, Norbert Wiener, Paul Samuelson, price mechanism, random walk, reserve currency, risk free rate, risk/return, riskless arbitrage, Sharpe ratio, short selling, stochastic process, stochastic volatility, time value of money, transaction costs, volatility smile, Wiener process, yield curve, zero-coupon bond, zero-sum game

Scenario 1 First, suppose that the spot wheat price drops to PT(ω)=$5.85/bu at the end of 4 months. Compared to the current wheat spot price level, that is a loss of 500,000*(+PT(ω)–Pt)=500,000*(+$5.85–$5.9875)=–$68,750. Fortunately, the farmer was hedged in the forward market where he made a profit of, Overall, his position locked in a profit of $732,500–$68,750=$663,750. TABLE 2.7 Profit from the Fully Hedged Spot Position Wheat Spot Price @ Expiration Profits from a Naked (Unhedged) Long Spot Wheat Position Profit To a Naked Short Forward Position in 500,000 bu. of wheat Profits to the Combined (Fully Hedged) Position: Long Spot, Short Forward 5.8 –93750 757500 663750 5.85 –68750 732500 663750 5.9 –43750 707500 663750 5.95 –18750 682500 663750 6 6250 657500 663750 6.05 31250 632500 663750 6.1 56250 607500 663750 6.15 81250 582500 663750 6.2 106250 557500 663750 6.25 131250 532500 663750 6.3 156250 507500 663750 6.35 181250 482500 663750 6.4 206250 457500 663750 6.45 231250 432500 663750 6.5 256250 407500 663750 6.55 281250 382500 663750 6.6 306250 357500 663750 6.65 331250 332500 663750 6.7 356250 307500 663750 6.75 381250 282500 663750 TABLE 2.8 Price Data Summary Current Spot Price Pt $5.9875 bu Current Forward Price Ft,T $7.315 /bu Ultimate Spot Price PT(ω) ?

pages: 829 words: 186,976

The Signal and the Noise: Why So Many Predictions Fail-But Some Don't by Nate Silver

airport security, Alan Greenspan, Alvin Toffler, An Inconvenient Truth, availability heuristic, Bayesian statistics, Bear Stearns, behavioural economics, Benoit Mandelbrot, Berlin Wall, Bernie Madoff, big-box store, Black Monday: stock market crash in 1987, Black Swan, Boeing 747, book value, Broken windows theory, business cycle, buy and hold, Carmen Reinhart, Charles Babbage, classic study, Claude Shannon: information theory, Climategate, Climatic Research Unit, cognitive dissonance, collapse of Lehman Brothers, collateralized debt obligation, complexity theory, computer age, correlation does not imply causation, Credit Default Swap, credit default swaps / collateralized debt obligations, cuban missile crisis, Daniel Kahneman / Amos Tversky, disinformation, diversification, Donald Trump, Edmond Halley, Edward Lorenz: Chaos theory, en.wikipedia.org, equity premium, Eugene Fama: efficient market hypothesis, everywhere but in the productivity statistics, fear of failure, Fellow of the Royal Society, Ford Model T, Freestyle chess, fudge factor, Future Shock, George Akerlof, global pandemic, Goodhart's law, haute cuisine, Henri Poincaré, high batting average, housing crisis, income per capita, index fund, information asymmetry, Intergovernmental Panel on Climate Change (IPCC), Internet Archive, invention of the printing press, invisible hand, Isaac Newton, James Watt: steam engine, Japanese asset price bubble, John Bogle, John Nash: game theory, John von Neumann, Kenneth Rogoff, knowledge economy, Laplace demon, locking in a profit, Loma Prieta earthquake, market bubble, Mikhail Gorbachev, Moneyball by Michael Lewis explains big data, Monroe Doctrine, mortgage debt, Nate Silver, negative equity, new economy, Norbert Wiener, Oklahoma City bombing, PageRank, pattern recognition, pets.com, Phillips curve, Pierre-Simon Laplace, Plato's cave, power law, prediction markets, Productivity paradox, proprietary trading, public intellectual, random walk, Richard Thaler, Robert Shiller, Robert Solow, Rodney Brooks, Ronald Reagan, Saturday Night Live, savings glut, security theater, short selling, SimCity, Skype, statistical model, Steven Pinker, The Great Moderation, The Market for Lemons, the scientific method, The Signal and the Noise by Nate Silver, The Wisdom of Crowds, Thomas Bayes, Thomas Kuhn: the structure of scientific revolutions, Timothy McVeigh, too big to fail, transaction costs, transfer pricing, University of East Anglia, Watson beat the top human players on Jeopardy!, Wayback Machine, wikimedia commons

And in the sixth, back in Portland, they fell out of rhythm early and never caught the tune, as the Blazers marched to a 103-93 win. Suddenly the series was even again, with the deciding Game 7 to be played in Los Angeles. The prudent thing for a gambler would have been to hedge his bet. For instance, Voulgaris could have put $200,000 on Portland, who were 3-to-2 underdogs, to win Game 7. That would have locked in a profit. If the Blazers won, he would make more than enough from his hedge to cover the loss of his original $80,000 bet, still earning a net profit of $220,000.9 If the Lakers won instead, his original bet would still pay out—he’d lose his hedge, but net $320,000 from both bets combined.* That would be no half-million-dollar score, but still pretty good.

pages: 840 words: 202,245

Age of Greed: The Triumph of Finance and the Decline of America, 1970 to the Present by Jeff Madrick

Abraham Maslow, accounting loophole / creative accounting, Alan Greenspan, AOL-Time Warner, Asian financial crisis, bank run, Bear Stearns, book value, Bretton Woods, business cycle, capital controls, Carl Icahn, collapse of Lehman Brothers, collateralized debt obligation, credit crunch, Credit Default Swap, credit default swaps / collateralized debt obligations, currency risk, desegregation, disintermediation, diversified portfolio, Donald Trump, financial deregulation, fixed income, floating exchange rates, Frederick Winslow Taylor, full employment, George Akerlof, Glass-Steagall Act, Greenspan put, Hyman Minsky, income inequality, index fund, inflation targeting, inventory management, invisible hand, John Bogle, John Meriwether, junk bonds, Kitchen Debate, laissez-faire capitalism, locking in a profit, Long Term Capital Management, low interest rates, market bubble, Mary Meeker, Michael Milken, minimum wage unemployment, MITM: man-in-the-middle, Money creation, money market fund, Mont Pelerin Society, moral hazard, mortgage debt, Myron Scholes, new economy, Nixon triggered the end of the Bretton Woods system, North Sea oil, Northern Rock, oil shock, Paul Samuelson, Philip Mirowski, Phillips curve, price stability, quantitative easing, Ralph Nader, rent control, road to serfdom, Robert Bork, Robert Shiller, Ronald Coase, Ronald Reagan, Ronald Reagan: Tear down this wall, scientific management, shareholder value, short selling, Silicon Valley, Simon Kuznets, tail risk, Tax Reform Act of 1986, technology bubble, Telecommunications Act of 1996, The Chicago School, The Great Moderation, too big to fail, union organizing, V2 rocket, value at risk, Vanguard fund, War on Poverty, Washington Consensus, Y2K, Yom Kippur War

They leveraged those gains by borrowing money. Arbitrage opportunities were found in other kinds of securities as markets developed, especially in options and futures contracts on government bonds and international currencies. Mergers gave rise to this riskier form of arbitrage. An arbitrageur could lock in a profit when one company offered shares at a premium for another. The arbs could buy the target company’s shares and sell the acquirer’s shares, thus locking in the spread. (They typically sold short—that is, sold shares they did not actually own but merely borrowed at an interest cost with the promise to give them back even if the price of the shares rose.)

pages: 1,042 words: 266,547

Security Analysis by Benjamin Graham, David Dodd

activist fund / activist shareholder / activist investor, asset-backed security, backtesting, barriers to entry, Bear Stearns, behavioural economics, book value, business cycle, buy and hold, capital asset pricing model, Carl Icahn, carried interest, collateralized debt obligation, collective bargaining, corporate governance, corporate raider, credit crunch, Credit Default Swap, credit default swaps / collateralized debt obligations, currency risk, diversification, diversified portfolio, fear of failure, financial engineering, financial innovation, fixed income, flag carrier, full employment, Greenspan put, index fund, intangible asset, invisible hand, Joseph Schumpeter, junk bonds, land bank, locking in a profit, Long Term Capital Management, low cost airline, low interest rates, Michael Milken, moral hazard, mortgage debt, Myron Scholes, prudent man rule, Right to Buy, risk free rate, risk-adjusted returns, risk/return, secular stagnation, shareholder value, stock buybacks, The Chicago School, the market place, the scientific method, The Wealth of Nations by Adam Smith, transaction costs, two and twenty, zero-coupon bond

(p. 64) He himself had gone from the ridiculous to the sublime (and sometimes back again) in the conduct of his own investment career. His quick and easy grasp of mathematics made him a natural arbitrageur. He would sell one stock and simultaneously buy another. Or he would buy or sell shares of stock against the convertible bonds of the identical issuing company. So doing, he would lock in a profit that, if not certain, was as close to guaranteed as the vicissitudes of finance allowed. In one instance, in the early 1920s, he exploited an inefficiency in the relationship between DuPont and the then red-hot General Motors (GM). DuPont held a sizable stake in GM. And it was for that interest alone which the market valued the big chemical company.